Philippines Cybersecurity Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2026-2034

Philippines Cybersecurity Market Summary:

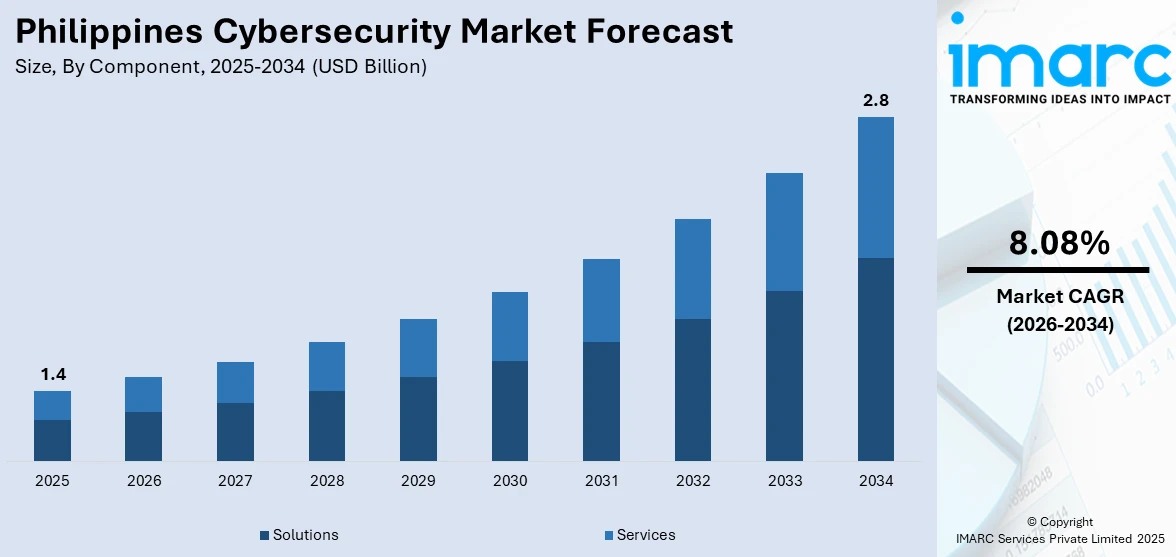

The Philippines cybersecurity market size was valued at USD 1.4 Billion in 2025 and is projected to reach USD 2.8 Billion by 2034, growing at a compound annual growth rate of 8.08% from 2026-2034.

The Philippines cybersecurity market is experiencing strong expansion driven by accelerating digital transformation across public and private sectors, increasing adoption of cloud computing and Internet of Things technologies, and heightened awareness of cyber threats among enterprises. Government initiatives establishing comprehensive cybersecurity frameworks and mandatory compliance requirements are stimulating investments in security solutions, while the proliferation of digital financial services and e-commerce platforms amplifies demand for advanced threat detection, identity management, and data protection capabilities throughout the Philippine cybersecurity market share.

Key Takeaways and Insights:

- By Component: Solutions dominate the market with a share of 52% in 2025, owing to the comprehensive protection capabilities offered by integrated security platforms that address endpoint security, network defense, and vulnerability management. Enterprises increasingly prefer all-in-one security suites that streamline operations.

- By Deployment Type: On-premises leads the market with a share of 55% in 2025, driven by regulatory compliance requirements and data sovereignty concerns that compel enterprises, particularly in banking and government sectors, to maintain direct control over sensitive security infrastructure.

- By User Type: Large enterprises represent the biggest segment with a market share of 63% in 2025, reflecting substantial cybersecurity budgets, complex IT infrastructures requiring sophisticated protection, and stringent regulatory obligations that mandate comprehensive security implementations.

