Philippines Banking Market Size, Share, Trends and Forecast by Banking Services, End User, and Region, 2026-2034

Philippines Banking Market Overview:

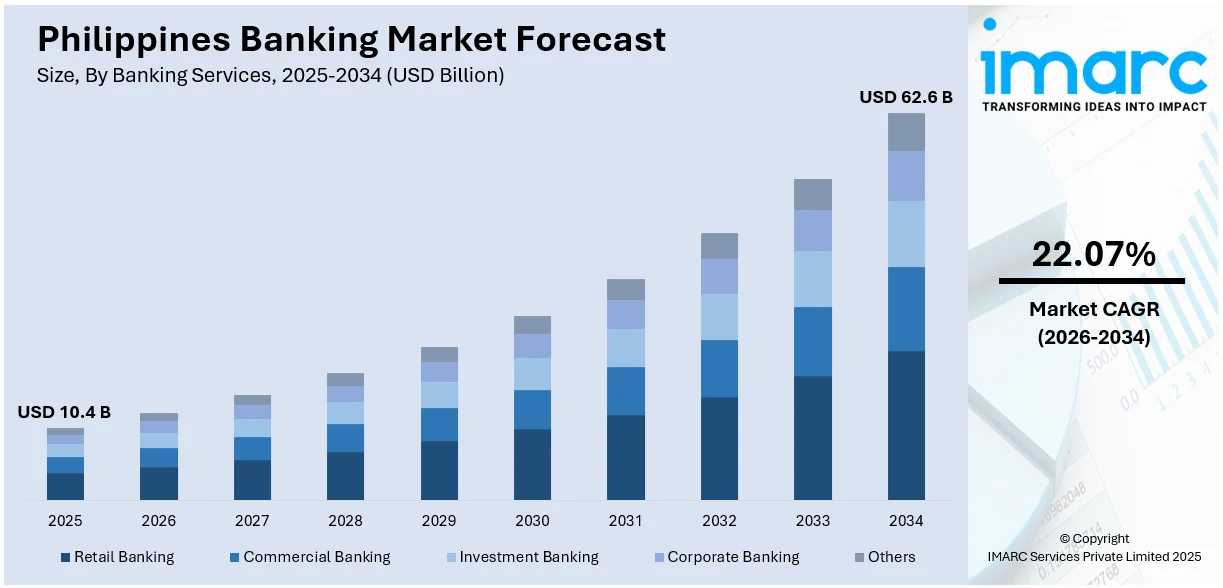

The Philippines banking market size reached USD 10.4 Billion in 2025. Looking forward, the market is expected to reach USD 62.6 Billion by 2034, exhibiting a growth rate (CAGR) of 22.07% during 2026-2034. The market is experiencing steady expansion, supported by rising financial inclusion, growing middle-class demand, and increasing reliance on remittance-driven services. Digital innovations, supportive regulations, and consumer preference for modern financial products are reshaping the sector, enhancing competitiveness and accessibility, and contributing to the overall growth of Philippines banking market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 10.4 Billion |

| Market Forecast in 2034 | USD 62.6 Billion |

| Market Growth Rate (2026-2034) | 22.07% |

Key Trends of Philippines Banking Market:

Rapid shift toward digitalization

The market is primarily driven by the rapid shift toward digitalization due to the increasing availability and usage of smartphones and improved internet connectivity across the country. For instance, as per industry reports, imports for mobile phones, including brands like Apple and Samsung, reached around USD 3.93 Billion in the year 2024 across Philippines. This escalating digital transformation is reshaping how consumers interact with banks, as online and mobile banking platforms become the preferred choice for conducting transactions. Furthermore, the growth of digital payments, mobile wallets, and mobile banking apps reflects a growing demand for more accessible and efficient banking solutions, thereby propelling the market. Additionally, the increasing expenditures in leading-edge techniques, like machine learning or artificial intelligence, banks are providing personalized financial services, which in turn is providing an impetus to the market. Also, accelerating digitalization is improving the accessibility of banking services, thereby allowing consumers to manage accounts, make payments, transfer funds, and access financial products from anywhere at any time, supporting the market further.

To get more information on this market Request Sample

Rise of fintech solutions

The wide utilization of fintech solutions for banking activities is propelling the market in Philippines. Furthermore, the growing popularity of the fintech companies is fostering the market further as they are delivering cutting-edge services that fill holes in traditional banking, especially in terms of making financial solutions easily available to underserved and unbanked communities. The market is further driven by the collaborations between numerous fintech firms and well-established banks that are working to develop integrated platforms that broaden the range of financial services available to clients, enhancing convenience and accessibility. Apart from this, the emergence of digital wallets, including GCash and PayMaya has led to the transformation of payment systems as it is enabling individuals to send money, make payments and buy services without requiring a conventional bank account. For instance, industry reports state that as of 2024, GCash has more than 90 Million users across Philippines. In line with this, as of first half of 2024, Maya Bank, earlier known as PayMaya, witnessed substantial growth, with deposit balances growing to USD 588 Million.

