Philippines Crane Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

Philippines Crane Market Summary:

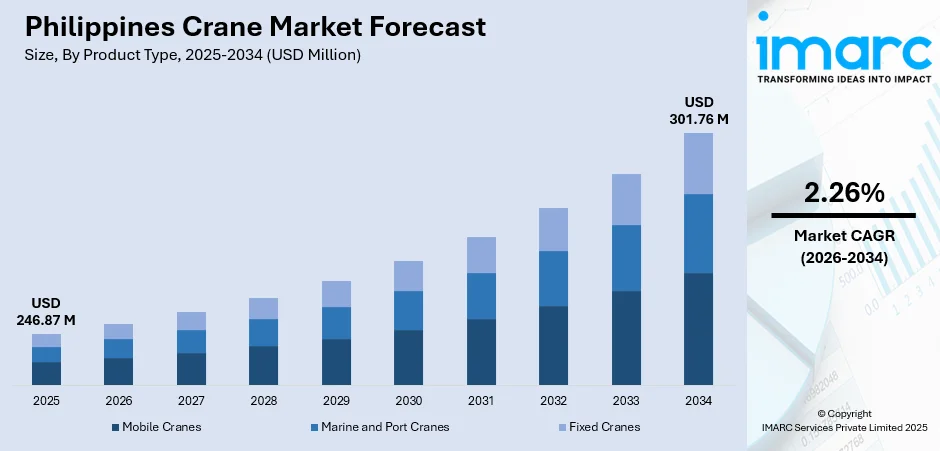

The Philippines crane market size was valued at USD 246.87 Million in 2025 and is projected to reach USD 301.76 Million by 2034, growing at a compound annual growth rate of 2.26% from 2026-2034.

The Philippines crane market is experiencing sustained expansion driven by accelerating infrastructure modernization, urban development initiatives, and industrial growth across key economic zones. Rising demand for heavy lifting equipment spans construction, mining, port operations, and energy sectors, supported by government investments in transportation networks and private sector real estate development. The market reflects the nation's broader economic transformation and commitment to building world-class infrastructure.

Key Takeaways and Insights:

-

By Product Type: Mobile cranes dominate the market with a share of 78.61% in 2025, driven by their operational versatility across diverse terrain conditions, rapid deployment capabilities for time-sensitive construction projects, and cost-effectiveness for contractors requiring flexible lifting solutions across multiple job sites throughout the archipelago.

-

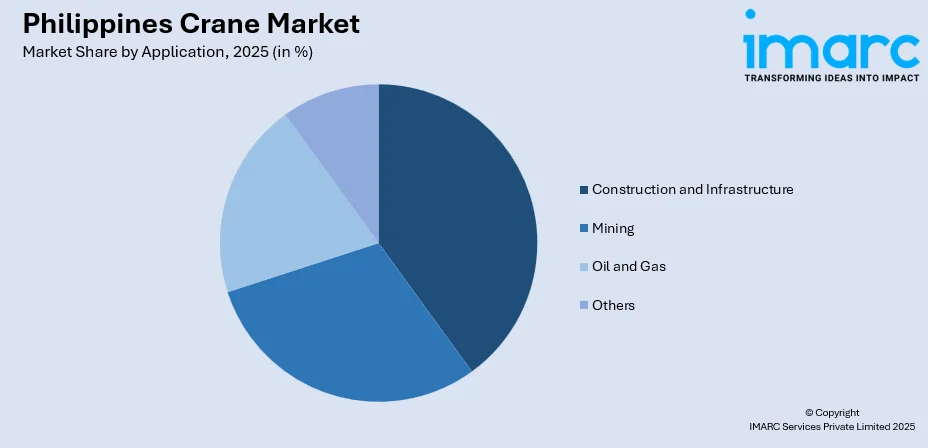

By Application: Construction and infrastructure leads the market with a share of 35.04% in 2025, attributed to extensive government-funded infrastructure programs, proliferation of high-rise residential and commercial developments in metropolitan areas, and sustained investment in transportation corridors connecting major urban centers.

-

By Region: Luzon represents the largest segment with a market share of 58% in 2025, owing to Metro Manila's position as the primary economic hub, concentration of major construction activities, presence of key industrial zones, and strategic location of primary port facilities driving crane utilization.

-

Key Players: The Philippines crane market exhibits moderate competitive intensity characterized by the presence of international equipment manufacturers, regional distributors, and local rental service providers. Market participants compete on equipment quality, after-sales service capabilities, financing options, and technical support infrastructure to capture market share across diverse end-use industries.

