Philippines Construction Equipment Market Report by Solution Type (Products, Services), Equipment Type (Heavy Construction Equipment, Compact Construction Equipment), Type (Loader, Cranes, Forklift, Excavator, Dozers, and Others), Application (Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, and Others), Industry (Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, and Others), and Region 2026-2034

Philippines Construction Equipment Market Overview:

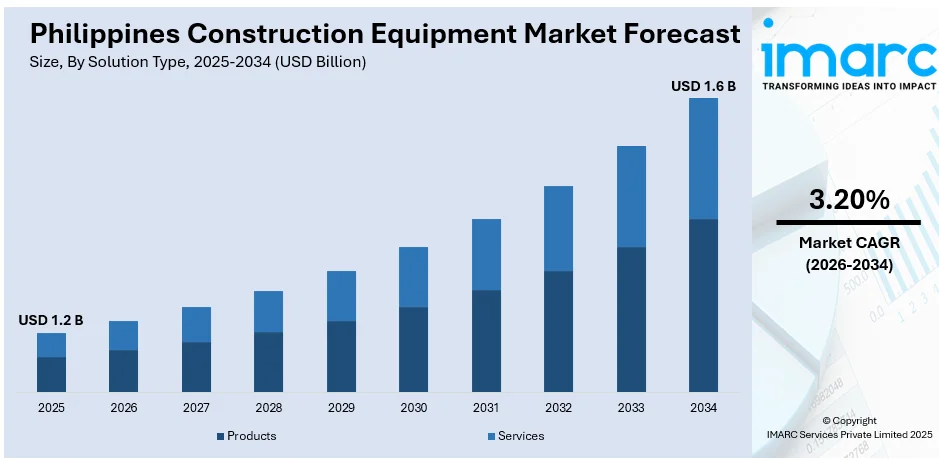

The Philippines construction equipment market size reached USD 1.2 Billion in 2025. Looking forward, the market is expected to reach USD 1.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.20% during 2026-2034. The market is majorly driven by the government's massive infrastructure initiatives, rapid urbanization demanding residential and commercial construction, increased private sector investments, a focus on sustainable and disaster-resilient building practices, and the expansion of mining and tourism-related infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 1.6 Billion |

| Market Growth Rate 2026-2034 | 3.20% |

Key Trends of Philippines Construction Equipment Market:

Continual Technological Advancements in Equipment

The incorporation of new technologies in the construction equipment industry is one of the key industry trends in the Philippines. The incorporation of GPS tracking, advanced automation including application of artificial intelligence, and working remotely in construction equipment have enhanced its functioning efficiency and minimized mishaps occurrence in construction sites. Also, the rising awareness of environmental impacts has led to increased demand for electric and hybrid construction equipment. These are not only new products that drive the market with its consumption but also make the owners of old equipment invest in new equipment thus driving the market. In addition, changes in the Philippine regulations and increased concern over welfare and environmental impact necessitate operation with more advanced and efficient equipment.

To get more information on this market Request Sample

Increased Focus on Disaster-Resilient Infrastructure

The Philippines is among countries with the highest vulnerability to natural disasters including typhoons, earthquakes, and volcanic activities. Due to this vulnerability, there has been an increased consciousness in putting up of disaster-resistant infrastructure to minimize the effects of such events. They help increase demand for construction equipment since more projects need high-tech equipment that can engage and managing challenging, strong structures, such as flood barriers, earthquake-resistant buildings, and strengthened transport infrastructure. Private organizations are committing and focusing on investment dedicated for building up a high end and more robust structures, this has leads to construct an appropriate demand for constructing machineries to be operated in sever and helping for constructing sustainable infrastructures.

Private Sector Investment

According to the Philippines construction equipment market analysis, private sector investments in real estate and commercial developments are also substantial contributors to the market. With the country's economic growth, there has been an increase in the development of shopping malls, office buildings, and hotels. This private sector dynamism encourages the adoption of modern construction techniques and equipment to ensure timely and quality construction. Companies are investing in technologically advanced machinery for better efficiency and productivity, augmenting the market for construction equipment forward.

