Philippines Cold Brew Coffee Market Size, Share, Trends and Forecast by Type, Category, Distribution Channel, and Region, 2026-2034

Philippines Cold Brew Coffee Market Summary:

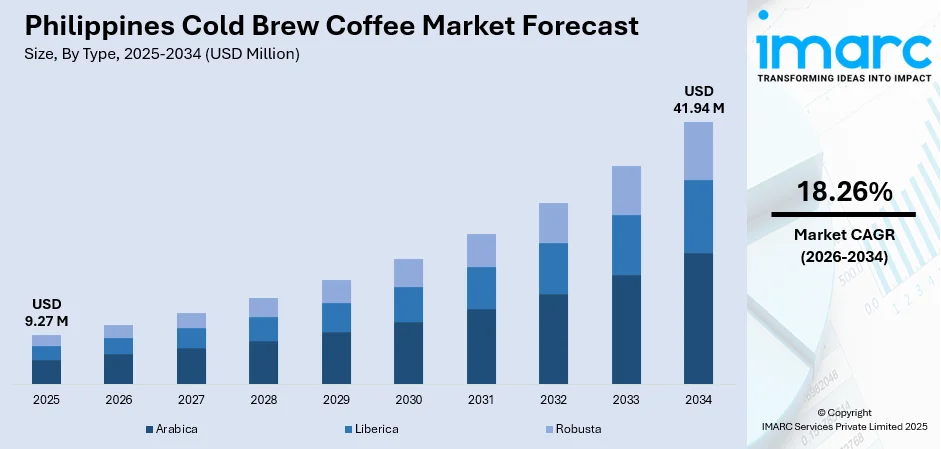

The Philippines cold brew coffee market size was valued at USD 9.27 Million in 2025 and is projected to reach USD 41.94 Million by 2034, growing at a compound annual growth rate of 18.26% from 2026-2034.

The Philippines cold brew coffee market is experiencing remarkable expansion driven by the increasing adoption of premium, low-acid beverages among health-conscious consumers. Rising urbanization and the growth of specialty coffee culture are reshaping consumption patterns across the archipelago. The proliferation of ready-to-drink formats and expanding retail distribution networks are enhancing product accessibility. Consumer preferences for smoother, naturally sweet coffee profiles are accelerating demand among younger demographics, particularly millennials and Generation Z. Additionally, the expansion of e-commerce platforms and modern retail outlets is broadening market reach, positioning the Philippines as an emerging hub for cold brew coffee innovation and consumption within the Southeast Asian region.

Key Takeaways and Insights:

-

By Type: Arabica dominates the market with a share of 66.82% in 2025, owing to its superior flavor profile characterized by smooth, naturally sweet notes that align perfectly with cold brew extraction methods. Growing consumer preference for premium, single-origin coffees and specialty blends is fueling sustained demand for Arabica-based cold brew products throughout the country.

-

By Category: Decaf leads the market with a share of 58.84% in 2025, driven by increasing health consciousness among Filipino consumers seeking caffeine-free alternatives without compromising on taste. The naturally lower acidity of cold brew coffee combined with decaffeination appeals to individuals with digestive sensitivities and those monitoring their caffeine intake.

-

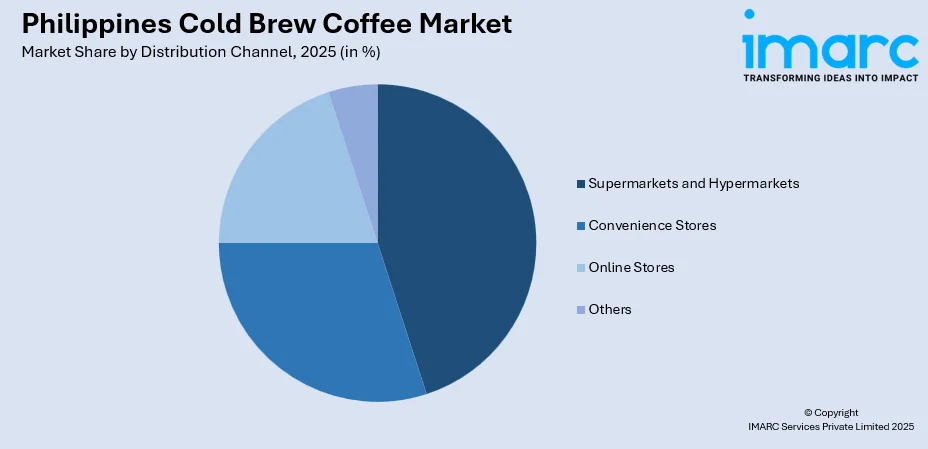

By Distribution Channel: Supermarkets and hypermarkets represent the biggest segment with a market share of 44.56% in 2025, reflecting the critical role of organized retail in cold brew coffee distribution. The extensive store networks of major chains provide wide product accessibility, while in-store promotions and refrigerated display sections enhance consumer visibility and impulse purchases.

