Philippines Alternative Data Market Size, Share, Trends and Forecast by Data Type, Industry, End User, and Region, 2025-2033

Philippines Alternative Data Market Overview:

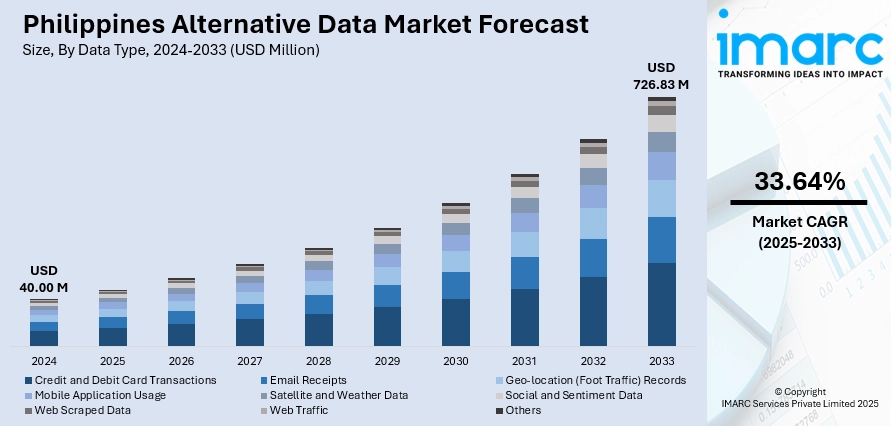

The Philippines alternative data market size reached USD 40.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 726.83 Million by 2033, exhibiting a growth rate (CAGR) of 33.64% during 2025-2033. Rapid digitalization, fintech expansion, data-driven decision-making, and demand from financial and retail sectors propel Philippines alternative data market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.00 Million |

| Market Forecast in 2033 | USD 726.83 Million |

| Market Growth Rate 2025-2033 | 33.64% |

Philippines Alternative Data Market Trends:

Technology Integration in Finance

Within the Philippines alternative data market, a prominent trend is the embedding of AI and geospatial analytics into financial services. Investment firms and fintechs are leveraging transaction data, web traffic, and mobile usage to enhance credit scoring and risk assessment. These methods supply insights beyond traditional financial metrics, reflecting evolving consumer data usage and contributing to enhanced market sophistication in the Philippines alternative data sector. For instance, in August 2025, Trusting Social, a fintech AI company, used anonymized telco data to provide alternative credit scoring in the Philippines, helping underbanked individuals access formal credit. Partnering with over 50 financial institutions, the platform supported over 1 million borrowers monthly. This innovation promoted financial inclusion by enabling loans for those without traditional banking histories, especially in remote areas.

To get more information on this market, Request Sample

Demand for Real-Time Insights

Another trend pushing the Philippines alternative data market growth concerns demand for real-time, actionable intelligence. Companies increasingly rely on streaming data—such as social sentiment, satellite imagery, and email traffic—to inform operational decisions. This shift toward high-frequency, dynamic datasets supports agility in business strategies and strengthens the market’s adaptability to volatile environments. For instance, in January 2025, HES FinTech announced a strategic partnership with Credolab to enhance AI-powered credit risk management. By integrating Credolab’s behavioral analytics from mobile and web metadata, HES clients gain deeper insights into borrower creditworthiness. The collaboration supports financial inclusion by enabling lenders to assess underbanked populations using alternative data. Credolab’s technology complements HES’s AI decisioning tool, GiniMachine, improving scoring accuracy. Both companies aim to help lenders make better decisions and responsibly expand credit access, particularly in emerging markets like the Philippines.

Philippines Alternative Data Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on data type, industry, and end user.

Data Type Insights:

- Credit and Debit Card Transactions

- Email Receipts

- Geo-location (Foot Traffic) Records

- Mobile Application Usage

- Satellite and Weather Data

- Social and Sentiment Data

- Web Scraped Data

- Web Traffic

- Others

The report has provided a detailed breakup and analysis of the market based on the data type. This includes credit and debit card transactions, email receipts, geo-location (foot traffic) records, mobile application usage, satellite and weather data, social and sentiment data, web scraped data, web traffic, and others.

Industry Insights:

- Automotive

- BFSI

- Energy

- Industrial

- IT and Telecommunications

- Media and Entertainment

- Real Estate and Construction

- Retail

- Transportation and Logistics

- Other

A detailed breakup and analysis of the market based on the industry have also been provided in the report. This includes automotive, BFSI, energy, industrial, IT and telecommunications, media and entertainment, real estate and construction, retail, transportation and logistics, and others.

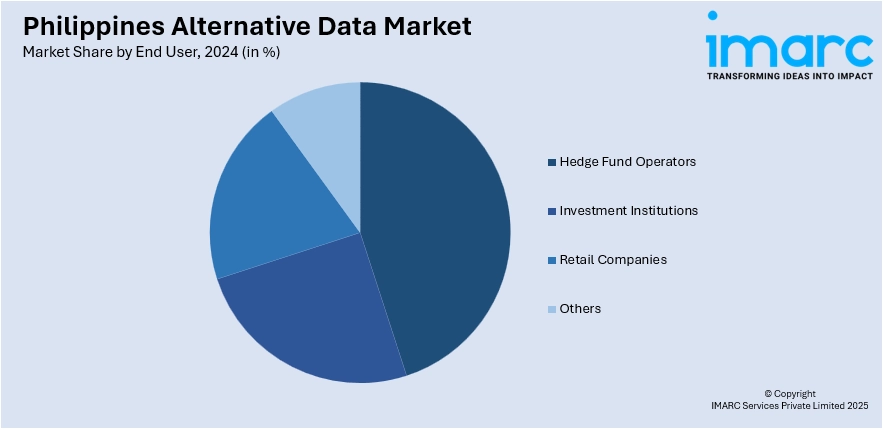

End User Insights:

- Hedge Fund Operators

- Investment Institutions

- Retail Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hedge fund operators, investment institutions, retail companies, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major country markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Alternative Data Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Types Covered | Credit and Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite and Weather Data, Social and Sentiment Data, Web Scraped Data, Web Traffic, Others |

| Industries Covered | Automotive, BFSI, Energy, Industrial, IT and Telecommunications, Media and Entertainment, Real Estate and Construction, Retail, Transportation and Logistics, Others |

| End Users Covered | Hedge Fund Operators, Investment Institutions, Retail Companies, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines alternative data market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines alternative data market on the basis of data type?

- What is the breakup of the Philippines alternative data market on the basis of industry?

- What is the breakup of the Philippines alternative data market on the basis of end user?

- What is the breakup of the Philippines alternative data market on the basis of region?

- What are the various stages in the value chain of the Philippines alternative data market?

- What are the key driving factors and challenges in the Philippines alternative data market?

- What is the structure of the Philippines alternative data market and who are the key players?

- What is the degree of competition in the Philippines alternative data market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines alternative data market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines alternative data market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines alternative data industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)