Philippines Beauty & Personal Care Market Size, Share, Trends and Forecast by Type, Product, Pricing, Distribution Channel, End User, and Region, 2026-2034

Philippines Beauty & Personal Care Market Overview:

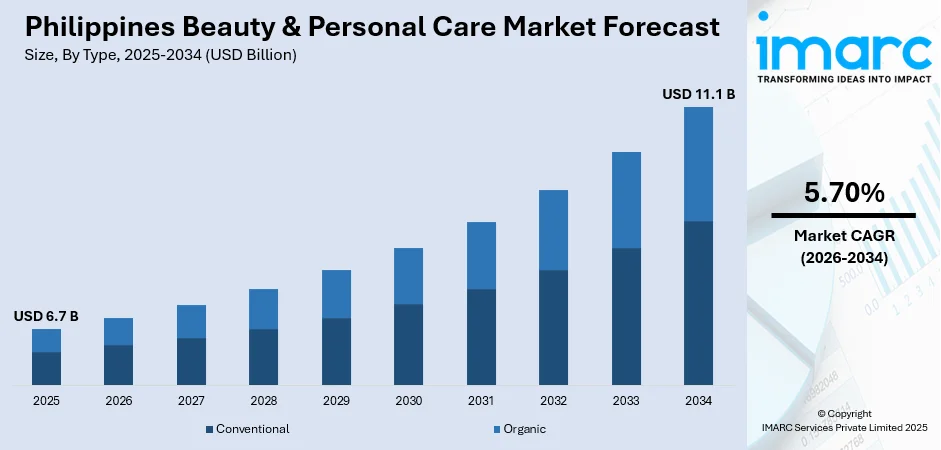

The Philippines beauty & personal care market size reached USD 6.7 Billion in 2025. Looking forward, the market is expected to reach USD 11.1 Billion by 2034, exhibiting a growth rate (CAGR) of 5.70% during 2026-2034. The Philippines beauty & personal care market share is expanding, driven by the growing preference for skincare items made with plant-based, cruelty-free, and eco-friendly ingredients, which is encouraging brands to launch innovative products, along with the increasing adoption of social media portals where brands introduce online campaigns, giveaways, and live-stream shopping events to entice customers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 6.7 Billion |

| Market Forecast in 2034 | USD 11.1 Billion |

| Market Growth Rate (2026-2034) | 5.70% |

Key Trends of Philippines Beauty & Personal Care Market:

Rising preference for natural and organic beauty products

More Filipinos are choosing natural and organic beauty items, which is fueling the Philippines beauty & personal care market growth. People are becoming more aware about the ingredients in their skincare and personal care products. They prefer items that are free from harsh chemicals. Many users, especially young adults, look for items made with plant-based, cruelty-free, and eco-friendly ingredients. Local and international brands respond by creating skincare, haircare, and cosmetics that use natural extracts, essential oils, and organic materials. Individuals trust brands that promote sustainability and transparency, so companies highlight their ethical sourcing and environment friendly packaging. With more people dealing with sensitive skin and allergies, gentle and chemical-free options have become more popular. Local businesses and small startups introduce natural beauty products to compete with bigger brands. Organic and herbal solutions, inspired by traditional Filipino remedies, gain attention as well. This shift pushes the beauty industry to innovate and offer safer, greener alternatives. As the demand for natural products continues to grow, it shapes the future of beauty in the Philippines, making it more health-conscious and eco-friendly. In July 2024, APHROZONE Philippines, the prominent skincare brand, teamed up with Aphrozone Co. Ltd. Korea, to unveil its natural method for timeless beauty in a major launch event in the Philippines. The company declared itself as the only and exclusive distributor in the country for ‘365 Ruby-Cell’, which is the range of plant-based stem cell dermatology products created by Aphrozone Co. Ltd. Korea.

To get more information on this market, Request Sample

Growing influence of social media and celebrity endorsements

The rising influence of social media and celebrity endorsements is offering a favorable Philippines beauty & personal care market outlook. With higher internet access in the country, more people spend time on social media platforms where beauty influencers and celebrities share their skincare routines, makeup tips, and favorite products. As per industry reports, at the beginning of 2024, the Philippines had 86.98 million internet users, with internet penetration reaching 73.6%. As of January 2024, the Philippines had 86.75 million social media users, representing 73.4% of its entire population. When a famous personality promotes a brand, their followers trust their recommendations and are more likely to buy the same items. Local and international brands utilize influencers to reach a wider audience, making their products more popular. Social media sites also create beauty trends that spread fast, encouraging people to try new skincare and makeup items. Many brands launch online campaigns, giveaways, and live-stream shopping events to attract users. With easy access to reviews and tutorials, individuals feel more confident about their purchases. This trend makes the market in the country more dynamic and competitive.