-

By Region: Luzon is the largest region with 61% share in 2025, driven by the concentration of the Philippines' urban population in Metro Manila and surrounding provinces, higher disposable incomes enabling premium beverage purchases, and the dense network of retail outlets and specialty coffee establishments throughout the region.

-

Key Players: Leading manufacturers drive the Philippines cold brew coffee market by expanding product portfolios, introducing innovative flavor profiles, and strengthening nationwide distribution networks. Their investments in premium packaging, sustainable sourcing initiatives, and partnerships with retail chains boost consumer awareness, accelerate market penetration, and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Philippines cold brew coffee market is advancing as consumers increasingly embrace premium, health-oriented beverage alternatives that deliver smooth, low-acid flavor profiles. The market benefits from supportive government initiatives through the Philippine Coffee Industry Roadmap 2021-2025, which promotes value-added coffee products and local café startups through training programs, processing technology access, and branding support. Industry exhibitions and coffee festivals across the country continue to attract growing participation from roasters, retailers, and enthusiasts, reflecting the dynamic interest in the specialty coffee sector. Young professionals and millennials are driving adoption, seeking convenient ready-to-drink formats that fit their on-the-go lifestyles. Domestic roasters and international brands alike are expanding their cold brew offerings, while convenience stores and online platforms serve as key distribution channels. The emergence of sustainable sourcing practices and ethical production is resonating with socially conscious consumers, further strengthening long-term market prospects.

Philippines Cold Brew Coffee Market Trends:

Rising Adoption of Ready-to-Drink Cold Brew Formats

Consumer demand for convenient, ready-to-drink cold brew coffee is accelerating across the Philippines, driven primarily by younger urban demographics seeking premium beverages that fit their fast-paced lifestyles. Manufacturers are responding with innovative packaging solutions, including single-serve bottles and resealable containers that maintain freshness and portability. The trend reflects broader shifts toward premiumization in the beverage sector, with consumers willing to pay higher prices for quality and convenience. Modern retail channels including convenience stores and supermarkets are expanding their refrigerated beverage sections to accommodate growing cold brew product lines.

Expansion of Specialty Coffee Culture

The specialty coffee movement is gaining significant traction in the Philippines, with cold brew emerging as a centerpiece of this cultural shift. Urban cafés and specialty coffee shops are increasingly experimenting with brewing techniques, presenting distinctive cold brew variations that highlight quality and flavor innovation. Consumer education initiatives and tasting events are raising awareness about cold brew's unique characteristics, including its smoother taste profile and lower acidity compared to traditional hot-brewed coffee. This cultural evolution is transforming coffee from a mere caffeine source into an artisanal experience appreciated for its complexity.

Integration of Health and Wellness Positioning

Health-conscious consumers are increasingly drawn to cold brew coffee for its naturally lower acidity and smoother flavor profile that is gentler on the digestive system. Brands are strategically positioning their products around wellness benefits, emphasizing reduced stomach irritation and the availability of decaffeinated options for those monitoring caffeine intake. The trend aligns with broader consumer preferences for functional beverages that offer both enjoyment and health advantages. Marketing communications increasingly highlight the natural brewing process that preserves beneficial compounds while minimizing bitterness and harsh acidic notes.

Market Outlook 2026-2034:

The Philippines cold brew coffee market is positioned for sustained expansion as consumer preferences continue shifting toward premium, convenient beverage options. Urbanization trends, rising disposable incomes, and the growing café culture are expected to drive consistent demand growth throughout the forecast period. The increasing presence of specialty coffee shops in metropolitan areas and the expanding footprint of modern retail formats in provincial regions are creating new consumption opportunities. The market generated a revenue of USD 9.27 Million in 2025 and is projected to reach a revenue of USD 41.94 Million by 2034, growing at a compound annual growth rate of 18.26% from 2026-2034. Distribution channel expansion, product innovation in flavors and packaging formats, and increasing retail penetration beyond major urban centers will sustain positive market momentum. Additionally, growing awareness of cold brew's health benefits and smoother taste profile will continue attracting new consumer segments.

Philippines Cold Brew Coffee Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Arabica |

66.82% |

|

Category |

Decaf |

58.84% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

44.56% |

|

Region |

Luzon |

61% |

Type Insights:

- Arabica

- Liberica

- Robusta

Arabica dominates with a market share of 66.82% of the total Philippines cold brew coffee market in 2025.

