Philippines Building System Components Market Size, Share, Trends and Forecast by Product Type, and Region, 2026-2034

Philippines Building System Components Market Overview:

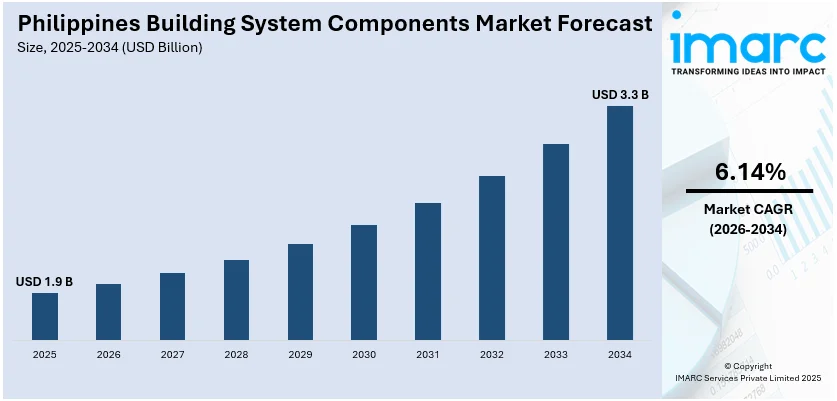

The Philippines building system components market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.14% during 2026-2034. The market is driven by government infrastructure projects, along with a growing real estate sector and sustainability initiatives promoting energy-efficient and disaster-resilient structures, which is fostering industry expansion and long-term growth opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.9 Billion |

| Market Forecast in 2034 | USD 3.3 Billion |

| Market Growth Rate 2026-2034 | 6.14% |

Philippines Building System Components Market Trends:

Elevating Government Infrastructure Investments

The government in the Philippines has consistently prioritized infrastructure development as the foundation of its economic policy. This is evident by the significant level of funding allocated to public works and transportation facilities. Between January and November 2023, the regulatory body across the country allocated approximately ₱ 1.02 Trillion for infrastructure and other capital expenditures, thereby marking an increase of 18.5% from the ₱ 861.8 Billion spent during the same period in 2022. However, this rise in infrastructure spending is not recent. In 2021, the government planned to allocate approximately ₱ 1.17 Trillion for infrastructure, which accounted for 5.9% of the gross domestic product (GDP). Moreover, this ongoing investment demonstrates the administration's dedication to enhancing the nation's infrastructure. The strategic emphasis on buildings is further underscored by the Medium-Term Infrastructure Program, which seeks to sustain infrastructure expenditures at about 5% to 6% of GDP per annum up to 2028. This long-term program guarantees an ongoing requirement for building system components since many projects are scheduled to be initiated and completed over the next several years. With the government pouring more money into infrastructure, the demand for quality building materials and components increases, thereby offering a strong market for suppliers and manufacturers.

To get more information on this market Request Sample

Growth of the Construction Industry

The Philippine construction sector has become a key driver of the country's economic development. In the second quarter of 2021, the GDP of this nation saw a growth of 11.8%, with the construction sector being among the primary drivers, along with manufacturing and trade. For example, during the first quarter of 2023, the Cordillera Administrative Region had a total of 421 construction activities with a floor area of 113,962 square meters and a total value of ₱ 1.628 Billion. In line with this, the expanding construction sector is inflating the need for building system parts. With an increasing number of residential, commercial, and industrial projects being initiated, the need for materials like cement, steel, electrical systems, and other parts increases. The demand is not only quantitative but also qualitative, with an increased focus on high-quality, long-lasting, and sustainable building materials. Additionally, government infrastructure projects tend to be large-scale in nature, requiring large amounts of building materials. The combination of public infrastructure projects and private construction projects results in a strong ecosystem, stimulating innovation and promoting investment in the building system components market.

Philippines Building System Components Market Segmentation:

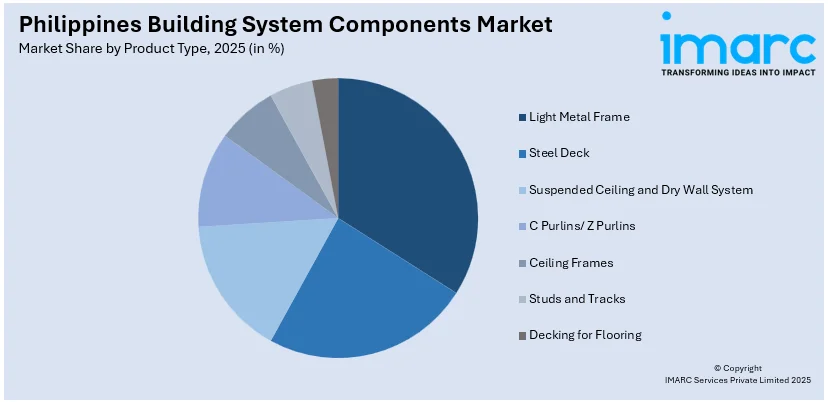

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type.

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Light Metal Frame

- Steel Deck

- Suspended Ceiling and Dry Wall System

- C Purlins/ Z Purlins

- Ceiling Frames

- Studs and Tracks

- Decking for Flooring

The report has provided a detailed breakup and analysis of the market based on the product type. This includes light metal frame, steel deck, suspended ceiling and dry wall system, C purlins/Z purlins, ceiling frames, studs and tracks, and decking for flooring.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Building System Components Market News:

- January 2025: SteelAsia Manufacturing Corporation built a heavy structural steel mill in Candelaria, Quezon, to minimize the Philippines' dependence on imports, with the goal of saving the nation USD 1.2 Billion per year. The plant, which will start operating in 2027, and manufacture more than one million metric tons of structural steel, including H-beams, I-beams, and sheet piles.

- March 2023: SteelAsia established a heavy-section steel facility in the Philippines to decrease dependence on imported structural steel, manufacturing beams and sheet piles domestically. This action bolsterd the Philippine market for building system components by improving local supply, stabilizing prices, and fostering infrastructure development.

Philippines Building System Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Light Metal Frame, Steel Deck, Suspended Ceiling and Dry Wall System, C Purlins/ Z Purlins, Ceiling Frames, Studs and Tracks, Decking for Flooring |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines building system components market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines building system components market on the basis of product type?

- What are the various stages in the value chain of the Philippines building system components market?

- What are the key driving factors and challenges in the Philippines building system components market?

- What is the structure of the Philippines building system components market and who are the key players?

- What is the degree of competition in the Philippines building system components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines building system components market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines building system components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines building system components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)