Philippines AI in Fintech Market Size, Share, Trends and Forecast by Offering, Component, Farming Environment, Application, and Region, 2025-2033

Philippines AI in Fintech Market Overview:

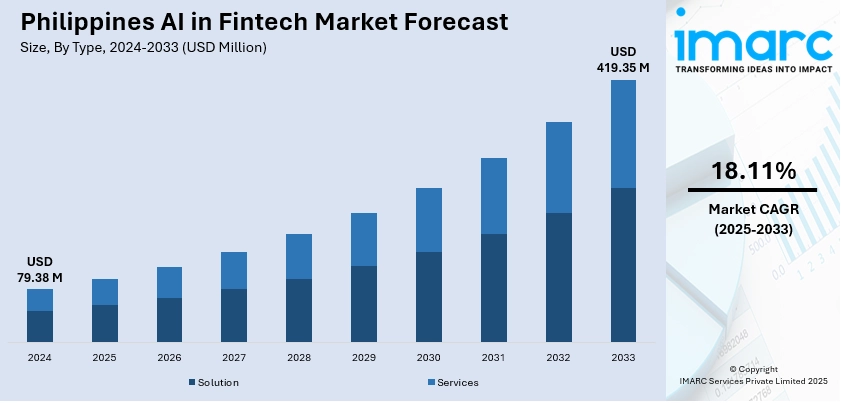

The Philippines AI in fintech market size reached USD 79.38 Million in 2024. The market is projected to reach USD 419.35 Million by 2033, exhibiting a growth rate (CAGR) of 18.11% during 2025-2033. The market is expanding with growing adoption of digital lending, fraud detection, and AI-based customer support solutions. Moreover, increasing financial inclusion initiatives and advanced data analytics applications continue to support Philippines AI in fintech market share across banking, payments, and insurance segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 79.38 Million |

| Market Forecast in 2033 | USD 419.35 Million |

| Market Growth Rate 2025-2033 | 18.11% |

Philippines AI in Fintech Market Trends:

Rising Adoption of AI Solutions

The Philippines AI in fintech market growth is being fueled by increasing adoption of digital financial services. Banks, payment providers, and lending platforms are integrating AI-driven tools to improve decision-making and reduce risks. Automated fraud detection and real-time monitoring are becoming essential as online transactions rise across the country. Customer service chatbots and AI-enabled virtual assistants are also gaining traction, helping institutions handle growing user demands while lowering costs. The strong push toward financial inclusion in the Philippines adds to this trend, as AI-based scoring systems allow unbanked and underbanked populations to access credit without traditional banking history. Local regulators have been supportive of digital transformation, encouraging responsible AI integration. This alignment between demand, technology, and regulation is accelerating fintech development. The competitive landscape is also expanding as global firms partner with local players to offer AI-powered financial products, making innovation a critical driver of growth in the sector.

To get more information on this market, Request Sample

Expanding Role of Data Analytics

Data analytics is emerging as a major driver for the AI-driven fintech market in the Philippines. Financial institutions are leveraging machine learning to process large amounts of customer and transaction data, allowing more accurate credit risk evaluations and personalized financial solutions. Predictive models help providers identify patterns in spending and borrowing, which improves both marketing and risk management strategies. In addition, insurers and digital lending platforms are adopting AI-based analytics to streamline claims processing and loan approvals. This shift toward data-driven decision-making is enhancing efficiency, reducing fraud, and improving customer trust. With mobile payments and e-wallets expanding rapidly, the demand for AI solutions that can analyze unstructured data is also increasing. Startups and established fintech players are investing in AI research to differentiate their services and meet the rising expectations of tech-savvy users. Collectively, these developments are positioning AI analytics as a core element of financial innovation in the Philippines.

Philippines AI in Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, deployment model, and application.

Type Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solution and services.

Deployment Model Insights:

- Cloud-based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based and on-premises.

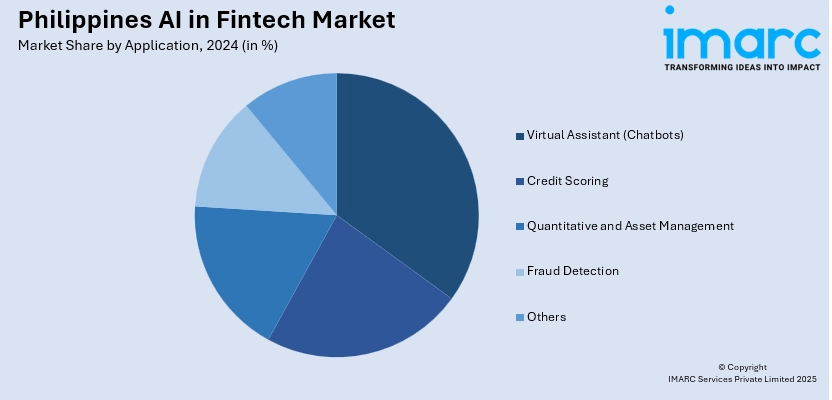

Application Insights:

- Virtual Assistant (Chatbots)

- Credit Scoring

- Quantitative and Asset Management

- Fraud Detection

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes virtual assistant (chatbots), credit scoring, quantitative and asset management, fraud detection, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines AI in Fintech Market News:

- August 2025: The Philippine Government and Sutherland launched an AI Academy to train Filipinos in future-ready skills, including fintech applications. The initiative strengthened the talent pool, boosted AI adoption in financial services, and enhanced digital resilience, driving innovation and competitiveness in the fintech market.

- April 2025: PLDT inaugurated the VITRO Sta. Rosa hyperscale data center, powered by NVIDIA GPU servers and offering the Philippines’ first GPU as a Service. This advanced AI infrastructure accelerated fintech adoption, reducing costs and strengthening digital transformation across financial services.

Philippines AI in Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solution, Services |

| Deployment Models Covered | Cloud-based, On-premises |

| Applications Covered | Virtual Assistant (Chatbots), Credit Scoring, Quantitative and Asset Management, Fraud Detection, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines AI in fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines AI in fintech market on the basis of type?

- What is the breakup of the Philippines AI in fintech market on the basis of deployment model?

- What is the breakup of the Philippines AI in fintech market on the basis of application?

- What is the breakup of the Philippines AI in fintech market on the basis of region?

- What are the various stages in the value chain of the Philippines AI in fintech market?

- What are the key driving factors and challenges in the Philippines AI in fintech market?

- What is the structure of the Philippines AI in fintech market and who are the key players?

- What is the degree of competition in the Philippines AI in fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines AI in fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines AI in fintech market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines AI in fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)