Philippines Biochar Market Size, Share, Trends and Forecast by Feedstock Type, Technology Type, Product Form, Application, and Region, 2025-2033

Philippines Biochar Market Overview:

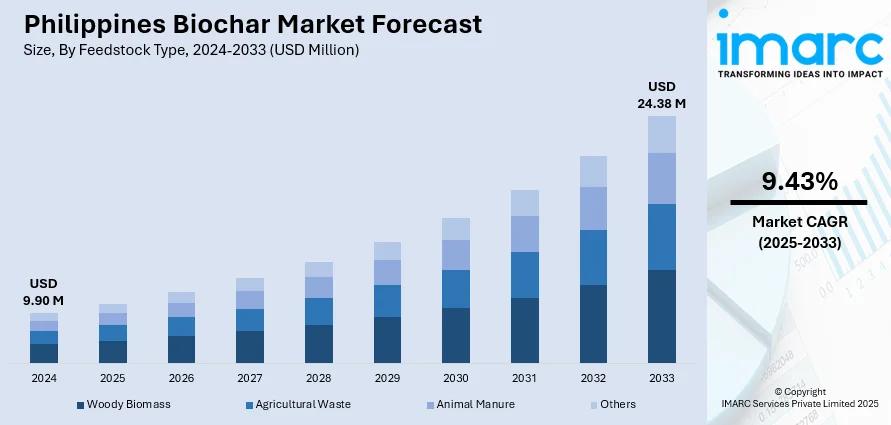

The Philippines biochar market size reached USD 9.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 24.38 Million by 2033, exhibiting a growth rate (CAGR) of 9.43% during 2025-2033. Increasing sustainability focus, organic agriculture growth, favorable policies, and production innovations expand the Philippines biochar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.90 Million |

| Market Forecast in 2033 | USD 24.38 Million |

| Market Growth Rate 2025-2033 | 9.43% |

Philippines Biochar Market Trends:

Agricultural Soil Enhancement

A prominent trend in the Philippines biochar market is the growing utilization of biochar as a soil amendment to improve agricultural productivity. Biochar has been shown to significantly enhance nutrient retention, improve soil structure, and increase water-holding capacity, particularly in light-textured and degraded soils. These benefits are especially valuable in the cultivation of key crops such as rice and corn. Local farmers, agricultural cooperatives, and environmental organizations are increasingly endorsing biochar as a sustainable solution to long-term soil fertility challenges. The product’s ability to restore degraded farmland while simultaneously improving yields positions it as both an agronomic and environmental tool. This convergence of ecological and economic value is a key driver in the growth of the Philippines biochar market. For instance, in April 2024, Climate tech startup WasteX partnered with a rice mill in Tarlac, Philippines, to deploy its biochar technology aimed at improving crop yields and farmer livelihoods. The biochar will be distributed to local rice farms, enhancing soil health and reducing fertilizer dependence. WasteX offers a full biochar solution, including equipment, a mobile app, and carbon credit facilitation.

To get more information on this market, Request Sample

Production Scale and Carbon Incentives

A significant development in the Philippines biochar market is the scaling of production infrastructure supported by integration into carbon markets. For instance, in August 2024, Green Carbon, Inc. signed an MOU with Alcom Carbon Markets Philippines, a biochar plant manufacturer holding Southeast Asia’s first Puro Earth certification. The partnership aims to expand carbon credit production from biochar across Southeast Asia, beginning in the Philippines. Alcom will supply biochar infrastructure, while Green Carbon leads implementation, including AWD-based methane reduction in rice paddies. The collaboration supports decarbonization, farmer income, and sustainable agriculture, with plans to scale operations to 10,000 hectares and broaden impact across afforestation, mangroves, and livestock emission reduction projects. These projects benefit from a combination of local government support, international climate financing, and alignment with sustainability targets. Moreover, such facilities often provide discounted biochar to local farmers and simultaneously generate verified carbon credits, creating a dual stream of environmental and economic benefits. This intersection of sustainable agriculture, climate policy, and carbon trading frameworks is accelerating adoption and investment. Consequently, these dynamics are reinforcing the financial and environmental case for broader Philippines biochar market growth.

