Philippines Automotive Market Size, Share, Trends and Forecast by Type, Propulsion Type, and Region, 2025-2033

Philippines Automotive Market Overview:

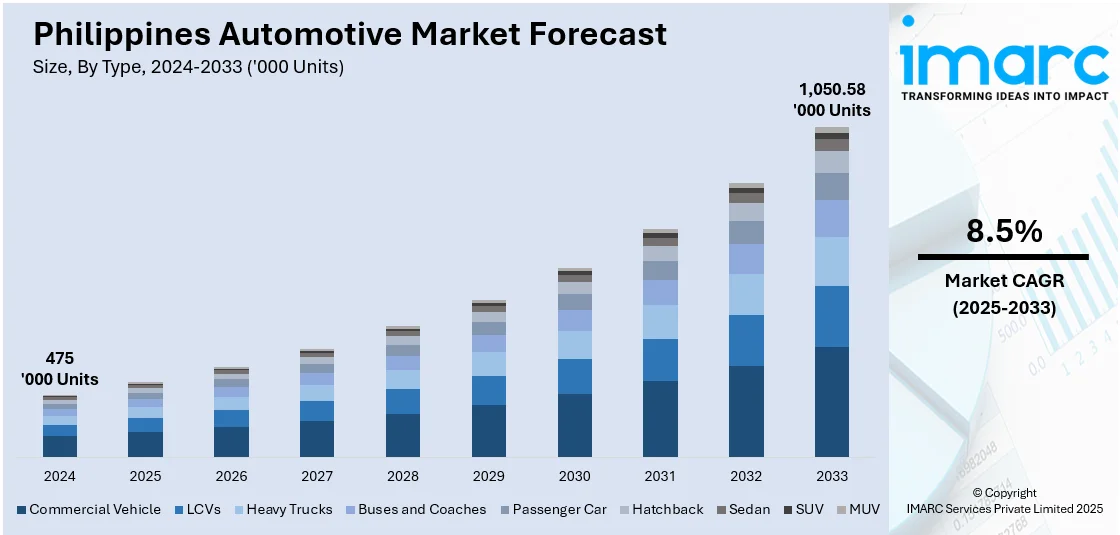

The Philippines automotive market size reached 475 Thousand Units in 2024. Looking forward, the market is expected to reach 1,050.58 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 8.5% during 2025-2033. The rising disposable incomes, increasing demand for personal vehicles, expanding infrastructure, and government incentives for eco-friendly cars are some of the factors contributing to the Philippines automotive market share. Additionally, growth in the e-commerce sector and improving financing options also contribute to the market's expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 475 Thousand Units |

| Market Forecast in 2033 | 1,050.58 Thousand Units |

| Market Growth Rate 2025-2033 | 8.5% |

Key Trends of Philippines Automotive Market:

Strong Market Leadership in the Automotive Sector

The Philippine automotive market has witnessed impressive growth, with a key player capturing a significant portion of the market share. This dominance reflects growing consumer interest and increasing competition. With an eye on sustaining its stronghold, the company plans to introduce new models and maintain an optimistic outlook for the industry. The ongoing innovations and strategic market approaches highlight the evolving landscape of the sector, which is expected to see further expansion driven by diverse consumer needs and preferences. This shift signifies a competitive environment where continuous product offerings and adaptations play a crucial role in shaping the market's future. These factors are intensifying the Philippines automotive market growth. For example, in February 2025, Toyota Motor Philippines announced a record-breaking sales performance, selling 218,019 vehicles in 2024. This accounted for 46% of the total Philippine automotive market share. The company aims to maintain its strong market presence in 2025 with new model introductions and an optimistic outlook for the automotive industry.

To get more information on this market, Request Sample

Philippine Auto Industry Setting Ambitious Sales Targets

The Philippine automotive market experienced a notable sales increase, with commercial vehicles driving much of the growth. This surge is attributed to rising demand across various vehicle segments, supported by fresh model releases and favorable market conditions. Expectations for continued growth are high, as industry associations aim for substantial sales targets in the coming period. New vehicle models and government-backed incentives are set to further fuel the sector's expansion, catering to evolving consumer needs and preferences. This momentum suggests a dynamic shift in the automotive market, where strategic product offerings and external support play key roles in achieving new milestones, contributing to the overall market's robust outlook. For instance, in February 2025, the Philippine automotive industry achieved a 10.4% increase in sales, totaling 37,604 units. Commercial vehicles led the growth with a 16.6% rise. The Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA) aim for 500,000-unit sales in 2025, supported by new model introductions and government incentives.

