Philippines Corporate Wellness Market Size, Share, Trends and Forecast by Service, Category, Delivery, Organization Size, and Region, 2025-2033

Philippines Corporate Wellness Market Overview:

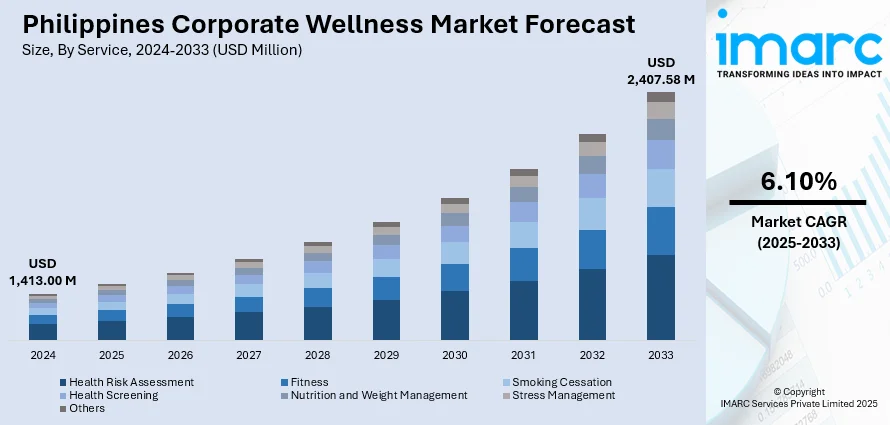

The Philippines corporate wellness market size reached USD 1,413.00 Million in 2024. Looking forward, the market is expected to reach USD 2,407.58 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. In the Philippines, organizations are increasingly realizing the heightened health awareness among workers. Moreover, the Philippines government is actively endorsing wellness programs through public health policies that invite corporate involvement. Additionally, increasing corporate expenses related to health problems is expanding the Philippines corporate wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,413.00 Million |

| Market Forecast in 2033 | USD 2,407.58 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Key Trends of Philippines Corporate Wellness Market:

Enhancing Health Consciousness Among Staffs

In the Philippines, organizations are increasingly realizing the heightened health awareness among workers. Workers are now focusing more on their well-being, and companies are introducing wellness programs to boost productivity and minimize absenteeism. Companies are integrating health-oriented programs like fitness schemes, stress management sessions, and mental health care systems. By addressing such demands, companies are promoting healthier workplaces. Workers are increasingly participating in preventive health interventions, leading businesses to create customized wellness plans. These programs are becoming increasingly common as employers realize the long-term gains from having a healthier labor force. Because workers are speaking louder about what they need for their health, businesses are reshaping their corporate wellness programs to keep pace with this phenomenon, propelling the market growth. mWell, the digital health division of Metro Pacific Health, a subsidiary of Metro Pacific Investments Corp., which is one of three main Philippine entities of Hong Kong’s First Pacific Co. Ltd., alongside Philex Mining Corp. and PLDT, Inc., unveiled Wellness@Work on May 23, 2025, a collection of adjustable programs designed to foster a healthier and more efficient workforce. The suite offers HR stakeholders a dashboard to oversee all elements of employee wellness in a single location.

To get more information of this market, Request Sample

Government Initiatives Promoting Wellness

The Philippine government is actively endorsing wellness programs through public health policies that invite corporate involvement, thereby contributing to the Philippines corporate wellness market growth. Public awareness initiatives on the value of employee health are being driven by government-led initiatives, with campaigns focusing on physical health, mental well-being, and work-life balance. More companies are finding alignment between their wellness programs and national health objectives as these efforts gain momentum, building a healthier workforce. Incentives are also being provided by the government to businesses that introduce wellness programs, and more businesses are being encouraged to invest in employee health. With a conducive regulatory framework, companies are embarking on corporate wellness solutions in greater numbers, driving the market. This is assisting in creating awareness at a national level about the role of a healthy workforce in stimulating the economy's productivity.

Increasing Corporate Expenses Related to Health Problems

Firms in the Philippines are facing substantial expenses related to health concerns like employee absenteeism, medical bills, and productivity decline. These increasing expenses are encouraging businesses to invest in corporate wellness initiatives as a preventive strategy to minimize long-term healthcare costs. Businesses are readily concentrating on lowering health issues by giving their employees access to health check-ups, wellness visits, and other preventive care. Through early intervention on health issues, companies are reducing the economic costs associated with chronic disease and workplace accidents. As a result, the reduction in insurance claims and health care expenses, coupled with an increase in employee morale and job satisfaction, is helping alter attitudes and spark change. With the increasing obviousness of the direct connection between health expenditures and corporate performance, companies are steadily embracing holistic wellness solutions, driving the corporate wellness market. In 2024, the Philippines government made PhilHealth mandatory for employees in order to make them access basic healthcare. The program helps cover surgeries, hospitalization, and doctor consultations.

