Philippines Connected Healthcare Market Report by Type (mHealth Services, mHealth Devices, E-Prescription), Function Type (Remote Patient Monitoring, Clinical Monitoring, Telemedicine, and Others), Application (Diagnosis and Treatment, Monitoring Application, Wellness and Prevention, Healthcare Management, and Others), and Region 2026-2034

Philippines Connected Healthcare Market Overview:

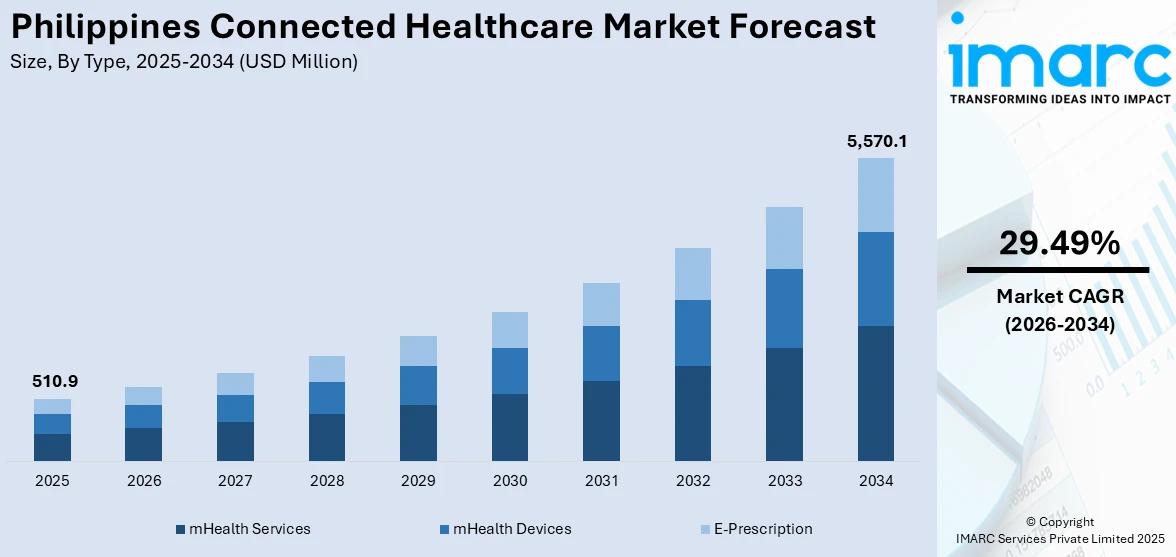

The Philippines connected healthcare market size reached USD 510.9 Million in 2025. Looking forward, the market is expected to reach USD 5,570.1 Million by 2034, exhibiting a growth rate (CAGR) of 29.49% during 2026-2034. The market is rapidly growing, driven by the widespread adoption of telemedicine, mobile health apps, and wearable devices, steadily increasing government support. The rise of health tech startups and improved health information systems are enhancing healthcare access, efficiency, and patient outcomes across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 510.9 Million |

| Market Forecast in 2034 | USD 5,570.1 Million |

| Market Growth Rate (2026-2034) | 29.49% |

Key Trends of Philippines Connected Healthcare Market:

Integration of AI and Big Data Analytics

Artificial intelligence (AI) and big data analytics are transforming the connected healthcare market in the Philippines. AI-powered tools enhance disease prediction, diagnostics and personalized treatment plans by analyzing vast amounts of health data. These tools can detect patterns and anomalies enabling early intervention and more accurate diagnosis. For instance, the Department of Health regional office in the Philippines has received a state-of-the-art mobile tuberculosis clinic donated by the Philippine Business for Social Progress. This mobile van, equipped with AI technology, aims to efficiently screen for TB in remote areas. The initiative, in collaboration with the Japan International Cooperation Agency, has already shown promising results in detecting TB cases and expediting treatment. This represents a significant stride in addressing TB incidence in the country, with a focus on early detection and treatment. Big data analytics further aids healthcare by identifying health trends and patterns across large populations. According to the Philippines connected healthcare market analysis, this helps in optimizing resource allocation further ensuring that medical supplies and personnel are efficiently distributed. Furthermore, big data analytics supports public health initiative by tracking the spread of disease and evaluating the effectiveness of health intervention. Together, AI and big data analytics improve overall healthcare outcomes by providing data-driven insights enhancing patient care and enabling more effective health management strategies.

