Philippines Automotive Wiring Harness Market Size, Share, Trends and Forecast by Application, Material Type, Transmission Type, Vehicle Type, Category, Component, and Region, 2026-2034

Philippines Automotive Wiring Harness Market Summary:

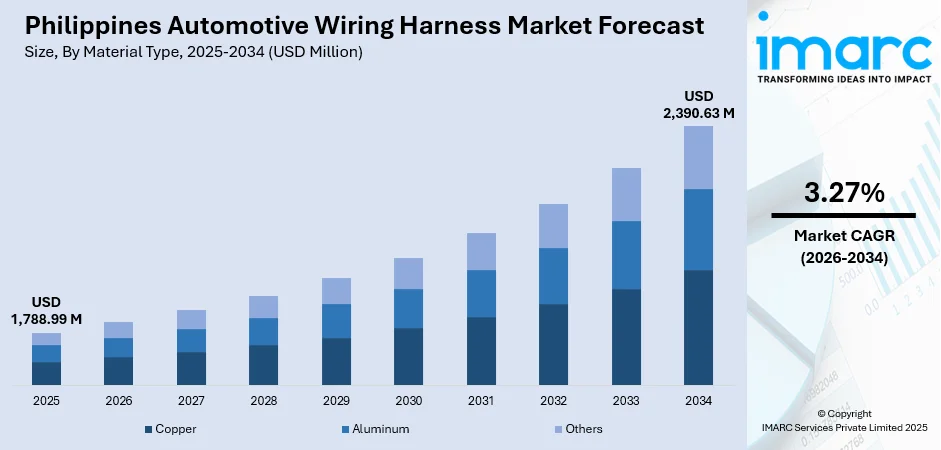

The Philippines automotive wiring harness market size was valued at USD 1,788.99 Million in 2025 and is projected to reach USD 2,390.63 Million by 2034, growing at a compound annual growth rate of 3.27% from 2026-2034.

The Philippines automotive wiring harness market is experiencing steady expansion driven by increasing vehicle assembly activity, strategic positioning within ASEAN export networks, and rising electronics integration in modern vehicles. Local manufacturers are enhancing production capabilities through automation investments, lean methodologies, and quality assurance protocols. Growing demand for advanced driver assistance systems, sophisticated infotainment platforms, and connectivity features is elevating harness complexity and value per unit. Cost-effective manufacturing environments, skilled workforce development, and strategic partnerships with global automotive suppliers are expanding the Philippines automotive wiring harness market share.

Key Takeaways and Insights:

-

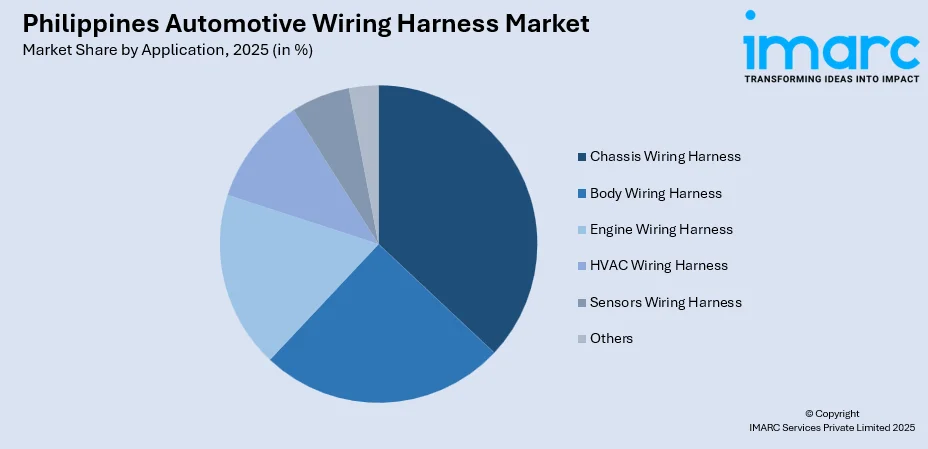

By Application: Chassis wiring harnesses dominate the market with a share of 34.92% in 2025, establishing themselves as the critical foundation for power distribution and signal transmission across essential vehicle systems.