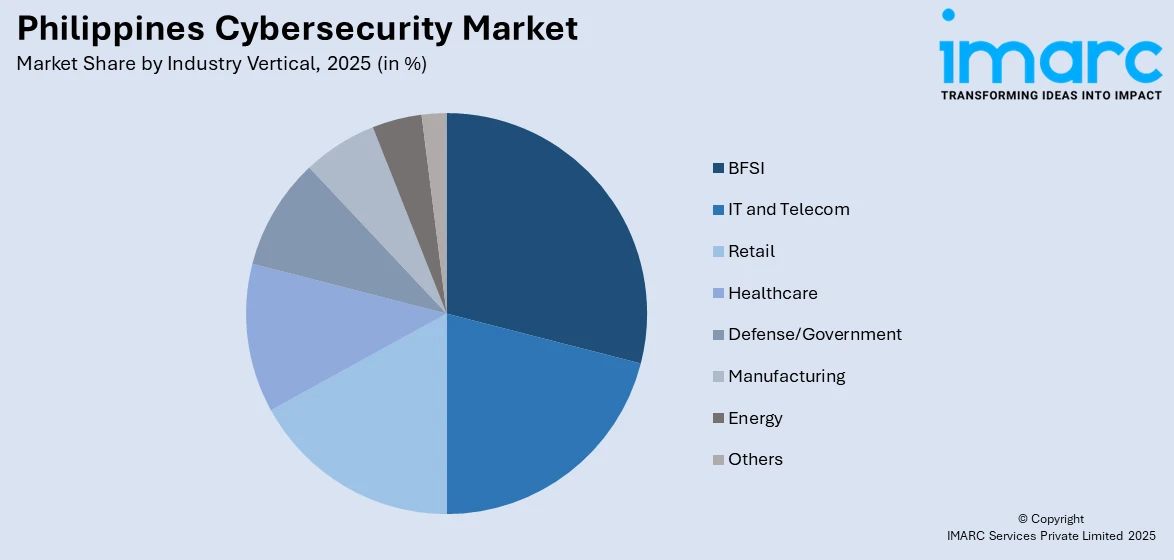

- By Industry Vertical: BFSI exhibits a clear dominance in the market with 32% share in 2025, driven by the sector's handling of sensitive financial data, stringent central bank cybersecurity mandates, and accelerating digital banking transformation requiring robust fraud prevention systems.

- By Region: Luzon is the largest region with 68% share in 2025, attributable to the concentration of corporate headquarters, financial institutions, technology companies, and government agencies in Metro Manila and surrounding economic zones.

- Key Players: Leading cybersecurity vendors drive the Philippines market through continuous innovation in threat detection technologies, strategic partnerships with local system integrators, and development of solutions tailored to regional compliance requirements and industry-specific security needs.

To get more information on this market Request Sample

The Philippines cybersecurity landscape is undergoing significant transformation as organizations confront escalating cyber threats amid rapid digitalization. The country has witnessed a dramatic surge in cyberattacks, with hacking incidents increasing in the first quarter of 2024, compelling enterprises to prioritize security investments. Financial institutions, government agencies, and telecommunications providers are implementing multi-layered defense strategies encompassing advanced threat intelligence, behavioral analytics, and zero-trust architectures to protect critical assets. The business process outsourcing industry, a cornerstone of the Philippine economy, requires stringent security certifications to maintain contracts with international clients, driving substantial demand for compliance-focused solutions. Healthcare organizations are accelerating cybersecurity spending following high-profile ransomware incidents that exposed vulnerabilities in patient data protection. The convergence of artificial intelligence with security operations enables proactive threat hunting and automated incident response capabilities. As digital payment adoption expands and remote work arrangements persist, enterprises recognize that robust cybersecurity infrastructure is fundamental to sustaining competitive advantage and maintaining stakeholder trust in the evolving Philippine digital economy.

Philippines Cybersecurity Market Trends:

Artificial Intelligence-Driven Security Operations Transformation

Philippine enterprises are increasingly deploying AI-powered cybersecurity solutions to address the sophistication of modern threats. Machine learning algorithms enable real-time anomaly detection, automated threat correlation, and predictive risk assessment that traditional rule-based systems cannot achieve. Security operations centers leverage AI to prioritize alerts, reducing analyst fatigue while accelerating mean time to detection. In March 2024, Microsoft Corporation announced a skill development program targeting 100,000 Filipino women in AI and cybersecurity, demonstrating the growing intersection of these technologies in the Philippine market.

Managed Security Services Adoption Surge

The persistent cybersecurity talent shortage is driving Philippine organizations toward managed security service providers for monitoring, incident response, and compliance management. Enterprises facing hiring constraints increasingly view MSSPs as extensions of internal IT teams rather than outsourced functions. Local system integrators benefit as global vendors rely on them for customization and regulatory compliance mapping. This trend resonates particularly with mid-market companies lacking resources for dedicated security operations centers, enabling them to access enterprise-grade protection through subscription-based operational expenditure models.

