Philippines Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

Philippines Cyber Insurance Market Overview:

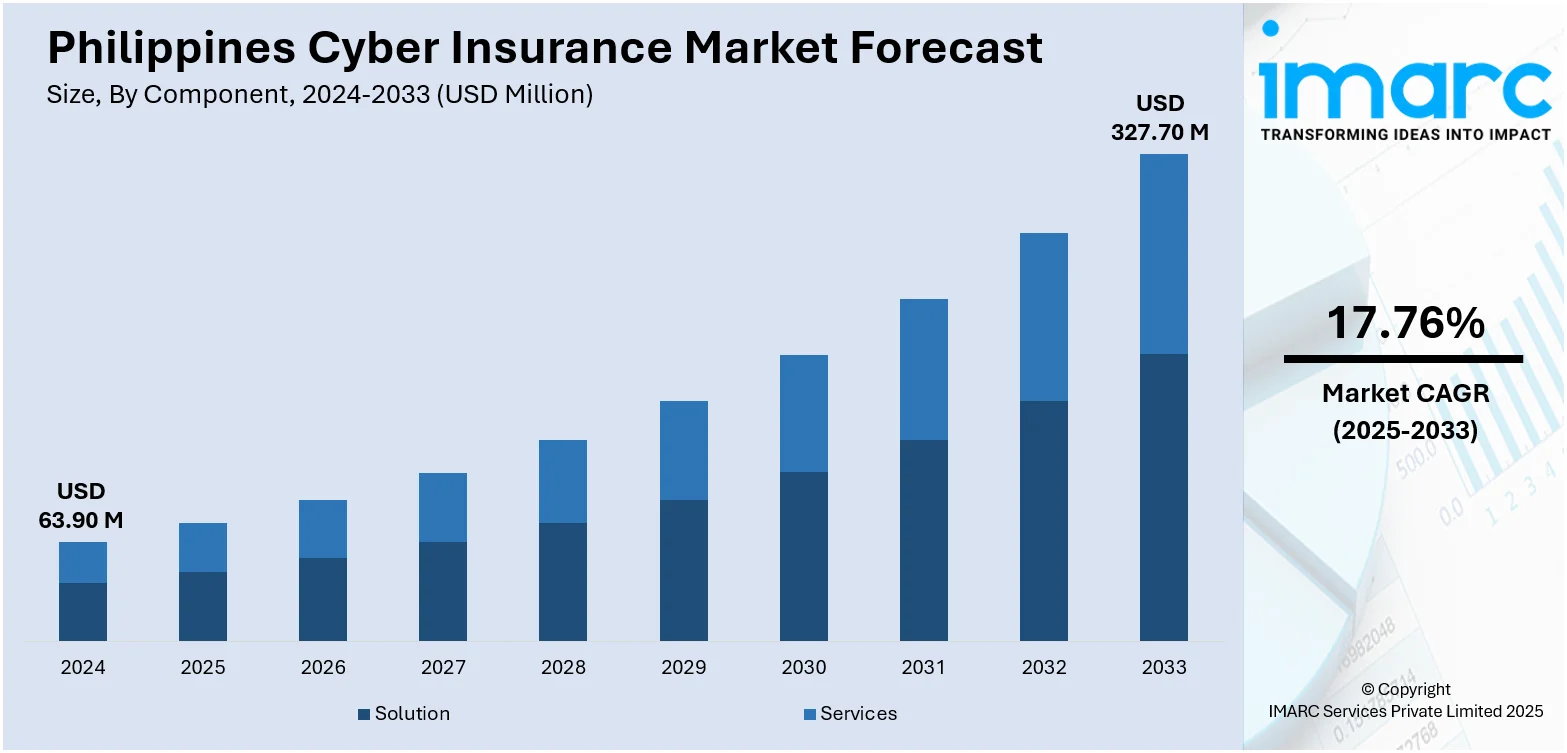

The Philippines cyber insurance market size reached USD 63.90 Million in 2024. The market is projected to reach USD 327.70 Million by 2033, exhibiting a growth rate (CAGR) of 17.76% during 2025-2033. The market is expanding as more businesses seek protection against data breaches, ransomware, and regulatory penalties. Growing awareness, digital transformation, and evolving compliance standards continue to support Philippines cyber insurance market share across finance, retail, and small-to-medium enterprise sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 63.90 Million |

