Philippines Car Subscription Market Size, Share, Trends and Forecast by Service Providers, Vehicle Type, Subscription Period, End Use, and Region, 2026-2034

Philippines Car Subscription Market Summary:

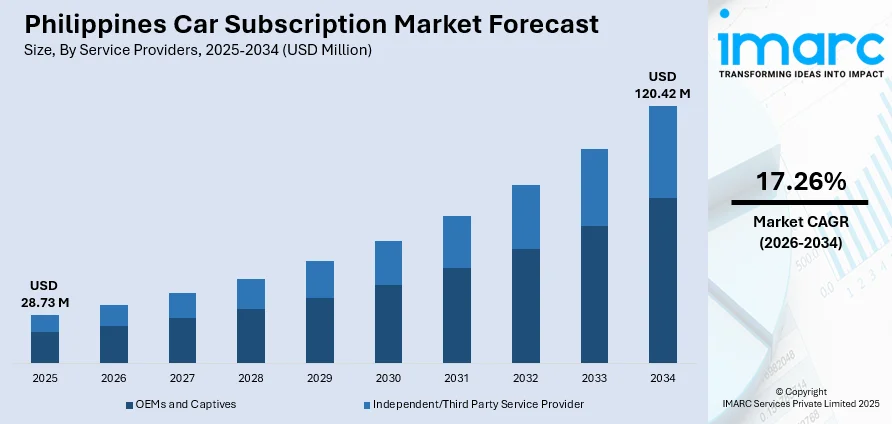

The Philippines car subscription market size was valued at USD 28.73 Million in 2025 and is projected to reach USD 120.42 Million by 2034, growing at a compound annual growth rate of 17.26% from 2026-2034.

The Philippines car subscription market is experiencing robust expansion as urbanization accelerates and consumer preferences shift toward flexible mobility solutions. Severe traffic congestion in Metro Manila, rising vehicle ownership costs including insurance and maintenance expenses, and increasing digitization of transportation services are driving adoption. Growing demand from corporate clients seeking cost-effective fleet alternatives and the emergence of integrated subscription platforms bundling maintenance, insurance, and roadside assistance are strengthening Philippines car subscription market share.

Key Takeaways and Insights:

-

By Service Providers: Independent/Third party service provider dominates the market with a share of 37.84% in 2025, driven by flexible subscription terms and diverse vehicle portfolios catering to varied consumer preferences.

-

By Vehicle Type: IC powered vehicle leads the market with a share of 73.05% in 2025, owing to established fuel infrastructure and consumer familiarity with conventional powertrains.

-

By Subscription Period: 6 to 12 months represents the largest segment with a market share of 45.31% in 2025, reflecting corporate preference for medium-term commitments balancing flexibility and cost efficiency.

-

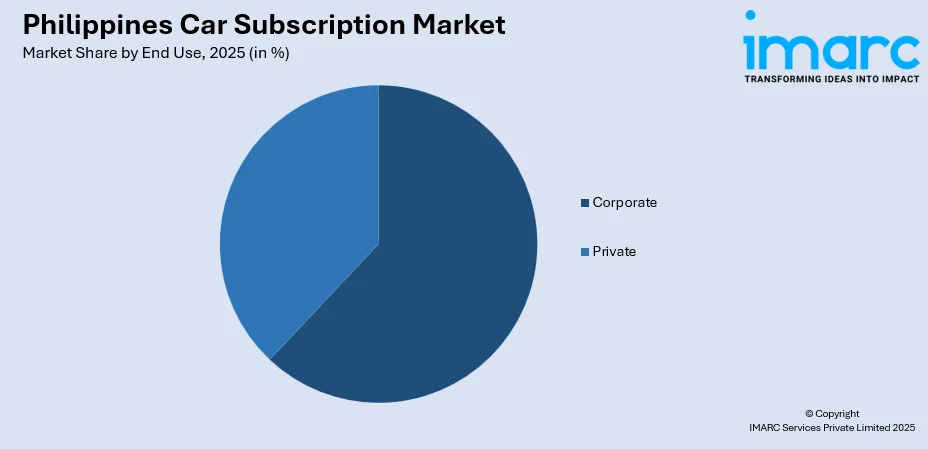

By End Use: Corporate dominates the market with a share of 62.06% in 2025, as businesses optimize fleet management costs and reduce administrative burdens through subscription models.

-

By Region: Luzon represents the largest share at 64% in 2025, driven by Metro Manila's population concentration, severe traffic congestion, and high commercial activity.

-

Key Players: The Philippines car subscription market features competition among established automotive manufacturers launching subscription services and independent mobility platforms. Players are focusing on digital platform integration, comprehensive service bundling, flexible subscription terms, and corporate fleet solutions to capture market share.

