Philippines Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Philippines Bancassurance Market Overview:

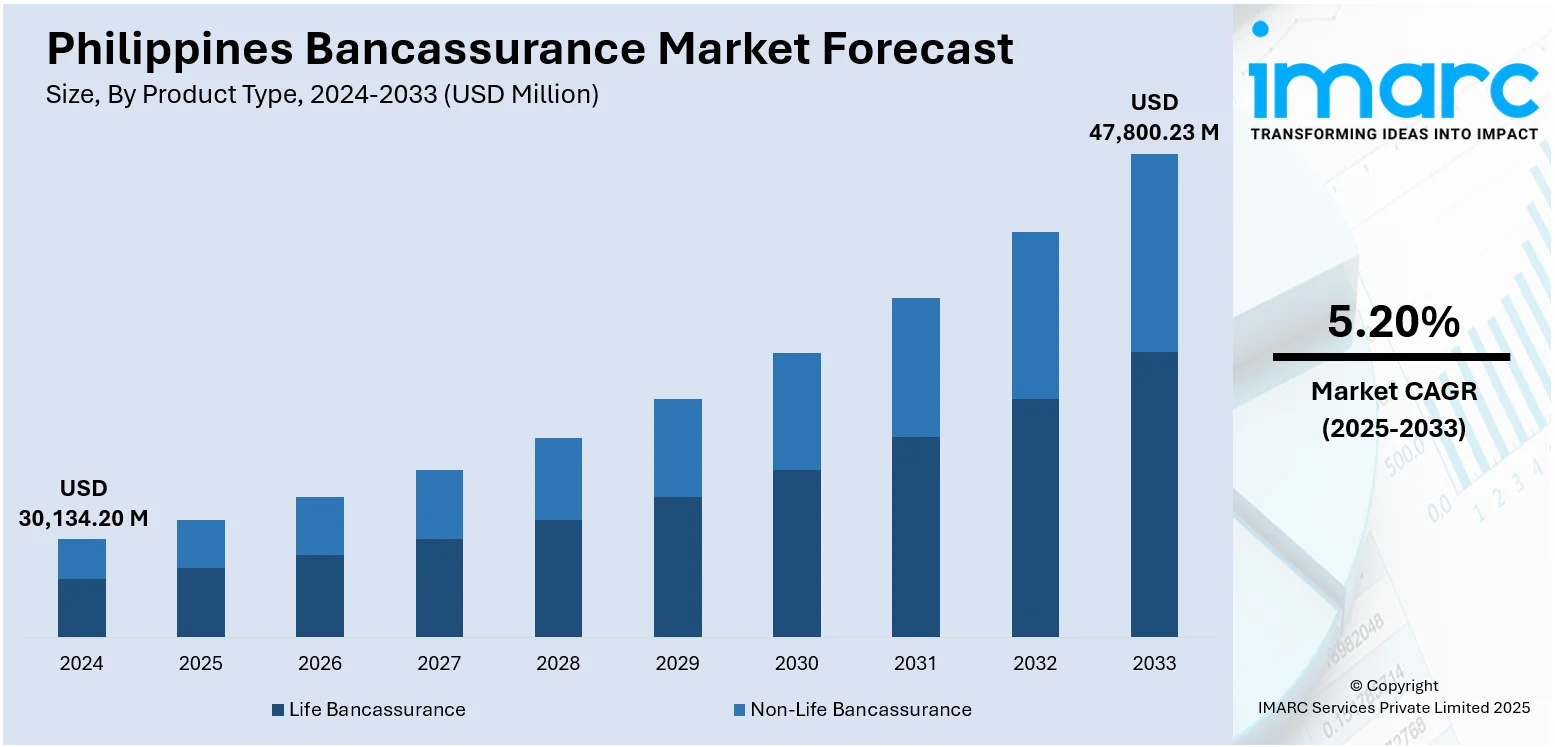

The Philippines bancassurance market size reached USD 30,134.20 Million in 2024. Looking forward, the market is projected to reach USD 47,800.23 Million by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is driven by expanding bancassurance partnerships between leading banks and insurers, supported by regulatory reforms that promote wider insurance access. Digital transformation and financial literacy initiatives are also enabling insurers to reach previously underserved groups. These combined factors are strengthening consumer trust and broadening product adoption, thereby enhancing the Philippines bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30,134.20 Million |

| Market Forecast in 2033 | USD 47,800.23 Million |

| Market Growth Rate 2025-2033 | 5.20% |

Philippines Bancassurance Market Trends:

