Philippines Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Region, 2025-2033

Philippines Chocolate Market Overview:

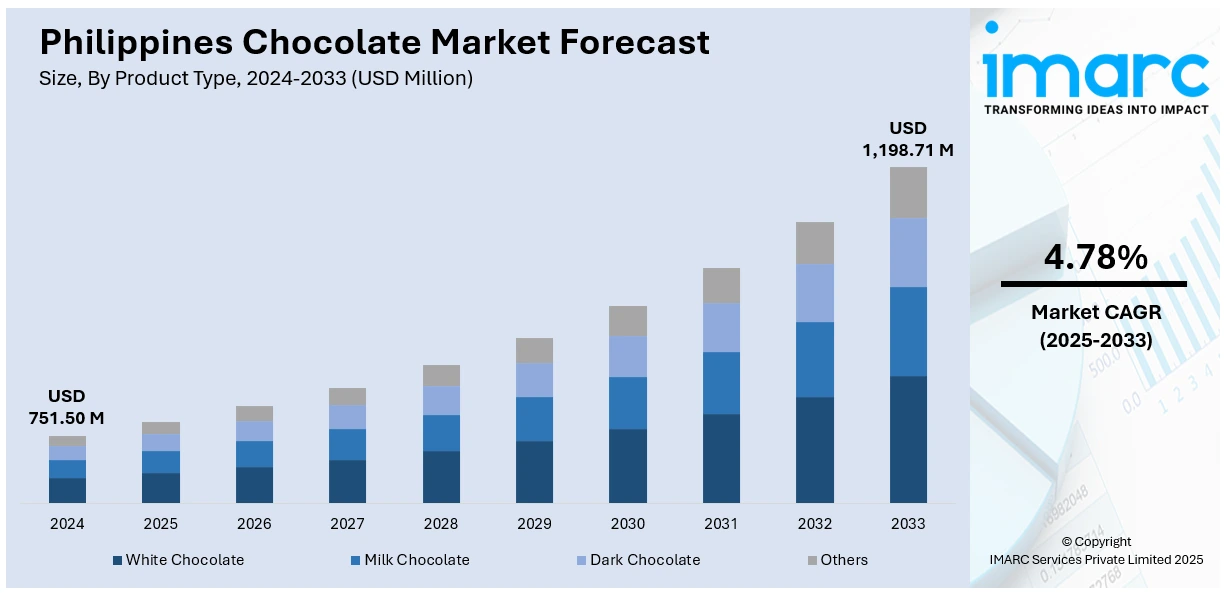

The Philippines chocolate market size reached USD 751.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,198.71 Million by 2033, exhibiting a growth rate (CAGR) of 4.78% during 2025-2033. The rise in demand for premium and artisanal chocolate products by consumers is impelling the market growth. Apart from this, the fast growth of e-commerce and digital retail platforms is supporting the growth of the market. Additionally, local cacao production in the country is consistently gaining strength, which is contributing to the expansion of the Philippines chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 751.50 Million |

| Market Forecast in 2033 | USD 1,198.71 Million |

| Market Growth Rate 2025-2033 | 4.78% |

Philippines Chocolate Market Trends:

Growing Consumer Demand for Premium and Artisanal Chocolate Products

The chocolate market in the Philippines is experiencing a rise in demand for premium and artisanal chocolate products by consumers. This preference is being fueled by increasing disposable incomes and heightened exposure to international trends in confectionery. Consumers are becoming more sophisticated and are actively looking for products that provide better taste, high cocoa content, and distinct flavorings. The craft chocolate movement is gaining traction locally, with Filipino brands pushing bean-to-bar processes and emphasizing cacao origin and quality of locally-sourced cacao. The trend not only increased consumer consciousness of sustainable and ethical practices but also developed a niche for single-origin and organic chocolate products. Moreover, the promotion of premium chocolates as luxury and health foods, particularly with dark chocolate content, is further appealing health-oriented consumers. Domestic players and international companies alike are therefore widening their premium products to tap into this fast-growing segment. In 2024, San Miguel Brewery Inc. (SMB), a leader in the alcoholic beverage market, offers fresh and thrilling experiences at every opportunity. Raising the standard with its finest beers, SMB draws on indulgence for creativity as it launches the latest entry in its brand lineup, San Miguel Chocolate Lager.

To get more information on this market, Request Sample

Growing E-commerce and Digital Retail Platforms

The Philippine chocolate market is being significantly impacted by the fast growth of e-commerce and digital retail platforms. Internet buying is becoming more common following the extensive adoption of smartphones, enhanced internet connectivity, and increased confidence in electronic payment systems. Consumers are increasingly turning to the convenience of online stores to view a greater selection of chocolate products, including imported and special products that might not be easily found in conventional outlets. E-commerce is allowing both domestic and foreign chocolate brands to reach wider markets and provide direct-to-consumer sales, frequently with customizable packaging and subscription options. Social media promotions and influencer marketing are also proving important in driving internet sales, especially among the younger consumer. With continually enhanced delivery logistics and cold-chain capabilities, online chocolate sales are being made more practical even for heat-sensitive chocolates. This digital transition is transforming consumer behavior and fueling expansion of the overall chocolate market. IMARC Group states that the Philippines e-commerce market is projected to attain USD 75.59 Billion by 2033.

