Philippines Biosimilar Market Size, Share, Trends and Forecast by Molecule, Indication, Manufacturing Type, and Region, 2025-2033

Philippines Biosimilar Market Overview:

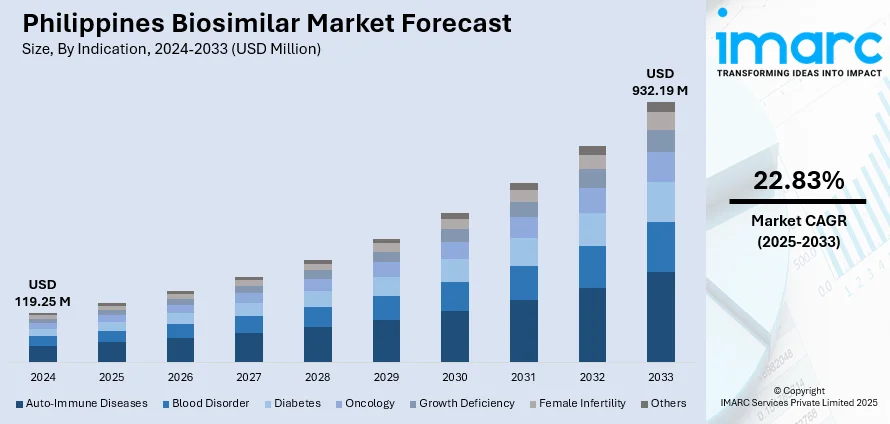

The Philippines biosimilar market size reached USD 119.25 Million in 2024. The market is projected to reach USD 932.19 Million by 2033, exhibiting a growth rate (CAGR) of 22.83% during 2025-2033. The market is experiencing significant demand for affordable and efficacious treatments in fields like oncology, autoimmune disorders, and diabetes. Domestic pharmaceutical companies are investing aggressively in research, development, and manufacturing capacity to bring these therapies to a wider population. Technological innovation in biologics is enhancing product quality and availability throughout the nation. All these positive trends are promoting innovation and reinforcing the potential of the industry, leading to the Philippines biosimilar market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 119.25 Million |

| Market Forecast in 2033 | USD 932.19 Million |

| Market Growth Rate 2025-2033 | 22.83% |

Philippines Biosimilar Market Trends:

Regulatory Reforms Accelerate Market Access

The Philippine Food and Drug Administration (FDA) is making considerable effort to rationalize the drug approval process to increase access and affordability of medicines for patients. The program aims to streamline regulatory requirements with a view to shortening approval times, which is critical for biosimilars biologic products that provide cost-saving options compared to higher-priced originator biologics. In February 2024, the FDA released upgraded procedures aimed at facilitating faster reviews while ensuring rigorous safety and effectiveness requirements are met. These reforms are anticipated to spur manufacturers to bring biosimilars to market sooner, thereby increasing competition in the pharmaceutical sector. Faster access to biosimilars fosters public health objectives by enhancing patient access to critical therapies. Additionally, these regulatory enhancements are expected to encourage domestic and foreign investment and spur innovation in the industry. As these reforms gain traction, they directly support the positive trajectory of the Philippine biosimilar market, paving the way for wider availability and enhanced affordability in future years.

To get more information on this market, Request Sample

Advancing Local Innovation Through Strategic Policy

Philippines is making strategic moves to improve its domestic innovation ecosystem, underlining the important contribution biosimilar development can make to enhanced access and affordability of healthcare. The most important policy milestone was achieved in February 2024, when the Tatak Pinoy Act was passed into law, aimed at strengthening domestic capabilities in high-value industries, including pharmaceuticals. The bill creates a strategic council tasked with guiding investment, infrastructure development, and technology transfer, supporting stronger alignment between government, industry, and research sectors. The move promotes a wider vision of self-reliance through encouraging local production of complex therapeutics, including biosimilars. It also assists in developing a regulatory and scientific ecosystem capable of supporting sustained innovation. Through the inclusion of biosimilar development in the national industrial strategy, the Philippines is setting the stage for a more competitive and responsive healthcare industry. This policy move not only supports national resilience but also enhances knowledge development and cross-sector cooperation both of which are necessary in driving market maturity. These trends signal a favorable and strategic direction of Philippines biosimilar market trends.