To get more information on this market Request Sample

The Philippines crane market continues to evolve as the nation pursues ambitious infrastructure development goals aligned with its long-term economic vision. Government initiatives focusing on transportation networks, urban renewal, and industrial expansion have created substantial demand for advanced lifting equipment across the archipelago. The construction sector remains the primary demand driver, with mobile cranes finding extensive application in building projects ranging from residential complexes to commercial towers. The Philippines construction market size reached USD 41.3 Billion in 2025. Looking forward, the market is projected to reach USD 61.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.56% during 2026-2034. Mining operations contribute significantly to market growth, particularly in regions rich in mineral resources where heavy-duty cranes facilitate extraction and processing activities. Port modernization projects have spurred demand for specialized marine and port cranes capable of handling increased cargo volumes. For instance, the ongoing expansion of container terminal facilities across major ports demonstrates the market's responsiveness to growing international trade requirements, positioning the Philippines as a key logistics hub in Southeast Asia.

Philippines Crane Market Trends:

Surge in Urban Vertical Development

Metropolitan centers across the Philippines are experiencing accelerated vertical development as urban population growth and limited land availability push construction upward. Developers are increasingly focusing on high-rise residential buildings, mixed-use projects, and large commercial complexes that depend on advanced tower cranes designed for high-altitude operations and precise load handling. This pattern is no longer confined to Metro Manila, as rapidly developing secondary cities are also embracing multi-storey construction, expanding nationwide demand for specialized lifting equipment tailored to complex vertical building requirements.

Expansion of Renewable Energy Infrastructure

The Philippines' commitment to diversifying its energy portfolio has accelerated renewable energy project development throughout the archipelago. For instance, in September 2025, President Ferdinand Marcos Jr. attended the commissioning of the Philippines’ first “baseload” power plant to integrate solar photovoltaic generation with battery storage, marking a milestone in the country’s renewable energy transition. The President led the ceremonial energisation of Citicore Renewable Energy’s Citicore Solar (CS) Batangas 1 project on 15 September. The facility combines a large-scale solar PV installation with a battery energy storage system, enabling power to be supplied to the local grid beyond daylight hours. Developer Citicore Renewable Energy Corporation said the hybrid configuration allows electricity delivery even when solar generation is not active, enhancing grid reliability. Wind farm installations, solar power facilities, and geothermal energy plants require specialized cranes for component installation and maintenance activities. Crawler cranes and telescopic boom models are increasingly deployed for turbine erection and heavy equipment positioning, reflecting the energy sector's growing contribution to crane market demand.

Adoption of Advanced Equipment Technologies

Market participants are increasingly prioritizing cranes equipped with modern safety features, telematics systems, and enhanced operational capabilities. For instance, in October 2025, Yuantai Crane supplied three 10-ton single-girder overhead cranes to a client in the Philippines. The company provides end-to-end services, including system design, installation, operator training, and spare parts support. Describing itself as a technical crane manufacturer, Yuantai Crane emphasizes its commitment to delivering professional crane solutions to clients worldwide. Digital monitoring solutions allow for real-time performance tracking and predictive maintenance planning, minimizing downtime and maximizing equipment efficiency. Environmental considerations are driving interest in cranes with improved fuel efficiency and reduced emissions, aligning with broader sustainability objectives across the Philippine industrial sector.

Market Outlook 2026-2034:

The Philippines crane market outlook remains positive as infrastructure spending continues to accelerate across multiple sectors. Government commitment to flagship transportation projects, industrial zone development, and urban renewal initiatives provides sustained demand visibility for crane suppliers and rental service providers. Private sector investment in commercial real estate, manufacturing facilities, and logistics infrastructure further strengthens market prospects. Mining sector expansion, particularly for nickel and copper extraction, ensures continued demand for heavy-duty lifting equipment in resource-rich regions. The strategic importance of port modernization to support international trade flows reinforces marine crane demand trajectories. The market generated a revenue of USD 246.87 Million in 2025 and is projected to reach a revenue of USD 301.76 Million by 2034, growing at a compound annual growth rate of 2.26% from 2026-2034.

Philippines Crane Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Mobile Cranes |

78.61% |

|

Application |

Construction and Infrastructure |

35.04% |

|

Region |

Luzon |

58% |

Product Type Insights:

- Mobile Cranes

- Marine and Port Cranes

- Fixed Cranes

The mobile cranes dominates with a market share of 78.61% of the total Philippines crane market in 2025.

