Philippines Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Philippines Carbon Black Market Overview:

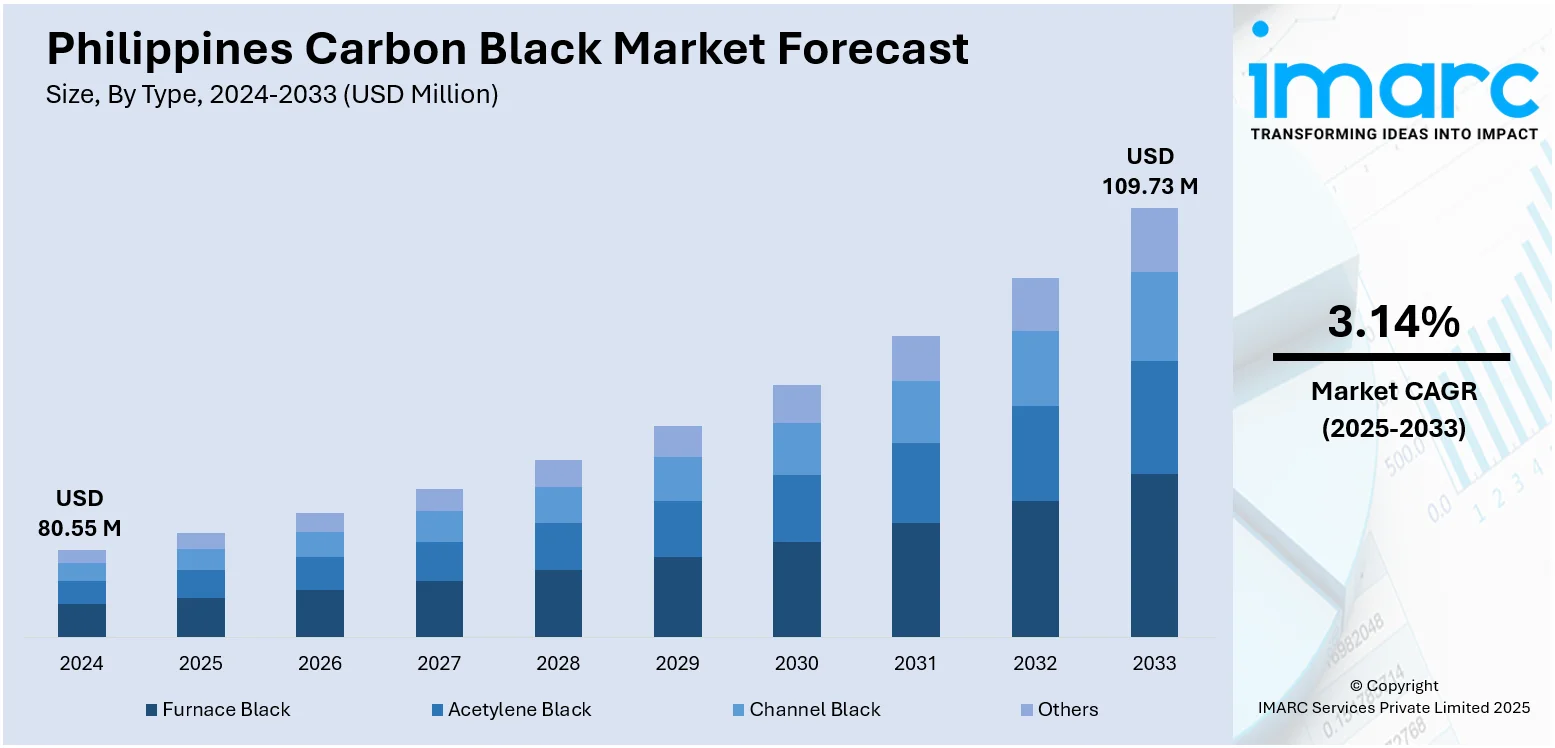

The Philippines carbon black market size reached USD 80.55 Million in 2024. Looking forward, the market is projected to reach USD 109.73 Million by 2033, exhibiting a growth rate (CAGR) of 3.14% during 2025-2033. The market is advancing steadily across diverse segments, from plastic compounding to decorative coatings and industrial inks. High-end applications in cable insulation, flexible packaging, and architectural finishes are pushing adoption of specialty carbon black with consistent particle control and performance. Rising interest in material innovation and value-added formulations is expected to redefine downstream integration, further augmenting the Philippines carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 80.55 Million |

| Market Forecast in 2033 | USD 109.73 Million |

| Market Growth Rate 2025-2033 | 3.14% |

Philippines Carbon Black Market Trends:

Expansion of Plastic Converting and Compounding in Domestic Manufacturing

The Philippines’ plastics industry is witnessing growing demand for value-added compounds across automotive interiors, appliance housings, and electrical components. The Philippine automotive industry posted record-high vehicle sales in 2024, reaching 467,252 units, which is an 8.7% increase from 429,807 units sold in 2023, as reported by the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association (TMA). As local converters scale up production, the need for high-dispersion and thermally stable black masterbatches is expanding. Carbon black serves a critical role in enhancing pigment density, UV resistance, and structural rigidity in polypropylene, ABS, and polyethylene-based blends. Food-contact applications and consumer-safe packaging formats also require low-contaminant carbon black with traceability and safety certifications. Manufacturers are responding by integrating specialty dispersions and filtration systems that meet both export and domestic compliance thresholds. The added focus on material quality, color consistency, and recyclability aligns with broader circular economy initiatives, while enabling innovation in lightweight and weather-resistant plastic products. These diverse applications are actively contributing to Philippines carbon black market growth

