Philippines CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Philippines CCTV Camera Market Overview:

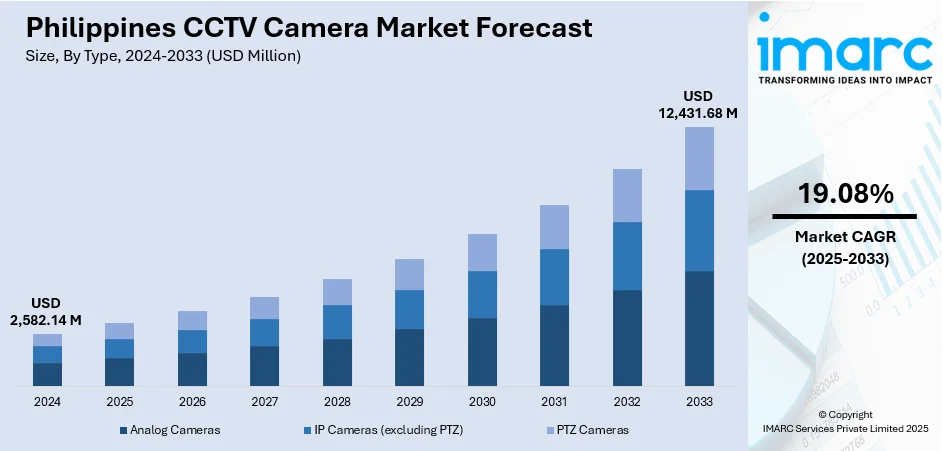

The Philippines CCTV camera market size reached USD 2,582.14 Million in 2024. Looking forward, the market is projected to reach USD 12,431.68 Million by 2033, exhibiting a growth rate (CAGR) of 19.08% during 2025-2033. The market is experiencing steady growth due to rising concerns over public safety, increased urbanization, and government initiatives promoting surveillance infrastructure. Demand is also driven by commercial establishments, residential complexes, and transport hubs adopting IP-based and AI-enabled camera systems. Ongoing infrastructure development, smart city projects, and rising demand from commercial and residential sectors are fueling the market growth, shaping a highly competitive landscape for the Philippines CCTV camera market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,582.14 Million |

| Market Forecast in 2033 | USD 12,431.68 Million |

| Market Growth Rate 2025-2033 | 19.08% |

Philippines CCTV Camera Market Trends:

Integration with AI and Analytics

The convergence of artificial intelligence and sophisticated analytics plays a significant role in enhancing the growth of the CCTV camera market in the Philippines. New-age surveillance solutions are progressively integrating AI-powered capabilities such as facial recognition, motion detection, object tracking, and behavior analysis. Such cognitive capabilities allow early threat detection, reduce the necessity for human monitoring, and lead to faster response times to incidents. For instance, facial recognition supports the identification of people in public places, whereas behavior analysis assists in identifying suspicious activity in real-time, thereby improving situational awareness. Numerous companies and government organizations are adopting such smart technologies to improve security at public places, transportation networks, and business properties. For instance, in July 2023, the Philippines launched a new CCTV command center in Pasig City, featuring over 400 high-definition cameras and plans for facial recognition technology. The initiative aims to enhance urban security, while the MMDA reviews body camera rules for traffic enforcement to ensure transparency and reduce corruption. Additionally, AI-enhanced video analytics lead to improved data management and operational efficiency by filtering and highlighting critical footage. The rising demand for smart surveillance solutions is a significant factor in the ongoing Philippines CCTV camera market growth.

To get more information on this market, Request Sample

Rising Use in Public Infrastructure

The increasing implementation of CCTV systems throughout public infrastructure significantly contributes to the growth of the Philippines CCTV camera market. Government entities are emphasizing safety and surveillance by deploying advanced camera systems in key areas such as transport terminals, roadways, educational institutions, hospitals, and government buildings. For instance, in May 2025, the Department of the Interior and Local Government announced its plans to install 60,000 CCTV cameras across Metro Manila to strengthen the 911 emergency response system. Connected to a command center, the system will enhance coordination among emergency services and aims for response times of three to five minutes in the city. These efforts are designed to deter criminal activities, oversee crowd dynamics, and enable swift responses to emergencies. In transport centers, CCTV cameras are utilized to regulate traffic flow and improve commuter safety, while in schools, they foster secure environments for both students and staff. Investments from the public sector are also in line with national and local safety initiatives, promoting broader adoption. As urban areas continue to grow more densely populated and security issues change, the significance of video surveillance within public infrastructure is increasingly vital, sustaining robust growth in the Philippines CCTV camera market.

Philippines CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

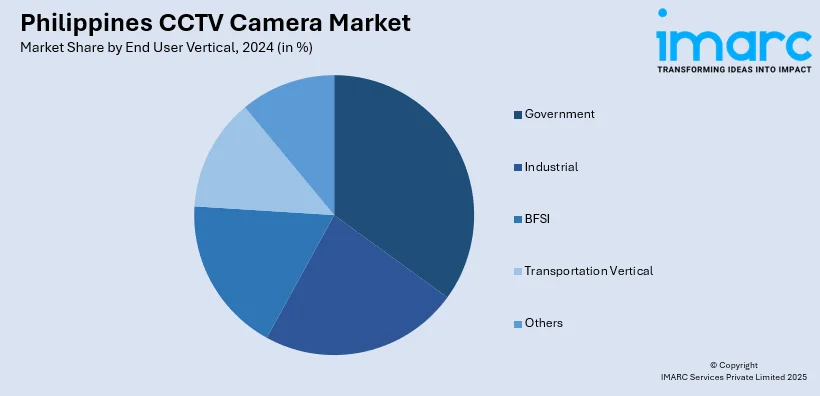

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines CCTV Camera Market News:

- In May 2025, the Metropolitan Manila Development Authority (MMDA) plans to enhance its No Contact Apprehension Policy (NCAP) by deploying AI-enabled CCTV cameras. Traffic Enforcement Group Director Atty. Victor Nuñez confirmed at a Senate hearing that this could lead to retrenchment of some traffic enforcers, limiting their roles primarily to traffic management.

- In March 2023, Bacolod City announced its plans to enhance its anti-crime efforts by acquiring 430 CCTV cameras, increasing its current count of 85. Mayor Alfredo Abelardo Benitez emphasized the need for comprehensive surveillance coverage in critical areas to improve crime response times and address unsolved cases, with implementation expected within the year.

Philippines CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines CCTV camera market on the basis of type?

- What is the breakup of the Philippines CCTV camera market on the basis of end user vertical?

- What is the breakup of the Philippines CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Philippines CCTV camera market?

- What are the key driving factors and challenges in the Philippines CCTV camera market?

- What is the structure of the Philippines CCTV camera market and who are the key players?

- What is the degree of competition in the Philippines CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)