Philippines Alcoholic Beverages Market Size, Share, Trends and Forecast by Category, Alcoholic Content, Flavor, Packaging Type, Distribution Channel and Region, 2025-2033

Philippines Alcoholic Beverages Market Overview:

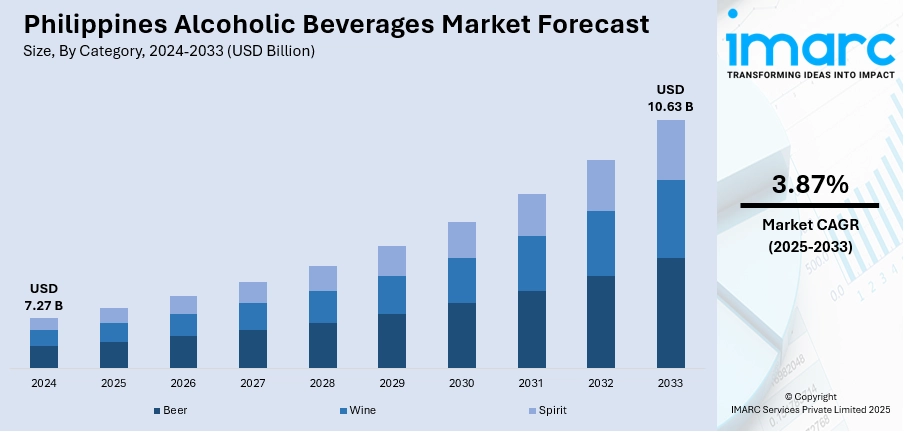

The Philippines alcoholic beverages market size reached USD 7.27 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.63 Billion by 2033, exhibiting a growth rate (CAGR) of 3.87% during 2025-2033. Urbanization, rising disposable income, expanding e-commerce, youthful demographics, and preference for premium and flavored drinks expand the Philippines alcoholic beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.27 Billion |

| Market Forecast in 2033 | USD 10.63 Billion |

| Market Growth Rate 2025-2033 | 3.87% |

Philippines Alcoholic Beverages Market Trends:

Premiumization and Craft Growth

The Philippines alcoholic beverages market is experiencing a surge in premium and craft offerings. Urban consumers increasingly favor artisanal spirits, craft beers, and specialty blends. Major brands launch premium variants, while microbreweries and distilleries proliferate in metro areas. The ready-to-drink (RTD) segment, especially flavored and craft-style cocktails, is rapidly growing, reflecting evolving consumer preferences and expanding market depth. For instance, from 2024 onward, the Philippines' alcoholic beverage market is set for strong growth. Wine sales are forecast to rise 5.4% annually, reaching 33 million liters by 2027. Beer sales are projected to grow 10% annually to 3.8 billion liters by 2027, led by mid-priced lagers (10.8% CAGR). Spirits sales will grow 4.7% annually, hitting 1.1 billion liters by 2027, with gin and shochu/soju as fastest growers. Rising disposable income and cocktail culture fuel these trends.

To get more information on this market, Request Sample

Omnichannel Distribution and Digital Marketing

Another significant trend in the Philippines alcoholic beverages market growth is the shift toward omnichannel sales and digital outreach. E‑commerce platforms and home delivery services extend product reach beyond traditional retail. Brands engage younger consumers through influencer campaigns and social media activation. Concurrently, tourism recovery bolsters on-premise demand via hotels and nightlife venues. This integrated approach enhances market accessibility and growth potential. For instance, in October 2024, leading alcohol makers, e-commerce platforms, and industry groups launched the Philippines Standards Coalition to prevent harmful alcohol use, especially by minors. The coalition, including major producers and 7,000 micro-retailers, pledged responsible marketing, strict age verification, and regular monitoring to support existing laws. The initiative aligns with WHO’s goal to reduce harmful alcohol use by 20% by 2030, promoting safer consumption while sustaining the local retail and hospitality industries.