Zero-Trust Architecture Implementation Acceleration

Philippine organizations are transitioning from perimeter-based security models to zero-trust frameworks that continuously verify every access request regardless of source. The proliferation of remote work, cloud migration, and bring-your-own-device policies has expanded attack surfaces beyond traditional network boundaries. Financial institutions and government agencies lead adoption, implementing identity orchestration, behavioral biometrics, and micro-segmentation to protect sensitive assets. This architectural shift emphasizes continuous authentication, least-privilege access principles, and comprehensive visibility across hybrid environments.

Market Outlook 2026-2034:

The Philippines cybersecurity market demonstrates strong growth prospects underpinned by accelerating digital transformation, expanding threat landscape, and supportive regulatory environment. Government initiatives including the National Cybersecurity Plan 2023-2028 establish workforce development, policy frameworks, and critical infrastructure protection milestones that accelerate private sector procurement cycles. The market generated a revenue of USD 1.4 Billion in 2025 and is projected to reach a revenue of USD 2.8 Billion by 2034, growing at a compound annual growth rate of 8.08% from 2026-2034. Continued expansion of digital payment platforms, 5G network deployments, and cloud adoption will sustain demand for advanced security solutions. Enterprises increasingly prioritize cybersecurity investments to protect digital assets and maintain regulatory compliance.

Philippines Cybersecurity Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Solutions |

52% |

|

Deployment Type |

On-premises |

55% |

|

User Type |

Large Enterprises |

63% |

|

Industry Vertical |

BFSI |

32% |

|

Region |

Luzon |

68% |

Component Insights:

- Solutions

- Identity and Access Management (IAM)

- Infrastructure Security

- Governance, Risk and Compliance

- Unified Vulnerability Management Service Offering

- Data Security and Privacy Service Offering

- Others

- Services

- Professional Services

- Managed Services

Solutions dominate with a market share of 52% of the total Philippines cybersecurity market in 2025.

The solutions segment encompasses comprehensive security platforms that provide enterprises with integrated capabilities for threat prevention, detection, and response. Philippine organizations increasingly prefer unified security suites that consolidate multiple functions including endpoint protection, network security, and vulnerability management into cohesive platforms. This consolidation reduces operational complexity while improving threat visibility across diverse IT environments. Government agencies are expanding procurement of security solutions, establishing benchmarks that influence private sector adoption and driving broader market growth. The preference for integrated platforms reflects enterprise recognition that fragmented point solutions create management burdens and security gaps.

Identity and access management solutions are gaining prominence as enterprises implement zero-trust security models requiring continuous authentication and authorization. Data security platforms experience heightened demand as organizations navigate stringent data protection regulations and address ransomware threats targeting sensitive information assets. Infrastructure security solutions protect critical systems from increasingly sophisticated attacks, while governance, risk, and compliance tools help enterprises demonstrate regulatory adherence and manage cyber risk exposure across expanding digital footprints encompassing cloud environments, mobile endpoints, and operational technology networks.

Deployment Type Insights:

- Cloud-based

- On-premises

On-premises leads with a share of 55% of the total Philippines cybersecurity market in 2025.

On-premises deployment maintains market leadership as Philippine enterprises, particularly in highly regulated sectors, prioritize data sovereignty and direct infrastructure control. Financial institutions subject to central bank cybersecurity guidelines often mandate local data residency for sensitive security operations to ensure compliance with regulatory frameworks governing financial data handling. Government agencies implementing the National Cybersecurity Plan similarly prefer on-premises installations that align with national security considerations. The Philippine Digital Infrastructure Project worth USD 288 Million supports domestic infrastructure development, reinforcing organizational preferences for locally deployed security systems. Ongoing domestic infrastructure development initiatives reinforce organizational preferences for locally deployed security systems that provide complete visibility and control over sensitive operations.

Cloud-based deployments are experiencing accelerated growth as enterprises recognize scalability benefits and seek to reduce capital expenditure on security infrastructure. Hybrid deployment models enable organizations to maintain on-premises systems for critical applications while leveraging cloud-native security tools for distributed workforce protection and elastic threat detection capabilities. Managed detection and response services delivered via cloud platforms address the cybersecurity talent shortage by providing access to expert analysts without requiring significant internal hiring investments.