Growth Drivers of Philippines Banking Market:

Expanding Middle-Class Population

The rapid expansion of the middle-class population in the Philippines is significantly fueling growth in the banking sector. As household incomes rise, more consumers are seeking access to financial services that support their evolving lifestyles and long-term goals. There is a growing demand in the savings accounts, investment products and credit products like personal loans, mortgages and credit cards. This rising group is also becoming more willing to embrace the digital and mobile banking opportunities so that it also becomes more convenient. This trend is not only restricted to urban locations, but the semi-urban localities are also experiencing the high activity of banking as the families are dreaming of financial security. As per serving the demands of this growth demographic, the banks are consolidating their consumer base as well as ensuring sustainable growth of the sector.

Increasing Focus on Financial Inclusion

Financial inclusion remains a central priority for the Philippine banking industry, as a significant share of the population still lacks access to formal financial services. Many rural and remote communities rely on informal systems, highlighting the need for affordable and reliable banking solutions. To address this gap, banks, supported by government initiatives, are introducing microfinancing, mobile-based banking services, and simplified account options to reach underserved populations. These efforts not only expand customer participation but also foster a culture of saving and financial responsibility. Greater inclusion also empowers small businesses and entrepreneurs by offering credit opportunities that stimulate local economies, which drives the Philippines banking market demand. By extending services beyond major cities, the banking sector is building a more inclusive financial ecosystem that supports national economic development.

Strong Remittance Inflows

The Philippines is one of the world’s largest recipients of remittances, and this consistent inflow of funds from overseas Filipino workers plays a vital role in strengthening the banking sector. These remittances fuel household spending, savings, and investments, contributing to steady economic activity. Banks are capitalizing on this trend by offering specialized products such as remittance-linked savings accounts, preferential loan options, and digital transfer services that simplify cross-border transactions. The steady inflow also enhances liquidity within the banking system, enabling institutions to diversify their offerings and expand credit facilities. Additionally, remittances contribute to financial stability by providing households with disposable income to manage expenses and long-term goals. As banks innovate around remittance services, they are securing stronger revenue streams and deeper customer relationships.

Government Support for Philippines Banking Market:

Policy Frameworks for Financial Inclusion

The Philippine government is actively implementing strong policy frameworks to promote financial inclusion and bring more citizens into the formal banking system. Initiatives such as the National Strategy for Financial Inclusion are designed to expand access to financial services, especially in rural and underserved areas where traditional banking is limited. These programs focus on encouraging savings, microfinancing, and affordable credit options to empower individuals and small businesses. By providing the right regulatory support, the government ensures that banks and financial institutions develop innovative services tailored to marginalized communities. This inclusive approach not only reduces financial inequality but also stimulates economic growth by integrating more people into the financial ecosystem, strengthening the overall stability of the banking sector.

Regulatory Push for Open Banking

The Philippine authorities are prioritizing the adoption of open banking frameworks as a way to increase competition, efficiency, and innovation within the financial sector. Open banking allows customers’ financial data to be securely shared with authorized third parties, enabling collaboration between banks, fintech firms, and digital platforms. According to the Philippines banking market analysis, this regulatory shift empowers consumers with more choices, as it leads to the creation of personalized financial products, improved lending solutions, and better user experiences. By encouraging transparency and customer-centric services, regulators are reshaping the competitive landscape, giving smaller fintechs opportunities to thrive alongside established banks. This move also aligns with global banking modernization trends, ensuring that the Philippines remains at the forefront of digital financial innovation while safeguarding consumer rights and trust.

Promotion of Cashless Economy

The Philippine government is strongly pushing for a cashless economy through policies and initiatives that promote digital payments and electronic transactions, which is further fueling the Philippines banking market growth. By encouraging the adoption of online banking, QR-based payments, and mobile wallets, authorities aim to reduce the country’s dependence on cash, which often limits transparency and efficiency. These government-led programs not only enhance transaction speed and convenience but also foster accountability, minimizing risks of fraud and corruption. The shift towards a cashless system is also vital for improving financial inclusion, as digital payment platforms reach populations without access to physical banks. With ongoing campaigns and supportive regulations, the government is driving cultural and behavioral changes, making electronic payments a key pillar of the financial ecosystem and overall economic growth.