Growth Drivers of Philippines Beauty & Personal Care Market:

Rising Middle-Class Population and Disposable Income

The expanding middle-class population in the Philippines represents a significant growth driver for the beauty and personal care market. While economic conditions are improving and urbanization is picking up, there are more Filipino consumers with enhanced disposable incomes to spend on personal care and beauty products. This demographic change is building a bigger consumer base that is willing to invest in premium cosmetics, skincare, and personal hygiene products over and above basic needs. The expanding middle class is more aware of looks and grooming, fueling need for varied product categories such as anti-aging treatments, niche skincare therapy, and premium cosmetics. According to the Philippines beauty & personal care market analysis, this demographic is more brand-aware and inclined towards internationally acknowledged beauty brand names, resulting in more market competition and product development. The increase in dual-earner households and women working further enhances increased spending capacity and personal grooming habits. This socioeconomic change is prompting local and foreign beauty firms to strengthen their presence and bring out products that meet the Filipinos' preferences and skin types.

Increasing Beauty Consciousness Among Male Consumers

The growing beauty consciousness among Filipino men is emerging as a significant market driver, expanding the target demographic beyond traditional female consumers. The contemporary Filipino male is becoming more accustomed with skincare practices, grooming, and is interested in looking after their looks. Social norms, professional needs, exposure to beauty trends in the world, social media, and entertainment has contributed to this cultural change. The male grooming category is enjoying the booming business and higher demand of the men skincare products, facial cleaners, moisturizers and some special treatment to the common skin problems. Beauty brands are responding by developing gender-specific product lines and marketing campaigns that appeal to male consumers without compromising their masculinity. The acceptance of male beauty routines is particularly strong among younger generations and urban populations, creating opportunities for brands to tap into this previously underserved market segment. This trend is supported by the rise of male beauty influencers and celebrities who openly discuss their grooming routines and product preferences.

Government Support for Local Beauty Industry Development

Government initiatives aimed at promoting the local beauty and personal care industry are creating favorable conditions for Philippines beauty & personal care market demand. The Philippine government is implementing policies that support local manufacturers, encourage innovation, and facilitate easier market entry for domestic beauty brands. These initiatives include tax incentives for local production, support for research and development in cosmetics manufacturing, and programs that promote Filipino beauty brands in international markets. The government's focus on developing the country's manufacturing capabilities is attracting foreign investment in beauty production facilities, creating jobs and building local expertise. Additionally, regulatory frameworks are being streamlined to facilitate faster product approvals while maintaining safety standards, enabling companies to bring new products to market more efficiently. The emphasis on supporting micro, small, and medium enterprises (MSMEs) in the beauty sector is fostering entrepreneurship and innovation, leading to the emergence of unique Filipino beauty brands that cater to local preferences and utilize indigenous ingredients.

Opportunities of Philippines Beauty & Personal Care Market:

E-commerce Platform Expansion and Digital Marketing

The rapid growth of e-commerce platforms presents substantial opportunities for beauty and personal care brands to reach consumers across the Philippines archipelago. Online marketplaces such as Lazada, Shopee, and local platforms are becoming primary shopping destinations for beauty products, offering brands access to consumers in remote areas previously difficult to reach through traditional retail channels. The integration of social commerce features, live streaming shopping, and influencer collaborations on these platforms creates innovative marketing opportunities that drive consumer engagement and sales conversion. Digital payment solutions and improved logistics infrastructure are making online beauty shopping more accessible and convenient for Filipino consumers. The opportunity extends to developing personalized shopping experiences through artificial intelligence and data analytics, enabling brands to offer customized product recommendations and targeted marketing campaigns. Additionally, the rise of beauty subscription services and direct-to-consumer models allows brands to build stronger customer relationships and generate recurring revenue streams while providing consumers with convenient access to their favorite products.

Development of Halal-Certified Beauty Products

The growing Muslim population in the Philippines, particularly in Mindanao and other regions, presents significant opportunities for halal-certified beauty and personal care products. This market segment represents an underserved demographic with specific religious and cultural requirements for beauty products that comply with Islamic law. The development of halal-certified cosmetics, skincare products, and personal care items addresses the needs of Muslim consumers who seek products free from prohibited ingredients and manufactured according to halal standards. This opportunity extends beyond the domestic market, as the Philippines could serve as a production hub for halal beauty products destined for other Southeast Asian markets with large Muslim populations. The halal beauty market is experiencing global growth, and Filipino companies that obtain proper certification and develop expertise in this segment could capture both local and export opportunities. Additionally, the growing awareness and acceptance of halal products among non-Muslim consumers who perceive them as cleaner and more ethical alternatives create additional market potential.