To get more information on this market Request Sample

The Philippines car subscription market is advancing as consumers and businesses embrace alternative mobility solutions amid rising ownership costs and urban congestion challenges. Service providers are expanding offerings to include comprehensive packages covering insurance, maintenance, and roadside assistance, reducing friction in vehicle usership. For instance, in November 2024, Toyota Mobility Solutions Philippines launched KINTO One, a full-service car leasing subscription covering maintenance, insurance, and roadside assistance with Fleet 360 GPS tracking for business clients and mileage options up to 40,000 kilometers annually. The integration of digital platforms enabling seamless booking, vehicle selection, and subscription management is enhancing accessibility, particularly among younger demographics and urban professionals seeking convenient alternatives to traditional ownership.

Philippines Car Subscription Market Trends:

Shift from Ownership to Subscription-Based Mobility

Filipino consumers are increasingly prioritizing flexibility and convenience over traditional vehicle ownership as urban congestion intensifies and ownership costs escalate. Car subscription services that bundle insurance, maintenance, and flexible terms are gaining traction among urban commuters and professionals seeking hassle-free mobility. According to JICA estimates, traffic congestion in Metro Manila costs approximately PHP 3.5 billion daily, projected to rise to PHP 5.4 billion by 2035, making subscription-based alternatives increasingly attractive for cost-conscious consumers navigating the capital's mobility challenges.

Integration of Electric Vehicle Battery Subscription Models

Electric vehicle manufacturers are introducing innovative battery subscription models to lower entry barriers and accelerate EV adoption in the Philippines. These models separate battery costs from vehicle prices, offering monthly subscription plans based on driving distance and usage patterns. In September 2024, VinFast launched the VF 3 electric mini SUV in the Philippines with battery subscription plans starting at PHP 2,800 monthly, enabling consumers to optimize costs based on travel needs while receiving free maintenance and battery replacement guarantees when capacity falls below 70%.

Corporate Fleet Digitalization and Management Solutions

Businesses are increasingly adopting digital fleet management solutions integrated with car subscription services to simplify operations and cut administrative burdens. Features such as GPS tracking, real-time vehicle monitoring, and driver behavior analytics are becoming standard in corporate subscription offerings, helping companies gain better control over their fleets. These technology-enabled solutions support improved vehicle utilization, proactive maintenance, and enhanced safety oversight. As enterprises manage more distributed and mobile workforces, demand is rising for integrated platforms that improve operational visibility, efficiency, and overall fleet performance.

Market Outlook 2026-2034:

The Philippines car subscription market is positioned for sustained expansion as digital mobility platforms mature and consumer acceptance of service-based vehicle access strengthens. Rising smartphone adoption, the expansion of ride-hailing ecosystems, and growing corporate use of fleet subscription services are creating favorable conditions for the Philippines car subscription market. These trends are improving access, increasing demand for flexible mobility, and encouraging wider acceptance of subscription-based vehicle solutions. The market generated a revenue of USD 28.73 Million in 2025 and is projected to reach a revenue of USD 120.42 Million by 2034, growing at a compound annual growth rate of 17.26% from 2026-2034.

Philippines Car Subscription Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Service Providers |

Independent/Third Party Service Provider |

37.84% |

|

Vehicle Type |

IC Powered Vehicle |

73.05% |

|

Subscription Period |

6 to 12 Months |

45.31% |

|

End Use |

Corporate |

62.06% |

|

Region |

Luzon |

64% |

Service Providers Insights:

- OEMs and Captives

- Independent/Third Party Service Provider

The Independent/Third party service provider dominates with a market share of 37.84% of the total Philippines car subscription market in 2025.

Independent and third-party service providers lead the Philippines car subscription market due to their flexibility, competitive pricing, and customer-centric offerings. Unlike OEM-led models, these players can source vehicles from multiple brands, allowing them to tailor subscription plans across different price points and user needs. Their asset-light or hybrid fleet strategies also help keep costs lower, making subscriptions more accessible to individual users, SMEs, and startups seeking short- to mid-term mobility without long-term ownership commitments.

Additionally, independent providers excel in digital integration and service agility, enabling faster onboarding, flexible contract terms, and bundled services such as insurance, maintenance, and roadside assistance. Their ability to partner with fintech firms, insurers, and fleet management technology providers strengthens value propositions for both consumers and corporate clients. This adaptability is particularly important in the Philippines, where diverse mobility needs, urban congestion, and cost sensitivity favor customizable, service-driven subscription models.

Vehicle Type Insights:

- IC Powered Vehicle

- Electric Vehicle

The IC powered vehicle leads the market with a share of 73.05% of the total Philippines car subscription market in 2025.