Philippines Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on banking services and end user.

Banking Services Insights:

- Retail Banking

- Commercial Banking

- Investment Banking

- Corporate Banking

- Others

The report has provided a detailed breakup and analysis of the market based on the banking services. This includes retail banking, commercial banking, investment banking, and corporate banking.

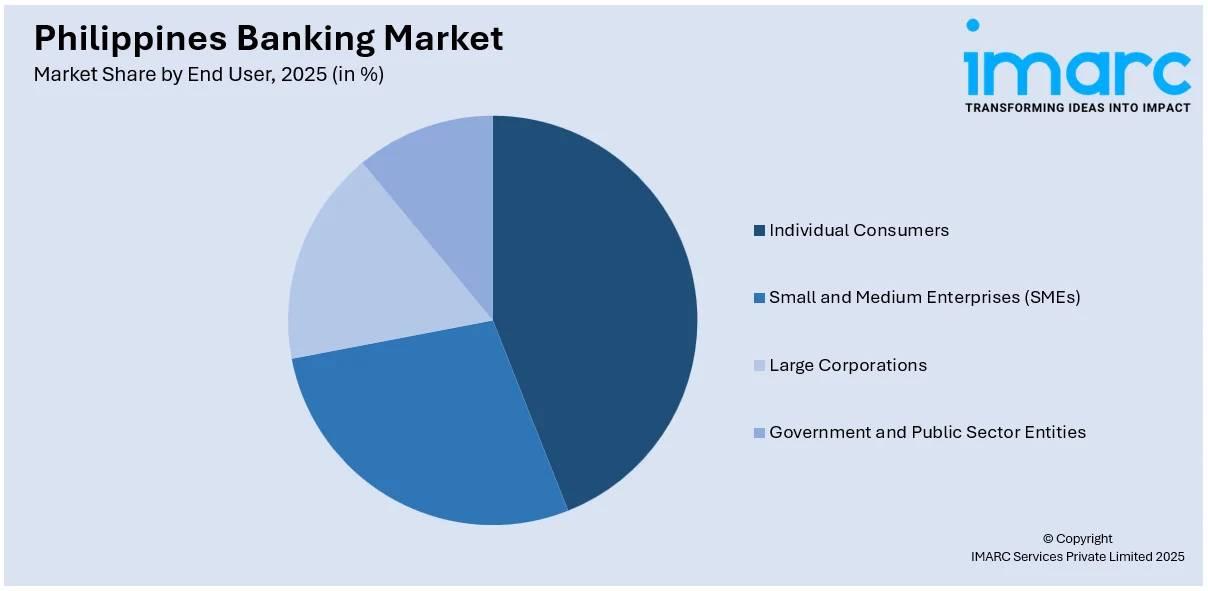

End User Insights:

Access the Comprehensive Market Breakdown Request Sample

- Individual Consumers

- Small and Medium Enterprises (SMEs)

- Large Corporations

- Government and Public Sector Entities

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes individual consumers, small and medium enterprises (SMEs), large corporations, and government and public sector entities.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Banking Market News:

- In July 2024, the Bangko Sentral ng Pilipinas (BSP) issued Circular No. 1198, Series of 2024, establishing a regulatory policy for merchant payment acceptance activities (MPAA). This framework targets to set regulations and best practices to secure user funds and protect merchants' rights when negotiating with operators of payment systems (OPS) involved in MPAA.

- In May 2024, CTBC Bank Philippines announced strategic partnership with Hitachi Asia to upgrade its mobile banking apps as well as web interface to boost services for digital financing and facilitate better financial inclusion.

Philippines Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Banking Services Covered | Retail Banking, Commercial Banking, Investment Banking, Corporate Banking |

| End Users Covered | Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government and Public Sector Entities. |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines banking market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The banking market in the Philippines was valued at USD 10.4 Billion in 2025.

The Philippines banking market is projected to exhibit a CAGR of 22.07% during 2026-2034.

The Philippines banking market is projected to reach a value of USD 62.6 Billion by 2034.

The Philippines banking market is shaped by digital transformation, with rapid adoption of mobile banking and fintech solutions enhancing financial inclusion. Rising demand for cashless payments, cybersecurity investments, and regulatory support for open banking are key trends, while customer-centric services and innovative lending models continue to drive market evolution.

The Philippines banking market is driven by rising digital adoption, expanding financial inclusion initiatives, and increasing consumer demand for convenient mobile and online services. Strong government support, economic growth, and fintech collaboration further accelerate modernization, boosting efficiency, accessibility, and competitiveness across the country’s banking sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)