Mobile cranes have established overwhelming dominance in the Philippines market due to their unmatched operational flexibility across the archipelago's diverse geographic landscape. The Philippines' island geography necessitates equipment capable of rapid deployment and relocation between project sites, making mobile cranes the preferred choice for contractors managing multiple concurrent construction activities. Rough terrain models prove particularly valuable for projects in undeveloped areas lacking established road infrastructure.

The versatility of mobile cranes enables deployment across virtually all end-use applications, from urban high-rise construction to remote mining operations and port cargo handling. All-terrain cranes accommodate varying ground conditions encountered throughout Philippine construction sites, while truck-mounted models offer efficient highway transport between urban project locations. This equipment flexibility reduces the capital investment burden on contractors while maximizing equipment utilization rates across diverse project portfolios.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction and Infrastructure

- Mining

- Oil and Gas

- Others

The construction and infrastructure lead with a share of 35.04% of the total Philippines crane market in 2025.

Construction and infrastructure applications represent the largest demand segment driven by extensive government investment in national infrastructure modernization. Major transportation projects, including expressway expansion, bridge construction, and railway development, require substantial crane deployment for structural component installation and heavy material handling. Urban development initiatives have intensified crane utilization in metropolitan areas where vertical construction dominates the building landscape.

Private sector construction activity complements government infrastructure spending, with commercial real estate development, industrial facility construction, and residential housing projects generating consistent crane demand. The growth of business process outsourcing facilities and manufacturing plants across designated economic zones further stimulates construction sector crane requirements. Integration of modern building methods emphasizing prefabricated components increases demand for precision lifting capabilities throughout the construction value chain.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits clear dominance with a 58% share of the total Philippines crane market in 2025.

Luzon's leading market share reflects the region's economic primacy within the Philippine archipelago, anchored by Metro Manila's status as the national capital and primary commercial center. The concentration of major infrastructure projects, high-rise developments, and industrial facilities in and around the capital region generates substantial and sustained crane demand. Northern Luzon's industrial corridors and Central Luzon's manufacturing zones further contribute to regional crane utilization.

Strategic port facilities along Luzon's coastline require marine cranes for container handling and cargo operations supporting international trade flows. The region's relatively developed road network facilitates efficient crane deployment and relocation between project sites, enhancing equipment utilization efficiency. Ongoing expansion of economic zones and continued urbanization ensure Luzon maintains its dominant position in crane market activity throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the Philippines Crane Market Growing?

Government Infrastructure Investment Programs

The Philippine government's sustained commitment to infrastructure development represents the primary growth catalyst for crane market expansion. National development plans emphasizing transportation network enhancement, including expressway construction, bridge building, and railway system development, create substantial demand for heavy lifting equipment. Urban renewal initiatives targeting congestion reduction and improved connectivity require extensive crane deployment for structural work and material handling. Port modernization efforts aimed at enhancing trade facilitation capabilities further stimulate demand for specialized lifting equipment. The strategic prioritization of infrastructure spending as an economic growth enabler ensures consistent budget allocation for construction projects requiring crane utilization. Regional development programs extending infrastructure improvements beyond Metro Manila broaden geographic demand patterns across the archipelago.

Expanding Mining and Natural Resource Sector

The Philippines' abundant mineral resources, including substantial nickel, copper, gold, and chromite deposits, drive mining sector expansion and associated crane demand. Exploration activities and mine development projects require heavy-duty lifting equipment for equipment installation, material transport, and processing facility construction. The global transition toward electric vehicles and renewable energy technologies has intensified international interest in Philippine mineral reserves, particularly nickel and copper essential for battery production and electrical systems. Mining operations in remote locations necessitate rugged crane equipment capable of operating in challenging terrain conditions. Processing plant construction and expansion projects generate additional demand for cranes capable of handling heavy industrial components. The strategic importance of mineral exports to national economic development ensures continued government support for responsible mining sector growth. Following the successful visit of President Ferdinand R. Marcos Jr. and Trade Secretary Alfredo Pascual to Melbourne in March 2024, which secured major business agreements, a mining permit has been awarded to Makilala Mining Company, Inc. (MMCI). The permit covers the Maalinao-Caigutan-Biyog (MCB) Mining Project in the Cordillera Administrative Region. MMCI is the Philippine unit of Perth-based mining firm Celsius Resources.