Government Infrastructure Initiatives

The Philippines government has been aggressively promoting infrastructure development through various initiatives. This ambitious infrastructure plan aims to enhance mobility, alleviate congestion, and provide sustainable development through numerous projects, including roads, bridges, airports, and railways. The increased government spending on infrastructure is a significant catalyst for the growth of the construction equipment market as these projects require extensive use of various types of construction machinery. The development of the metro manila subway and the expansion of Clark international airport have necessitated substantial deployment of earthmoving and heavy lifting equipment, thus supporting the demand within the sector.

Growth Drivers of Philippines Construction Equipment Market:

Expansion of Transportation and Logistics Networks

One of the major growth drivers for the Philippines construction equipment market share is the modernization push of the country for its transport and logistics infrastructure. Government and private sector funds are being heavily invested in the development of seaports, airports, expressways, and railways to facilitate regional trade and ease traffic congestion in urban areas. New intermodal transportation terminals and logistics centers are arising in prime locations such as Clark, Batangas, and Davao, necessitating massive earthworks and structural construction. These constructions need different types of construction equipment such as cranes, pavers, concrete mixers, and drilling machines. Furthermore, the construction of intermodal transportation networks and logistics corridors throughout Luzon, Visayas, and Mindanao is driving demand for equipment that can work in difficult terrain and in remote locations. With the Philippines emerging as a prime logistics hub in Southeast Asia, the demand for productive and high-capacity equipment remains on the increase, generating steady business prospects for equipment dealers, rental companies, and manufacturers.

Expansion of the Mining and Quarrying Industry

The region’s bountiful reserves of natural and mineral resources offer another great opportunity for the Philippines construction equipment market growth. Mining and quarrying operations—specifically for gold, copper, nickel, and limestone—are growing as a result of renewed government enthusiasm for responsible mining and increasing worldwide demand for raw materials. When mine operations expand in areas such as Caraga, Cordillera, and Palawan, demand for heavy equipment like loaders, excavators, rock crushers, and hauling trucks also expands simultaneously. The growth in limestone quarries used in the production of cement also fuels construction activity connected with infrastructure and real estate development. Most of the mines lie in hilly or inaccessible areas, calling for hardy and terrain-suited machines. In addition, local operators are finding equipment featuring sophisticated safety systems and environmental control to meet tougher regulations and reduce ecological footprints. This expansion in extractive industries supports sustained demand for high-performance, specialist construction equipment.

Rise of Equipment Leasing and Finance Options

Another significant growth driver in the Philippine construction equipment market is the emergence of equipment leasing, financing, and rental options specifically designed for small and mid-sized contractors. Most construction companies in the country have low budgets and short project tenures, making it challenging to support big-ticket capital spends on fresh machinery. Consequently, leasing packages and flexible financing schemes have gained prominence, particularly in provinces where ownership rates are low. Domestic and foreign companies currently provide leasing packages with maintenance, operator training, and buyback arrangements, diminishing the financial risk to smaller contractors. These services are most important for gaining access to more advanced equipment that otherwise would be fiscally impossible. The emergence of online platforms and marketplaces for equipment rental has also promoted greater transparency and ease of use within the industry. By reducing the entry barriers, these financial innovations are also serving to - democratize access to quality machinery, increase usage, and grow the Philippines construction equipment market demand in all parts of the region.

Philippines Construction Equipment Market News:

- On 15th November 2023, Orica signed a memorandum of understanding (MoU) with Caterpillar to develop integrated workflows across the mining value chain. Through the collaboration, the companies intend to provide intelligence to customers to improve decision-making and optimize their entire mining operations.

- On 14th November 2023, Volvo CE partnered with CRH to decarbonize construction. The strategic partnership focuses on electrification, charging infrastructure, low carbon fuels and renewable energy, which have the combined potential to reduce emissions.

