Philippines Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Philippines Co-Working Office Space Market Overview:

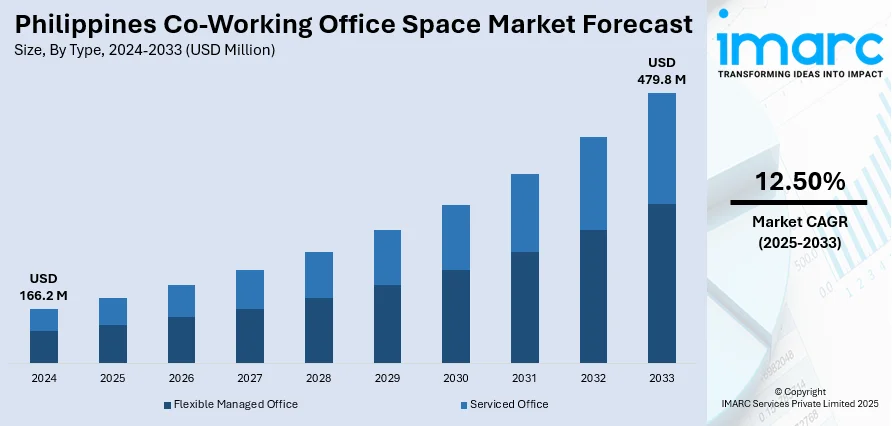

The Philippines co-working office space market size reached USD 166.2 Million in 2024. Looking forward, the market is expected to reach USD 479.8 Million by 2033, exhibiting a growth rate (CAGR) of 12.50% during 2025-2033. The market is expanding as enterprises, freelancers, and remote teams increasingly favor flexible, scalable workspace solutions. Driven by evolving work cultures, digital transformation, and urban development, co-working providers are adapting with innovative layouts, hybrid work support, and regional growth. Enhanced amenities and community-focused environments are also attracting diverse professionals. These shifts are redefining the industry and contributing to the growing Philippines co-working office space market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 166.2 Million |

|

Market Forecast in 2033

|

USD 479.8 Million |

| Market Growth Rate 2025-2033 | 12.50% |

Philippines Co-Working Office Space Market Trends:

Growth of Freelancers, Startups, and SMEs

The rise of freelancers, startups, and small to medium-sized enterprises (SMEs) is a key driver of co-working demand in the Philippines. Such groups appreciate flexibility, low expenses, and the ability to scale as key factors, all available in co-working spaces. It is usually hard for new businesses to afford traditional office leases because they require long leases and a significant initial payment. On the other hand, people in co-working spaces benefit from brief contracts, well-prepared offices, and a social setting that supports them in joining and cooperating with others. Due to this, startups and entrepreneurs can mainly concentrate on achieving growth instead of handling daily operations. The startup ecosystem, supported by government and private accelerators, continues to expand in key cities like Manila, Cebu, and Davao, further fueling demand for agile office solutions and reinforcing the role of co-working spaces in the country’s evolving business landscape.

To get more information on this market, Request Sample

Shift Toward Hybrid and Remote Work Models

The widespread adoption of hybrid and remote work models is significantly boosting the Philippines co-working office space market growth. Businesses across sectors are rethinking traditional workplace structures, prioritizing flexibility and employee autonomy. As full-time office presence becomes less critical, companies are turning to co-working spaces to provide satellite offices, collaboration zones, or meeting hubs that complement home-based work. These spaces offer professional settings with robust amenities, helping remote workers maintain productivity without the isolation of working from home. For employers, this model supports operational cost savings and workforce satisfaction. Co-working providers are responding with customized packages and tech-integrated services tailored for hybrid teams. This shift reflects a long-term change in workplace behavior, positioning co-working spaces as an essential part of the modern employment ecosystem.

Urban Development and Decentralization Trends

Urban expansion and the decentralization of business districts are also fueling the growth of co-working spaces across the Philippines. As traffic congestion and high rental costs in major cities like Metro Manila become more challenging, companies and professionals are seeking workspace solutions in secondary urban centers and emerging townships. This shift aligns with government-led infrastructure projects such as improved public transit and regional development programs, which are making suburban areas more accessible and economically viable. Co-working operators are seizing this opportunity by launching branches in cities like Clark, Iloilo, and Cagayan de Oro, meeting the demand for convenient, high-quality office environments closer to residential zones. These developments are broadening market reach and diversifying the user base, making co-working spaces an integral part of the country’s evolving urban and economic landscape.