-

By Material Type: Copper leads the market with a share of 86.25% in 2025, maintaining leadership through superior electrical conductivity, durability, and reliability standards required for automotive electrical architectures.

-

By Transmission Type: Electrical wiring represents the largest segment with a market share of 81.54% in 2025, reflecting the predominant role of conventional power and signal transmission systems in Philippine-assembled vehicles.

-

By Vehicle Type: Passenger cars lead the market with a share of 52.26% in 2025, underscoring strong consumer demand for personal mobility solutions equipped with increasingly sophisticated electrical systems.

-

By Category: General wires represent the largest segment with a market share of 40.09% in 2025, serving as fundamental building blocks for standard automotive electrical connections and power distribution networks.

-

By Component: Wires lead the market with a share of 42.24% in 2025, forming the essential conductive pathways that enable electrical power and data transmission throughout vehicle architectures.

-

By Region: Luzon represents the largest segment with a market share of 62% in 2025, its concentration of automotive manufacturing facilities, original equipment manufacturer assembly plants, and wiring harness supplier operations clustered in industrial zones.

-

Key Players: The Philippines automotive wiring harness market features established global suppliers expanding local production capacities, investing in automation technologies, developing workforce capabilities, and forging strategic partnerships with original equipment manufacturers to strengthen market positions and capture growth opportunities across passenger and commercial vehicle segments.

To get more information on this market Request Sample

The Philippines automotive wiring harness market is advancing as manufacturers respond to escalating vehicle assembly volumes, growing electronics content, and evolving technical requirements. The market benefits from the country's competitive manufacturing economics, established supplier relationships, and strategic location within Southeast Asian automotive production networks. Vehicles assembled locally increasingly incorporate advanced infotainment systems, telematics modules, and driver assistance technologies, necessitating more complex wiring architectures with Ethernet data lines, shielded connectors, and multi-core cables. In 2024, the Philippines produced 10,554 vehicle units, representing 27.1 percent growth compared to 8,303 units manufactured during the same month in 2023, according to the ASEAN Automotive Federation. This production momentum underscores the expanding demand for sophisticated wiring harnesses that support modern vehicle functionalities. Manufacturers are responding by investing in precision crimping equipment, inline inspection technologies, and automated assembly processes that enhance quality consistency while scaling output to meet original equipment manufacturer specifications. The integration of advanced electronics is fundamentally reshaping harness design requirements, prompting suppliers to develop specialized capabilities in high-speed data transmission, electromagnetic interference mitigation, and thermal management for increasingly electronics-dense vehicle environments.

Philippines Automotive Wiring Harness Market Trends:

Integration of Advanced Deriver Assisted Systems (ADAS) and Advanced Electronics

Philippines-assembled vehicles are rapidly incorporating advanced driver assistance systems, creating substantial demand for sophisticated wiring harness architectures capable of supporting complex electronic functionalities. This remarkable growth trajectory reflects the increasing integration of camera modules, lane departure warning systems, adaptive cruise control, and collision avoidance technologies in locally assembled vehicles. These advanced systems require wiring harnesses equipped with shielded connectors, high-speed signal pathways, and Ethernet data lines to ensure electrical stability and reliable data transmission between sensors, processors, and actuators, driving innovation and investment throughout the Philippines automotive wiring harness supply chain. In 2025, Isuzu Philippines Corporation (IPC) mesmerized visitors at the launch of the 2025 Manila International Auto Show (MIAS) with a striking and energetic exhibit, signifying the public unveiling of the highly anticipated 2025 Isuzu mu-X. The updated model also brings a notable improvement in safety with the newest version of Isuzu’s Advanced Driver Assist System (ADAS).

