Philippines Bunker Fuel Market Size, Share, Trends and Forecast by Fuel Type, Vessel Type, Seller, and Region, 2025-2033

Philippines Bunker Fuel Market Overview:

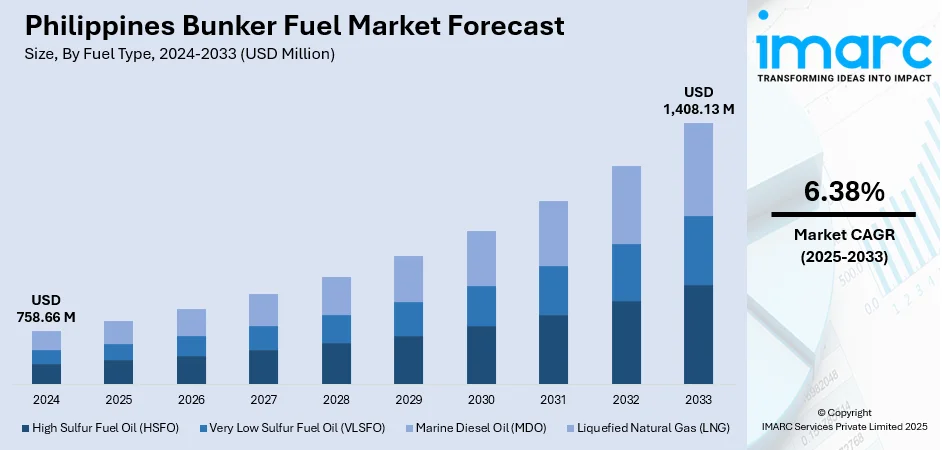

The Philippines bunker fuel market size reached USD 758.66 Million in 2024. The market is projected to reach USD 1,408.13 Million by 2033, exhibiting a growth rate (CAGR) of 6.38% during 2025-2033. Rising maritime trade, port expansions, increasing shipping traffic, and stricter emission regulations promoting cleaner fuel are some of the factors contributing to the Philippines bunker fuel market share. Growth in international cargo movement and government investment in port infrastructure further strengthen market prospects.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 758.66 Million |

| Market Forecast in 2033 | USD 1,408.13 Million |

| Market Growth Rate 2025-2033 | 6.38% |

Philippines Bunker Fuel Market Trends:

Shift toward Low-Sulfur Fuel and Compliance-Driven Demand

The Philippines bunker fuel market is undergoing a structural shift due to international maritime regulations, particularly the IMO 2020 mandate limiting sulfur content in marine fuels to 0.5%. Philippine ports, being strategically important for Southeast Asian trade routes, have seen growing demand for very low sulfur fuel oil (VLSFO) and marine gasoil (MGO). Shipping companies operating in and out of Manila, Cebu, and Subic Bay are increasingly sourcing compliant fuels to avoid penalties and ensure smoother operations across global trade hubs. This trend has pushed local suppliers to adapt storage and blending infrastructure to accommodate cleaner fuels. Although higher costs remain a concern for operators, the gradual integration of compliance-focused products has created opportunities for refiners and traders. Furthermore, as the Philippines develops its maritime logistics sector, greater investment is expected in fuel storage terminals and bunkering facilities, ensuring that compliant fuel supply remains reliable and competitive against regional peers like Singapore and Malaysia. These factors are intensifying the Philippines bunker fuel market growth.

To get more information on this market, Request Sample

Rising Interest in LNG and Alternative Marine Fuels

Alongside traditional demand for bunker fuel, there is a noticeable tilt toward cleaner alternatives such as liquefied natural gas (LNG) in the Philippines. Domestic shipping companies, influenced by global decarbonization efforts and rising fuel price volatility, are evaluating LNG-powered vessels as long-term investments. Pilot projects in major shipping corridors highlight this emerging interest, supported by government initiatives to modernize the maritime fleet and reduce emissions. Although LNG infrastructure is still limited, partnerships with regional energy companies and foreign investors are slowly addressing supply chain gaps. The Philippines’ growing role in international trade and its archipelagic geography make it a candidate for adopting LNG bunkering hubs in the future. This trend contrasts with the immediate dominance of VLSFO, as LNG adoption represents a longer-term shift tied to sustainability goals. Over the next decade, the interplay between environmental policies, technological adoption, and infrastructure readiness will determine whether LNG and other alternative fuels become a mainstream part of the Philippine bunker fuel mix.

