Philippines Consumer Credit Market Size, Share, Trends and Forecast by Credit Type, Service Type, Issuer, Payment Method, and Region, 2025-2033

Philippines Consumer Credit Market Overview:

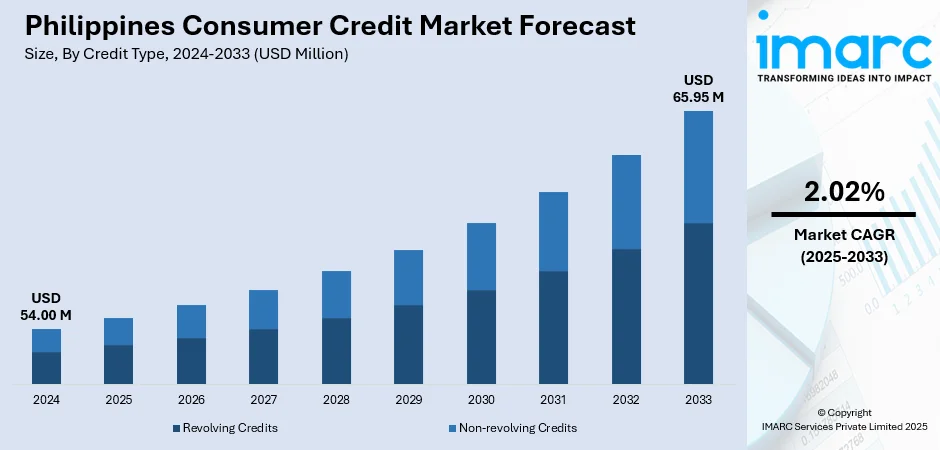

The Philippines consumer credit market size reached USD 54.00 Million in 2024. The market is projected to reach USD 65.95 Million by 2033, exhibiting a growth rate (CAGR) of 2.02% during 2025-2033. The market is expanding as more people gain access to varied credit options like revolving credit, personal loans, and digital lending platforms. Fintech innovations, mobile apps, and Buy Now Pay Later solutions are increasing convenience and financial inclusion, especially among younger and underserved segments. While traditional banks and neobanks both play a role, regulatory frameworks and responsible lending practices continue to shape market dynamics. This evolving ecosystem underscores the growing relevance of the Philippines consumer credit market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.00 Million |

| Market Forecast in 2033 | USD 65.95 Million |

| Market Growth Rate 2025-2033 | 2.02% |

Philippines Consumer Credit Market Trends:

Smoother Credit Supply Conditions

The credit environment in the Philippines is becoming more balanced, with financial institutions adjusting to consumer needs while still managing risk. As more households explore borrowing options, the market is responding by refining its approach not by limiting access, but by introducing clearer expectations around repayment and eligibility. In January 2025, a central bank report revealed that while demand for household loans remained steady, banks were preparing to slightly tighten lending standards to keep risk levels in check. Rather than signaling restriction, this reflects a credit landscape that’s learning to evolve with borrower behavior. The result is a lending environment that feels more stable and predictable, offering consumers confidence in both availability and fairness. Households are also becoming more strategic, applying for credit with clearer goals and understanding the long-term impact of their borrowing choices. Together, these trends indicate a maturing system that values sustainability over short-term volume. As institutions and consumers align expectations, we’re seeing stronger resilience and smarter borrowing habits shaping the Philippines consumer credit market trends.

To get more information on this market, Request Sample

Broader Consumer Credit Reach

The Philippine consumer credit market is slowly becoming more inclusive, with more Filipinos becoming confident in using credit as a financial tool. Previously considered a last option, credit is now considered by many families as a sensible solution for coping with planned costs, e.g., tuition, home repairs, or unexpected needs. In the latter part of 2024, national polls started showing a change in consumer attitude, where more people showed willingness towards organized lending, particularly if terms are clear and repayment feasible. This change isn't caused by gimmicky campaigns; it’s due to sustained awareness efforts better lending practices, and better access online. The increasing popularity of mobile banking has enabled people in urban and rural areas to easily comprehend their credit choices and avail themselves of it when the need arises. With financial literacy increasing and access expanding, increasingly more consumers are seeing credit as a normal aspect of planning finances and not as something to be shunned. All these are building good grounds for wholesome Philippines consumer credit market growth.

