Philippines Community Cloud Market Size, Share, Trends and Forecast by Component, Application, Industry Vertical, and Region, 2025-2033

Philippines Community Cloud Market Overview:

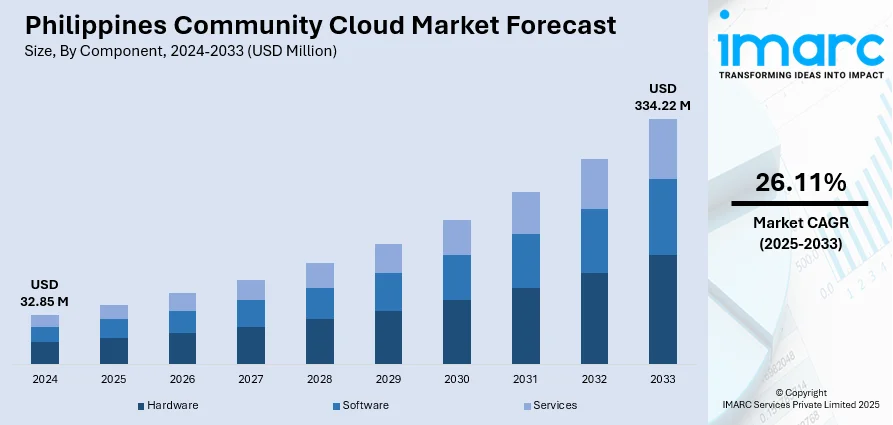

The Philippines community cloud market size reached USD 32.85 Million in 2024. The market is projected to reach USD 334.22 Million by 2033, exhibiting a growth rate (CAGR) of 26.11% during 2025-2033. The market is propelled by the expanding adoption of cloud-based technologies across businesses looking to optimize operational efficiency and minimize costs. In addition to this, the escalating demand for scalable and secure infrastructure, together with government programs, is accelerating digital transformation. Moreover, the growing need for data compliance and data privacy regulations and developments in networking technologies immensely augment the Philippines community cloud market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 32.85 Million |

| Market Forecast in 2033 | USD 334.22 Million |

| Market Growth Rate 2025-2033 | 26.11% |

Key Trends of Philippines Community Cloud Market:

Increasing Adoption of Cloud-based Solutions by SMEs

The Philippines has seen a strong increase in the use of cloud-based services, particularly in Micro, small, and medium-sized enterprises (MSMEs) and small and medium-sized enterprises (SMEs). With MSMEs accounting for 99.5% of all registered businesses in the Philippines, adopting digital transformation is important in order to stay competitive in an evolving economic landscape. Furthermore, with increased government assistance towards digital programs and expanding emphasis on developing digital infrastructure, MSMEs are finding cloud services as a vital component of business strategy. Furthermore, as companies seek efficient yet scalable solutions, cloud services provide a cost-effective solution against conventional IT infrastructure. For SMEs, community cloud platforms provide shared resources and decrease the complexity of sustaining in-house systems. With cloud applications providing everything from customer relationship management (CRM) to enterprise resource planning (ERP), SMEs are taking advantage of such applications to streamline processes and improve productivity. Additionally, the scalability of cloud platforms indicates that SMEs can grow without having to constantly increase infrastructure costs, making payments only when they utilize the resources. Increased availability of low-cost cloud solutions and the expanding internet penetration further drive this trend. SMEs are giving growing importance to digitalization, seeking to advance customers' experiences and compete in a rapidly changing market.

To get more information of this market, Request Sample

Government Initiatives and Digital Transformation Policies

The government plays an essential role in propelling the Philippines community cloud market growth through different programs aimed at advancing digital transformation in various industries. Among the most important initiatives is the National ICT Policy, which focuses on building digital infrastructure and encouraging cloud computing as a strategic means for business entities and government institutions. According to industry reports, the Philippines improved significantly in the United Nations E-Government Development Index by moving from rank 89 as of 2022 to rank 73 as of 2024. This improvement is largely due to the country's embracing of centralized cloud solutions and measures that eliminate inefficiencies. Additionally, government-sponsored initiatives that aim to increase data security, enhance connectivity, and drive the transition to e-government services have promoted the use of cloud technologies. The government has also recognized the potential of community cloud platforms for providing cost-effective, secure, and scalable public service solutions. In promoting cloud adoption, the government hopes to achieve an innovation-driven ecosystem that drives growth, economic development, and better services. Apart from this, the growing emphasis on cloud infrastructure and digital literacy in education and local government initiatives further drives the expansion of the market, making cloud technology a pillar of national development.

Growth Drivers of the Philippines Community Cloud Market:

Expansion of Industry-Specific Cloud Applications

The Philippines is witnessing a surge in demand for community cloud solutions tailored to the unique needs of specific industries such as healthcare, education, and financial services. These industries have their necessities to platforms that are involved in strict compliance needs, manifold security, as well as operational workflows that are exceptionally suitable to their surroundings. The community clouds deploy tailored structures, data processing, and security processing congruent with these industries, which helps the organizations to match the regulatory and performance standards. For instance, in healthcare, there are strict privacy laws to abide by patient information, whereas in financial services, transaction security and audit values are central. This ability to provide industry-focused capabilities is making community clouds an attractive choice for organizations seeking scalable, compliant, and collaborative digital infrastructure, which is further driving the Philippines community cloud market demand.