Automation and Lean Manufacturing Adoption

Philippine manufacturers are systematically upgrading production capabilities through strategic investments in automation technologies and lean manufacturing methodologies designed to enhance operational efficiency and product quality. The Department of Science and Technology (DOST) has revealed intentions to allocate over PHP2.6 billion (around US$ 44 million) for artificial intelligence (AI) initiatives by 2028, highlighting the Philippines’ dedication to leveraging innovative technologies for national growth. Local suppliers are deploying crimping robots, visual inspection systems, barcode traceability platforms, and Internet of Things (IoT)-enabled production lines integrated with enterprise resource planning and manufacturing execution systems, enabling real-time production monitoring, defect reduction, and enhanced throughput to meet escalating original equipment manufacturer demands for consistent quality and delivery performance.

Sustainable Materials and Circular Economy Practices

The automotive wiring harness industry is increasingly embracing sustainable production practices and circular economy principles through the development and adoption of recycled materials that maintain performance standards while reducing environmental impact. In 2024, PETValue Philippines, the nation’s inaugural bottle-to-bottle, food-grade recycling plant, marks a significant milestone of 1 billion PET bottles recycled, highlighting the effect of robust collaborative efforts toward a completely circular economy. The initiative demonstrates how major industry participants are advancing sustainability objectives without compromising product functionality, positioning recycled materials as viable alternatives that support both environmental responsibility and technical performance requirements in automotive applications.

Market Outlook 2026-2034:

The Philippines automotive wiring harness market is positioned for sustained growth throughout the forecast period, supported by escalating vehicle assembly volumes, expanding electronics integration, and strengthening export participation within ASEAN automotive supply networks. The market generated a revenue of USD 1,788.99 Million in 2025 and is projected to reach a revenue of USD 2,390.63 Million by 2034, growing at a compound annual growth rate of 3.27% from 2026-2034. Manufacturers investing in automation capabilities, workforce development, and technical design competencies will be well-positioned to capture opportunities arising from next-generation vehicle requirements including electrification preparedness, high-speed data transmission capabilities, and modular harness designs that support evolving automotive architectures across passenger and commercial vehicle segments.

Philippines Automotive Wiring Harness Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Application |

Chassis |

34.92% |

|

Material Type |

Copper |

86.25% |

|

Transmission Type |

Electrical Wiring |

81.54% |

|

Vehicle Type |

Passenger Cars |

52.26% |

|

Category |

General Wires |

40.09% |

|

Component |

Wires |

42.24% |

|

Region |

Luzon |

62% |

Application Insights:

Access the comprehensive market breakdown Request Sample

- Body Wiring Harness

- Engine Wiring Harness

- Chassis Wiring Harness

- HVAC Wiring Harness

- Sensors Wiring Harness

- Others

Chassis wiring harnesses dominates with a market share of 34.92% of the total Philippines automotive wiring harness market in 2025.

Chassis wiring harnesses serve as critical electrical infrastructure connecting brake systems, suspension components, fuel delivery systems, and steering assemblies that form the structural and functional foundation of vehicle operation. The segment's dominance reflects the essential role these harnesses play in ensuring reliable power distribution and signal transmission across safety-critical systems. Modern vehicles increasingly incorporate electronic stability control, anti-lock braking systems, and advanced traction management technologies that demand sophisticated chassis harness architectures capable of supporting complex electronic functionalities.

In 2024, from January to September, local vehicle makers produced 97,139 units, indicating a growth rate of 18.3 percent from the 82,092 units tallied in the same period a year ago. In terms of production growth during the nine months, the Philippines was second among its peers in the Association of Southeast Asian Nations (Asean), second only to the 136 percent of Myanmar, a country which had a relatively small output volume of 812 units. This production expansion directly correlates with rising demand for chassis wiring harnesses that meet stringent reliability standards and support the integration of electronic control modules governing fundamental vehicle dynamics and safety performance.