Digital Innovation and Regulatory Momentum

The Philippines’ consumer credit market is getting a real lift from digital innovation and evolving regulatory support, quietly reshaping how people access and understand credit. As digital tools expand from e‑wallets and mobile lending platforms to digital IDs and open finance frameworks consumers are finding it easier to engage with formal credit, even in places once labeled underserved. On the regulatory front, the central bank is playing a vital role in steering this shift: it’s crafting guidelines to level the playing field among digital-ready institutions and ensuring safeguards through sandbox environments and digital-centric licensing rules. That kind of approach supports safer innovation while keeping consumer protection front and center. What’s more, efforts around digital payments, consumer fintech literacy, and responsible lending standards are helping build trust and making credit feel less like a mystery and more like a tool people can use with understanding. All of this is fostering a more inclusive ecosystem by blending speed, simplicity, and security. It’s the kind of quiet progress that often precedes bigger shifts and it’s paving the way for sustained Philippines consumer credit market.

Philippines Consumer Credit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on credit type, service type, issuer, and payment method.

Credit Type Insights:

- Revolving Credits

- Non-revolving Credits

The report has provided a detailed breakup and analysis of the market based on the credit type. This includes revolving credits and non-revolving credits.

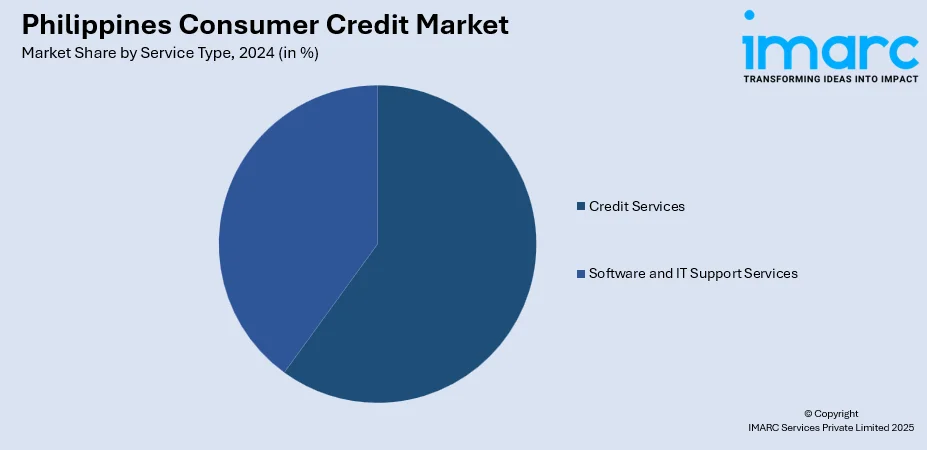

Service Type Insights:

- Credit Services

- Software and IT Support Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes credit services and software and IT support services.

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

The report has provided a detailed breakup and analysis of the market based on the issuer. This includes banks and finance companies, credit unions, and others.

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes direct deposit, debit card, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Consumer Credit Market News:

- June 2025: Fintech firm Salmon Group Ltd has secured a substantial funding infusion to accelerate its expansion in the Philippines. The capital includes funds drawn from a pioneering Nordic bond agreement and fresh equity investments led by global and local backers. With a BSP‑regulated bank and financing arm already operating locally, Salmon aims to broaden its financial services reach leveraging AI and cutting‑edge technology to deliver accessible credit, rewarding deposits, and seamless digital experiences for Filipino consumers.

- March 2025: Tonik, the Philippines’ first digital-only neobank, has surpassed one million cumulative loans since its launch, reinforcing its position as a leading force in consumer lending and digital finance locally. Armed with an AI-driven underwriting approach and a credit-first strategy, Tonik is reshaping credit inclusion for Filipinos. Its innovation in digital banking has enabled efficient, high-volume lending while advancing accessibility and affordability in the Philippine financial landscape.

Philippines Consumer Credit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Credit Types Covered | Revolving Credits, Non-revolving Credits |

| Service Types Covered | Credit Services, Software and IT Support Services |

| Issuers Covered | Banks and Finance Companies, Credit Unions, Others |

| Payment Methods Covered | Direct Deposit, Debit Card, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines consumer credit market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines consumer credit market on the basis of credit type?

- What is the breakup of the Philippines consumer credit market on the basis of service type?

- What is the breakup of the Philippines consumer credit market on the basis of issuer?

- What is the breakup of the Philippines consumer credit market on the basis of payment method?

- What is the breakup of the Philippines consumer credit market on the basis of region?

- What are the various stages in the value chain of the Philippines consumer credit market?

- What are the key driving factors and challenges in the Philippines consumer credit market?

- What is the structure of the Philippines consumer credit market and who are the key players?

- What is the degree of competition in the Philippines consumer credit market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines consumer credit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines consumer credit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines consumer credit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)