Philippines Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Philippines Commercial Insurance Market Overview:

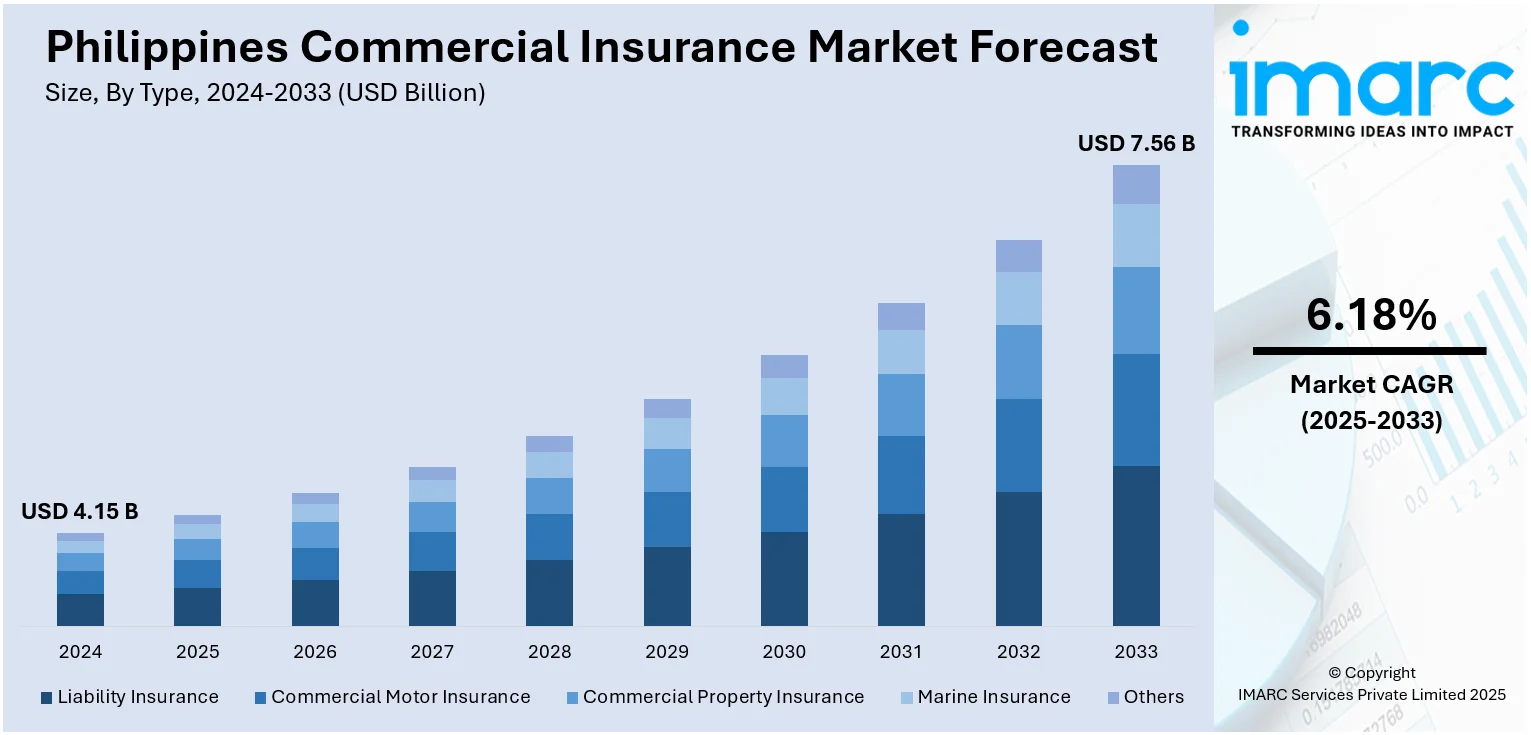

The Philippines commercial insurance market size reached USD 4.15 Billion in 2024. The market is projected to reach USD 7.56 Billion by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is expanding due to increasing demand for customized coverage and digital insurance solutions. Growing sectors like real estate and construction, along with a focus on risk management, are boosting demand. These factors continue to support the Philippines commercial insurance market share in various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.15 Billion |

| Market Forecast in 2033 | USD 7.56 Billion |

| Market Growth Rate 2025-2033 | 6.18% |

Philippines Commercial Insurance Market Trends:

Increased Demand for Customized Insurance Solutions

The Philippine commercial insurance industry is witnessing the need for tailor-made coverage as more companies appreciate the need to secure themselves against a wide range of perils. Growth in the market is greatly driven by the increasing number of small and medium-sized businesses (SMEs) seeking inclusive insurance packages. These businesses, long overlooked when it comes to coverage, are now going out of their way to search for policies that address special needs, such as property, liability, and medical insurance. The rapid digital transformation is also playing a leading role in this movement, making it easier to access and manage policies through the internet. Apart from SMEs, large corporations are increasingly interested in risk management products to safeguard their assets against natural calamities, burglary, and disruption of business. Expansion of businesses like real estate, construction, and technology further accelerates the demand for customized commercial insurance products. The Philippines commercial insurance industry is being reshaped through technological innovations, providing new opportunities for insurers and policyholders. These advancements have largely driven the Philippines commercial insurance market growth, as companies see the value of having strong coverages to hedge financial risks. The changing environment is indicative of a more proactive mindset towards securing business futures, especially in a scenario characterized by higher uncertainty and market volatility.