To get more information on this market, Request Sample

Emergence of Health Tech Startups

Healthcare technology startup ecosystem in Philippines is burgeoning mainly driven by demand for innovative solutions to enhance healthcare delivery. KonsultaMD and Watsons Philippines have teamed up to offer free 24/7 doctor consultations to Filipinos. Customers can access this service with a minimum purchase at Watsons, and KonsultaMD members can also enjoy free delivery for purchases over P1,000 on the Watsons website or mobile app. This partnership aims to make healthcare easily accessible, allowing up to five family members to benefit from the free KonsultaMD health plan for one month. Startups are developing cutting edge technologies in areas like telemedicine which offers remote consultation and digital health platforms that streamline patient management and healthcare coordination. Health data analytics is another key focus with the startup creating tools to analyze and utilize patient data for improved diagnostics and personalized care. This innovation is further supported by a vibrant entrepreneurial culture, increased funding opportunities and government initiatives aimed at fostering digital health advancements. These startups are not only addressing existing healthcare challenges but also paving the way for a more connected and efficient healthcare system. Their contributions are vital transforming healthcare access and quality ensuring that the benefits of connected healthcare we each have broader segment of the population.

Growth Drivers of Philippines Connected Healthcare Market:

Healthcare Infrastructure Modernization and Digital Transformation

The Philippines' comprehensive healthcare infrastructure modernization initiatives are driving unprecedented connected healthcare adoption across both public and private sectors. Government investments in fiber optic networks, 5G connectivity expansion, and cloud-based health information systems create robust technological foundations supporting telemedicine, remote monitoring, and digital health platforms. Implementation of the Universal Health Care Act within the Department of Health implies integrated health information systems, and this requires all hospitals and clinics to use electronic medical records and an interoperable digital platform. Such a regulatory process speeds up the process of connected healthcare technology acquisition and implementation across the country. Furthermore, the technology transfer, expertise exchange, and funding procedures are realized through the public-private partnerships to help smaller medical centers benefit from high-level digital healthcare solutions. The modernization effort includes establishing regional telehealth hubs, upgrading medical equipment with IoT connectivity, and implementing standardized digital health protocols, creating a comprehensive ecosystem supporting sustained Philippines connected healthcare market demand and technological advancement.

Rising Healthcare Access Challenges and Geographic Barriers

The Philippines' unique archipelagic geography, with over 7,641 islands, creates substantial healthcare access challenges that connected healthcare technologies are uniquely positioned to address effectively. Isolated communities on islands, rugged areas, and rural locations with poor healthcare access frequently do not have sufficient medical facilities, specialized doctors, and emergency services. Remote monitoring devices, mobile health apps, and telemedicine platforms can help healthcare providers bring their services past the old geographic boundaries to previously inaccessible populations. Connected healthcare solutions reduce travel costs, transportation barriers, and time constraints that prevent many Filipinos from accessing quality medical care, fueling the Philippines connected healthcare market share. The growing recognition that digital health technologies can democratize healthcare access drives government support, international development funding, and private sector investment in connected healthcare infrastructure. This geographic imperative creates sustained demand for innovative connected healthcare solutions that can operate reliably in challenging environments while providing high-quality medical services to underserved communities across the archipelago.

Pandemic-Accelerated Digital Health Adoption and Behavioral Change

The COVID-19 pandemic fundamentally transformed Filipino healthcare consumption patterns, accelerating digital health adoption rates and creating lasting behavioral changes that continue driving the Philippines connected healthcare market growth. Social distancing requirements, healthcare facility capacity constraints, and infection prevention concerns motivated millions of Filipinos to embrace telemedicine consultations, online pharmacy services, and remote health monitoring technologies. This pandemic-driven digital health experience demonstrated the convenience, safety, and effectiveness of connected healthcare solutions, creating sustained consumer preference for digital health options. Healthcare providers who implemented telemedicine and digital patient management systems during the pandemic continue expanding these services due to proven efficiency gains, cost reductions, and patient satisfaction improvements. The pandemic also highlighted the importance of health data analytics, population health monitoring, and coordinated digital health responses, driving continued investment in connected healthcare platforms that support public health preparedness and individual health management across diverse Filipino communities and healthcare settings.

Philippines Connected Healthcare Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, function type, and application.

Type Insights:

- mHealth Services

- mHealth Devices

- E-Prescription

The report has provided a detailed breakup and analysis of the market based on the type. This includes mhealth services, mhealth devices, and e-prescription.

Function Type Insights:

- Remote Patient Monitoring

- Clinical Monitoring

- Telemedicine

- Others

A detailed breakup and analysis of the market based on the function type have also been provided in the report. This includes remote patient monitoring, clinical monitoring, telemedicine, and others.

