Philippines Athletic Footwear Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2026-2034

Philippines Athletic Footwear Market Summary:

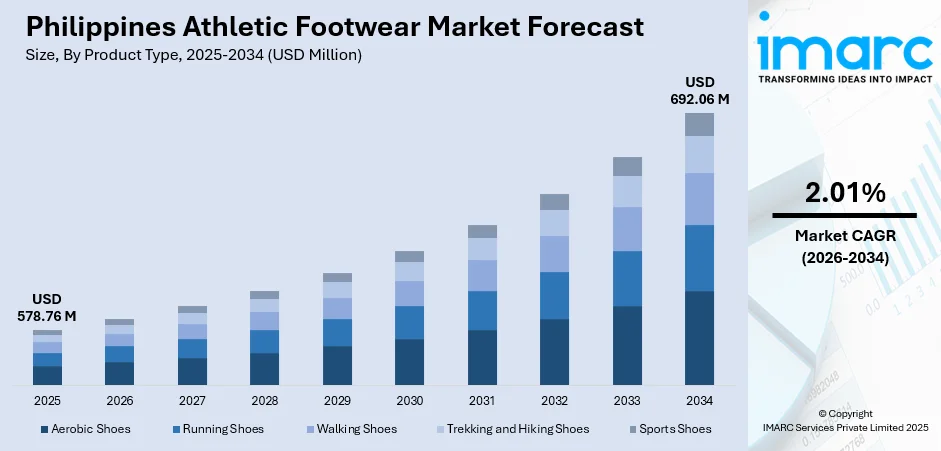

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025 and is projected to reach USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034.

The Philippines athletic footwear market is experiencing steady expansion driven by increasing health consciousness among the population and rising participation in fitness activities. The growing middle class with higher disposable incomes is investing more in quality athletic footwear for running, basketball, and outdoor recreational activities. The athleisure trend continues to blur the lines between sportswear and casual fashion, creating sustained demand for versatile footwear options that transition seamlessly from workout sessions to everyday wear.

Key Takeaways and Insights:

-

By Product Type: Running shoes dominated the market with 35.08% share in 2025, driven by the growing running culture across the archipelago, increasing participation in marathons and fun runs, and the versatility of running footwear for both athletic activities and casual daily wear among health-conscious Filipino consumers.

-

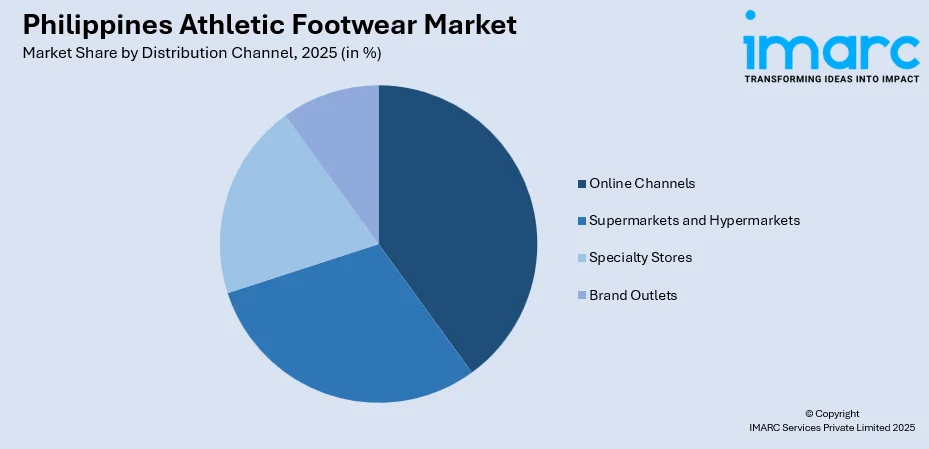

By Distribution Channel: Online channels led the market with a share of 40.02% in 2025, supported by high smartphone penetration rates, growing e-commerce adoption among Filipino consumers, convenient payment options including cash-on-delivery, and the wide product variety and competitive pricing offered through digital platforms.

