Philippines Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2026-2034

Philippines Air Freight Market Overview:

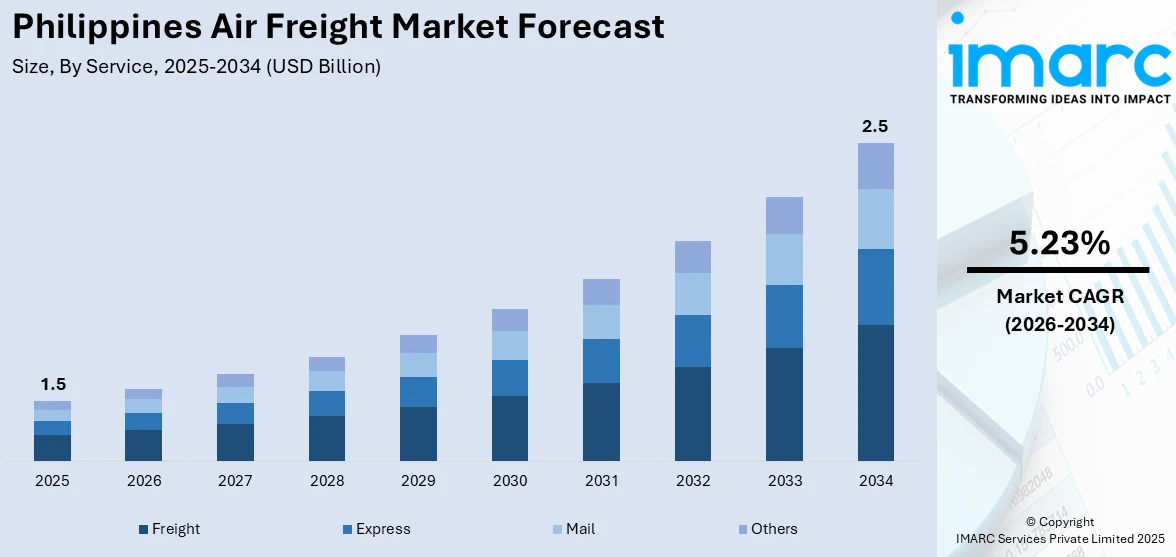

The Philippines air freight market size reached USD 1.5 Billion in 2025. Looking forward, the market is projected to reach USD 2.5 Billion by 2034, exhibiting a growth rate (CAGR) of 5.23% during 2026-2034. The market is majorly driven by the expanding e-commerce sector, which demands fast delivery and integrated logistics infrastructure. Air freight’s critical role in transporting pharmaceuticals, perishables, and high-value exports underscores its importance in supply chain continuity. Combined with infrastructure expansion and regulatory improvements, these factors are further augmenting the Philippines air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.5 Billion |

| Market Growth Rate 2026-2034 | 5.23% |

Key Trends of Philippines Air Freight Market:

Growing E-Commerce Sector and Demand for Express Delivery

The Philippines’ expanding e-commerce ecosystem is a major driver of growth for its air freight industry. Online marketplaces, fueled by increased smartphone penetration and affordable internet access, have accelerated demand for fast and reliable delivery services. Filipino consumers, particularly in urban centers like Metro Manila, Cebu, and Davao, expect expedited shipping for goods such as electronics, apparel, and beauty products. Air freight offers the most effective means of meeting these delivery expectations, especially for inter-island connectivity. In 2023, the Philippines handled 830,000 tons of air cargo, ranking as the 28th largest global air cargo market and 42nd in global trade, with Hong Kong serving as its top international gateway. This underscores aviation’s critical role in driving the country’s trade connectivity and economic integration. Logistics providers, including local startups and global freight integrators, are establishing partnerships with airlines to develop integrated delivery models. Warehouses and fulfillment centers near major airports are seeing targeted investments, streamlining order processing and air cargo handling. Additionally, improved air connectivity between Luzon, Visayas, and Mindanao is enhancing delivery speed for interregional shipments. Government support for logistics modernization through initiatives like the National Logistics Master Plan further strengthens infrastructure. This convergence of retail innovation, customer expectations, and logistics infrastructure development is central to Philippines air freight market growth, making air cargo indispensable for sustaining e-commerce expansion.