Material Type Insights:

- Copper

- Aluminum

- Others

Copper leads with a share of 86.25% of the total Philippines automotive wiring harness market in 2025.

Copper's predominance stems from its superior electrical conductivity properties, mechanical durability, and proven reliability in automotive applications spanning diverse operating conditions and environmental exposures encountered throughout vehicle lifecycles. The material's excellent heat dissipation characteristics, resistance to oxidation and corrosion, and ability to maintain stable electrical performance across wide temperature variations ranging from sub-zero cold starts to elevated under-hood temperatures make it indispensable for power distribution networks and signal transmission pathways in modern vehicles.

Copper's inherent ductility facilitates precise wire forming, terminal crimping processes, and connector assembly operations essential for manufacturing high-quality harness assemblies that meet stringent automotive specifications for mechanical strength, electrical continuity, and vibration resistance. As vehicle electronics content increases dramatically with ADAS systems, copper's reliable performance characteristics become increasingly valuable for ensuring electrical system integrity, minimizing voltage drops across complex distribution networks, and supporting long-term operational reliability demanded by original equipment manufacturers and vehicle owners throughout demanding service lives.

Transmission Type Insights:

- Data Transmission

- Electrical Wiring

Electrical wiring exhibits a clear dominance with 81.54% share of the total Philippines automotive wiring harness market in 2025.

Electrical wiring encompasses conventional power distribution networks and signal transmission pathways that constitute the primary electrical infrastructure in Philippine-assembled vehicles across passenger and commercial segments. This dominant segment reflects the predominance of traditional 12-volt electrical systems, battery power distribution circuits, lighting networks, and standard electronic control unit interconnections that form the backbone of automotive electrical architectures supporting essential vehicle functions including ignition systems, fuel delivery, climate control, instrumentation, and accessory power outlets. The segment's substantial share underscores the continuing importance of reliable power delivery and basic signal connectivity even as vehicle electronics advance in sophistication with expanding feature sets and connectivity capabilities.

Modern electrical wiring systems incorporate enhanced shielding materials, improved insulation compounds with superior thermal stability, and optimized routing designs that minimize wire length while maintaining electromagnetic compatibility and reducing potential interference in increasingly electronics-dense vehicle environments containing multiple control modules, sensors, and actuators operating simultaneously. Philippine manufacturers are investing in advanced wire processing equipment, precision terminal crimping technologies, and comprehensive testing protocols that ensure electrical wiring meets stringent quality standards for conductivity, insulation resistance, and mechanical durability required by original equipment manufacturers demanding consistent performance across diverse operating conditions.

Vehicle Type Insights:

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Passenger cars dominate with a market share of 52.26% of the total Philippines automotive wiring harness market in 2025.

Passenger vehicles represent the primary demand driver for automotive wiring harnesses in the Philippines, reflecting strong consumer preference for personal mobility solutions and the dominance of passenger car assembly in local automotive manufacturing activities concentrated in industrial zones throughout Luzon. Modern passenger vehicles increasingly incorporate sophisticated electrical systems supporting advanced infotainment platforms with touchscreen displays and smartphone integration, automatic climate control automation with multi-zone temperature regulation, power-operated accessories including windows and mirrors, comprehensive safety features encompassing multiple airbags and stability systems, and connectivity functionalities enabling telematics services and over-the-air updates.

These expanding feature sets necessitate complex wiring harness architectures with higher wire counts exceeding 1,500 individual circuits in premium models, increased connector density requiring compact packaging solutions, and enhanced data transmission capabilities supporting Controller Area Network and Local Interconnect Network protocols that coordinate electronic control modules throughout vehicle architectures while maintaining reliability standards and cost competitiveness essential for mass-market passenger vehicle applications.