Enhancing Domestic Cacao Production and Government Assistance

Local cacao production in the country is consistently gaining strength, which is contributing to the Philippines chocolate market growth. The government is also actively assisting the cacao sector through a number of initiatives that enhance yield quality, increase cultivation areas, and encourage local consumption of chocolate products. Initiatives like the Department of Agriculture's Cacao Industry Development Roadmap are boosting farmer training, quality seedling access, and post-harvest infrastructure. Such targeted support is helping to build a strong value chain from farm to finished product, making the country a competitive force in local and global markets. Increasing availability of good quality locally produced cacao is motivating small and medium-sized enterprises (SMEs) to develop bean-to-bar chocolates, which are increasingly popular among customers looking for authenticity and traceability. Thus, the growing interlinkage between agricultural development and the manufacturing sector of chocolates is playing a crucial role in offering a favorable market outlook.

Philippines Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, product form, application, pricing, and distribution.

Product Type Insights:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes white chocolate, milk chocolate, dark chocolate, and others.

Product Form Insights:

- Molded

- Countlines

- Others

A detailed breakup and analysis of the market based on the product form have also been provided in the report. This includes molded, countlines, and others.

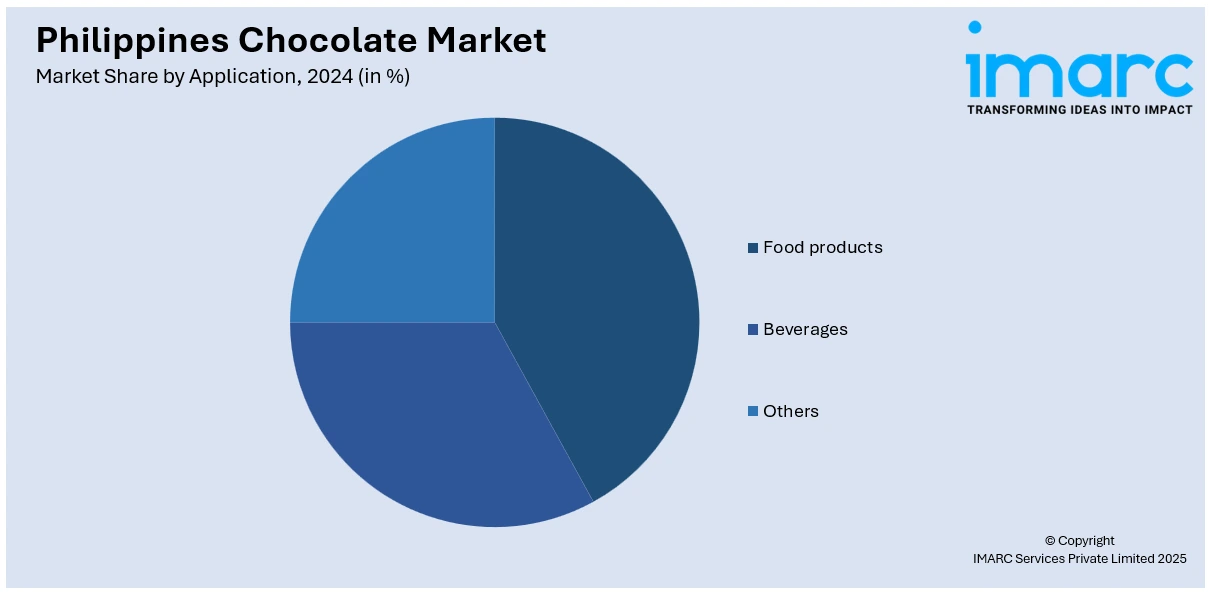

Application Insights:

- Food products

- Bakery products

- Sugar confectionary

- Desserts

- Others

- Beverages

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food products (bakery products, sugar confectionary, desserts, and others), beverages, and others.

Pricing Insights:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes everyday chocolate, premium chocolate, and seasonal chocolate.

Distribution Insights:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution have also been provided in the report. This includes direct sales (B2B), supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines chocolate market on the basis of product type?

- What is the breakup of the Philippines chocolate market on the basis of product form?

- What is the breakup of the Philippines chocolate market on the basis of application?

- What is the breakup of the Philippines chocolate market on the basis of pricing?

- What is the breakup of the Philippines chocolate market on the basis of distribution channel?

- What is the breakup of the Philippines chocolate market on the basis of region?

- What are the various stages in the value chain of the Philippines chocolate market?

- What are the key driving factors and challenges in the Philippines chocolate market?

- What is the structure of the Philippines chocolate market and who are the key players?

- What is the degree of competition in the Philippines chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)