Philippines Computer Vision Market Size, Share, Trends and Forecast by Component, Product Type, Application, Vertical, and Region, 2026-2034

Philippines Computer Vision Market Summary:

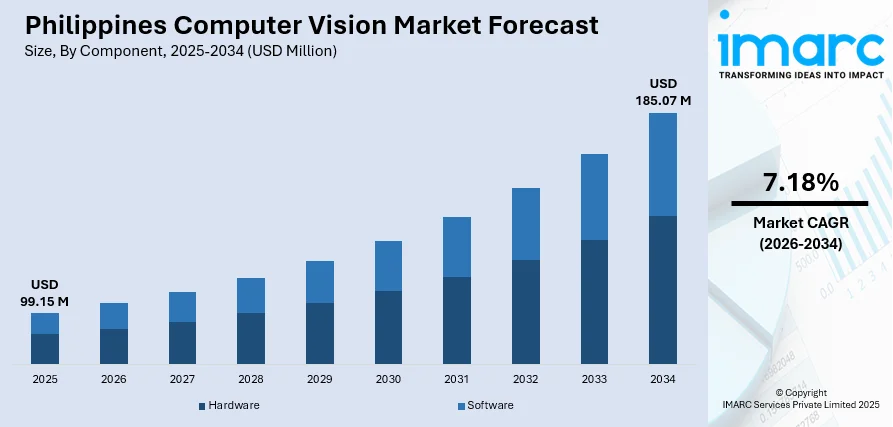

The Philippines computer vision market size was valued at USD 99.15 Million in 2025 and is projected to reach USD 185.07 Million by 2034, growing at a compound annual growth rate of 7.18% from 2026-2034.

The Philippines computer vision market is experiencing robust expansion driven by digital transformation initiatives across manufacturing, retail, and security sectors. Growing investments in artificial intelligence capabilities, smart surveillance infrastructure, and automated quality control systems are reshaping industrial operations. The convergence of cloud computing adoption, increasing smartphone penetration, and government-backed smart city programs accelerates market development throughout the archipelago.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 72.72% in 2025, driven by substantial investments in high-resolution cameras, specialized imaging sensors, and processing units essential for deploying vision-based systems across manufacturing facilities and security installations nationwide.

-

By Product Type: PC-based solutions lead the market with a share of 62.94% in 2025, owing to their superior processing capabilities, flexibility in handling complex algorithms, and seamless integration with existing enterprise infrastructure for demanding industrial applications.

-

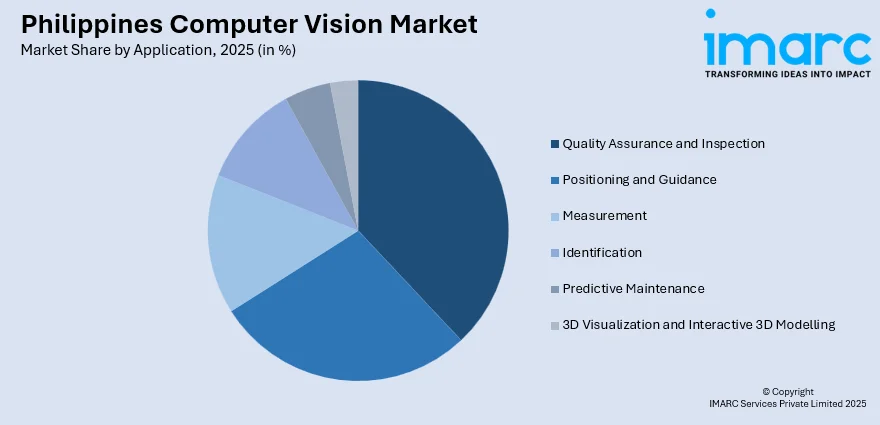

By Application: Quality assurance and inspection represents the largest segment with a market share of 17.35% in 2025, reflecting the critical importance of automated defect detection and precision measurement in electronics manufacturing and semiconductor assembly operations.

-

By Vertical: Industrial sector exhibits dominance with 53% market share in 2025, underpinned by accelerating automation adoption in manufacturing zones, growing emphasis on operational efficiency, and increasing deployment of machine vision for process optimization.