To get more information of this market Request Sample

Infrastructure Development and Government Policy Support

Infrastructure development and supportive government policies are strengthening the Philippines’ air freight sector, addressing longstanding bottlenecks in cargo handling capacity. Projects such as the expansion of Clark International Airport and the development of New Manila International Airport in Bulacan reflect national efforts to decentralize air traffic and increase freight capacity. Additionally, modernization initiatives at regional airports are enhancing connectivity between the archipelago’s islands, facilitating smoother cargo movement. The Philippine Economic Zone Authority (PEZA) is also playing a role by offering incentives to logistics companies operating within special economic zones, encouraging private sector investment in warehousing and distribution infrastructure. In 2024, the gross value added (GVA) from the Philippines’ air transportation industry reached 123.54 Billion Philippine pesos, up from 106.28 Billion pesos in 2023. This growth highlights the sector’s recovering contribution to national output, underlining aviation’s growing importance to the Philippine economy. Furthermore, the Bureau of Customs has implemented digitalization initiatives, streamlining customs clearance processes for air cargo shipments. Combined with multimodal transport links, including road and seaport connections, these developments are fostering a more integrated logistics ecosystem. With continued emphasis on public-private partnerships, the government is positioning the Philippines to become a regional logistics hub. The alignment of infrastructure upgrades with favorable policies is solidifying the long-term potential of the country’s air freight sector.

Growth Drivers of Philippines Air Freight Market:

Expansion of International Trade

The Philippines is increasingly active in global trade, with steady growth in the import and export of goods such as electronics, automotive components, pharmaceuticals, and other high-value commodities. This expansion is largely driven by the country’s role in international supply chains, benefiting from strong manufacturing capabilities and rising demand for Philippine-made products abroad. As global trade volumes increase, businesses require faster and more reliable transportation to meet deadlines and maintain competitiveness. Air freight services are well-positioned to fulfill these needs by offering speed, safety, and efficiency for time-sensitive shipments. This growing dependency on swift logistics solutions is significantly boosting the demand for air cargo services, making international trade a key driver for the Philippines air freight market.

Rise in Perishable Goods Transportation

The transportation of perishable goods such as fresh seafood, tropical fruits, vegetables, and cut flowers has become a major driver of the Philippines air freight market demand. Given the country’s reputation for producing high-quality agricultural and marine products, there is strong demand from international markets for fresh, premium goods. Air freight plays a critical role in ensuring these perishable items reach their destinations quickly, maintaining freshness, nutritional value, and overall quality. Exporters depend on timely delivery to preserve the competitiveness of their products, especially when supplying distant markets with stringent quality standards. This demand for rapid, temperature-controlled logistics solutions has created new opportunities for specialized air cargo services, particularly those equipped with advanced cold chain systems to handle sensitive perishable shipments efficiently.

Increased Use in High-Value Goods Logistics

Air freight is becoming an increasingly preferred mode of transportation for industries handling high-value goods such as advanced electronics, luxury fashion, jewelry, precision instruments, and critical healthcare products. The speed, security, and reliability offered by air cargo make it ideal for transporting these sensitive and costly items, where even minor delays or damage can lead to significant financial losses. The Philippines is witnessing growing demand from sectors like technology manufacturing, luxury retail, and medical supply distribution, all of which prioritize fast and secure deliveries to both domestic and global markets. With increasing consumer demand for premium and innovative products, the role of air freight in high-value goods logistics is expected to expand further, contributing significantly to market growth.

Opportunities of Philippines Air Freight Market:

Growth in Cold Chain Logistics

The demand for temperature-controlled logistics in the Philippines is steadily rising, driven by the need to transport pharmaceuticals, fresh agricultural produce, seafood, and other specialty goods that require strict preservation conditions. Air freight, with its speed and reliability, is an essential link in maintaining product integrity during transit. This is particularly important for industries like healthcare, where vaccines and sensitive medicines must be delivered under precise temperature conditions, and for exporters of tropical fruits and seafood aiming to meet international freshness standards. The expansion of cold chain infrastructure, including advanced storage facilities and temperature-controlled cargo aircraft, presents a major opportunity for specialized air freight operators to capture growing market demand while delivering high-value services to temperature-sensitive supply chains.