Growth Drivers of Philippines Co-Working Office Space Market:

Rising Demand for Flexible Leasing Options

An increasing number of businesses are shifting away from traditional long-term leases in favor of short-term, flexible arrangements that reduce financial commitments and offer operational agility. Co-working spaces will support this need of the companies as they offer scalable solutions that enable companies to scale up or down according to project demand or market conditions. This model is especially attractive to startups, SMEs, and even big companies who might want satellite offices since the initial expenses are low on the spending in terms of structure and maintenance. The ability of co-working operators to offer options of different membership plans and flexible workspace ensures that they can attract clients across industries seeking low-risk, cost-efficient solutions to the traditional office arrangement, and thus, flexibility itself determines the feasibility of long-term demand in the Philippine co-working market.

Increasing Corporate Focus on Collaboration and Networking

Businesses are increasingly acknowledging the role of collaborative environments in stimulating creativity, fostering partnerships, and driving innovation. Co-working spaces naturally create ecosystems where professionals from diverse industries can interact, exchange ideas, and explore joint ventures. This setting benefits startups seeking mentorship, freelancers looking for partnerships, and established companies wanting fresh perspectives. The open and community-driven layout of co-working hubs promotes informal networking, while organized events, workshops, and industry meetups further strengthen professional connections. By positioning themselves as hubs of collaboration, operators appeal to organizations aiming to enhance team synergy, improve employee engagement, and access cross-sector expertise, thus making networking opportunities a central factor fueling the Philippines co-working office space market demand.

Expansion of Technology-Enabled Work Environments

The integration of advanced technology into co-working spaces is significantly enhancing their appeal to modern businesses. High-speed internet, cloud-based collaboration tools, and smart office systems are becoming standard features, enabling seamless workflows and efficient communication. Many operators are also incorporating video conferencing rooms, AI-driven booking systems, and cybersecurity measures to meet the needs of hybrid and remote teams. These innovations attract both domestic companies and foreign firms seeking reliable, tech-forward workspaces that can support diverse operational requirements. By offering technology-driven environments, co-working providers not only improve productivity but also position themselves as competitive alternatives to traditional offices, especially for businesses that prioritize flexibility, efficiency, and digital readiness in their workplace infrastructure.

Opportunities of Philippines Co-Working Office Space Market:

Development of Niche and Industry-Specific Spaces

Designing co-working spaces tailored to specific industries, such as creative sectors, healthcare professionals, or tech startups, offers a significant opportunity to capture targeted market segments. These niche environments can provide specialized facilities, tools, and layouts that directly address the operational needs of each sector. For example, creative spaces may include design studios, soundproof rooms, or photography areas, while tech-focused hubs could offer advanced IT infrastructure and innovation labs. Industry-specific communities also foster networking among like-minded professionals, enabling collaboration, partnerships, and shared growth opportunities. By delivering customized services and cultivating a strong professional identity, operators can command higher occupancy rates, build loyalty, and attract long-term members who value the relevance and exclusivity of these tailored environments over generic shared offices.

Partnership Models with Corporations and Institutions

Collaborating with corporations, educational institutions, or government agencies can significantly enhance the growth prospects of co-working operators in the Philippines. Such partnerships can secure a stable stream of tenants, as these organizations may lease spaces for teams, training programs, or collaborative projects. According to the Philippines co-working office space market analysis, joint initiatives allow resource sharing, such as technology access, funding support, or promotional campaigns, reducing operational costs while strengthening brand visibility. For example, partnering with a university could attract student entrepreneurs, while working with a corporate innovation hub may bring in established teams. These alliances can also improve credibility, enabling operators to position themselves as trusted, strategic partners rather than just service providers, ensuring more consistent occupancy rates and long-term business stability.

Integration of Wellness and Lifestyle Amenities

Incorporating wellness and lifestyle amenities into co-working spaces presents a compelling differentiator in an increasingly competitive market. Features such as on-site fitness centers, yoga or meditation rooms, relaxation lounges, and healthy dining options can significantly enhance the user experience while promoting physical and mental well-being. These additions address the growing emphasis on work-life balance and employee wellness among businesses and freelancers alike. By creating an environment that supports both productivity and personal health, operators can attract companies seeking to improve staff satisfaction and retention. Moreover, lifestyle-focused offerings help foster a vibrant, community-oriented atmosphere, encouraging longer memberships and positive word-of-mouth referrals. Ultimately, wellness-driven co-working models can command premium rates and secure a loyal client base that values holistic workplace experiences.