-

By Region: Luzon captures the largest regional share at 54% in 2025, attributed to Metro Manila's concentration of technology enterprises, industrial parks, and government smart city initiatives alongside superior telecommunications infrastructure development.

-

Key Players: The Philippines computer vision market exhibits a moderately fragmented competitive structure characterized by the presence of global technology corporations alongside regional system integrators and emerging local startups specializing in customized vision solutions.

To get more information on this market Request Sample

The Philippines computer vision market demonstrates substantial growth potential as enterprises across diverse sectors increasingly recognize the transformative capabilities of visual intelligence technologies. Across Luzon's industrial zones, manufacturing facilities are adopting advanced computer vision technologies to automate quality control processes, whereas retail networks are leveraging visual analytics tools to gain insights into customer behavior, improve shopping experiences, and streamline store organization. The security sector represents another significant growth avenue, with both government agencies and private enterprises investing in advanced surveillance systems featuring facial recognition and behavioral analysis capabilities. Smart city initiatives in Metro Manila and emerging urban centers create sustained demand for traffic monitoring, crowd management, and public safety applications. The business process outsourcing industry, a cornerstone of the Philippine economy, leverages computer vision for document processing automation and identity verification services. Educational institutions and healthcare facilities are exploring vision-based solutions for attendance tracking, patient monitoring, and diagnostic support applications.

Philippines Computer Vision Market Trends:

Integration of Edge Computing with Vision Systems

Philippine enterprises are progressively implementing edge computing systems that allow image processing to occur locally on devices instead of depending entirely on cloud infrastructure. This method minimizes latency, which is crucial for applications such as manufacturing quality control and security monitoring, while also lowering bandwidth usage. Industrial operations can detect defects instantly, enabling faster corrective actions, and retail businesses can analyze customer behavior in real time without delays caused by data transmission. Overall, edge computing enhances operational efficiency, responsiveness, and data-driven decision-making across sectors.

Expansion of Vision-Enabled Agricultural Applications

Agricultural technology adoption throughout the Philippines archipelago increasingly incorporates computer vision for crop monitoring, pest detection, and yield estimation. Farming cooperatives and agribusiness enterprises deploy drone-based imaging systems to assess plant health across vast cultivation areas. These precision agriculture applications help optimize resource utilization and improve harvest quality while addressing labor shortage challenges in rural provinces. For instance, in June 2025, the Food and Agriculture Organization (FAO) initiated the Sustainable Agricultural Mechanization and Agribusiness Development Along the Value Chain (SAM-ADVC-FFS) project at the headquarters of the Philippine Center for Postharvest Development and Mechanization under the Department of Agriculture. This program aims to advance agricultural mechanization and strengthen agribusiness practices through Farmer Field Schools, supporting improved productivity, postharvest efficiency, and sustainable farming methods across the Philippines.

Growing Adoption in Healthcare and Telemedicine

Healthcare institutions across the Philippines are integrating computer vision technologies for medical imaging analysis, patient monitoring, and diagnostic assistance. The expansion of telemedicine services following digital health mandates drives demand for remote patient assessment tools incorporating visual analysis capabilities. The Philippines telemedicine market size reached USD 1,830.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,520.8 Million by 2033, exhibiting a growth rate (CAGR) of 17% during 2025-2033. Hospitals and clinics leverage these systems to enhance diagnostic accuracy and extend specialized medical expertise to underserved regions.

Market Outlook 2026-2034:

The Philippines computer vision market outlook remains highly favorable as digital transformation accelerates across industrial, commercial, and public sectors. Sustained government investments in smart city infrastructure, expanding manufacturing automation initiatives, and growing emphasis on operational efficiency position the market for continued expansion. Enterprise adoption of artificial intelligence capabilities and the increasing availability of affordable vision hardware solutions further strengthen growth prospects. The convergence of improved telecommunications infrastructure with cloud computing accessibility creates an enabling environment for widespread deployment. The market generated a revenue of USD 99.15 Million in 2025 and is projected to reach a revenue of USD 185.07 Million by 2034, growing at a compound annual growth rate of 7.18% from 2026-2034.