Internal combustion (IC)-powered vehicles currently lead the Philippines car subscription market mainly due to affordability, infrastructure, and consumer preference. IC vehicles (gasoline and diesel) have lower upfront costs compared with electric vehicles (EVs), making them more attractive to Filipino subscribers and operators focused on keeping subscription fees manageable. They benefit from an established fueling network nationwide, whereas EV charging infrastructure is still limited and expanding gradually.

Also, Filipinos have historically preferred conventional engines due to familiarity, easier maintenance, and readily available spare parts. This has translated into broader acceptance of IC cars in flexible ownership models like subscriptions, where lower operational complexity and predictable running costs matter to consumers and providers alike. Additionally, although EVs and hybrids are growing, they still represent a relatively small share of the overall automotive market in the Philippines, partly due to higher vehicle costs and slower infrastructure development, which limits their penetration in subscription fleets compared to IC cars.

Subscription Period Insights:

- 1 to 6 Months

- 6 to 12 Months

- More Than 12 Months

The 6 to 12 months represent the largest share at 45.31% of the total Philippines car subscription market in 2025.

Six- to twelve-month subscription providers lead the Philippines car subscription market because they strike an optimal balance between flexibility and affordability. This duration appeals to consumers who need personal vehicles for medium-term requirements such as job assignments, project-based work, or temporary relocations, without committing to long-term ownership or leases. Compared to shorter plans, these subscriptions offer lower monthly costs, making them more economical for users seeking stability while retaining the option to switch or exit after a defined period.

Additionally, this subscription length aligns well with provider economics and fleet management efficiency. Six- to twelve-month contracts allow companies to better forecast demand, optimize vehicle utilization, and manage maintenance schedules more effectively than short-term rentals. In the Philippines, where consumers are cost-conscious and value predictable expenses, these plans also reduce churn and operational risk. As a result, providers can offer competitive pricing, bundled services, and wider vehicle choices, reinforcing the dominance of this subscription duration.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Private

- Corporate

The corporate leads the market with a share of 62.06% of the total Philippines car subscription market in 2025.

Corporate clients represent the primary revenue source as businesses increasingly transition from vehicle ownership to subscription models for fleet management optimization. Companies across industries including business process outsourcing, logistics, and financial services are adopting subscriptions to reduce capital expenditure, minimize administrative overhead associated with vehicle procurement and disposal, and access comprehensive fleet management technologies including GPS tracking and driver behavior monitoring.

The BPO industry alone supported 1.82 million jobs in 2024, concentrated in PEZA-registered IT parks across Metro Manila, Cebu, and emerging hubs like Iloilo and Davao. This workforce concentration creates substantial corporate mobility demand that subscription services are positioned to address. Fleet management features including real-time vehicle tracking, maintenance scheduling, and utilization analytics enable corporate subscribers to optimize transportation costs while ensuring employee mobility across distributed office locations and client sites.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates with a market share of 64% of the total Philippines car subscription market in 2025.

The Philippines car subscription market, especially in Luzon, is driven by traffic congestion and the demand for flexible mobility solutions. Metro Manila’s severe daily traffic costs billions in lost productivity, pushing commuters to look for alternatives that reduce the burden of long-term car ownership and unpredictable costs. Subscription services offer bundled insurance, maintenance, and flexible terms that appeal to urban professionals and younger consumers seeking convenience without ownership hassles. This shift from traditional ownership to service-based mobility is bolstered by rising vehicle costs, limited parking, and changing lifestyle preferences in dense urban centers across Luzon.

Another key factor is digitization and improving market infrastructure in Luzon. High internet penetration and mobile platform adoption enable seamless subscription sign-ups, real-time fleet management, and digital payments, which attract tech-savvy users. Luzon’s strong economic activity, especially in Metro Manila and CALABARZON, also supports wider subscription uptake due to higher disposable income and financial services access. Additionally, partnerships between financial institutions and digital marketplaces improve affordability and payment flexibility, encouraging more consumers to try subscription models.

Market Dynamics:

Growth Drivers:

Why is the Philippines Car Subscription Market Growing?

Severe Urban Traffic Congestion Driving Alternative Mobility Adoption

Metro Manila's persistent traffic congestion is fundamentally reshaping consumer attitudes toward vehicle ownership and driving subscription service adoption. The capital region experiences some of the world's longest commute times, with average travel speeds falling below 20 kilometers per hour during peak periods. This congestion generates enormous economic costs estimated at PHP 3.5 billion daily, projected to escalate to PHP 5.4 billion by 2035 according to JICA studies. For consumers and businesses spending significant time in traffic, the total cost of vehicle ownership including depreciation during idle time becomes increasingly difficult to justify. Subscription services offering flexible terms and the ability to return vehicles when not needed provide financially rational alternatives to capital-intensive ownership.