-

By End User: Men represented the largest segment with a market share of 50.03% in 2025, attributed to higher participation rates in sports activities including basketball and running, greater spending on performance footwear, and strong brand consciousness among male consumers seeking both functionality and style.

-

By Region: Luzon dominated the market with 61% revenue share in 2025, owing to the concentration of urban population centers including Metro Manila, higher disposable incomes, greater presence of retail outlets and brand stores, and well-developed e-commerce infrastructure in the region.

-

Key Players: The Philippines athletic footwear market exhibits moderate to high competitive intensity, with multinational sportswear corporations competing alongside regional specialty retailers. The market features a blend of global brand leadership and localized retail expertise, with companies focusing on exclusive product launches, digital commerce expansion, and experiential retail environments to capture market share among fashion-forward and fitness-conscious consumers.

To get more information on this market Request Sample

The Philippines athletic footwear industry is witnessing transformative growth as fitness consciousness permeates mainstream culture, particularly among the younger demographic comprising millennials and Generation Z consumers. The cultural phenomenon of the barkada, or close-knit friend groups, has amplified the social fitness trend, transforming running events and gym sessions into community bonding experiences. Basketball remains deeply embedded in Filipino sporting culture, sustaining strong demand for performance basketball shoes, while the athleisure movement has expanded the market by positioning athletic footwear as fashion-forward lifestyle accessories. The entry of international specialty retailers and enhanced digital commerce capabilities have broadened consumer access to premium global brands and exclusive product releases, establishing the Philippines as an increasingly important market within the Southeast Asian athletic footwear landscape.

Philippines Athletic Footwear Market Trends:

Rising Health Consciousness and Fitness Culture Adoption

The Philippines is experiencing a cultural shift toward healthier lifestyles, with fitness activities becoming integral to daily routines across urban centers. The running boom has transformed recreational jogging into a mainstream social phenomenon, with increasing participation in marathons, fun runs, and community fitness events throughout the archipelago. For instance, the 4th Edition of the Philippines Fitness & Wellness Expo 2026, held alongside the Philippines Medical Expo 2026, unites top names in fitness, sports, and wellness in a single venue. Featuring global brands, cutting-edge health solutions, and natural therapies, the expo aims to inspire healthier lifestyles and encourage holistic well-being. This growing emphasis on physical wellness is driving demand for specialized athletic footwear designed to support various exercise modalities, from high-intensity interval training to outdoor recreational activities.

Digital Commerce Transformation and Omnichannel Retail

The athletic footwear retail landscape is undergoing rapid digital transformation, with e-commerce platforms emerging as primary shopping destinations for Filipino consumers. The Philippines e-commerce market size reached USD 28.0 Billion in 2025. Looking forward, the market is expected to reach USD 86.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.32% during 2026-2034. High smartphone penetration and expanding internet connectivity have facilitated the growth of online athletic footwear sales, enabling consumers to access broader product selections and compare prices effortlessly. Retailers are investing in omnichannel strategies that integrate physical stores with digital platforms, providing seamless shopping experiences through click-and-collect services and enhanced mobile commerce capabilities.

Athleisure Integration and Fashion-Forward Designs

The convergence of athletic performance and lifestyle fashion continues to reshape consumer preferences in the Philippines footwear market. Athletic shoes are increasingly designed to transition seamlessly from fitness activities to casual social settings, reflecting the growing demand for versatile footwear options. This trend is particularly pronounced among younger consumers who prioritize both functionality and aesthetic appeal, driving brands to develop innovative designs that merge technical performance features with contemporary streetwear styling. For instance, in December 2025, 2023 NBA MVP Joel Embiid teamed up with Skechers to launch his latest signature shoe, the SKX JE1. In a media statement, Embiid highlighted his active involvement in the design and development of the SKX JE1 alongside the brand.