Arabica coffee beans command the largest share of the Philippines cold brew coffee market due to their superior flavor characteristics that are ideally suited for cold extraction methods. The smooth, naturally sweet profile with subtle fruity and floral notes creates a refined drinking experience that resonates with discerning consumers seeking premium beverage options. Cold brewing further enhances Arabica's inherent qualities by reducing bitterness and acidity while amplifying the complex flavor compounds that distinguish this variety from other coffee types.

The Philippines has emerged as a significant producer of specialty-grade Arabica beans, with high-altitude regions in Benguet, Bukidnon, and Mount Apo yielding exceptional quality crops. At the Philippine Coffee Quality Competition 2024, 38 out of 50 Arabica entries from Davao Region were classified as specialty coffee, demonstrating the country's growing capacity to produce world-class beans. This domestic production capability supports the cold brew segment by providing access to locally sourced, traceable ingredients that appeal to consumers valuing authenticity and supporting Filipino farmers.

Category Insights:

- Traditional

- Decaf

Decaf leads with a share of 58.84% of the total Philippines cold brew coffee market in 2025.

Decaffeinated cold brew coffee has emerged as the dominant category in the Philippines market, driven by increasing health consciousness among consumers who desire the rich flavor experience of coffee without the stimulating effects of caffeine. The naturally lower acidity inherent in cold brew extraction makes decaf variants particularly appealing to individuals with digestive sensitivities or those seeking to limit caffeine consumption due to medical advice or lifestyle choices. This segment benefits from the growing wellness trend that prioritizes balanced, health-supportive beverage options. The smooth, mellow taste profile of decaf cold brew appeals to consumers who enjoy evening coffee consumption without sleep disruption concerns.

The Philippines decaf coffee market has witnessed a significant rise in health awareness, with consumers actively seeking healthier beverage options according to industry assessments. Specialty decaf coffee options are becoming more widely available as manufacturers recognize the commercial potential of this health-oriented segment. The expansion of decaf cold brew offerings across retail channels reflects consumer demand for products that deliver satisfying taste experiences while aligning with personal wellness goals and caffeine management strategies. Cafés and restaurants are increasingly incorporating decaf cold brew into their menus to accommodate diverse customer preferences.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 44.56% share of the total Philippines cold brew coffee market in 2025.

Supermarkets and hypermarkets serve as the primary distribution channel for cold brew coffee in the Philippines due to their extensive store networks, refrigerated storage capabilities, and established consumer traffic patterns. These retail formats provide optimal visibility for cold brew products through dedicated chilled beverage sections and strategic shelf placements that encourage impulse purchases. The channel benefits from one-stop shopping convenience, allowing consumers to incorporate cold brew purchases into their regular grocery routines. Promotional activities, loyalty programs, and seasonal discounts offered by these retailers further stimulate consumer trial and repeat purchases of cold brew products.

Major retail chains are actively expanding their presence across provincial areas. In 2024, SM Markets announced plans to open 10 to 15 new provincial stores to provide essential products including premium beverages to underserved communities. This retail expansion directly supports cold brew coffee market growth by extending distribution reach into emerging consumer markets beyond Metro Manila. The increasing availability of refrigerated display units and improved cold chain logistics across these expanding retail networks ensures product freshness and quality throughout the distribution process.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon represents the leading segment with a 61% share of the total Philippines cold brew coffee market in 2025.

Luzon dominates the Philippines cold brew coffee market primarily due to its concentration of the country's urban population, economic activity, and retail infrastructure. Metro Manila serves as the epicenter of the specialty coffee movement, hosting numerous cafés, coffee shops, and premium retail outlets that drive cold brew consumption and awareness. The region's higher average disposable incomes enable consumers to afford premium beverage products, while the dense network of supermarkets, hypermarkets, and convenience stores ensures widespread product accessibility throughout the island. The presence of major business districts, universities, and commercial centers creates a substantial consumer base of young professionals and students who gravitate toward trendy, convenient beverage options.

Beyond Metro Manila, rapidly urbanizing provinces in Luzon including Cavite, Laguna, and Bulacan are experiencing growing demand for premium coffee products as retail infrastructure expands into these areas. The region also benefits from well-developed cold chain logistics and transportation networks that facilitate efficient distribution of refrigerated cold brew products. Additionally, the concentration of food service establishments, hotels, and office complexes in Luzon creates significant institutional demand channels that complement retail sales.

Market Dynamics:

Growth Drivers:

Why is the Philippines Cold Brew Coffee Market Growing?

Increasing Health Consciousness and Demand for Low-Acid Beverages

Health-conscious consumers are increasingly gravitating toward cold brew coffee due to its naturally lower acidity compared to traditional hot-brewed alternatives. The cold extraction process produces a smoother, less bitter beverage that is gentler on the digestive system, making it particularly appealing to individuals with acid reflux, gastric sensitivities, or those seeking to minimize stomach irritation from their daily coffee consumption. This health-oriented positioning aligns with broader wellness trends driving consumer choices across the food and beverage sector. The availability of decaffeinated options further expands the addressable market to include consumers monitoring caffeine intake for medical or lifestyle reasons, creating additional growth opportunities within the health-conscious demographic segment.