Expanding Regulatory Pathways for Biosimilars

The Philippines is taking concrete steps towards strengthening its regulatory strategy for biosimilars, part of a wider push to increase access to lower-cost medicines. A clearer, more transparent registration procedure is needed to appeal to local and foreign developers alike. In October 2024, the Food and Drug Administration issued Administrative Order 2024-0013, which established straightforward procedures for biosimilar product filings. This directive made application categories, more precise technical requirements, and a more certain review process. Not only do these reduce delays, but they also allow manufacturers to manage compliance with greater confidence . For a maturing market such as the Philippines, these steps are important in securing investor confidence and stimulating innovation in biosimilar development. With biosimilars providing lower-cost alternatives to expensive biologics, smoother regulatory processes have a direct effect on patient access and health sustainability. With the new framework taking hold, more applications and approvals are anticipated, faster bringing new drugs to market. These developments are key milestones for the Philippines biosimilar market, portending a more contemporary, responsive regulatory environment.

Philippines Biosimilar Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on molecule, indication, and manufacturing type.

Molecule Insights:

- Infliximab

- Insulin Glargine

- Epoetin Alfa

- Etanercept

- Filgrastim

- Somatropin

- Rituximab

- Follitropin Alfa

- Adalimumab

- Pegfilgrastim

- Trastuzumab

- Bevacizumab

- Others

The report has provided a detailed breakup and analysis of the market based on the molecule. This includes infliximab, insulin glargine, epoetin alfa, etanercept, filgrastim, somatropin, rituximab, follitropin alfa, adalimumab, pegfilgrastim, trastuzumab, bevacizumab, and others.

Indication Insights:

- Auto-Immune Diseases

- Blood Disorder

- Diabetes

- Oncology

- Growth Deficiency

- Female Infertility

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes auto-immune diseases, blood disorders, diabetes, oncology, growth deficiency, female infertility, and others.

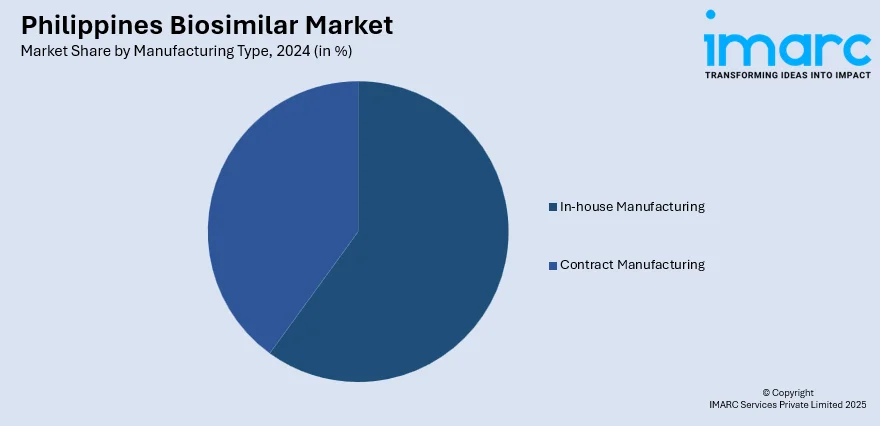

Manufacturing Type Insights:

- In-house Manufacturing

- Contract Manufacturing

The report has provided a detailed breakup and analysis of the market based on the manufacturing type. This includes in-house manufacturing and contract manufacturing.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Biosimilar Market News:

- March 2025: Bio-Thera Solutions and Dr. Reddy’s Laboratories have forged an exclusive partnership to introduce two biosimilars BAT2206 (a Stelara analog) and BAT2506 (a Simponi analog) across Southeast Asia, including the Philippines. Bio-Thera will develop, manufacture, and supply these therapies, while Dr. Reddy’s will lead regulatory filings and commercialization within the region. The partnership seeks to expand access to advanced treatments in the Philippines and neighboring markets, combining Bio-Thera’s development strengths with Dr. Reddy’s robust commercial experience

Philippines Biosimilar Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Molecules Covered | Infliximab, Insulin Glargine, Epoetin Alfa, Etanercept, Filgrastim, Somatropin, Rituximab, Follitropin Alfa, Adalimumab, Pegfilgrastim, Trastuzumab, Bevacizumab, Others |

| Indications Covered | Auto-Immune Diseases, Blood Disorder, Diabetes, Oncology, Growth Deficiency, Female Infertility, Others |

| Manufacturing Types Covered | In-house Manufacturing, Contract Manufacturing |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines biosimilar market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines biosimilar market on the basis of molecule?

- What is the breakup of the Philippines biosimilar market on the basis of indication?

- What is the breakup of the Philippines biosimilar market on the basis of manufacturing type?

- What is the breakup of the Philippines biosimilar market on the basis of region?

- What are the various stages in the value chain of the Philippines biosimilar market?

- What are the key driving factors and challenges in the Philippines biosimilar market?

- What is the structure of the Philippines biosimilar market and who are the key players?

- What is the degree of competition in the Philippines biosimilar market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines biosimilar market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines biosimilar market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines biosimilar industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)