Market Outlook 2026-2034:

The Philippines athletic footwear market demonstrates promising growth prospects supported by favorable demographic trends and evolving consumer lifestyles. Continued urbanization, rising middle-class prosperity, and increasing health awareness are expected to sustain demand for quality athletic footwear across all consumer segments. The expansion of international retail presence and enhancement of domestic distribution networks will improve product accessibility, while digital commerce growth will continue reshaping purchasing behaviors. The market generated a revenue of USD 578.76 Million in 2025 and is projected to reach a revenue of USD 692.06 Million by 2034, growing at a compound annual growth rate of 2.01% from 2026-2034.

Philippines Athletic Footwear Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Running Shoes |

35.08% |

|

Distribution Channel |

Online Channels |

40.02% |

|

End User |

Men |

50.03% |

|

Region |

Luzon |

61% |

Product Type Insights:

- Aerobic Shoes

- Running Shoes

- Walking Shoes

- Trekking and Hiking Shoes

- Sports Shoes

Running shoes dominated with a market share of 35.08% of the total Philippines athletic footwear market in 2025.

Running shoes have established clear market leadership in the Philippines athletic footwear sector, reflecting the nationwide embrace of running culture as both fitness activity and social phenomenon. The proliferation of organized running events, from community fun runs to international marathons, has created sustained demand for specialized running footwear featuring advanced cushioning technologies and performance-enhancing designs. Filipino consumers increasingly seek running shoes that offer optimal support for various running surfaces and distances while providing durability for the tropical climate conditions prevalent throughout the archipelago. For instance, in January 2025, the Global running brand Saucony officially arrived in the Philippines, ushering in a new chapter for local runners and fitness enthusiasts. The launch of the Saucony Philippines e-commerce store, built on Shopify Plus and developed by LeapOut, brings over 125 years of Saucony’s running innovation closer to Filipino consumers.

The running shoe segment benefits from strong crossover appeal, with consumers purchasing these products for both athletic performance and casual everyday wear. The versatility of modern running shoe designs, which incorporate lightweight construction with contemporary aesthetics, positions them as ideal choices for health-conscious consumers seeking multipurpose footwear solutions. Major brands continue investing in product innovations specifically tailored for the Southeast Asian market, introducing breathable materials and responsive cushioning systems suited to local running conditions and consumer preferences.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Brand Outlets

- Online Channels

Online channels led with a share of 40.02% of the total Philippines athletic footwear market in 2025.

Online channels have emerged as the dominant distribution pathway for athletic footwear in the Philippines, driven by robust e-commerce ecosystem development and shifting consumer shopping preferences. The widespread adoption of digital payment solutions, coupled with reliable logistics networks offering convenient delivery options including cash-on-delivery, has accelerated the migration of athletic footwear purchases to digital platforms. Filipino consumers appreciate the extensive product variety, competitive pricing transparency, and time-saving convenience that online shopping provides, particularly in congested urban areas where physical retail visits require significant time investment.

The digital channel dominance reflects broader retail transformation across the Philippines, with major e-commerce platforms investing heavily in athletic footwear categories and establishing partnerships with leading brands for exclusive online releases. Social commerce integration has further amplified online sales, with influencer marketing and live-selling events generating significant consumer engagement and purchase conversion. Retailers are enhancing their digital capabilities through improved mobile applications, augmented reality features for virtual try-ons, and seamless return policies that address consumer concerns about online footwear purchases.

End User Insights:

- Men

- Women

- Kids

Men exhibited a clear dominance with a 50.03% share of the total Philippines athletic footwear market in 2025.

The men's segment maintains market leadership in the Philippines athletic footwear industry, supported by higher male participation rates across popular sporting activities and greater average spending on performance footwear products. Basketball culture remains deeply ingrained in Filipino society, with amateur and recreational basketball driving consistent demand for basketball-specific shoes among male consumers. The segment also benefits from strong male engagement in running communities and gym fitness activities, creating diverse demand across multiple athletic footwear categories.