Rising Need for Cost-Effective IT Infrastructure

Businesses in the Philippines are increasingly turning to community cloud models to reduce capital expenditure on IT infrastructure while optimizing operational efficiency. Unlike traditional on-premises systems, community clouds allow multiple organizations with shared objectives to pool resources, lowering costs associated with hardware procurement, maintenance, and upgrades. This model enables scalability, allowing businesses to expand capacity as needed without heavy upfront investments. Additionally, shared infrastructure fosters collaboration between organizations within the same sector, improving interoperability and knowledge sharing. By streamlining processes and minimizing redundancy, community clouds offer a more sustainable, flexible, and budget-friendly alternative. This cost efficiency is especially appealing to mid-sized enterprises and organizations seeking to modernize their IT systems without straining financial resources.

Emphasis on Data Sovereignty and Local Compliance

Growing regulatory scrutiny and the enforcement of strict data protection laws in the Philippines are driving organizations toward locally hosted community cloud solutions. These platforms ensure that sensitive information, such as personal data or proprietary business records, remains within national borders, addressing both legal and security concerns. For industries handling critical or confidential information, such as healthcare, finance, and government, data sovereignty is a key consideration in selecting cloud service providers. Local hosting also offers advantages in terms of latency, customer support availability, and alignment with domestic compliance frameworks. By enabling businesses to maintain full control over their data while adhering to evolving regulatory requirements, community cloud providers with local infrastructure are gaining a competitive edge in the market.

Opportunities of the Philippines Community Cloud Market:

Growth in Disaster Recovery and Business Continuity Solutions

Given the Philippines’ vulnerability to typhoons, earthquakes, and other natural disasters, businesses are increasingly prioritizing disaster recovery and business continuity. This creates a strong opportunity for community cloud providers to deliver secure, scalable, and resilient backup and recovery solutions. By leveraging shared infrastructure, organizations can safeguard critical data, quickly restore operations after disruptions, and reduce downtime costs. Community cloud models also allow for geographically distributed storage, minimizing the risk of data loss from localized disasters. For industries such as banking, healthcare, and government, ensuring uninterrupted service is essential for both compliance and customer trust. Providers that offer robust disaster recovery frameworks combined with proactive monitoring and rapid response capabilities stand to capture significant demand in this environment.

Integration with Emerging Technologies

Community cloud platforms in the Philippines are increasingly positioned to integrate advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics. This integration allows organizations to unlock new capabilities, ranging from predictive analytics in manufacturing to real-time monitoring in healthcare. By combining shared cloud infrastructure with emerging technologies, businesses can streamline workflows, enhance decision-making, and deliver more personalized services to customers. For example, IoT-enabled sensors in agriculture can transmit data to a community cloud for analysis, enabling smarter farming practices. According to the Philippines community cloud market analysis, this convergence of cloud and innovation not only boosts efficiency but also drives industry-specific transformation. Providers that facilitate seamless integration and scalability will be well-placed to attract organizations seeking future-ready digital solutions.

Expansion into Underserved Rural Areas

Expanding reliable internet access in the Philippines is opening new opportunities for community cloud providers to serve rural and underserved regions. As connectivity infrastructure improves, these areas can benefit from shared cloud solutions that enable cost-effective access to advanced IT resources. For small businesses, cooperatives, and educational institutions in remote communities, community clouds can facilitate collaboration, data storage, and access to digital tools without heavy infrastructure investments. This expansion also supports national digital inclusion goals by bridging the urban–rural technology gap. Providers offering localized support, language-friendly interfaces, and tailored solutions for specific rural needs can differentiate themselves. By tapping into these emerging markets, community cloud operators can both foster social impact and drive long-term business growth.

Challenges of the Philippines Community Cloud Market:

Limited Cloud Expertise and Skills Gap

The adoption of community cloud solutions in the Philippines is challenged by a shortage of IT professionals with specialized cloud expertise. Many organizations lack the internal skills necessary to plan, deploy, and manage cloud environments effectively, leading to inefficient usage or security vulnerabilities. These skills gap also extends to advanced areas such as cloud security, compliance management, and optimization for industry-specific needs. Without adequate training, businesses may struggle to leverage the full benefits of community cloud systems, resulting in slower adoption rates. Service providers that offer training programs, technical support, and managed services can help bridge this gap, but the broader issue requires a focus on workforce development to meet growing market demands.