Banking Reach and Expanding Insurance Penetration

The Philippines has experienced steady growth in bancassurance as both banks and insurers recognize the importance of expanding financial access in a country where a large portion of the population remains underinsured. Major banks such as BDO, Metrobank, and Bank of the Philippine Islands have built strong partnerships with global insurance providers, offering consumers convenient access to a wide range of protection and investment-linked solutions through existing banking channels. The Insurance Commission has also played a significant role in facilitating this development by easing regulations for bancassurance distribution and encouraging collaborations that increase insurance penetration. Rising middle-class income levels, combined with heightened awareness of the importance of financial protection, have created fertile ground for expansion. In June 2025, AIA Philippines and BPI AIA launched two new variable universal life (VUL) insurance plans, AIA Goals Protect and BPI AIA Prosper, designed to offer affordable, flexible protection and investment options to Filipinos starting at Php 2,085/month (USD 36). AIA Goals Protect offers up to 3.5% loyalty bonuses, enhanced death benefits, and access to top-performing global funds, while BPI AIA Prosper targets BPI clients with customizable coverage and fund allocation. These products aim to boost insurance accessibility and support long-term financial wellness. Consumers increasingly prefer bundled financial services that allow them to manage savings, investments, and insurance under one institution, making bancassurance a practical and trusted option. Over the coming years, Philippines bancassurance market growth is expected to be further reinforced by banking sector modernization, customer-centric product innovation, and policies aimed at improving financial inclusion nationwide.

To get more information on this market, Request Sample

Digitalization and Financial Literacy Expansion

The Philippines’ rapid digital adoption has fundamentally reshaped the distribution model for bancassurance. In December 2024, FWD Life Philippines and Security Bank extended their bancassurance partnership, marking over a decade of collaboration since its inception in October 2014. The renewal comes as insurance penetration in the Philippines reached 1.74% in Q3 2024, reflecting strong industry growth potential. FWD Life ranked 4th in premium income with Php 24.3 Billion (USD 434 Million) in 2023, while Security Bank posted a 13.58% year-on-year increase in Q3 net income to Php 3.01 Billion (USD 53.8 Million), reinforcing the alliance's financial strength in the market. With a highly mobile-first population and widespread use of online banking and e-wallets, digital platforms are increasingly central to the promotion, sale, and servicing of insurance products. Banks and insurers are leveraging mobile apps, chatbots, and online portals to provide seamless access to policy information, claims, and renewals, enhancing customer experience and expanding reach to younger demographics. This digital shift has been particularly effective in reaching rural and previously underserved populations, where physical branches are limited but mobile penetration is high. At the same time, financial literacy campaigns spearheaded by government agencies, NGOs, and financial institutions are helping consumers better understand the importance of insurance in long-term financial planning. As awareness grows, more individuals are using digital channels to compare products and make informed decisions, strengthening confidence in bancassurance solutions. The convergence of technology and education ensures that bancassurance is no longer confined to urban or affluent households but is gradually becoming accessible to a broader population. This democratization of access is expected to cement bancassurance as a key pillar of financial inclusion in the Philippines.