Challenges of Philippines Co-Working Office Space Market:

Market Saturation in Prime Locations

The rapid growth of co-working office space providers in the Philippines has led to increased saturation, particularly in central business districts (CBDs) such as Makati, Bonifacio Global City, and Ortigas. With numerous operators competing for the same clientele, maintaining high occupancy rates has become a significant challenge. Many spaces offer similar amenities, such as high-speed internet, meeting rooms, and communal areas, making it difficult to stand out without a distinctive value proposition. To remain competitive, providers must differentiate through niche offerings, unique community engagement initiatives, specialized services, or enhanced design and comfort. Without innovation, operators risk losing potential tenants to competitors offering more tailored, flexible, or cost-effective solutions in these highly contested business hubs.

Economic Uncertainty Affecting Occupancy

Economic fluctuations in the Philippines can directly influence the co-working sector’s performance, as businesses often reassess budgets and operational commitments during periods of instability. When uncertainty arises, due to factors like inflation, reduced investment activity, or global market pressures, companies may opt to downsize, delay expansion plans, or terminate co-working space leases altogether. This can lead to reduced occupancy rates and revenue volatility for operators. Additionally, startups and small enterprises, which form a large portion of the co-working market, may be more vulnerable to these financial pressures, impacting their ability to maintain membership. To counter this, operators need to offer flexible payment structures, short-term agreements, and value-added services that help retain tenants despite challenging economic conditions.

Infrastructure Limitations in Emerging Cities

While demand for co-working spaces is expanding beyond major metropolitan areas, infrastructure challenges in emerging cities pose a barrier to growth. Inconsistent internet connectivity, limited bandwidth, and unstable electricity supply can significantly hinder the service quality expected by tenants. These issues can disrupt daily operations, reduce productivity, and ultimately affect customer satisfaction and retention. Businesses relying on uninterrupted communication and access to cloud-based tools may hesitate to commit to co-working spaces in such locations. To address this, operators must invest in backup power solutions, multiple internet service providers, and infrastructure partnerships to ensure consistent service delivery. Without resolving these fundamental challenges, co-working providers risk losing potential market share in fast-developing yet infrastructure-limited regions.

Philippines Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

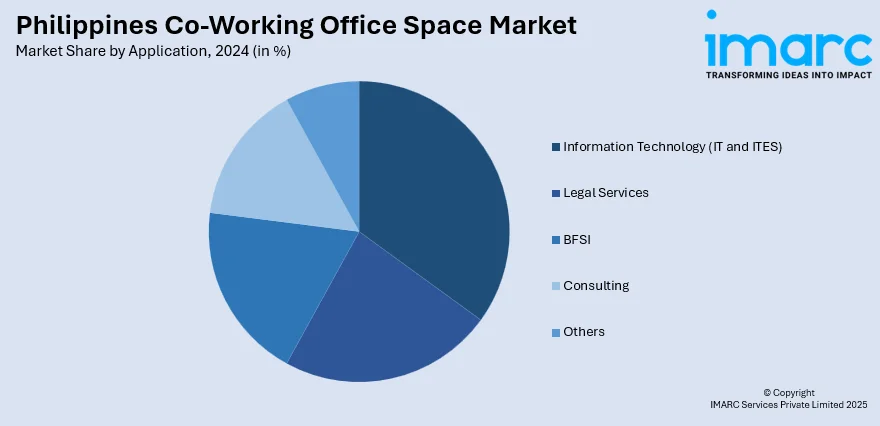

Application Insights:

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Co-Working Office Space Market News:

- In January 2025, Cebu Landmasters Inc. (CLI), a developer specializing in the Visayas and Mindanao, joined the coworking space market as businesses seek to expand their offerings in response to the growing need for flexible arrangements.

- In April 2024, Property developer Filinvest Land Inc. (FLI), led by Gotianun, collaborated with international co-working space provider KMC Community Inc. to meet the growing demand for co-working spaces in the Philippines.

Philippines Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines co-working office space market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The co-working office space market in the Philippines was valued at USD 166.2 Million in 2024.

The Philippines co-working office space market is projected to exhibit a CAGR of 12.50% during 2025-2033.

The Philippines co-working office space market is projected to reach a value of USD 479.8 Million by 2033.

The Philippines co-working office space market is witnessing trends such as increased adoption of hybrid work models, growth in demand from freelancers and startups, and the integration of advanced technologies. Operators are also focusing on wellness amenities, niche industry-specific spaces, and expanding into emerging cities to cater to diverse client needs.

The Philippines co-working office space market is driven by rising demand for flexible leasing, increasing corporate focus on collaboration, and the adoption of technology-enabled workspaces. Expansion into underserved areas and tailored offerings for specific industries further boost market growth and attract diverse professional segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)