User Type Insights:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises exhibit a clear dominance with a 63% share of the total Philippines cybersecurity market in 2025.

Large enterprises command the majority market share due to substantial IT security budgets, complex infrastructure requiring sophisticated protection, and stringent compliance obligations across multiple regulatory frameworks. Major corporations in banking, telecommunications, and business process outsourcing sectors maintain dedicated security operations centers and implement comprehensive defense-in-depth strategies. According to Fortinet's 2024 Global Cybersecurity Skills Gap Report, 94% of organizations in the Philippines experienced at least one security breach, with large enterprises particularly targeted due to their valuable data assets.

Enterprise security strategies increasingly incorporate advanced threat intelligence platforms, security orchestration and automation tools, and continuous vulnerability assessment programs to proactively identify and remediate weaknesses before exploitation occurs. Board-level awareness of cybersecurity risks has elevated security investments from operational expenditures to strategic priorities, with executive leadership recognizing that robust protection underpins business continuity, regulatory compliance, and stakeholder confidence. Large enterprises also drive demand for specialized consulting services, penetration testing, and incident response retainers that ensure rapid expert assistance during security events requiring immediate containment and remediation actions.

Industry Vertical Insights:

Access the Comprehensive Market Breakdown Request Sample

- IT and Telecom

- Retail

- BFSI

- Healthcare

- Defense/Government

- Manufacturing

- Energy

- Others

BFSI represent the leading segment with a 32% share of the total Philippines cybersecurity market in 2025.

The banking, financial services, and insurance sector leads cybersecurity investments due to the critical nature of financial data protection and stringent regulatory requirements from the central bank. The rapid expansion of digital payment transactions continues to expose banks and e-wallet operators to increasingly sophisticated fraud schemes, necessitating advanced security measures across all digital touchpoints. Financial institutions deploy AI-based analytics for real-time anomaly detection, partner with anti-fraud specialists, and implement robust identity verification systems to protect expanding digital banking channels. The growing adoption of mobile banking applications and contactless payment solutions further amplifies the need for comprehensive endpoint security and transaction monitoring capabilities.

The sector's cybersecurity posture is reinforced by central bank mandates requiring comprehensive risk management frameworks for electronic money issuers and digital banks. Open banking initiatives necessitate substantial API security investments while accelerating digital transformation continuously expands attack surfaces across interconnected financial ecosystems. Institutions increasingly recognize that strategic security investments can support rather than impede innovation, enabling them to deliver seamless customer experiences while maintaining robust protection against evolving cyber threats targeting the Philippine financial services landscape.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon dominates the market with a share of 68% of the total Philippines cybersecurity market in 2025.

Luzon maintains market dominance due to Metro Manila's status as the nation's economic, financial, and technological hub housing the majority of corporate headquarters, banks, technology companies, and government agencies. The National Capital Region concentrates critical infrastructure requiring robust protection while serving as the primary location for business process outsourcing operations that demand stringent security certifications. The Philippine Digital Infrastructure Project is completing national fiber backbone connections linking Metro Manila to Southern Luzon, enhancing connectivity while creating additional cybersecurity requirements for network protection.

The region benefits from superior digital infrastructure connectivity, skilled workforce availability, and proximity to regulatory bodies that facilitate compliance-driven security implementations. Government cybersecurity initiatives primarily emanate from agencies located in Metro Manila, creating localized demand for security solutions while establishing standards adopted nationwide. Educational institutions and training centers concentrated in Luzon produce the majority of cybersecurity professionals entering the workforce. Additionally, the presence of major technology parks, special economic zones, and innovation hubs attracts security vendors establishing regional operations, further reinforcing Luzon's position as the cybersecurity market epicenter.

Market Dynamics:

Growth Drivers:

Why is the Philippines Cybersecurity Market Growing?