Category Insights:

- General Wires

- Heat Resistant Wires

- Shielded Wires

- Tubed Wires

General wires lead with a share of 40.09% of the total Philippines automotive wiring harness market in 2025.

General wires constitute the fundamental building blocks of automotive electrical systems, providing standard power distribution and signal transmission capabilities across conventional vehicle applications that do not require specialized wire characteristics such as extreme temperature resistance or electromagnetic shielding. This category encompasses multi-strand copper conductors with standard insulation materials including polyvinyl chloride and cross-linked polyethylene suitable for typical automotive operating temperatures ranging from minus 40 to 125 degrees Celsius, voltage ranges up to 60 volts, and environmental exposures encountered in passenger and commercial vehicle applications including humidity, road salt, and mechanical abrasion.

General wires serve essential functions including battery-to-starter connections delivering high current during engine cranking, lighting circuits powering headlamps and interior illumination, accessory power delivery supporting radio systems and charging ports, and basic sensor signal pathways transmitting temperature and pressure measurements that form the majority of electrical interconnections in conventional vehicle architectures. Their substantial market share reflects the continuing dominance of standard electrical applications even as vehicles incorporate more advanced technologies requiring specialized wire categories, with general wires typically representing 60 to 70 percent of total wire length in typical passenger vehicle harness assemblies supporting everyday vehicle operations and basic electronic functionalities.

Component Insights:

- Connectors

- Wires

- Terminals

- Others

Wires exhibit a clear dominance with a 42.24% share of the total Philippines automotive wiring harness market in 2025.

Wires constitute the primary conductive pathways enabling electrical power distribution and signal transmission throughout vehicle electrical architectures, forming the essential infrastructure upon which all automotive electronic systems depend for reliable operation and functional integration. As the fundamental building blocks of wiring harnesses, individual wire segments represent the largest material input by volume and value in harness assembly processes, with modern vehicles requiring between 1,000 and 2,000 meters of wire depending on vehicle complexity and feature content.

Modern automotive wire specifications require precise conductor sizing ranging from 0.35 square millimeters for low-current signal circuits to 6.0 square millimeters for high-current power distribution, appropriate insulation materials engineered for specific thermal and chemical resistance requirements, standardized color coding schemes facilitating assembly and service operations, and consistent quality characteristics ensuring reliable electrical performance across diverse operating conditions including temperature extremes, vibration exposures, and humidity variations. The Philippines automotive wiring harness manufacturing sector processes millions of wire segments annually through automated cutting, stripping, and crimping operations, supporting local vehicle assembly operations producing and export commitments to regional automotive supply networks that demand high-quality, cost-competitive components meeting international automotive standards quality management requirements and original equipment manufacturer-specific technical specifications.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 62% of the total Philippines automotive wiring harness market in 2025.

Luzon's commanding regional position reflects its concentration of automotive manufacturing facilities, original equipment manufacturer assembly plants, and wiring harness supplier operations clustered in industrial zones and special economic areas surrounding Metro Manila, Laguna, Batangas, and Cavite provinces that form the heart of Philippine automotive production. The region hosts major vehicle assembly operations and other manufacturers participating in the Comprehensive Automotive Resurgence Strategy program that has collectively generated 207,165 enrolled vehicle units demonstrating successful collaboration between government incentives and private manufacturing investments.

Luzon's developed industrial infrastructure includes modern factory facilities with advanced production equipment, skilled labor availability supported by technical training institutions and vocational programs, proximity to port facilities in Manila and Batangas enabling efficient import of raw materials and export of finished products, and established logistics networks supporting just-in-time delivery requirements demanded by automotive assembly operations. The region's automotive wiring harness suppliers benefit from direct collaborative relationships with local vehicle assemblers enabling responsive engineering support, rapid prototype development, and flexible production adjustments aligned with changing assembly schedules, model transitions, and evolving product specifications that characterize dynamic automotive manufacturing environments requiring close supplier-customer coordination and technical collaboration.

