Philippines Bus Market Size, Share, Trends and Forecast by Type, Fuel Type, Seat Capacity, Application, and Region, 2025-2033

Philippines Bus Market Overview:

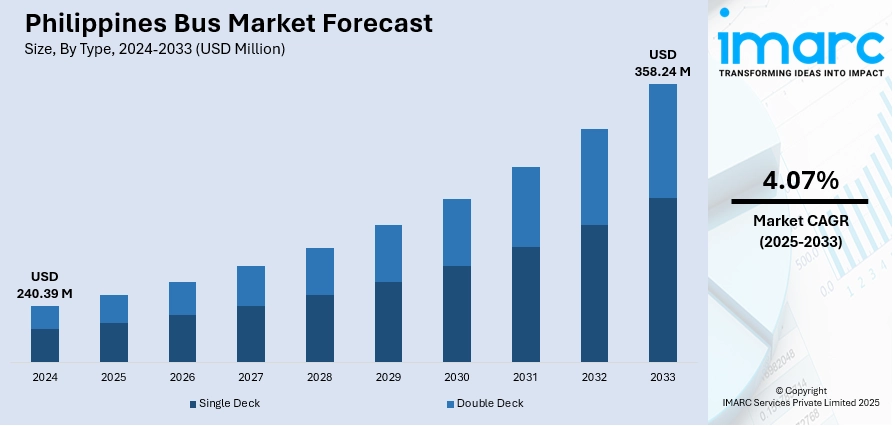

The Philippines Bus market size reached USD 240.39 Million in 2024. The market is projected to reach USD 358.24 Million by 2033, exhibiting a growth rate (CAGR) of 4.07% during 2025-2033. The market is aided by investments in infrastructure, modernization of urban transit, and increased emphasis on sustainable mobility. Government initiatives to drive fleet renewal and commuter safety also are driving adoption of advanced bus technologies. Expansion in demand for effective intercity and city transport also is driving fleet penetration higher. With focus on electrification, digitalization of tickets, and interconnectivity, the industry is ready for gradual progress, making the Philippines a critical hub in Southeast Asia. This development is captured in the Philippines bus market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 240.39 Million |

| Market Forecast in 2033 | USD 358.24 Million |

| Market Growth Rate 2025-2033 | 4.07% |

Philippines Bus Market Trends:

Electrification and Green Mobility

Electrification is quickly defining the future of public transport in the Philippines, with considerable momentum toward green mobility solutions. National energy efficiency initiatives and sustainability pledges are creating a conducive climate for the deployment of electric buses, especially in urban roadways where environmental pressures are most acute. In June 2025, Subic Bay Freeport will introduce ten pure battery electric buses with charging stations and 58 enhanced bus stops furthering its carbon-neutrality and sustainable public transportation efforts. Moreover, electric models not only mitigate reliance on imported fuel but also respond to increasing air quality concerns in metropolises. The rollout of charging infrastructure projects and state incentives is also moving in tandem with international trends toward clean transport solutions. This revolution also mirrors commuters' increasing demand for environmentally friendly alternatives, as green mobility is becoming a necessary component of city living. The Philippines bus market growth is now increasingly linked to how effectively fleet operators and transport agencies adopt electric and low-emission vehicles. With a focus on green transportation options, the sector is moving towards long-term sustainability while addressing commuter requirements for secure, clean, and contemporary traveling experiences.

To get more information on this market, Request Sample

Digital Ticketing and Smart Transit Solutions

The uptake of digital ticketing and smart solutions is emerging as a key driver of modernization in the Philippine bus industry. As urban mobility increases in scale and advancement, the blending of cashless payment schemes, contactless cards, and mobile payments is optimizing passenger flow and improving ease of use. These solutions not just enhance commuter experience but also allow operators to better manage fleets with data-driven insights. Smarter transport systems are also being introduced to maximize routes, track ridership patterns, and minimize congestion, hence enhancing service quality. The transition towards smart infrastructure aligns with transport trends worldwide where technology allows for safer, faster, and more transparent commuting. This digital shift underscores Philippines bus market trends, with the sector moving to incorporate innovation into its day-to-day activities. Better connectivity and digital accessibility are setting the stage for an integrated public transport ecosystem, driving efficiency and contributing to the broader modernization of the mobility landscape.