Growth Drivers of Philippines Automotive Market:

Rising Middle-Class Population and Urbanization

The growing middle class in the Philippines, combined with rapid urban development, is driving increased demand for personal vehicles. Increasing migration of Filipinos to the cities seeking a better way of life creates a greater need to ensure reliable and accessible means of transport. The ownership of cars in metropolitan areas such as Metro Manila, Cebu, and Davao is recording a significant rise caused by the rising incomes and the changing living demands. The customer base of the automotive industry is growing on account of this demographic change, especially among young professionals and upcoming households. The desire for independence, convenience, and time efficiency is prompting more individuals to invest in personal vehicles, making urbanization and rising incomes a crucial driver of growth in the Philippine automotive market demand.

Improved Financing Accessibility

Greater access to vehicle financing solutions is making car ownership more achievable for a wider range of Filipinos. Financial institutions, including banks and digital lenders, now offer competitive auto loans with lower interest rates, longer repayment terms, and minimal down payments. These flexible options are particularly appealing to first-time buyers and middle-income households looking to purchase new or used vehicles. The rise of fintech platforms has also simplified application processes and accelerated loan approvals, improving the customer experience. As financing becomes more inclusive and widely available, it is encouraging more consumers to enter the automotive market, thereby contributing significantly to overall vehicle sales growth across the Philippines.

Expansion of Infrastructure Projects

Ongoing infrastructure development across the Philippines is directly supporting the Philippine automotive market growth. Government initiatives such as the “Build, Build, Build” program are enhancing road networks, highways, and intercity transport routes, improving regional connectivity. These developments make vehicle ownership more practical and appealing for both personal and business use. As travel becomes more efficient, demand for cars increases, especially in areas now more accessible due to improved infrastructure. Provincial markets are also opening as better roads link them to urban centers. This growing ease of mobility is not only fueling car sales but also supporting a more integrated and connected transport ecosystem throughout the country.

Opportunities in Philippines Automotive Market:

Electric Vehicle (EV) Market Potential

The Philippine electric vehicle (EV) market holds strong potential, driven by increasing environmental consciousness and supportive government initiatives. Incentives such as tax breaks, reduced tariffs, and infrastructure plans for EV charging stations are creating a favorable environment for EV adoption. Although still in its infancy, the segment offers ample room for innovation and early investments. Automakers and startups can capitalize on this by developing affordable models suited for local needs, partnering with charging infrastructure providers, and promoting awareness around sustainability. As fuel prices rise and emissions regulations tighten, consumer interest in EVs is expected to grow. This evolving landscape provides a window of opportunity for brands to establish leadership in the green mobility space.

Growth of the Used Car Market

The used car segment in the Philippines is gaining momentum as more consumers seek cost-effective mobility options without compromising reliability. With inflation concerns and budget constraints affecting many households, pre-owned vehicles offer an attractive alternative to new car purchases. The rise of online auto marketplaces and dealership-backed certified pre-owned programs has improved trust and transparency, making the buying process smoother and more secure. According to the Philippine automotive market analysis, these platforms often include warranties, detailed inspections, and financing options, enhancing customer confidence. As digital access increases and the demand for practical transportation rises, the used car market is becoming an essential pillar of the overall automotive ecosystem, offering scalability and sustainability for both buyers and sellers.

Technological Integration and Digital Retailing

The digital transformation of the automotive industry is unlocking new growth avenues in the Philippines. From virtual showrooms and online booking to AI-powered customer service and digital financing, technology is reshaping how consumers shop for cars. This shift caters to a new generation of tech-savvy buyers who value convenience, speed, and personalization. Automotive brands and dealerships that invest in seamless digital experiences, such as mobile apps, 360-degree vehicle views, and chatbot support, can engage customers more effectively and drive higher conversions. Additionally, data analytics and CRM tools allow for better customer targeting and retention. As internet usage and smartphone penetration increase, digital retailing is poised to become a dominant sales channel in the market.