Philippines Computer Vision Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Hardware | 72.2% |

| Product Type | PC-Based | 62.94% |

| Application | Quality Assurance and Inspection | 17.35% |

| Vertical | Industrial | 53% |

| Region | Luzon | 54% |

Component Insights:

- Hardware

- Software

The hardware dominates with a market share of 72.72% of the total Philippines computer vision market in 2025.

The hardware component segment maintains commanding leadership within the Philippines computer vision market, reflecting the fundamental requirement for physical imaging and processing infrastructure. Organizations across manufacturing, security, and retail sectors prioritize investments in high-resolution cameras, specialized sensors, and dedicated processing units that form the foundation of vision-enabled operations. The hardware-intensive nature of industrial automation applications particularly drives this segment, as factories require robust camera systems capable of operating continuously in demanding production environments.

Philippine enterprises increasingly recognize that effective computer vision deployment depends critically on quality hardware infrastructure capable of capturing detailed visual information under varying conditions. Manufacturing facilities demand cameras with specific wavelength sensitivities and frame rates suited to production line speeds, while security applications require hardware optimized for low-light performance and wide-angle coverage. The growing availability of more affordable yet capable imaging hardware accelerates adoption across mid-sized enterprises previously constrained by equipment costs.

Product Type Insights:

- Smart Camera-Based

- PC-Based

The PC-based leads with a share of 62.94% of the total Philippines computer vision market in 2025.

PC-based computer vision systems maintain substantial market leadership in the Philippines due to their superior computational capabilities and operational flexibility. These systems leverage powerful processors and graphics cards to execute complex image analysis algorithms that exceed the processing capacity of embedded smart camera solutions. Manufacturing enterprises particularly favor PC-based architectures for applications requiring simultaneous analysis of multiple camera feeds or implementation of sophisticated deep learning models.

The adaptability of PC-based systems proves especially valuable in the Philippine market where diverse application requirements span from high-speed production line inspection to detailed quality verification processes. Organizations appreciate the ability to upgrade software capabilities and processing power independently, extending system lifecycles and protecting technology investments. Integration with existing enterprise systems and databases occurs more seamlessly with PC-based architectures, facilitating comprehensive data analytics and operational reporting.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Quality Assurance and Inspection

- Positioning and Guidance

- Measurement

- Identification

- Predictive Maintenance

- 3D Visualization and Interactive 3D Modelling

The quality assurance and inspection exhibits clear dominance with a 17.35% share of the total Philippines computer vision market in 2025.

Quality assurance and inspection applications represent the primary deployment use case for computer vision technology across Philippine manufacturing sectors. Electronics assembly facilities, semiconductor operations, and automotive component manufacturers rely extensively on automated visual inspection to maintain product quality standards while achieving production throughput targets. These systems detect surface defects, verify component placement accuracy, and confirm assembly completeness with consistency and speed exceeding manual inspection capabilities.

The export-oriented nature of Philippine manufacturing creates strong incentives for quality management excellence, driving sustained investment in inspection automation. Companies serving international customers face stringent quality requirements that necessitate comprehensive documentation of inspection processes and results. Computer vision systems provide both the inspection capability and the data capture necessary to demonstrate compliance with customer specifications and international quality standards.

Vertical Insights:

- Industrial

- Non-Industrial

The industrial dominates with a 53% share of the total Philippines computer vision market in 2025.

Industrial applications constitute the primary market for computer vision technology in the Philippines, reflecting the nation's significant manufacturing base and ongoing automation initiatives. Electronics manufacturing, food processing, pharmaceutical production, and automotive parts assembly operations deploy vision systems for quality control, process monitoring, and robotic guidance applications. The concentration of industrial activity in special economic zones and industrial parks creates clusters of technology adoption that drive market expansion.