Government Support and Industry Development Initiatives

The Philippine government is actively supporting the coffee industry through comprehensive policy frameworks and investment programs designed to boost domestic production and quality. The Philippine Coffee Industry Roadmap 2021-2025, implemented by the Department of Agriculture and Department of Trade and Industry, promotes value-added coffee products including cold brew through farmer training, processing technology access, and branding support for specialty beverages. The Department of Agriculture has announced significant investment plans to boost Philippine coffee production, aiming to reduce import dependency and raise coffee self-sufficiency levels substantially. These initiatives strengthen the domestic supply chain, improve bean quality, and support the growing cold brew segment with locally sourced ingredients.

Expansion of Retail Infrastructure and Distribution Networks

The rapid expansion of modern retail formats across the Philippines is significantly enhancing cold brew coffee accessibility and market penetration. Supermarket chains, hypermarkets, and convenience stores are increasing their footprint in provincial areas, bringing premium beverage products to previously underserved consumer markets. Supermarkets and hypermarkets collectively represent a substantial portion of Philippines retail market activity, supported by extensive outlet networks from major retailers including Robinsons Supermarket and SM Markets. These retail channels provide essential refrigerated storage and display infrastructure required for cold brew products while leveraging promotional activities and loyalty programs to drive consumer trial and repeat purchases.

Market Restraints:

What Challenges the Philippines Cold Brew Coffee Market is Facing?

Limited Domestic Coffee Production Capacity

The Philippines faces significant challenges in meeting domestic coffee demand due to limited local production capacity that currently supplies only a small fraction of total consumption requirements. This production shortfall necessitates substantial coffee imports, exposing manufacturers to global price volatility and supply chain vulnerabilities that can impact cold brew product costs and availability.

Higher Product Pricing Compared to Conventional Coffee

Cold brew coffee products typically command premium price points compared to traditional hot-brewed alternatives and instant coffee options due to longer brewing times, specialized equipment requirements, and packaging needs for ready-to-drink formats. This price differential may limit adoption among price-sensitive consumer segments, particularly in provincial markets where purchasing power remains lower than urban centers.

Cold Chain Infrastructure Limitations

The distribution of ready-to-drink cold brew coffee requires robust cold chain infrastructure to maintain product quality and freshness throughout the supply chain. Limited refrigerated storage and transportation capabilities in rural and provincial areas may restrict market expansion beyond major urban centers, creating distribution challenges for manufacturers that are seeking nationwide coverage.

Competitive Landscape:

The Philippines cold brew coffee market features an increasingly competitive landscape as manufacturers expand their presence across distribution channels. Companies are focusing on product differentiation through unique flavor profiles, premium packaging formats, and health-oriented positioning to capture consumer attention. Competition is driven by investments in marketing initiatives, retail partnerships, and local sourcing arrangements that strengthen brand positioning and supply chain resilience. Strategic collaborations with café chains, specialty coffee shops, and retail outlets are fostering innovation and accelerating product availability. Market players are continually refining their strategies to strengthen market share and capitalize on the growing shift toward premium, convenient cold brew coffee options among Filipino consumers.

Recent Developments:

-

In October 2025, Nestlé Philippines announced plans to open additional coffee buying stations in Mindanao, with new facilities in Tacurong City, Sultan Kudarat and Bukidnon provinces. This expansion complements the company's existing buying station in Cagayan de Oro and supports the Project Coffee++ capacity-building initiative that has equipped 3,000 coffee farmers with advanced agricultural skills and market access since 2018.

Philippines Cold Brew Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Arabica, Liberica, Robusta |

| Categories Covered | Traditional, Decaf |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines cold brew coffee market size was valued at USD 9.27 Million in 2025.

The Philippines cold brew coffee market is expected to grow at a compound annual growth rate of 18.26% from 2026-2034 to reach USD 41.94 Million by 2034.

Arabica dominates the market with a share of 66.82%, driven by its superior flavor profile characterized by smooth, naturally sweet notes that are ideally suited for cold extraction methods and appeal to consumers seeking premium coffee experiences.

Key factors driving the Philippines cold brew coffee market include increasing health consciousness among consumers seeking low-acid beverages, government support through the Philippine Coffee Industry Roadmap, expanding retail infrastructure, growing specialty coffee culture, and rising demand for convenient ready-to-drink formats among younger demographics.

Major challenges include limited domestic coffee production capacity requiring substantial imports, higher product pricing compared to conventional coffee alternatives, cold chain infrastructure limitations in provincial areas, consumer awareness gaps outside urban centers, and competition from established instant coffee brands.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)