Male consumers in the Philippines demonstrate pronounced brand consciousness and willingness to invest in premium athletic footwear that delivers both performance capabilities and style credentials. The sneaker culture phenomenon has particularly resonated with male demographics, with limited-edition releases and collaboration collections commanding significant consumer interest and premium pricing acceptance. Retailers recognize this segment's importance through targeted marketing campaigns and expanded product assortments catering to male preferences for technical features and contemporary designs.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominated with a 61% share of the total Philippines athletic footwear market in 2025.

Luzon island commands the largest share of the Philippines athletic footwear market, anchored by the economic concentration of Metro Manila and surrounding urban centers. The National Capital Region represents the primary hub for athletic footwear consumption, featuring the highest concentration of retail outlets, brand flagship stores, and specialty sporting goods retailers. Consumer purchasing power in Luzon significantly exceeds other regions, supported by higher average incomes and greater exposure to international fitness trends and lifestyle influences.

The region benefits from superior retail infrastructure including major shopping mall developments that house premium athletic footwear brands and international specialty retailers. E-commerce logistics networks are most developed within Luzon, enabling faster delivery times and broader product availability for online purchases. The concentration of fitness facilities, running clubs, and sports communities within Metro Manila and provincial capitals generates sustained athletic footwear demand across performance and lifestyle categories.

Market Dynamics:

Growth Drivers:

Why is the Philippines Athletic Footwear Market Growing?

Expanding Middle Class and Rising Disposable Incomes

The Philippines is experiencing substantial growth in its middle-class population, creating an expanding consumer base with increased purchasing power for discretionary products including quality athletic footwear. Economic development and job creation across major urban centers have elevated household incomes, enabling more Filipino families to allocate their budget toward fitness-related purchases and premium branded products. This demographic shift has fundamentally altered consumption patterns, with consumers increasingly willing to invest in higher-quality athletic footwear that offers superior performance, durability, and style credentials. The aspirational purchasing behavior of the emerging middle class drives demand for recognized international brands previously accessible only to affluent segments, democratizing access to premium athletic footwear products across broader consumer demographics.

Growing Health Consciousness and Fitness Participation

The Philippines is witnessing a transformative cultural shift toward health-conscious lifestyles, with fitness activities becoming mainstream pursuits across age groups and socioeconomic segments. Increasing awareness of lifestyle-related health conditions has motivated Filipinos to incorporate regular physical exercise into daily routines, generating sustained demand for appropriate athletic footwear. The fitness industry expansion, including gymnasium proliferation and group exercise class popularity, has created diverse athletic footwear requirements spanning running, training, and sports-specific categories. Social media influence has amplified health and fitness consciousness, with fitness influencers and wellness advocates promoting active lifestyles and appropriate athletic gear selection. This cultural momentum toward healthier living continues to strengthen as younger generations embrace fitness as an essential lifestyle component rather than optional activities.

E-commerce Expansion and Digital Retail Innovation

The rapid development of digital commerce infrastructure has transformed athletic footwear accessibility throughout the Philippines, enabling consumers nationwide to access extensive product selections previously limited to major urban retail centers. E-commerce platform investments in logistics capabilities, payment solutions, and customer experience have reduced barriers to online athletic footwear purchases, driving channel migration from traditional retail. The integration of social commerce features, including live-selling events and influencer partnerships, has created engaging shopping experiences that resonate with digitally-native consumer segments. Mobile commerce adoption has particularly accelerated athletic footwear sales, with consumers utilizing smartphone applications for product discovery, price comparison, and convenient purchasing. This digital retail evolution continues expanding the addressable market by reaching consumers in provincial areas with limited physical retail access while providing metropolitan consumers with time-efficient shopping alternatives.

Market Restraints:

What Challenges is the Philippines Athletic Footwear Market Facing?

Counterfeit Product Proliferation

The Philippines athletic footwear market faces persistent challenges from counterfeit products that undermine brand integrity and consumer confidence. Fake athletic footwear products circulating through informal retail channels and unverified online sellers create pricing pressure on legitimate products while potentially delivering substandard quality that disappoints consumers. This counterfeit prevalence complicates brand protection efforts and requires ongoing consumer education regarding product authentication.