| Market Forecast in 2033 | USD 327.70 Million |

| Market Growth Rate 2025-2033 | 17.76% |

Philippines Cyber Insurance Market Trends:

Cyber Threats Driving Insurance Demand

The increase in cyberattacks across the Philippines has made digital risk a serious concern for both private companies and public institutions. Ransomware, phishing, and business email compromise incidents have become more frequent, leading to financial losses, operational delays, and reputational harm. These challenges are pushing organizations to explore cyber insurance as a way to protect themselves from the high costs of recovery and legal exposure. The Philippines cyber insurance market growth is influenced by this rising need for better risk management tools. Businesses in sectors like banking, retail, and logistics are leading the shift toward cyber coverage, especially as they handle more customer data and rely heavily on digital systems. Cloud adoption, remote work, and digital payments are expanding the threat surface, making insurance more relevant. Companies are becoming more aware of the risks and the value of insurance through workshops, industry guidance, and direct exposure to cyber incidents. Insurance providers are also improving coverage options to address the local threat environment. While cost and policy clarity remain areas of concern, overall interest is growing. As cyber risks continue to affect organizations of all sizes, more Philippine businesses are beginning to treat cyber insurance as a key part of their risk planning.

To get more information on this market, Request Sample

Regulations and Market Accessibility Expanding

The regulatory environment in the Philippines is steadily evolving to address the realities of digital risk. With the Data Privacy Act and guidelines from the National Privacy Commission gaining more traction, companies are required to improve how they handle and protect personal data. These developments are encouraging businesses to look at cyber insurance not only as a protective tool but also as a way to show compliance with legal standards and customer expectations. Larger firms, especially in financial services, are adopting policies proactively to reduce exposure to penalties and data breach costs. At the same time, insurers are working to make cyber insurance more accessible and relevant to local businesses. There is a growing effort to design policies that fit the needs of small and medium enterprises, which form a major part of the economy. Brokers and IT advisors are also becoming more involved in helping clients understand coverage options and claim processes. Improved education and clearer policy structures are removing some of the confusion that previously slowed market adoption. As awareness continues to improve and digital operations expand across all sectors, the Philippines cyber insurance market is expected to grow steadily, driven by both compliance needs and a broader understanding of cyber risk exposure.