Development of Regional Air Cargo Hubs

Expanding cargo infrastructure beyond Metro Manila offers significant opportunities to improve air freight efficiency in the Philippines. Developing airports in key regions such as Cebu, Davao, and Clark into specialized air cargo hubs can help reduce congestion at primary gateways while providing faster access to local markets. According to the Philippines air freight market analysis, these regional hubs can support the movement of agricultural goods, manufactured products, and high-value shipments directly from production centers to domestic and international destinations. Enhanced regional connectivity will also make logistics operations more cost-efficient by shortening transport times and reducing reliance on overburdened facilities in the capital. With targeted investment and strategic planning, regional air cargo hubs can play a critical role in decentralizing freight operations and strengthening the country’s logistics network.

Integration with Multimodal Transport Networks

The integration of air freight with other transport modes, such as road, sea, and potential rail systems, can significantly enhance logistics efficiency in the Philippines. A seamless multimodal transport network allows for faster and more cost-effective movement of goods, combining the speed of air cargo with the broader reach of land and sea routes. This approach is especially beneficial for industries requiring rapid delivery to both domestic and international destinations, such as e-commerce, manufacturing, and agriculture. Coordinating schedules, improving cargo handling facilities, and streamlining customs procedures across all modes of transport can further optimize delivery times. By leveraging multimodal connectivity, the Philippines can strengthen its position as a competitive logistics hub, reduce bottlenecks, and improve supply chain resilience for businesses across sectors.

Challenges of Philippines Air Freight Market:

High Operational and Fuel Costs

Air freight in the Philippines remains significantly more expensive than other modes of transport, primarily due to high operational expenses. Rising global fuel prices place additional strain on carriers, as aviation fuel constitutes a substantial portion of overall costs. Maintaining aircraft, employing skilled personnel, and meeting strict safety and compliance requirements further increase expenditure. These cost pressures make it challenging for freight operators to offer competitive rates, particularly against sea and land transport options. For industries sensitive to shipping costs, this can reduce the attractiveness of air freight despite its speed advantages. Operators must explore cost-optimization strategies, such as route efficiency, fuel-saving technologies, and partnerships, to offset rising expenses while maintaining service quality in a competitive logistics landscape.

Limited Cargo Handling Capacity at Airports

Many airports in the Philippines struggle with limited infrastructure dedicated to air cargo operations, creating bottlenecks in the freight handling process. Insufficient storage space, outdated loading equipment, and a lack of specialized facilities for temperature-sensitive goods contribute to delays and inefficiencies. Major gateways such as Ninoy Aquino International Airport experience congestion due to high passenger and cargo traffic, slowing turnaround times. Smaller regional airports often lack modern cargo terminals or automated handling systems, further limiting throughput capacity. These infrastructure constraints impact both domestic and international shipments, affecting supply chain reliability. Addressing these challenges requires targeted investments in cargo facilities, advanced handling technology, and process optimization to improve efficiency and meet the growing demands of the country’s air freight market.

Regulatory and Customs Delays

Regulatory complexity and customs clearance procedures remain major challenges for the Philippine air freight sector. Lengthy documentation processes, inconsistent application of regulations, and limited coordination between agencies can slow down the movement of goods. For international shipments, differences in import/export requirements and inspection protocols can lead to additional delays. These inefficiencies directly affect delivery timelines, potentially harming customer satisfaction and disrupting supply chains for time-sensitive cargo such as perishable goods and high-value items. The problem is often worsened by limited adoption of digital processing systems, resulting in reliance on manual paperwork. Streamlining customs processes, harmonizing regulations, and enhancing inter-agency coordination can significantly improve freight movement speed, reduce operational bottlenecks, and strengthen the competitiveness of the Philippine air cargo industry.