Philippines Automotive Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and propulsion type.

Type Insights:

- Commercial Vehicle

- LCVs

- Heavy Trucks

- Buses and Coaches

- Passenger Car

- Hatchback

- Sedan

- SUV

- MUV

The report has provided a detailed breakup and analysis of the market based on the type. This includes commercial vehicle, LCVs, heavy trucks, buses and coaches, passenger car, hatchback, sedan, SUV, and MUV.

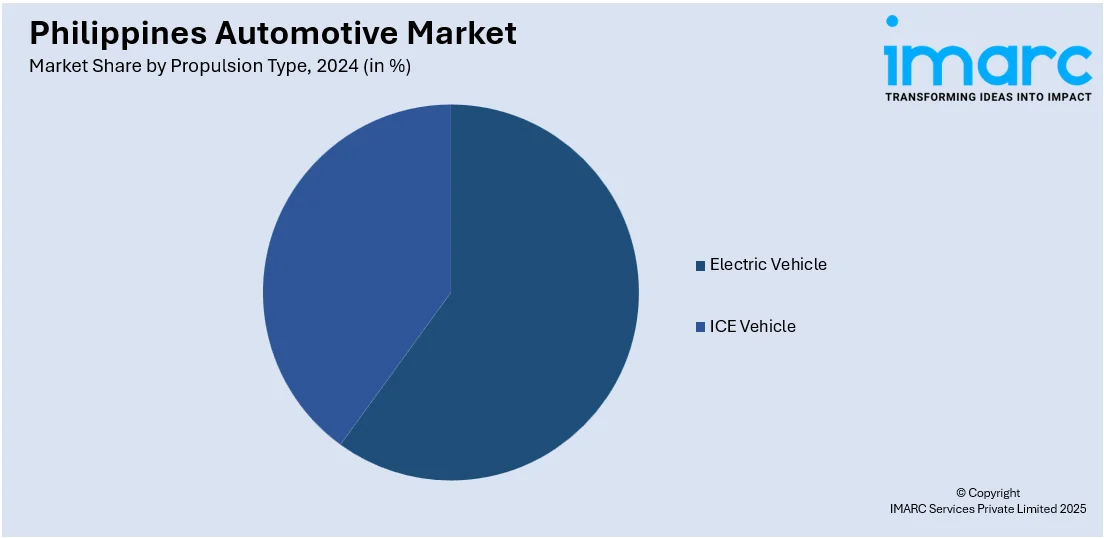

Propulsion Type Insights:

- Electric Vehicle

- ICE Vehicle

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes electric vehicle and ICE vehicle.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Automotive Market News:

- In February 2025, Chinese electric vehicle brand Omoda & Jaecoo launched operations in the Philippines, opening its first dealership in Bonifacio Global City. The company plans to establish 24 dealerships nationwide and introduce three full-EV models, targeting monthly sales of 500 units in the first half of the year.

- In February 2025, the Philippine government finalized a joint administrative order for the implementation of the P9-billion RACE program, aiming to support local vehicle manufacturing. The program offers fiscal incentives for producing 100,000 units of enrolled car models, with applications expected to open in April or May.

Philippines Automotive Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Commercial Vehicle, LCVs, Heavy Trucks, Buses and Coaches, Passenger Car, Hatchback, Sedan, SUV, MUV |

| Propulsion Types Covered | Electric Vehicle, ICE Vehicle |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines automotive market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines automotive market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines automotive industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive market in the Philippines reached 475 Thousand Units in 2024.

The Philippines automotive market is projected to exhibit a CAGR of 8.5% during 2025-2033.

The Philippines automotive market is projected to reach a volume of 1,050.58 Thousand Units by 2033.

The market is witnessing a shift toward electric vehicles, rising popularity of compact SUVs, increased adoption of digital retailing, and a growing preference for pre-owned certified cars. Technological integration, eco-conscious choices, and lifestyle-driven purchasing behavior are shaping consumer trends across both urban and provincial areas.

The market growth is fueled by rising middle-class incomes, expanding access to flexible auto financing, and nationwide infrastructure developments. Additionally, increased urbanization and evolving consumer aspirations are driving the demand for private vehicles, while supportive government policies continue to encourage both local and foreign automotive investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)