Market Dynamics:

Growth Drivers:

Why is the Philippines Automotive Wiring Harness Market Growing?

Rising Vehicle Assembly and ASEAN Export Strategies

The Philippines automotive wiring harness market is experiencing robust growth propelled by accelerating vehicle assembly activities and strategic positioning within ASEAN regional supply chains that create expanding demand for locally manufactured wiring systems. This production momentum reflects strengthening relationships between Filipino manufacturers and regional original equipment manufacturers seeking cost-competitive, high-quality component suppliers capable of meeting international automotive standards. The Philippine automotive industry sold 467,252 vehicles in 2024, up 8.7 percent from 429,807 units in 2023, demonstrating sustained market expansion that directly translates to increasing wiring harness requirements across passenger and commercial vehicle segments. As Filipino suppliers enhance technical capabilities and scale production capacities, they are capturing larger shares of regional supply networks, positioning the country as an increasingly vital node in ASEAN automotive value chains.

Expanding Electronics Content in Vehicles

Modern vehicles assembled in the Philippines increasingly incorporate sophisticated electronic systems including advanced driver assistance technologies, infotainment platforms, telematics modules, and connectivity features that substantially elevate wiring harness complexity and value per unit. These advanced electronic features require wiring harnesses equipped with Ethernet data lines, multi-core cables, shielded connectors, and high-speed signal pathways capable of supporting reliable data transmission between distributed sensors, electronic control units, and actuator systems throughout vehicle architectures. As electronics content continues rising across all vehicle segments, manufacturers are investing in precision crimping technologies, inline inspection systems, and advanced assembly processes that enable production of increasingly sophisticated harness designs. UNITED Asia Automotive Group, Inc. (UAAGI) has become the authorized distributor of the international auto brand Lynk & Co in the Philippines. The revelation took place during a private preview event at the Ayala Museum, weeks prior to its planned brand unveiling at the Manila International Auto Show (MIAS) on April 4, 2024. The 01 is a plug-in hybrid electric vehicle (PHEV) crossover. Equipped with a 1.5-liter turbo engine and an electric motor, the powertrain is matched with a 7-speed wet dual-clutch transmission.

Government Support for Automotive Manufacturing

Philippine government initiatives supporting automotive industry development are creating favorable conditions for manufacturing expansion, technology adoption, and supply chain strengthening that directly benefit wiring harness suppliers serving local assembly operations. The Department of Trade and Industry is considering extending the CARS program for an additional three years from 2024 to 2027, potentially sustaining incentives that encourage manufacturers to maintain production commitments, upgrade manufacturing capabilities, and develop local supplier networks including wiring harness producers. These policy initiatives reduce investment risks, improve manufacturing economics, and strengthen the Philippines' competitive positioning within regional automotive supply chains, encouraging both domestic and foreign suppliers to expand production capacities and technical capabilities that support growing vehicle assembly volumes and increasingly sophisticated product specifications throughout the forecast period.

Market Restraints:

What Challenges the Philippines Automotive Wiring Harness Market is Facing?

Material Cost Volatility

Fluctuating prices of essential raw materials, particularly copper and aluminum conductors, create significant cost pressures and margin challenges for wiring harness manufacturers operating in competitive automotive supply environments. Copper represents a major percent of material usage in Philippine automotive wiring harness production, making manufacturers highly exposed to global commodity price movements influenced by mining production levels, international trade dynamics, and industrial demand cycles. When copper prices rise substantially, manufacturers face difficult decisions regarding cost absorption versus price increases, potentially straining relationships with original equipment manufacturers operating under fixed-price supply agreements. This material cost volatility complicates financial planning, affects profit margins, and creates uncertainty in long-term contracting negotiations between suppliers and vehicle assemblers.