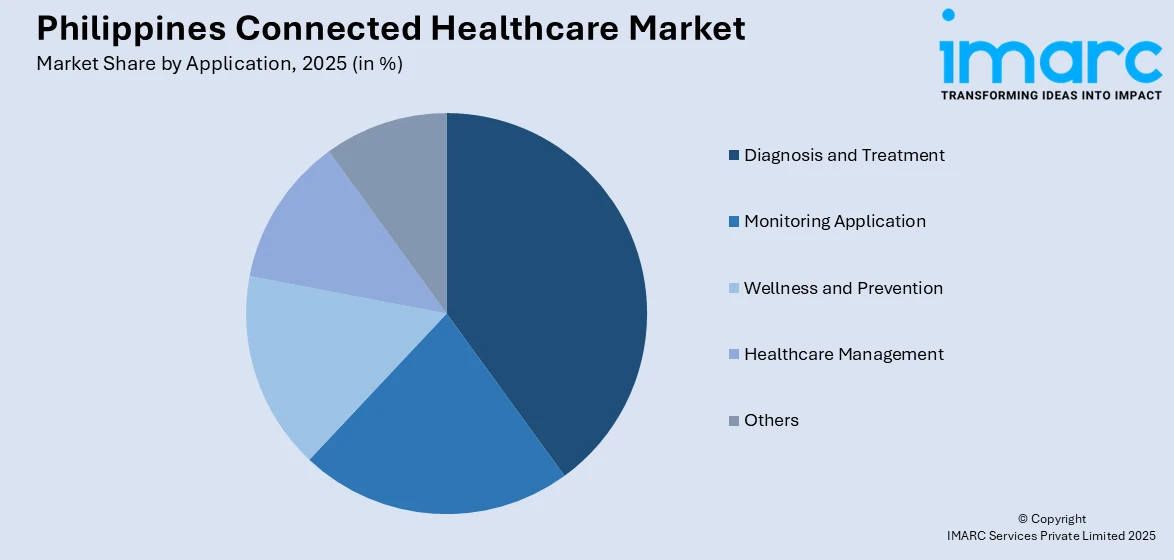

Application Insights:

Access the comprehensive market breakdown Request Sample

- Diagnosis and Treatment

- Monitoring Application

- Wellness and Prevention

- Healthcare Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes diagnosis and treatment, monitoring application, wellness and prevention, healthcare management, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Connected Healthcare Market News:

- In November 2023, MediLink Network is addressing healthcare challenges in the Philippines through an integrated IT platform to enhance patient outcomes. The platform comprises web-based applications for HMO members, providers, and corporate accounts, streamlining processes and improving services. With over 2 million active members and a track record of successful transactions, MediLink Network's efforts earned the prestigious Philippines Technology Excellence Award for Software - Healthcare Technology at the Asian Technology Excellence Awards 2023.

- In September 2022, Healthway Cancer Care Hospital (HCCH), an Ayala Healthcare Holdings, Inc. (AC Health) through Zodiac Health Ventures, Inc., sealed a long-term strategic Value Partnership with Siemens Healthineers. As part of this partnership, Siemens Healthineers will provide its broad oncology focused innovative medical imaging, radiation therapy and digital healthcare solutions together with clinical and technical expertise across the cancer care continuum, as well as operational efficiency services. The 100-bed facility will be the country’s first dedicated specialty cancer hospital and is set to open in mid-2023 at Ayala Land’s Arca South development in Taguig City, Philippines.

Philippines Connected Healthcare Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | mHealth Services, mHealth Devices, E-Prescription |

| Function Types Covered | Remote Patient Monitoring, Clinical Monitoring, Telemedicine, Others |

| Applications Covered | Diagnosis and Treatment, Monitoring Application, Wellness and Prevention, Healthcare Management, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines connected healthcare market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines connected healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines connected healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The connected healthcare market in the Philippines was valued at USD 510.9 Million in 2025.

The Philippines connected healthcare market is projected to exhibit a CAGR of 29.49% during 2026-2034.

The Philippines connected healthcare market is projected to reach a value of USD 5,570.1 Million by 2034.

The market experiences rapid growth driven by government Digital Health Strategy 2024-2028 implementation, AI and big data analytics integration for predictive healthcare, and thriving health tech startup ecosystem. Telemedicine adoption, wearable device utilization, and mobile health applications are transforming healthcare access nationwide.

The Philippines connected healthcare market is driven by comprehensive healthcare infrastructure modernization with 5G connectivity expansion, geographic barriers creating demand for telemedicine solutions across 7,641 islands, and pandemic-accelerated digital health adoption creating lasting behavioral changes in healthcare consumption patterns nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)