Philippines Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

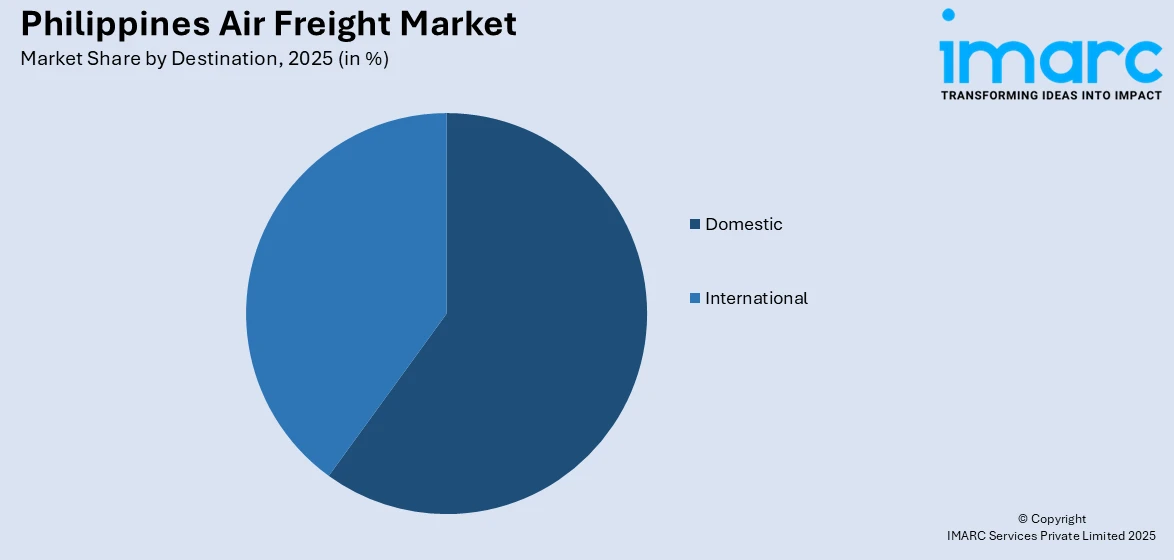

Destination Insights:

Access the comprehensive market breakdown Request Sample

- Domestic

- International

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

End-User Insights:

- Private

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end- user. This includes private and commercial.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all major regional markets. This includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Air Freight Market News:

- On May 1, 2025, Air Cargo News reported that Emirates and Philippine Airlines are exploring the expansion of their cargo interline partnership to enhance airfreight connectivity between Dubai and the Philippines. The agreement also aims to boost cooperation in ground handling, catering, technical training, and potential joint promotional initiatives. This move aligns with Emirates SkyCargo’s wider strategy to strengthen partnerships across Asia, supporting regional Philippines air freight market growth.

- On April 3, 2025, newly-launched Skyway Airlines of the Philippines appointed Hong Kong Air Cargo Terminals Limited (Hactl) as its ground handler for new e-commerce-focused freighter services to Hong Kong. Skyway operates six B737-400 freighter flights weekly, connecting Clark and Manila with Hong Kong, its first international destination. This development strengthens the Philippines’ dedicated cargo capacity, contributing to Philippines air freight market growth.

Philippines Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines air freight market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines air freight industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The air freight market in the Philippines was valued at USD 1.5 Billion in 2025.

The Philippines air freight market is projected to exhibit a CAGR of 5.23% during 2026-2034.

The Philippines air freight market is projected to reach a value of USD 2.5 Billion by 2034.

The Philippines air freight market is witnessing rising demand from e-commerce, increased transportation of perishables, and growth in high-value goods logistics. Expansion of international trade and integration with multimodal transport networks are shaping the sector, while infrastructure upgrades and regional cargo hub development enhance efficiency and market reach.

The Philippines air freight market is driven by expanding international trade, rising demand for perishable goods transportation, and increasing reliance on air cargo for high-value products. Growing cold chain logistics capabilities and the development of regional cargo hubs further strengthen market growth prospects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)