Development of Intercity and Provincial Bus Services

The intensifying need for intercity and provincial buses is growing more important in the Philippines, fueled by growing economic activity and increasing needs for connectivity between regions. As communities and businesses continue to extend beyond metropolitan areas, trustworthy long-distance transportation is essential for both commuters and tourists. Investments in highway infrastructure and road networks are facilitating smoother intercity travel, and equipped modern buses with upgraded comfort facilities are making the overall passenger experience better. This growth also fuels tourism, as convenient and affordable travel arrangements become more popular among travelers across destinations. Improved safety standards and systematic scheduling are also making intercity travel more reliable. The growth in the Philippines bus industry is proportional to the growing significance of these long-distance routes in offsetting accessibility between provinces and municipalities. Through the consolidation of provincial links, the industry is making regional integration, economic mobility, and constant demand for upgraded intercity bus routes throughout the nation possible.

Philippines Bus Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, fuel type, seat capacity, and application.

Type Insights:

- Single Deck

- Double Deck

The report has provided a detailed breakup and analysis of the market based on the type. This includes single deck and double deck.

Fuel Type Insights:

- Diesel

- Electric and Hybrid

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes diesel, electric and hybrid and, others

Seat Capacity Insights:

- 15-30 Seats

- 31-50 Seats

- More than 50 Seats

The report has provided a detailed breakup and analysis of the market based on the seat capacity. This includes 15-30 seats, 31-50 seats, and more than 50 seats.

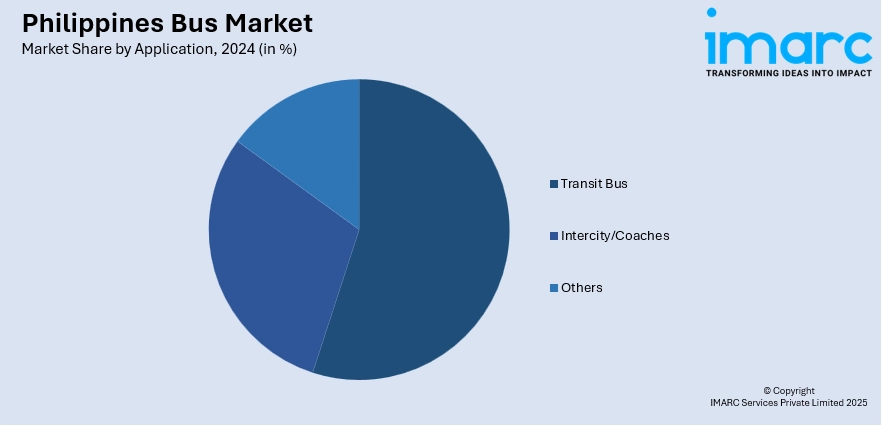

Application Insights:

- Transit Bus

- Intercity/Coaches

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes transit bus, intercity/coaches, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Bus Market News:

- In September 2024, MC Metro Transport Operation Inc., with Japan-based Zenmov, rolled out the Philippines' first autonomous bus service at New Clark City, Tarlac. Backed by the Smart Mobility Operation Cloud, the venture hopes to provide sustainable, scalable transport solutions and is a milestone in the country's new-age public mobility industry.

- In September 2024, the Philippines unveiled its first autonomous bus service in New Clark City. The Primary Rapid Transit, which runs on the Smart Mobility Operation Cloud (SMOC) power, will run on specific city and airport routes to ease congestion, make commuters' lives more convenient, and encourage sustainable, low-carbon public transport.

Philippines Bus Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Deck, Double Deck |

| Fuel Types Covered | Diesel, Electric and Hybrid, Others |

| Seat Capacities Covered | 15-30 Seats, 31-50 Seats, More than 50 Seats |

| Applications Covered | Transit Bus, Intercity/Coaches, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines bus market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines bus market on the basis of type?

- What is the breakup of the Philippines bus market on the basis of fuel type?

- What is the breakup of the Philippines bus market on the basis of seat capacity?

- What is the breakup of the Philippines bus market on the basis of application?

- What is the breakup of the Philippines bus market on the basis of region?

- What are the various stages in the value chain of the Philippines bus market?

- What are the key driving factors and challenges in the Philippines bus market?

- What is the structure of the Philippines bus market and who are the key players?

- What is the degree of competition in the Philippines bus market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines bus market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines bus market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines bus industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)