Philippine manufacturers increasingly recognize computer vision as essential technology for maintaining competitiveness in global supply chains while addressing domestic labor market challenges. Automation investments help companies manage rising wage expectations and workforce availability concerns while improving production consistency. Industrial vision applications deliver measurable returns through reduced defect rates, increased throughput, and lower quality-related customer claims that justify continued technology investment.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon captures the largest regional share at 54% of the total Philippines computer vision market in 2025.

Luzon dominates the Philippines computer vision market owing to the concentration of manufacturing facilities, technology enterprises, and government institutions within the National Capital Region and surrounding provinces. Metro Manila serves as the hub for business process outsourcing operations and retail chains that increasingly deploy vision-enabled solutions. Industrial parks in Calabarzon and Central Luzon house electronics manufacturing and automotive assembly operations, driving substantial hardware and software demand.

Superior telecommunications infrastructure and proximity to technology service providers give Luzon-based organizations implementation advantages for computer vision projects. The region benefits from concentrated technical expertise, established relationships with system integrators, and greater access to training and support services. Government smart city initiatives focused on Metro Manila traffic management and public safety further stimulate market activity within the region.

Market Dynamics:

Growth Drivers:

Why is the Philippines Computer Vision Market Growing?

Accelerating Digital Transformation Across Industries

The Philippines is experiencing a significant wave of digital transformation as enterprises across manufacturing, retail, financial services, and logistics sectors prioritize technology investments to enhance operational efficiency and competitive positioning. Organizations recognize that computer vision capabilities form a critical component of broader digitalization strategies, enabling automation of visual inspection tasks, customer analytics, and process monitoring that previously required manual observation. Government initiatives supporting digital economy development create a favorable policy environment that encourages technology adoption while improving digital infrastructure accessibility. Industry associations and trade groups actively promote awareness of automation benefits, helping overcome traditional resistance to technology change among established businesses. The growing pool of technology-literate workers entering the Philippine labor force facilitates the implementation and operation of sophisticated vision systems. For instance, in May 2025, the Department of Science and Technology (DOST), via the Advanced Science and Technology Institute (ASTI), showcased its newest artificial intelligence (AI) innovations and digital infrastructure initiatives during a press briefing organized by the Philippine Information Agency. The presentation underscored the nation’s commitment to fostering an inclusive, forward-looking AI ecosystem designed to strengthen technological capabilities and support the country’s transition toward a more digitally empowered future.

Rising Demand for Manufacturing Automation Solutions

Philippine manufacturing enterprises face increasing pressure to enhance productivity and quality while managing rising operational costs, driving substantial demand for automation technologies, including computer vision systems. Export-oriented manufacturers serving international customers must meet exacting quality standards that favor automated inspection over manual visual checking. Labor market dynamics, including workforce availability challenges and wage inflation expectations, encourage investments in technology that reduces dependence on manual operations while improving consistency. The semiconductor and electronics manufacturing sectors particularly embrace vision-based quality control to maintain competitiveness against regional manufacturing alternatives. Food processing and pharmaceutical operations deploy vision systems to ensure compliance with increasingly stringent regulatory requirements governing product quality and packaging integrity.

Expansion of Smart City and Public Safety Initiatives

Government-led smart city programs across the Philippines create sustained demand for computer vision applications addressing traffic management, public safety, and urban planning challenges. Metropolitan areas invest in intelligent transportation systems incorporating license plate recognition, traffic flow analysis, and incident detection capabilities to reduce congestion and improve emergency response. For instance, in May 2025, Iveda, a worldwide frontrunner in AI-powered video surveillance and smart city solutions, revealed the rollout of its IvedaAI™ platform in a prominent Philippine city center through an initial order valued at $180,000. This deployment represents the company’s inaugural smart city project in the country as part of its larger $3 million regional smart city initiative, signaling a significant step in expanding AI-driven urban infrastructure and public safety technologies in the area. Public safety initiatives deploy advanced surveillance systems featuring facial recognition, crowd behavior analysis, and anomaly detection to enhance security at transportation hubs, commercial centers, and public spaces. Disaster preparedness planning increasingly incorporates vision-based monitoring for flood detection, structural assessment, and evacuation management applications.

Market Restraints:

What Challenges is the Philippines Computer Vision Market Facing?