Philippines Bunker Fuel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on fuel type, vessel type, and seller.

Fuel Type Insights:

- High Sulfur Fuel Oil (HSFO)

- Very Low Sulfur Fuel Oil (VLSFO)

- Marine Diesel Oil (MDO)

- Liquefied Natural Gas (LNG)

The report has provided a detailed breakup and analysis of the market based on the fuel type. This includes high sulfur fuel oil (HSFO), very low sulfur fuel oil (VLSFO), marine diesel oil (MDO), and liquefied natural gas (LNG).

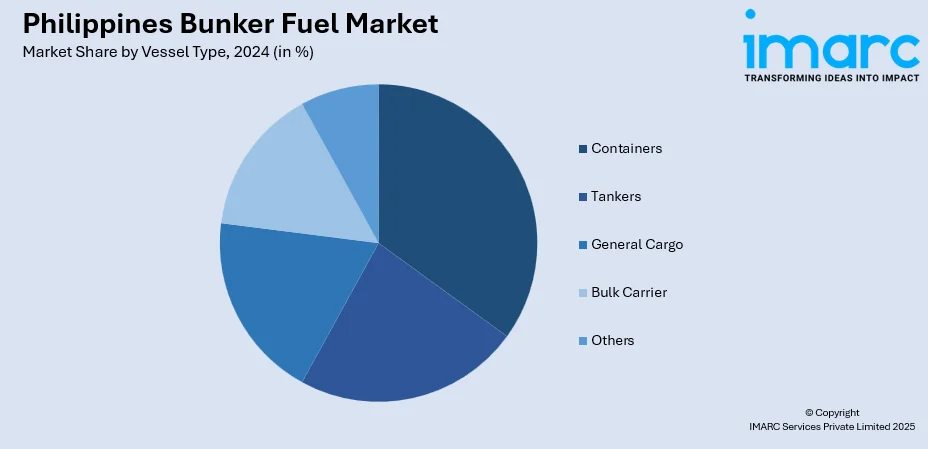

Vessel Type Insights:

- Containers

- Tankers

- General Cargo

- Bulk Carrier

- Others

The report has provided a detailed breakup and analysis of the market based on the vessel type. This includes containers, tankers, general cargo, bulk carrier, and others.

Seller Insights:

- Major Oil Companies

- Leading Independent Sellers

- Small Independent Sellers

The report has provided a detailed breakup and analysis of the market based on the seller. This includes major oil companies, leading independent sellers, and small independent sellers.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Bunker Fuel Market News:

- August 2025: Bernhard Schulte Shipmanagement (BSM) announced its plans to install a methanol bunkering simulator at its Maritime Training Centre in the Philippines by late 2025. The move supports the country’s bunker fuel market by strengthening alternative fuel readiness. As global shipping pivots to low-carbon fuels, this development positions the Philippines as a key hub for training seafarers in handling methanol and future ammonia bunkering, aligning with international decarbonization and clean energy shipping trends.

Philippines Bunker Fuel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fuel Types Covered | High Sulfur Fuel Oil (HSFO), Very Low Sulfur Fuel Oil (VLSFO), Marine Diesel Oil (MDO), Liquefied Natural Gas (LNG) |

| Vessel Types Covered | Containers, Tankers, General Cargo, Bulk Carrier, Others |

| Sellers Covered | Major Oil Companies, Leading Independent Sellers, Small Independent Sellers |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines bunker fuel market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines bunker fuel market on the basis of fuel type?

- What is the breakup of the Philippines bunker fuel market on the basis of vessel type?

- What is the breakup of the Philippines bunker fuel market on the basis of seller?

- What is the breakup of the Philippines bunker fuel market on the basis of region?

- What are the various stages in the value chain of the Philippines bunker fuel market?

- What are the key driving factors and challenges in the Philippines bunker fuel market?

- What is the structure of the Philippines bunker fuel market and who are the key players?

- What is the degree of competition in the Philippines bunker fuel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines bunker fuel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines bunker fuel market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines bunker fuel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)