Philippines Alcoholic Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on category, alcoholic content, flavor, packaging type, and distribution channel.

Category Insights:

- Beer

- Wine

- Still Light Wine

- Sparkling Wine

- Spirit

- Baijiu

- Vodka

- Whiskey

- Rum

- Liqueurs

- Gin

- Tequila

- Others

The report has provided a detailed breakup and analysis of the market based on the category. This includes beer, wine (still light wine, sparkling wine), spirit (baijiu, vodka, whiskey, rum, liqueurs, gin, tequila, and others).

Alcoholic Content Insights:

- High

- Medium

- Low

The report has provided a detailed breakup and analysis of the market based on the alcoholic content. This includes high, medium, and low.

Flavor Insights:

- Unflavored

- Flavored

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes unflavored, and flavored.

Packaging Type Insights:

- Glass Bottles

- Tins

- Plastic Bottles

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes glass bottles, tins, plastic bottles, and others.

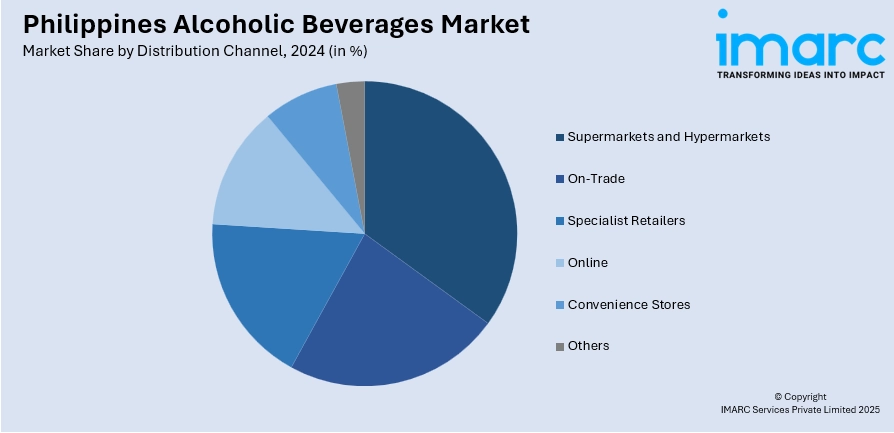

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- On-Trade

- Specialist Retailers

- Online

- Convenience Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, on-trade, specialist retailers, online, convenience stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major country markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Alcoholic Beverages Market News:

- In August 2024, PepsiCo launched its first ready-to-drink alcoholic beverage, Hard Mountain Dew, in the Philippines. With 5% ABV, zero caffeine, no added sugar, and 100 calories per serving, it targets responsible adult consumers. Available in Original and Beach Blast flavors, Hard Mountain Dew is sold in supermarkets, convenience stores, pubs, and bars across key cities, reflecting PepsiCo’s push into the growing RTD alcohol market.

Philippines Alcoholic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered |

|

| Alcoholic Contents Covered | High, Medium, Low |

| Flavors Covered | Unflavored, Flavored |

| Packaging Types Covered | Glass Bottles, Tins, Plastic Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, On-Trade, Specialist Retailers, Online, Convenience Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines alcoholic beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines alcoholic beverages market on the basis of category?

- What is the breakup of the Philippines alcoholic beverages market on the basis of alcohol content?

- What is the breakup of the Philippines alcoholic beverages market on the basis of flavor?

- What is the breakup of the Philippines alcoholic beverages market on the basis of packaging type?

- What is the breakup of the Philippines alcoholic beverages market on the basis of distribution channel?

- What is the breakup of the Philippines alcoholic beverages market on the basis of region?

- What are the various stages in the value chain of the Philippines alcoholic beverages market?

- What are the key driving factors and challenges in the Philippines alcoholic beverages market?

- What is the structure of the Philippines alcoholic beverages market and who are the key players?

- What is the degree of competition in the Philippines alcoholic beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines alcoholic beverages market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines alcoholic beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines alcoholic beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)