Philippines Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Philippines Bottled Water Market Overview:

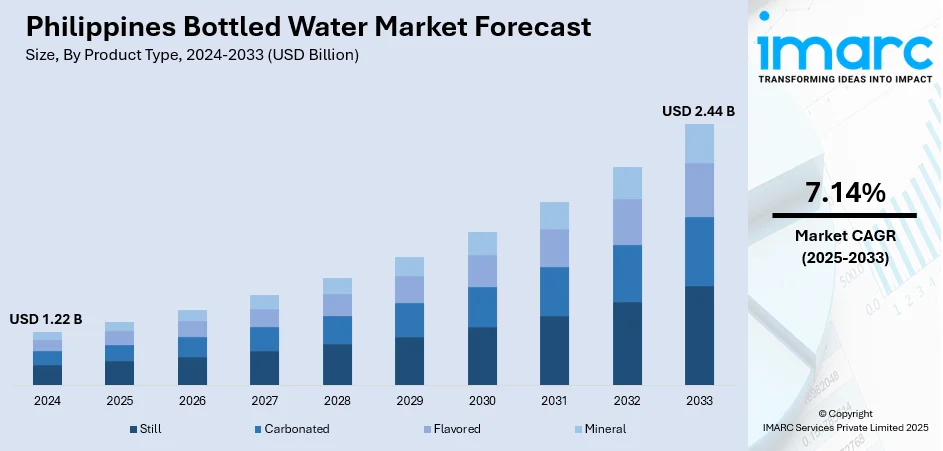

The Philippines bottled water market size reached USD 1.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.44 Billion by 2033, exhibiting a growth rate (CAGR) of 7.14% during 2025-2033. The market is experiencing robust expansion fueled by rising health awareness, urban population growth, and frequent concerns over tap water quality. Demand for premium, flavored, and functional bottled water variants is increasing across retail and modern trade channels. Growing tourism and commercial sectors are also driving consumption, while branded and private-label offerings gain traction through wider distribution and competitive pricing. Innovation in sustainable packaging and eco-friendly options further strengthens consumer appeal, contributing to the overall growth of the Philippines bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.22 Billion |

| Market Forecast in 2033 | USD 2.44 Billion |

| Market Growth Rate 2025-2033 | 7.14% |

Philippines Bottled Water Market Trends:

Premium and Functional Variants Driving Consumer Choice

As more people become aware of health in the Philippines, the demand for high-end, functional bottled water grows. Consumers are no longer satisfied with mere hydration and seek products that provide value added through mineral content, alkalinity, electrolytes, and flavor. These products appeal to fitness-goers, business professionals, and health-conscious consumers who integrate hydration into their wellness regimen. Responding to this, brands are adopting innovative packaging and niche marketing strategies that emphasize benefits such as immunity enhancement, detox, and energy. This diversification trend is helping companies move up the value chain and acquire a more discerning customer base, making premiumization a major trend in the evolving face of bottled water.

To get more information on this market, Request Sample

Sustainable and Eco-friendly Packaging

The move toward sustainability plays a crucial role in driving Philippines bottled water market growth. Companies are increasingly investing in eco-friendly packaging options such as biodegradable bottles, recycled PET plastics, and glass alternatives to minimize plastic waste. With rising environmental concerns, refill stations and reusable container initiatives are becoming more popular, particularly in urban settings. Younger consumers are aligning their buying decisions with sustainable values, leading brands to emphasize environmental certifications and eco-friendly practices in their marketing. This environmentally conscious strategy not only fosters brand loyalty but also ensures adherence to evolving governmental regulations aimed at combatting plastic pollution. Ultimately, the push for sustainable packaging is transforming production methods and shaping long-term market strategies in the Philippines.

Rising Retail Penetration and E-commerce Expansion

The way bottled water is accessed in the Philippines is changing due to increased retail presence and the swift development of e-commerce. Modern retail formats, such as supermarkets, hypermarkets, and convenience stores, now provide a wide array of bottled water choices, featuring both local and international brands. Additionally, online platforms are offering home delivery services, subscription plans, and bulk purchasing options to accommodate the needs of busy city dwellers. This shift in distribution is particularly impactful in metropolitan areas, where convenience and digital interaction are highly valued by consumers. Retailers are also providing exclusive online discounts and bundled deals to incentivize digital shopping. Consequently, multi-channel retail strategies have become vital for brands aiming to enhance their reach and maintain competitiveness in the bottled water sector.

Philippines Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

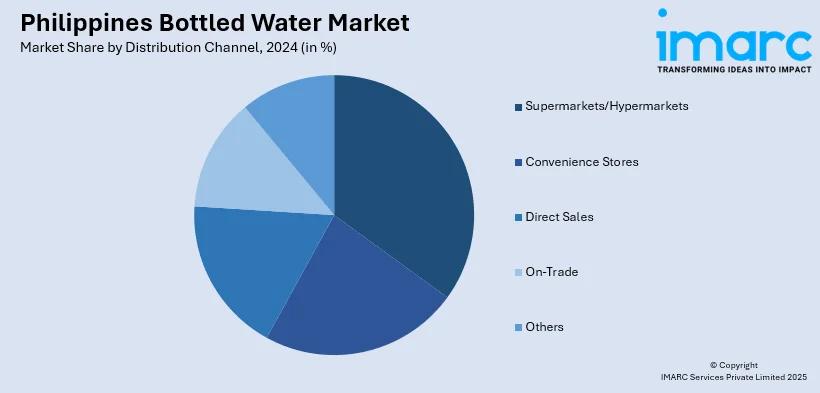

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines bottled water market on the basis of product type?

- What is the breakup of the Philippines bottled water market on the basis of distribution channel?

- What is the breakup of the Philippines bottled water market on the basis of packaging type?

- What is the breakup of the Philippines bottled water market on the basis of region?

- What are the various stages in the value chain of the Philippines bottled water market?

- What are the key driving factors and challenges in the Philippines bottled water market?

- What is the structure of the Philippines bottled water market and who are the key players?

- What is the degree of competition in the Philippines bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)