Concerns Over Inter-Organizational Data Security

While community clouds enable cost-sharing and collaboration, their shared infrastructure can raise significant concerns about data privacy and security among participating organizations. The possibility of unauthorized access, accidental exposure, or deliberate misuse of sensitive information between member entities can deter adoption. This challenge is particularly critical for sectors handling confidential data, such as healthcare, finance, or government services. Without strong encryption, access control measures, and clear governance policies, trust between participating organizations can erode. Cloud providers must implement advanced security protocols, conduct regular audits, and ensure transparent operational practices to alleviate these concerns. Building confidence in the safety of shared environments is essential for fostering broader acceptance of community cloud solutions.

Infrastructure Limitations in Remote Regions

Despite improvements in national connectivity, certain rural and remote areas in the Philippines still face inconsistent internet speeds and unstable network access. These limitations can severely impact the performance and reliability of community cloud services, which depend on stable connections for real-time collaboration, data synchronization, and application delivery. Organizations operating in these areas may experience latency issues, downtime, or restricted access to cloud-based tools, reducing the overall appeal of community cloud adoption. This challenge underscores the need for continued investment in telecom infrastructure, including fiber-optic expansion and satellite internet solutions. Providers offering offline-capable features, optimized bandwidth usage, or hybrid deployment models can help mitigate these barriers while supporting long-term market growth in underserved regions.

Philippines Community Cloud Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and industry vertical.

Component Insights:

- Hardware

- Server

- Networking

- Storage

- Others

- Software

- Enterprise Application Software

- Collaboration Tools Software

- Dashboards Business Intelligence Software

- Services

- Training Services

- Maintenance and Support

- Regulation and Compliance

- Consulting

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (server, networking, storage, and others), software (enterprise application software, collaboration tools software, and dashboards business intelligence software), and services (training services, maintenance and support, regulation and compliance, and consulting).

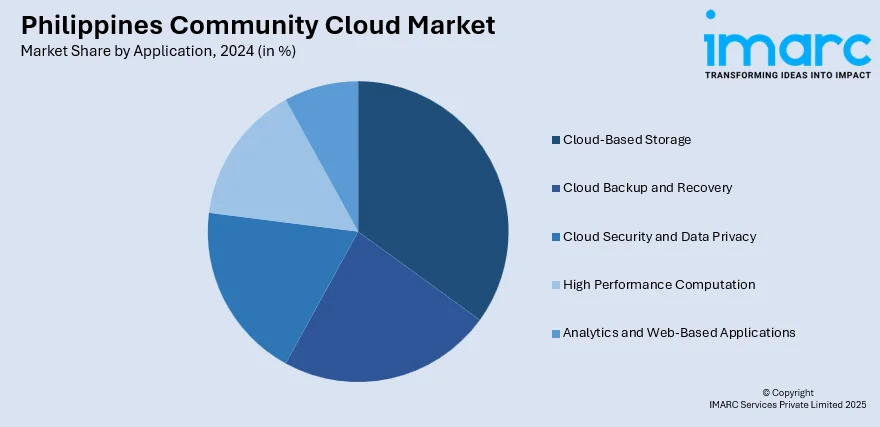

Application Insights:

- Cloud-Based Storage

- Cloud Backup and Recovery

- Cloud Security and Data Privacy

- High Performance Computation

- Analytics and Web-Based Applications

The report has provided a detailed breakup and analysis of the market based on the application. This includes cloud-based storage, cloud backup and recovery, cloud security and data privacy, high performance computation, and analytics and web-based applications.

Industry Vertical Insights:

- BFSI

- Gaming

- Government

- Healthcare

- Education

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, gaming, government, healthcare, education, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Community Cloud Market News:

- On December 3, 2024, Huawei launched its Philippines Region, introducing the country’s first local public cloud with three availability zones (3AZ). This initiative aims to accelerate digital transformation across key sectors such as finance, government, and retail, supported by over 100 cloud services and AI-native innovations like the Pangu models. Huawei Cloud Philippines has experienced a 22-fold growth since its inception, now serving over 300 local customers and emphasizing sustainability and local talent development.

Philippines Community Cloud Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Cloud-Based Storage, Cloud Backup and Recovery, Cloud Security and Data Privacy, High Performance Computation, Analytics and Web-Based Applications |

| Industry Verticals Covered | BFSI, Gaming, Government, Healthcare, Education, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines community cloud market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines community cloud market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines community cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The community cloud market in the Philippines was valued at USD 32.85 Million in 2024.

The Philippines community cloud market is projected to exhibit a CAGR of 26.11% during 2025-2033.

The Philippines community cloud market is projected to reach a value of USD 334.22 Million by 2033.

Key trends in the Philippines community cloud market include rising adoption of industry-specific cloud platforms, integration with emerging technologies like AI and IoT, and growing focus on data sovereignty. Expansion into rural areas, emphasis on disaster recovery solutions, and enhanced security measures are also shaping the market’s evolving landscape.

The Philippines community cloud market is driven by expanding industry-specific applications, rising demand for cost-effective IT infrastructure, and increasing emphasis on data sovereignty. Growing needs for secure, compliant, and collaborative platforms across sectors further fuel adoption, supporting the country’s shift toward advanced digital infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)