Integration of Traditional Filipino Ingredients and Remedies

The opportunity to incorporate traditional Filipino ingredients and beauty remedies into modern cosmetic formulations represents a unique market positioning strategy. Indigenous ingredients such as virgin coconut oil, papaya, calamansi, rice bran, and various tropical fruits and herbs have been used in traditional Filipino beauty practices for generations. Modern consumers, both locally and internationally, are showing increased interest in natural and culturally authentic beauty products, creating opportunities for brands to develop products that celebrate Filipino heritage while meeting contemporary beauty needs. This approach allows local brands to differentiate themselves from international competitors by offering unique formulations that cannot be easily replicated. The trend aligns with the global movement toward natural and sustainable beauty products while supporting local agricultural communities and preserving traditional knowledge. Companies can leverage storytelling and cultural authenticity in their marketing efforts, appealing to Filipino consumers' sense of national pride and international consumers' interest in exotic and natural ingredients from tropical regions.

Philippines Beauty & Personal Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type, product, pricing, distribution channel, and end user.

Type Insights:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the market based on the types. This includes conventional and organic.

Product Insights:

- Skin Care

- Hair Care

- Color Cosmetics

- Fragrances

- Others

A detailed breakup and analysis of the market based on the products have also been provided in the report. This includes skin care, hair care, color cosmetics, fragrances, and others.

Pricing Insights:

- Mass Products

- Premium Products

The report has provided a detailed breakup and analysis of the market based on the pricings. This includes mass products and premium products.

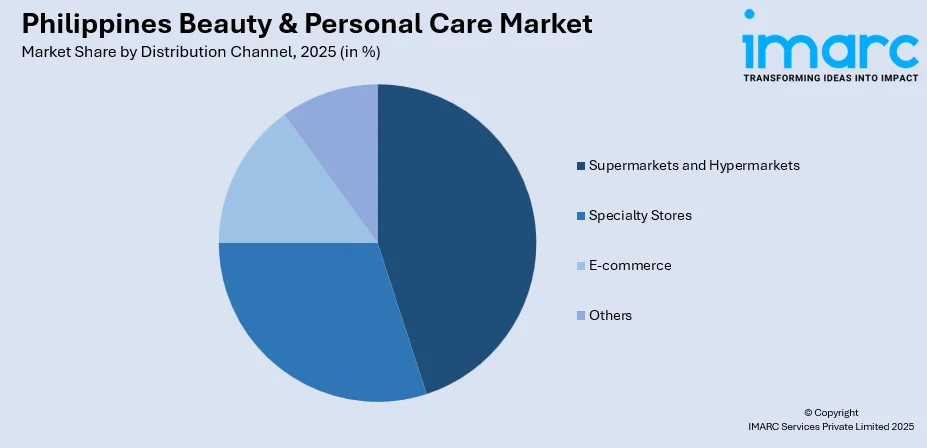

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- E-commerce

- Others

A detailed breakup and analysis of the market based on the distribution channels have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, e-commerce, and others.

End User Insights:

- Male

- Female

The report has provided a detailed breakup and analysis of the market based on the end users. This includes male and female.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Beauty & Personal Care Market News:

- In October 2024, Chanel Beauty, a French luxury fashion house, opened its inaugural boutique in Greenbelt 5, Philippines. The 167-square-meter area showcased the complete collection of the brand's signature beauty items, featuring fragrance, makeup, and skincare.

- In July 2024, Dr. Jart+, a well-known Korean skincare label, introduced its groundbreaking skincare product range in the Philippines. The selection was exclusively offered at ‘Watsons’ and ‘LOOK At Me’ outlets across the country, as well as online.

Philippines Beauty & Personal Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Conventional, Organic |

| Products Covered | Skin Care, Hair Care, Color Cosmetics, Fragrances, Others |

| Pricings Covered | Mass Products, Premium Products. |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Others |

| End Users Covered | Male, Female |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines beauty & personal care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines beauty & personal care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines beauty & personal care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines beauty & personal care market was valued at USD 6.7 Billion in 2025.

The Philippines beauty & personal care market is projected to exhibit a CAGR of 5.70% during 2026-2034.

The Philippines beauty & personal care market is projected to reach a value of USD 11.1 Billion by 2034.

The market experiences rapid growth driven by rising preference for natural and organic beauty products. Social media influence and celebrity endorsements dominate consumer behavior, reflecting Filipinos' focus on beauty consciousness and personal grooming. Integration with e-commerce platforms is becoming essential, enabling seamless online shopping experiences.

The Philippines beauty & personal care market is driven by rising middle-class population, increasing male beauty consciousness, and government support for local industry development. Social media adoption, disposable income growth, and preference for premium beauty solutions further accelerate adoption across diverse consumer segments nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)