Real Estate Development and Urbanization

Rapid urbanization and rising middle-class prosperity are fueling real estate development activity throughout Philippine metropolitan areas. High-rise residential condominium construction responds to housing demand from urban professionals seeking proximity to employment centers. Commercial real estate development, including office towers, retail complexes, and mixed-use developments, requires tower cranes and mobile lifting equipment for multi-story construction. Industrial real estate expansion, including manufacturing facilities and logistics warehouses, generates demand for cranes suited to horizontal construction applications. The Philippines real estate market size reached USD 94.4 Billion in 2025. Looking forward, the market is expected to reach USD 135.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.12% during 2026-2034. The growth of tourism infrastructure, encompassing resort development and hospitality facility construction, extends crane demand to leisure destinations across the archipelago. Continued population growth in urban centers ensures sustained residential construction activity driving long-term crane market expansion.

Market Restraints:

What Challenges the Philippines Crane Market is Facing?

High Equipment Acquisition and Operating Costs

The substantial capital investment required for crane acquisition presents barriers for smaller contractors seeking to expand equipment fleets. Import duties and logistics costs associated with bringing heavy equipment into the Philippines add to ownership expenses. Operating costs including fuel consumption, maintenance requirements, and skilled operator wages impact project economics. These cost factors encourage rental arrangements over ownership, limiting direct purchase market growth.

Skilled Operator Shortage

The specialized skills required for safe and efficient crane operation create workforce availability challenges across the Philippine market. Training and certification programs struggle to produce sufficient qualified operators to meet growing industry demand. Competition for experienced operators drives wage inflation, adding to project costs. The shortage constrains equipment utilization rates and can delay project timelines when qualified personnel are unavailable.

Geographic and Logistical Challenges

The Philippines' archipelagic geography complicates equipment mobilization between islands and regions. Underdeveloped road infrastructure in certain areas limits access for transporting large crane equipment. Typhoon-prone weather conditions can halt operations and potentially damage equipment during storm seasons. These geographic factors increase project planning complexity and can affect equipment availability in certain locations.

Competitive Landscape:

The Philippines crane market features a competitive landscape characterized by the presence of established international equipment manufacturers alongside regional distributors and local service providers. Market participants differentiate through equipment quality, technological capabilities, after-sales service networks, and financing solutions tailored to customer requirements. International manufacturers leverage global brand recognition and advanced product technologies to capture market share in premium segments. Regional distributors provide localized service capabilities and established relationships with domestic contractors. Rental service providers compete on fleet availability, geographic coverage, and operational support services. The market structure encourages competition on multiple dimensions beyond equipment pricing, including maintenance support, spare parts availability, and technical training programs. Strategic partnerships between international manufacturers and local distributors enhance market coverage and customer service delivery capabilities. Growing emphasis on equipment reliability and operational efficiency influences purchasing decisions, rewarding suppliers demonstrating consistent performance and responsive service.

Recent Developments:

-

In April 2024, International Container Terminal Services, Inc. upgraded the Manila International Container Terminal with three new quay cranes from Shanghai Zhenhua Heavy Industry. Two post-Panamax cranes were installed at Berths 3 and 4, while a neo-Panamax crane was positioned at Berth 7, boosting the terminal’s operational efficiency and vessel-handling capacity.

-

In January 2024, Zoomlion successfully delivered its ZCC11800 crawler crane, an 800-ton model, to a prominent construction company in the Philippines. This marks the largest-tonnage crawler crane ever exported to the country, highlighting a significant advancement in heavy-lifting equipment for local infrastructure projects.

Philippines Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mobile Cranes, Marine and Port Cranes, Fixed Cranes |

| Applications Covered | Construction and Infrastructure, Mining, Oil and Gas, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines crane market size was valued at USD 246.87 Million in 2025.

The Philippines crane market is expected to grow at a compound annual growth rate of 2.26% from 2026-2034 to reach USD 301.76 Million by 2034.

Mobile cranes dominated the market with 78.61% share in 2025, driven by their operational versatility across diverse terrain conditions, rapid deployment capabilities, and cost-effectiveness for contractors managing multiple project sites throughout the archipelago.

Key factors driving the Philippines crane market include government infrastructure investment programs, expanding mining and natural resource sector activities, real estate development and urbanization, port modernization initiatives, and renewable energy project development across the archipelago.

Major challenges include high equipment acquisition and operating costs, skilled operator shortages limiting equipment utilization, geographic and logistical challenges associated with the archipelagic geography, underdeveloped road infrastructure in certain regions, and weather-related operational disruptions during typhoon seasons.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)