Growth Drivers of the Philippines Corporate Wellness Market:

Rising Demand for Workplace Productivity Enhancement

Organizations in the Philippines are increasingly recognizing the link between employee well-being and overall productivity. Mental, physical, and emotional wellness programs by the companies will also promote reduced absenteeism, enhanced morale, and focus. Organizations are spending on exercise competitions, well-being seminars, and stress management approaches to make a healthier environment at work. Such programs enhance staff engagement while also supporting workforce retention in competitive sectors. The recent rise of hybrid and remote operations in companies makes flexible, tech-enabled wellness products and services, which include virtual fitness classes and online counselling, increasingly in demand and therefore further promotes the widespread use of corporate wellness services in different industries.

Growing Prevalence of Lifestyle-Related Health Risks

The increasing incidence of lifestyle-related health conditions, such as obesity, hypertension, and diabetes, is prompting companies to integrate preventive healthcare into workplace policies. According to the Philippines corporate wellness market analysis, sedentary work environments, poor diet habits, and high stress levels are contributing to these health challenges. Corporate wellness programs focused on promoting physical activity, healthy eating, and regular health screenings are gaining traction as cost-effective solutions to manage these risks. Employers are also adopting personalized wellness plans, wearable health tracking devices, and nutrition counseling to encourage long-term behavior change. This proactive approach not only improves employee health but also minimizes potential productivity losses and healthcare costs associated with chronic illnesses in the workforce.

Integration of Technology into Wellness Programs

Technology-driven wellness solutions are becoming a key growth driver in the Philippines corporate wellness market demand. Mobile apps, wearable devices, and digital health platforms allow companies to monitor employee progress, deliver personalized fitness or nutrition plans, and provide real-time feedback. Virtual wellness sessions, gamification features, and AI-powered health insights enhance engagement and participation rates. These tools are particularly valuable for remote or hybrid teams, ensuring consistent access to wellness resources regardless of location. The convenience, scalability, and data-driven nature of tech-enabled programs make them attractive to businesses seeking measurable results. As workplace digitalization accelerates, integrating technology into wellness strategies is becoming a standard practice for forward-thinking employers in the country.

Philippines Corporate Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, category, delivery, and organization size.

Service Insights:

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

Category Insights:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

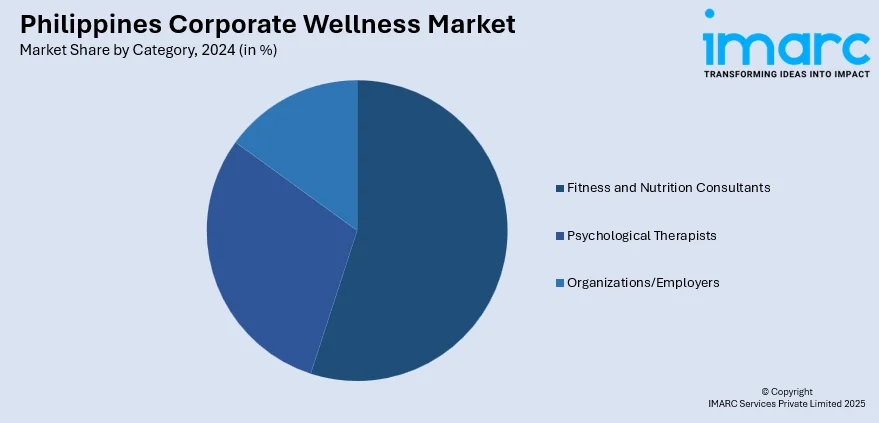

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes fitness and nutrition consultants, psychological therapists, and organizations/employers.

Delivery Insights:

- Onsite

- Offsite

A detailed breakup and analysis of the market based on the delivery have also been provided in the report. This includes onsite and offsite.

Organization Size Insights:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small scale organizations, medium scale organizations, and large scale organizations.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Corporate Wellness Market News:

- In June 2025, Infosys, a leading provider of next-generation digital solutions, entered a strategic partnership with the Mental Health Foundation Australia (MHFA) to advance mental health awareness initiatives across Australia and New Zealand. This effort forms part of Infosys’ wider Corporate Social Responsibility (CSR) agenda, aimed at harnessing technology to enhance community well-being.

Philippines Corporate Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, Others |

| Categories Covered | Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers |

| Deliveries Covered | Onsite, Offsite |

| Organization Sizes Covered | Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines corporate wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines corporate wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines corporate wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The corporate wellness market in the Philippines was valued at USD 1,413.00 Million in 2024.

The Philippines corporate wellness market is projected to exhibit a CAGR of 6.10% during 2025-2033.

The Philippines corporate wellness market is projected to reach a value of USD 2,407.58 Million by 2033.

Key trends in the Philippines corporate wellness market include the integration of digital platforms and wearable technology, rising focus on mental health initiatives, and the adoption of personalized wellness programs. Employers are also expanding offerings to support hybrid work models, emphasizing preventive healthcare and holistic well-being to enhance employee engagement and productivity.

The Philippines corporate wellness market is driven by rising demand for workplace productivity enhancement, growing prevalence of lifestyle-related health risks, and increasing integration of technology into wellness programs. Employers are also investing in holistic solutions to improve employee well-being, retention, and overall organizational performance.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)