High Implementation and Integration Costs

The substantial capital investment required for computer vision system deployment presents a significant barrier for small and medium enterprises that comprise the majority of Philippine businesses. Beyond hardware and software acquisition costs, organizations must allocate resources for system integration, staff training, and ongoing maintenance that extend total implementation expenses. Limited availability of local financing options specifically tailored for technology investments restricts access for capital-constrained organizations seeking automation solutions.

Technical Expertise and Talent Availability Constraints

The Philippines faces a shortage of specialized professionals with expertise in computer vision algorithm development, system integration, and operational management. Educational institutions produce insufficient graduates with relevant technical qualifications to meet growing market demands for skilled personnel. Competition from overseas employers attracts capable professionals away from the domestic market, while local compensation levels often fail to match international opportunities, creating persistent talent retention challenges for technology providers and end-user organizations.

Infrastructure Limitations in Regional Areas

Uneven development of digital infrastructure across the Philippine archipelago creates barriers to computer vision deployment beyond major metropolitan areas. Inconsistent power supply quality in some regions threatens the reliable operation of sensitive electronic equipment. Limited internet connectivity bandwidth constrains cloud-based vision applications and remote system management capabilities. These infrastructure gaps slow market expansion into regional manufacturing centers and agricultural applications where computer vision could deliver substantial benefits.

Competitive Landscape:

The Philippines computer vision market exhibits a moderately fragmented competitive structure characterized by diverse participant types addressing varied customer requirements across industrial, commercial, and public sector applications. The market features established global technology corporations with regional presence competing alongside specialized Asian vendors and emerging local solution providers. Competition intensity varies significantly across market segments, with industrial automation applications attracting greater international vendor focus while security and retail applications see stronger participation from regional and local suppliers. System integrators play a crucial intermediary role connecting technology providers with end-user organizations, often bundling hardware from multiple sources with locally developed software customizations. The market demonstrates ongoing consolidation as larger technology enterprises acquire specialized capabilities through partnership arrangements and technology licensing agreements. Competitive differentiation increasingly emphasizes local service capabilities, application-specific expertise, and total cost of ownership rather than purely technical specifications. The growing sophistication of Philippine enterprise customers drives vendors toward solution-oriented approaches that address complete business requirements rather than selling standalone technology components.

Recent Developments:

-

In August 2025, Safe Pro Group Inc. conducted a training program with the Philippine military on AI-enabled drone operations for landmine and unexploded ordnance detection using its SpotlightAI platform. The initiative equipped more than 30 Explosive Ordnance Disposal technicians at Camp Aquino in Tarlac with the skills needed to carry out humanitarian demining missions.

-

In October 2024, Hinduja Global Solutions inaugurated an AI Hub in Manila aimed at advancing public surveillance systems and supporting smart city development initiatives, showcasing technologies including computer vision, speech AI, and analytics for real-time safety and monitoring solutions aligned with government urban safety enhancement efforts.

Philippines Computer Vision Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software |

| Product Types Covered | Smart Camera-Based, PC-Based |

| Applications Covered | Quality Assurance and Inspection, Positioning and Guidance, Measurement, Identification, Predictive Maintenance, 3D Visualization and Interactive 3D Modelling |

| Verticals Covered | Industrial, Non-Industrial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines computer vision market size was valued at USD 99.15 Million in 2025.

The Philippines computer vision market is expected to grow at a compound annual growth rate of 7.18% from 2026-2034 to reach USD 185.07 Million by 2034.

The hardware dominated the Philippines computer vision market with 72.72% market share in 2025, driven by substantial investments in cameras, sensors, and processing units required for vision system deployment across manufacturing and security applications.

Key factors driving the Philippines computer vision market include accelerating digital transformation initiatives across industries, rising demand for manufacturing automation solutions to enhance productivity, and expansion of government-led smart city and public safety programs.

Major challenges include high implementation and integration costs that limit small and medium enterprise adoption, a shortage of specialized technical talent for system development and operation, and infrastructure limitations in regional areas affecting deployment beyond major metropolitan centers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)