To get more information on this market, Request Sample

Technology Innovations Transforming Insurance Scene

Application of technology like artificial intelligence (AI), machine learning (ML), and data analytics is increasing risk management and claims handling. These technologies allow insurers to offer bespoke insurance products based on sophisticated customer data, helping companies better gauge their specific needs and select the most appropriate cover. In addition, increased use of mobile platforms and digital tools has made it easier for businesses of all sizes to access insurance products. Insurers are also embracing automation in policy issuance, renewals, and claims processing, and this implies quicker response and improved customer satisfaction. Another significant trend is the entry of InsurTech start-ups, where such players leverage the latest technology to streamline operations and provide more customer-centric services. Furthermore, advancements in cloud computing and blockchain are enhancing data security and transparency, fostering confidence between insurers and policyholders. These new technologies are making insurance more efficient and transparent, making it more appealing and utilizable for commercial insurance. These trends will continue to influence the Philippine commercial insurance market, even as they motivate insurers and firms alike to embrace more innovative approaches

Philippines Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

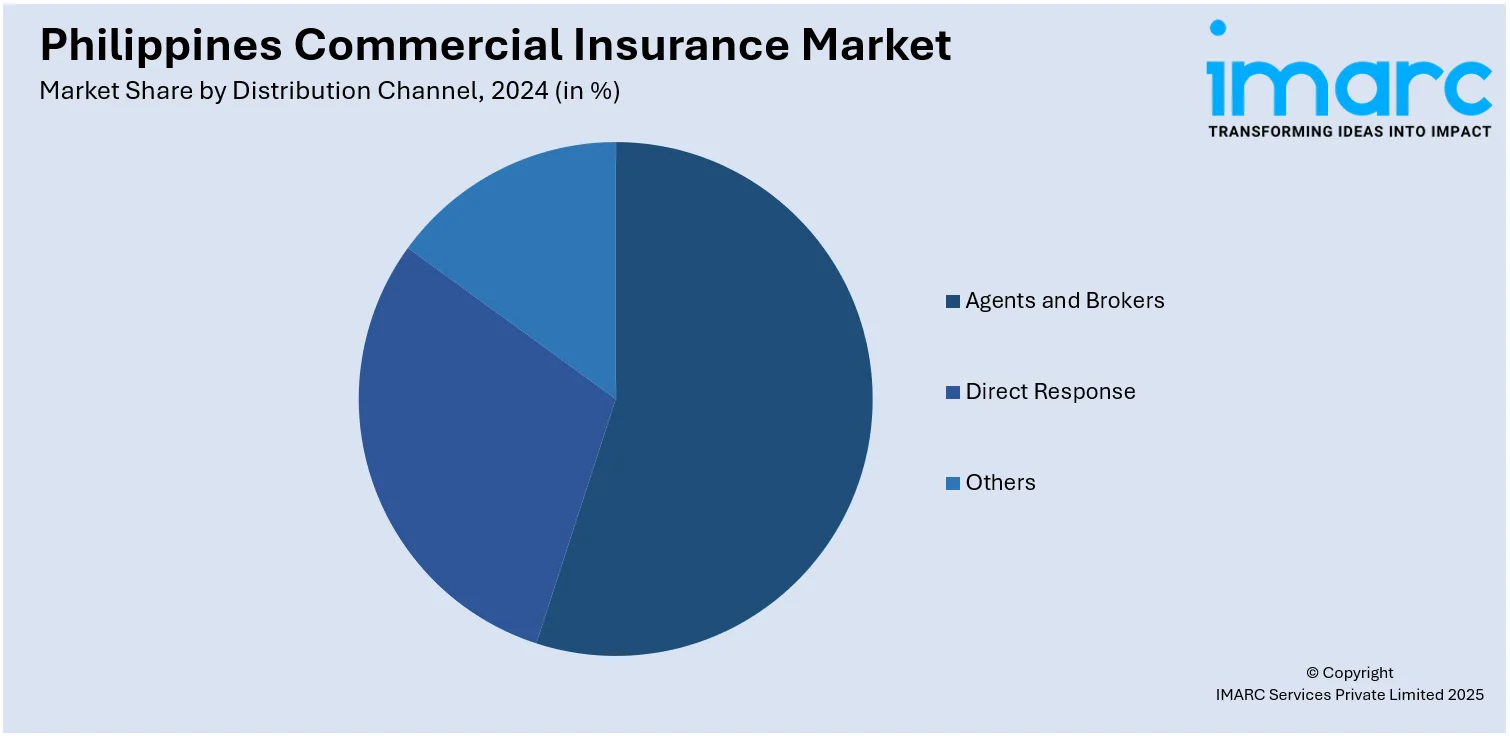

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Commercial Insurance Market News:

- April 2025: FWD Philippines launched the "Set for Life Plus" plan, combining life protection with investment growth. The milestone-based plan, offering start-up bonuses and premium extensions, addressed shifting consumer needs. This development impacted the Commercial Insurance market by driving demand for flexible, long-term policies tailored to evolving financial behaviors.

- March 2025: Pru Life UK launched PRUTerm Lindungi, a Shari’ah-compliant life insurance plan in the Philippines. The product, offering low-cost coverage with no interest or gambling, catered to underserved groups, including students and small business owners. This move expanded the commercial insurance market by addressing diverse financial protection needs.

Philippines Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines commercial insurance market on the basis of type?

- What is the breakup of the Philippines commercial insurance market on the basis of enterprise size?

- What is the breakup of the Philippines commercial insurance market on the basis of distribution channel?

- What is the breakup of the Philippines commercial insurance market on the basis of industry vertical?

- What is the breakup of the Philippines commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Philippines commercial insurance market?

- What are the key driving factors and challenges in the Philippines commercial insurance market?

- What is the structure of the Philippines commercial insurance market and who are the key players?

- What is the degree of competition in the Philippines commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)