Rising Technological Complexity

Modern vehicles contain increasingly sophisticated electronic architectures requiring wiring harness designs that support high-speed data transmission, high-voltage power distribution for electrified powertrains, and electromagnetic compatibility across densely packed electronics environments. Managing this design complexity while maintaining manufacturing efficiency, cost competitiveness, and quality consistency challenges engineering capabilities and production processes, particularly for smaller suppliers with limited research and development resources. Advanced harness specifications demand specialized knowledge in signal integrity analysis, thermal management, and testing protocols that exceed traditional manufacturing competencies, necessitating workforce skill development and engineering capability enhancements that require sustained investment commitments and organizational adaptation.

Capital Investment Requirements A

Automation technologies, advanced manufacturing equipment, and comprehensive quality control systems require substantial capital investments that create financial barriers for manufacturers seeking to upgrade production capabilities. Crimping robots, automated visual inspection systems, IoT-enabled production monitoring platforms, and enterprise resource planning integrations represent significant financial commitments that smaller manufacturers may struggle to justify or finance through conventional lending channels. For Philippine suppliers competing in price-sensitive automotive markets, accessing capital at competitive interest rates while maintaining adequate returns on invested capital presents ongoing challenges that influence technology adoption timelines and competitive positioning relative to larger global suppliers with greater financial resources and established technology partnerships.

Competitive Landscape:

The Philippines automotive wiring harness market features a competitive landscape characterized by established global suppliers expanding local production capabilities alongside domestic manufacturers building technical competencies and scaling operations. Leading international companies leverage advanced manufacturing technologies, comprehensive quality management systems, and extensive engineering resources to serve major original equipment manufacturers with sophisticated harness designs meeting stringent performance specifications. Competitive dynamics center on technological capabilities including automation proficiency, design engineering expertise, and quality consistency that enable suppliers to capture premium vehicle programs requiring advanced harness architectures. Manufacturers are investing in workforce development, establishing technical training programs, and building collaborative relationships with global automotive suppliers to enhance competitive positioning. Strategic focus areas include production automation, lean manufacturing implementation, precision assembly capabilities, and responsive customer service that support just-in-time delivery requirements and collaborative product development initiatives with vehicle assemblers pursuing differentiation through enhanced electronic features and connectivity functionalities.

Philippines Automotive Wiring Harness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Body Wiring Harness, Engine Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Sensors Wiring Harness, Others |

| Material Types Covered | Copper, Aluminum, Others |

| Transmission Types Covered | Data Transmission, Electrical Wiring |

| Vehicle Types Covered | Two Wheelers, Passenger Cars, Commercial Vehicles |

| Categories Covered | General Wires, Heat Resistant Wires, Shielded Wires, Tubed Wires |

| Components Covered | Connectors, Wires, Terminals, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines automotive wiring harness market size was valued at USD 1,788.99 Million in 2025.

The Philippines automotive wiring harness market is expected to grow at a compound annual growth rate of 3.27% from 2026-2034 to reach USD 2,390.63 Million by 2034.

Chassis wiring harness, commanding 34.92% revenue share, lead the Philippines automotive wiring harness market by serving as critical electrical infrastructure for brake systems, suspension components, and steering assemblies that form the structural foundation of vehicle operation requiring reliable power distribution and signal transmission capabilities.

Key factors driving the Philippines automotive wiring harness market include rising vehicle assembly activities within ASEAN supply networks, expanding electronics content in modern vehicles incorporating ADAS technologies, government support through programs like CARS that generated combined production units from major manufacturers, automation investments improving manufacturing efficiency, and strategic positioning within regional automotive value chains creating export opportunities.

Major challenges include material cost volatility particularly affecting copper prices that constitute over 86 percent of conductor usage, rising technological complexity demanding high-speed data transmission and electromagnetic compatibility management capabilities, substantial capital investment requirements for automation equipment and quality control systems, supply chain vulnerabilities affecting raw material availability, and workforce skill development needs supporting sophisticated harness design and manufacturing processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)