To get more information on this market, Request Sample

Growth in Domestic Coatings, Inks, and Decorative Finishes

Architectural and industrial coatings in the Philippines increasingly incorporate carbon black for tint strength, gloss control, and environmental resilience. Demand is strong across segments such as metal furniture, plastic coatings, roofing sheets, and automotive refinish systems, with producers requiring consistent blackness and low-grit particle distribution. High-jetness and solvent-stable carbon black is used for both aqueous and solvent-borne coatings to enhance visual appeal and UV durability under tropical climate conditions. Print packaging and ink manufacturers, particularly those serving the FMCG and retail sectors, favor grades that offer sharpness, rub resistance, and good flow across flexographic and gravure systems, which result in a higher product uptake. For instance, Knoll Printing & Packaging, a global leader in deluxe packaging, announced the production of its two millionth box at its fully-owned factory in the Philippines, in April 2025. In response to surging global demand, Knoll also unveiled expansion plans for this facility. With the shift toward premium finishes and decorative surfaces, demand for refined dispersions with tailored surface activity and minimal oil absorption is accelerating. These advancements in color technology and ink performance are solidifying carbon black’s critical role in high-quality coating and printing applications.

Philippines Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

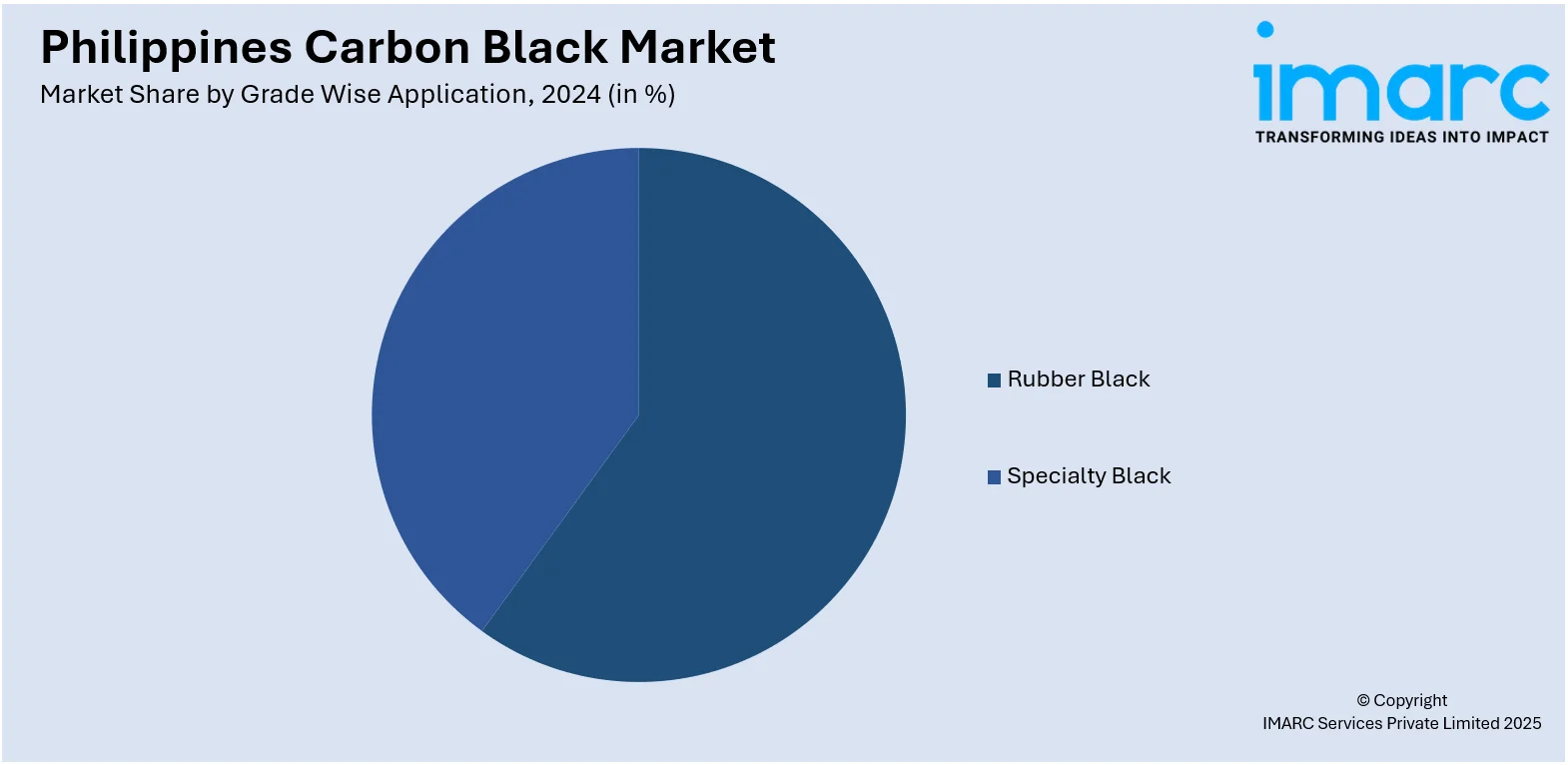

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all major regional markets. This includes Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines carbon black market on the basis of type?

- What is the breakup of the Philippines carbon black market on the basis of grade wise application?

- What is the breakup of the Philippines carbon black market on the basis of region?

- What are the various stages in the value chain of the Philippines carbon black market?

- What are the key driving factors and challenges in the Philippines carbon black market?

- What is the structure of the Philippines carbon black market and who are the key players?

- What is the degree of competition in the Philippines carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)