Price Sensitivity Among Mass Market Consumers

Despite growing prosperity, significant consumer segments in the Philippines remain highly price-sensitive, limiting market penetration for premium athletic footwear products. Budget constraints influence purchasing decisions toward lower-priced alternatives or delayed replacements, affecting market volume growth potential. This price sensitivity necessitates diverse product positioning strategies that address varying consumer affordability levels while maintaining acceptable profit margins for manufacturers and retailers.

Infrastructure Limitations in Provincial Markets

Retail infrastructure underdevelopment in provincial and rural areas restricts athletic footwear market expansion beyond major metropolitan centers. Limited physical retail presence, logistics challenges affecting e-commerce delivery times and costs, and reduced consumer exposure to brands and products constrain market growth potential in underserved regions. Addressing these infrastructure gaps requires sustained investment in distribution networks and retail format innovations suited to provincial market conditions.

Competitive Landscape:

The Philippines athletic footwear market operates within a competitive environment characterized by the presence of established multinational sportswear corporations alongside regional specialty retailers and emerging direct-to-consumer brands. Market competition centers on product innovation, brand positioning, distribution network expansion, and digital commerce capabilities. Leading players leverage extensive research and development investments to introduce performance-enhancing technologies and design innovations that differentiate their offerings. Retail competition has intensified with the entry of international specialty sporting goods retailers establishing flagship locations in premium mall developments, introducing exclusive product releases and elevated shopping experiences. Digital transformation has emerged as a critical competitive dimension, with market participants investing in e-commerce platforms, mobile applications, and omnichannel integration to capture evolving consumer shopping preferences. Strategic partnerships between international brands and local retail operators facilitate market penetration while ensuring localized market understanding and consumer engagement approaches.

Recent Developments:

-

June 2025: JD Sports, the UK's leading sneaker and sports fashion retailer, opened its first store in the Philippines at SM Mall of Asia in partnership with SSI Group. The flagship store spans over eight hundred square meters and features exclusive sneaker releases from global brands, marking a significant milestone in the retailer's Southeast Asian expansion strategy.

-

April 2024: Reebok unveiled the much-anticipated FloatZig 1 Running Shoes in the Philippines. Featuring the brand’s acclaimed Floatride Energy Foam and signature Zig Tech midsole design, this new running model offers a lightweight, responsive, and springy experience, crafted to make running more enjoyable for everyone.

-

July 2024: Toby's Sports received recognition as Sporting Goods Retailer of the Year - Philippines at the Retail Asia Awards, acknowledging the company's significant impact on the sports retail industry throughout its operations across numerous stores nationwide and its commitment to providing high-performance athletic footwear.

Philippines Athletic Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Aerobic Shoes, Running Shoes, Walking Shoes, Trekking and Hiking Shoes, Sports Shoes |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Brand Outlets, Online Channels |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines athletic footwear market size was valued at USD 578.76 Million in 2025.

The Philippines athletic footwear market is expected to grow at a compound annual growth rate of 2.01% from 2026-2034 to reach USD 692.06 Million by 2034.

Running shoes dominated the Philippines athletic footwear market with 35.08% share in 2025, driven by the growing running culture, increasing marathon participation, and the versatile appeal of running footwear for both athletic and casual wear applications.

Key factors driving the Philippines athletic footwear market include expanding middle-class population with rising disposable incomes, growing health consciousness and fitness participation rates, e-commerce expansion enabling broader product accessibility, athleisure trend integration into mainstream fashion, and strong basketball culture sustaining sports footwear demand.

Major challenges include counterfeit product proliferation affecting brand integrity, price sensitivity among mass market consumers limiting premium segment growth, infrastructure limitations restricting market expansion in provincial areas, intense competition requiring continuous investment in product innovation, and logistics challenges affecting e-commerce delivery efficiency outside metropolitan centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)