- In July 2025, Volvo Construction Equipment (Volvo CE) debuted its eagerly awaited New Generation Excavators in the Philippines during a major event at the Metrotent Convention Center. The event, attended by around 400 participants from the construction, mining, contracting, and local government industries, represented an important milestone for the heavy equipment sector in the Philippines.

- In January 2025, HD Hyundai Construction Equipment won a significant construction equipment supply contract, demonstrating its dominance in the global market. The Philippines Department of Public Works and Highways (DPWH) recently awarded the company (CEO Choi Cheol-gon) a contract for medium-sized excavators. 48 21-ton and 74 22-ton excavators make up the order's total of 122 units, which accounts for 36% of the business's entire sales in the Philippines for the prior year.

Philippines Construction Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on solution type, equipment type, type, application, and industry.

Solution Type Insights:

- Products

- Services

The report has provided a detailed breakup and analysis of the market based on the solution type. This includes products and services.

Equipment Type Insights:

- Heavy Construction Equipment

- Compact Construction Equipment

A detailed breakup and analysis of the market based on the equipment type have also been provided in the report. This includes heavy construction equipment and compact construction equipment.

Type Insights:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes loader, cranes, forklift, excavator, dozers, and others.

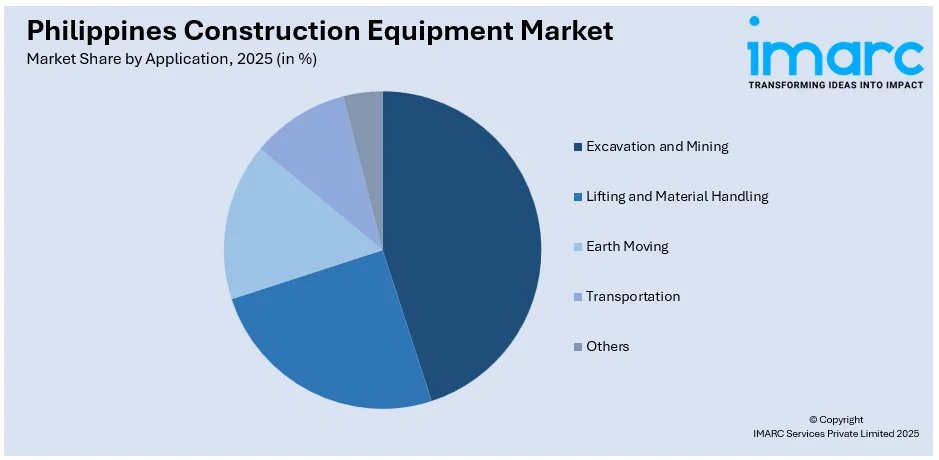

Application Insights:

Access the comprehensive market breakdown Request Sample

- Excavation and Mining

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes excavation and mining, lifting and material handling, earth moving, transportation, and others.

Industry Insights:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the industry. This includes oil and gas, construction and infrastructure, manufacturing, mining, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Construction Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines construction equipment market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines construction equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines construction equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines construction equipment market was valued at USD 1.2 Billion in 2025.

The Philippines construction equipment market is projected to exhibit a CAGR of 3.20% during 2026-2034.

The Philippines construction equipment market is expected to reach a value of USD 1.6 Billion by 2034.

The major trend of the Philippines construction equipment market is moving toward rentals, intelligent machinery, and fuel-efficient models. There is increasing demand for compact, multi-functional equipment appropriate for city projects. Digital equipment leasing platforms are becoming more popular, and environmentally friendly and safety-oriented machines are the norm with increasing infrastructure development and regulatory stringency compliance.

Major drivers for the Philippines construction equipment market are growing infrastructure projects, urbanization, and requirements for disaster-resilient structures. Mine, transport, and logistics sector growth also drives demand. Moreover, accessible leasing and government support toward regional development improves the accessibility of equipment and drives market growth across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)