Philippines Biochar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and region levels for 2025-2033. Our report has categorized the market based on feedstock type, technology type, product form, and application.

Feedstock Type Insights:

- Woody Biomass

- Agricultural Waste

- Animal Manure

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock type. This includes woody biomass, agricultural waste, animal manure, and others.

Technology Type Insights:

- Slow Pyrolysis

- Fast Pyrolysis

- Gasification

- Hydrothermal Carbonization

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes slow pyrolysis, fast pyrolysis, gasification, hydrothermal carbonization, and others.

Product Form Insights:

- Coarse and Fine Chips

- Fine Powder

- Pellets, Granules and Prills

- Liquid Suspension

The report has provided a detailed breakup and analysis of the market based on the product form. This includes coarse and fine chips, fine powder, pellets, granules and prills, and liquid suspension.

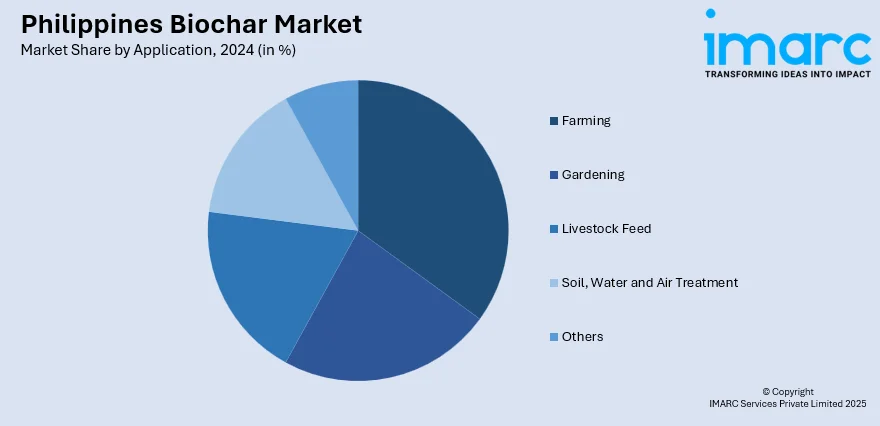

Application Insights:

- Farming

- Gardening

- Livestock Feed

- Soil, Water and Air Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes farming, gardening, livestock feed, soil, water and air treatment, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Biochar Market News:

- In April 2025, Alcom launched the Philippines’ first Combined Heat Power Biochar & Bio-Oil (CHPBB) facility in Mindoro, converting rice waste into biochar, bio-oil, electricity, and heat. Supported by GGGI’s $45 Million Green Transition Investment Program, the project promotes low-carbon farming, aims to sequester over 1 million metric tons of CO₂, and generate 1,000+ green jobs.

Philippines Biochar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstock Types Covered | Woody Biomass, Agricultural Waste, Animal Manure, Others |

| Technology Types Covered | Slow Pyrolysis, Fast Pyrolysis, Gasification, Hydrothermal Carbonization, Others |

| Product Forms Covered | Coarse and Fine Chips, Fine Powder, Pellets, Granules and Prills, Liquid Suspension |

| Applications Covered | Farming, Gardening, Livestock Feed, Soil, Water and Air Treatment, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines biochar market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines biochar market on the basis of feedstock type?

- What is the breakup of the Philippines biochar market on the basis of technology type?

- What is the breakup of the Philippines biochar market on the basis of product form?

- What is the breakup of the Philippines biochar market on the basis of application?

- What is the breakup of the Philippines biochar market on the basis of region?

- What are the various stages in the value chain of the Philippines biochar market?

- What are the key driving factors and challenges in the Philippines biochar?

- What is the structure of the Philippines biochar market and who are the key players?

- What is the degree of competition in the Philippines biochar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines biochar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines biochar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines biochar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)