Philippines Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

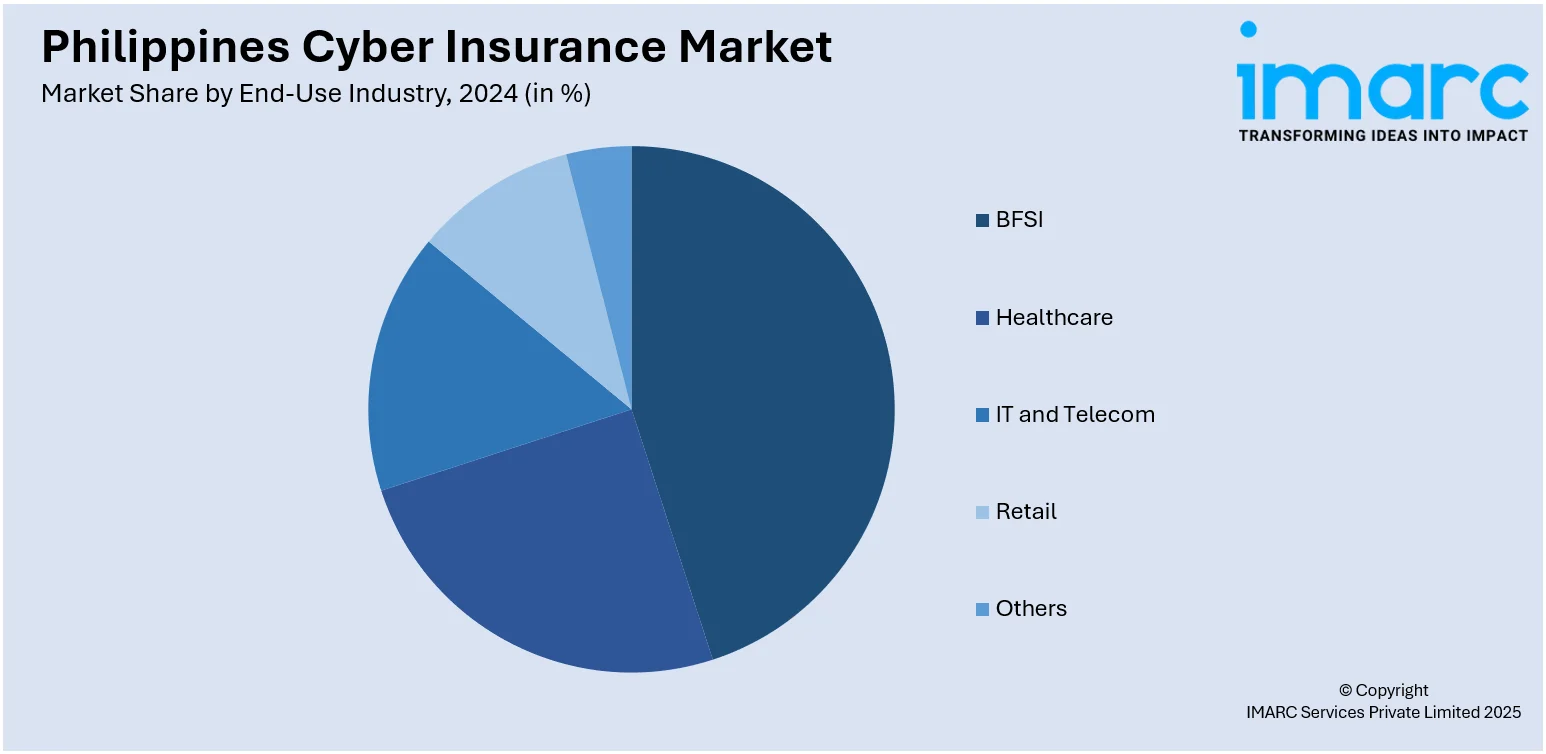

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Cyber Insurance Market News:

- December 2024: Viettel Cyber Security launched its consolidated SOC solution in the Philippines to enhance cyber resilience. It strengthened cybersecurity infrastructure, by offering 24/7 threat monitoring, automation, and localized intelligence, supporting cyber insurance adoption through improved risk assessment and reduced exposure for insurers.

- August 2024: The Bangko Sentral ng Pilipinas launched the Financial Services Cyber Resilience Plan (FSCRP) to strengthen cybersecurity in financial institutions. This initiative supported the Philippines cyber insurance sector by promoting risk awareness, encouraging adoption of cyber coverage, and improving insurers' ability to assess threats.

Philippines Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines cyber insurance market on the basis of component?

- What is the breakup of the Philippines cyber insurance market on the basis of insurance type?

- What is the breakup of the Philippines cyber insurance market on the basis of organization size?

- What is the breakup of the Philippines cyber insurance market on the basis of end-use industry?

- What is the breakup of the Philippines cyber insurance market on the basis of region?

- What are the various stages in the value chain of the Philippines cyber insurance market?

- What are the key driving factors and challenges in the Philippines cyber insurance market?

- What is the structure of the Philippines cyber insurance market and who are the key players?

- What is the degree of competition in the Philippines cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)