Rising Vehicle Ownership Costs and Financial Flexibility Demands

The comprehensive costs of vehicle ownership in the Philippines including insurance premiums, registration fees, maintenance expenses, and depreciation are driving consumers toward subscription alternatives offering predictable monthly expenses. Young professionals and expatriates particularly value subscription models that eliminate down payment requirements and provide access to vehicles without depleting savings or taking on multi-year financing obligations. The Philippine vehicle market reached record sales of 467,252 units in 2024, yet rising fuel prices and maintenance costs are prompting consumers to evaluate total ownership expenses more critically, creating favorable conditions for subscription alternatives.

Digital Platform Proliferation and Smartphone Penetration

Widespread smartphone adoption exceeding 85 million users in the Philippines enables seamless digital subscription management from vehicle selection through booking, payment, and service coordination. Mobile applications provide subscribers with transparent pricing, real-time vehicle availability, and convenient service scheduling without requiring dealership visits. The success of ride-hailing platforms valued at USD 1.2 billion has established consumer comfort with app-based transportation services, creating a foundation for subscription platform adoption. Digital payment integration including e-wallets and online banking further reduces friction in subscription transactions, particularly among younger demographics accustomed to digital-first service consumption.

Market Restraints:

What Challenges the Philippines Car Subscription Market is Facing?

Limited Charging Infrastructure Constraining EV Subscriptions

The Philippines' nascent electric vehicle charging network remains concentrated in Metro Manila and select urban areas, limiting subscriber confidence in EV subscription options for longer journeys or regional travel. While EV manufacturers are introducing battery subscription models to reduce cost barriers, range anxiety and charging accessibility concerns continue to favor internal combustion vehicle subscriptions for subscribers requiring predictable mobility across diverse routes and destinations.

Consumer Awareness and Subscription Cost Perceptions

Many Filipino consumers remain unfamiliar with car subscription models and perceive monthly subscription costs as expensive relative to traditional ownership when viewed in isolation without considering the total cost of ownership including maintenance, insurance, and depreciation. Building consumer understanding of subscription value propositions requires sustained education efforts, and cultural preferences for vehicle ownership as status symbols present additional adoption barriers requiring targeted marketing approaches.

Fleet Availability and Vehicle Selection Limitations

Subscription providers face challenges in maintaining diverse vehicle inventories capable of satisfying varied subscriber preferences across segments, from economy to premium vehicles. Fleet acquisition costs, vehicle depreciation management, and geographic distribution across the archipelago require substantial capital investment and operational expertise. Limited vehicle availability during peak demand periods or in locations outside major urban centers can diminish subscriber satisfaction and constrain market expansion potential.

Competitive Landscape:

The Philippines car subscription market exhibits an evolving competitive landscape as established automotive manufacturers and independent mobility platforms compete for market share. OEM-affiliated services leverage brand recognition, dealer networks, and vehicle warranties to attract brand-loyal subscribers, while independent providers compete through pricing flexibility, multi-brand portfolios, and digital convenience. Market participants are differentiating through comprehensive service bundling encompassing maintenance, insurance, and roadside assistance, along with fleet management technologies addressing corporate client requirements. Strategic partnerships between subscription platforms and automotive dealers, insurance providers, and digital payment platforms are enabling expanded service capabilities and geographic coverage across the Philippine archipelago.

Recent Developments:

-

October 2024: VinFast announced pricing and opened reservations for the VF 7 electric SUV during the 12th Philippines Electric Vehicle Summit, offering battery subscription plans starting at PHP 6,300 monthly with a 10-year/200,000-kilometer vehicle warranty and free maintenance with battery replacement if capacity falls below 70%.

Philippines Car Subscription Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Providers Covered | OEMs and Captives, Independent/Third Party Service Provider |

| Vehicle Types Covered | IC Powered Vehicle, Electric Vehicle |

| Subscription Periods Covered | 1 to 6 Months, 6 to 12 Months, More Than 12 Months |

| End Uses Covered | Private, Corporate |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines car subscription market size was valued at USD 28.73 Million in 2025.

The Philippines car subscription market is expected to grow at a compound annual growth rate of 17.26% from 2026-2034 to reach USD 120.42 Million by 2034.

Corporate end users represents the largest market share at 62.06% in 2025, driven by businesses optimizing fleet costs, reducing administrative burdens, and accessing comprehensive fleet management solutions through subscription models rather than vehicle ownership.

Key factors driving the Philippines car subscription market include severe urban traffic congestion increasing total ownership costs, rising vehicle expenses prompting consumers to seek flexible alternatives, growing corporate demand for fleet optimization, and digital platform proliferation enabling seamless subscription management.

Major challenges include limited EV charging infrastructure constraining electric vehicle subscription adoption, consumer awareness gaps regarding subscription value propositions, fleet availability limitations in regional markets, and competition from established ride-hailing platforms for urban mobility spend.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)