Philippines Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

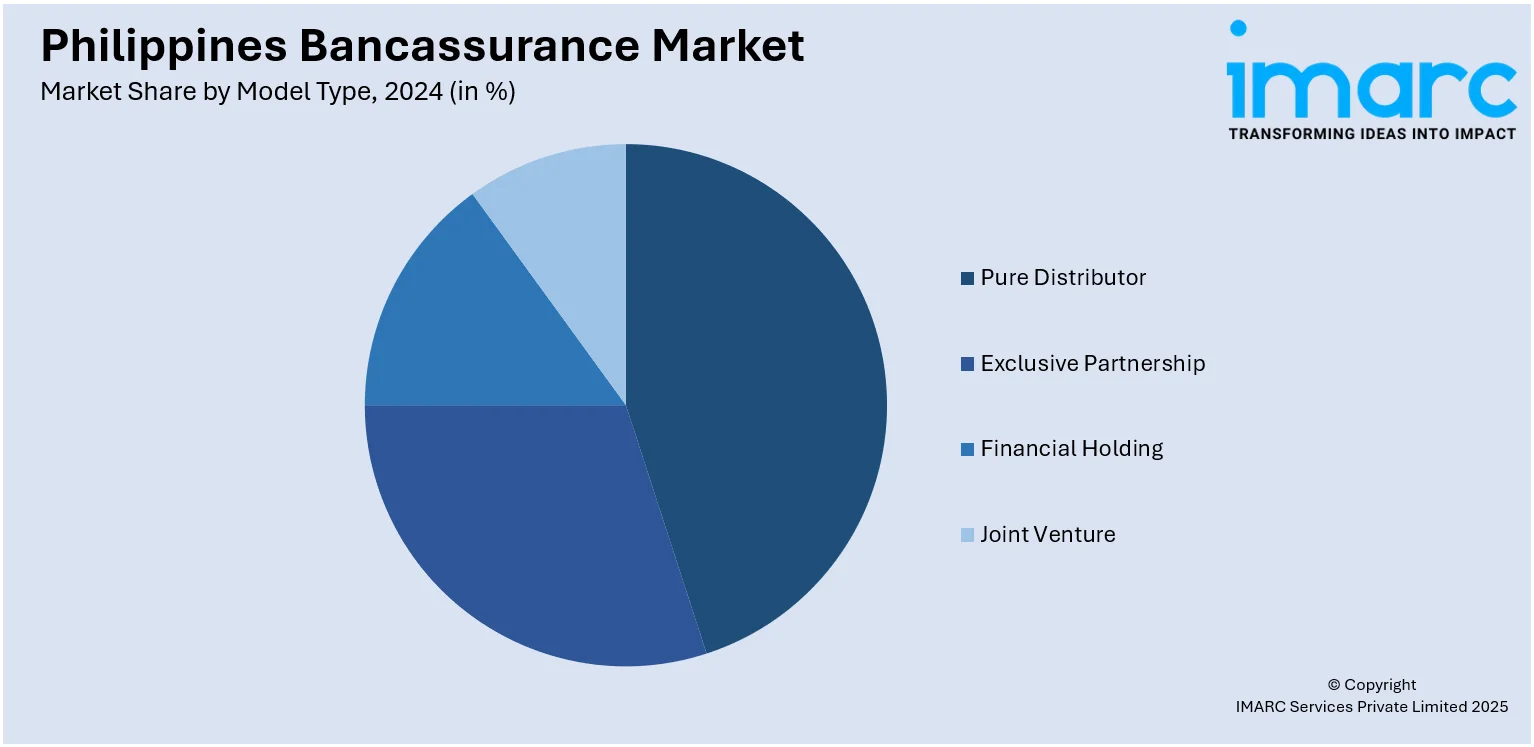

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The report has provided a detailed breakup and analysis of the market based on the model type. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all major regional markets. This includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Bancassurance Market News:

- In June 2025, Manulife Philippines and China Banking Corporation renewed their 15-year bancassurance partnership through Manulife China Bank Life (MCBL), continuing a strategic alliance first established in 2007. MCBL will keep offering life and health insurance products via 650 Chinabank and China Bank Savings branches nationwide, supporting long-term financial security and wealth growth for Filipino families.

Philippines Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines bancassurance market on the basis of product type?

- What is the breakup of the Philippines bancassurance market on the basis of model type?

- What is the breakup of the Philippines bancassurance market on the basis of region?

- What are the various stages in the value chain of the Philippines bancassurance market?

- What are the key driving factors and challenges in the Philippines bancassurance market?

- What is the structure of the Philippines bancassurance market and who are the key players?

- What is the degree of competition in the Philippines bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)