Escalating Cyber Threats and Attack Sophistication

The Philippines faces an intensifying cyber threat landscape characterized by increasingly sophisticated attacks targeting government agencies, financial institutions, and critical infrastructure. Malicious actors employ advanced techniques including AI-powered phishing campaigns, ransomware-as-a-service operations, and supply chain compromise tactics that challenge traditional security defenses. The country remains among the top ten most targeted nations globally for malware, phishing attempts, and ransomware attacks. Major institutions from government agencies to hospitals and universities have experienced cyberattacks resulting in data leaks, service disruptions, and reputational damage. BlueVoyant reported that 84% of surveyed Philippines organizations suffered at least one breach in 2024, averaging 3.13 incidents per organization. This alarming breach frequency compels enterprises to expand security investments and implement multi-layered defense strategies encompassing advanced threat intelligence, behavioral analytics, and automated incident response capabilities.

Government Initiatives and Regulatory Framework Strengthening

The Philippine government has established comprehensive cybersecurity frameworks that stimulate market growth through compliance requirements and public sector modernization. The administration has approved a national cybersecurity plan providing policy direction and operational guidelines for building national cyber defenses across public and private sectors. The Department of Information and Communications Technology received substantial budget increases enabling expanded cybersecurity programs and workforce development initiatives throughout the country. The government prioritizes training cybersecurity professionals through capacity building programs and academic partnerships to address persistent talent shortages affecting organizational security postures. These initiatives establish benchmarks that influence private sector security standards while creating procurement opportunities for security vendors seeking government contracts. The clarity of mandated controls has become a primary catalyst for enterprise action, particularly among government suppliers seeking contract eligibility and organizations operating in regulated industries requiring demonstrated compliance with national security frameworks.

Digital Transformation and Expanding Attack Surfaces

Rapid digital transformation across Philippine industries fundamentally expands cybersecurity requirements as organizations migrate operations to cloud platforms, implement IoT devices, and enable distributed workforces. The shift of businesses and services to internet-based models including e-commerce, digital transactions, remote employment, and online learning creates new attack vectors requiring protection. Financial technology expansion drives particular urgency as digital payment transactions and e-wallet adoption expose users to fraud schemes. The Philippines' suggested budget for 2024 allocated P38.75 Billion for digitalization efforts, representing a 60.6% increase from the previous year aimed at improving public services and digital infrastructure. This substantial investment in digital transformation correspondingly amplifies demand for cybersecurity solutions to protect newly digitized systems, sensitive data flows, and citizen information across expanding government and private sector digital ecosystems.

Market Restraints:

What Challenges the Philippines Cybersecurity Market is Facing?

Acute Cybersecurity Talent Shortage

The Philippines faces a critical shortage of qualified cybersecurity professionals that constrains market growth and leaves organizations vulnerable to threats. The majority of organizations report that the skills shortage creates additional security risks, with many enterprises experiencing breaches partially attributed to talent deficits and inadequate staffing levels. Brain drain to foreign companies offering higher compensation exacerbates domestic shortages, with cybersecurity professionals migrating to opportunities in other countries where salaries and career advancement prospects exceed local offerings. Educational institutions and training programs have not kept pace with rapidly evolving industry demands.

Budget Constraints Among Small and Medium Enterprises

Small and medium enterprises comprising the vast majority of Philippine businesses face significant financial barriers to implementing comprehensive cybersecurity measures. Most SMEs lack in-house security teams or even basic protocols to defend against increasingly sophisticated threats targeting smaller organizations. Limited budgets force difficult prioritization decisions between security investments and other operational needs, leaving many smaller organizations vulnerable to attacks that can prove catastrophic for business continuity and customer trust. Resource constraints often result in delayed security upgrades and insufficient employee training programs.

Supply Chain Security Visibility Gaps

Philippine organizations struggle to manage third-party cyber risks within increasingly complex supply chains spanning multiple vendors and partners. Many enterprises report having no capability to detect cybersecurity incidents within their supply chains, while a significant portion acknowledge that third-party risk management is not adequately prioritized within their security strategies. This visibility gap creates exploitable weaknesses as attackers target vendors and partners to compromise primary organizations, particularly in interconnected industries relying on extensive digital partnerships and outsourced services requiring data sharing arrangements.

Competitive Landscape:

The Philippines cybersecurity market features a dynamic competitive environment dominated by established multinational technology corporations alongside emerging regional specialists. Global vendors leverage extensive product portfolios, research capabilities, and brand recognition to capture enterprise accounts, while local system integrators provide essential customization, compliance mapping, and implementation services. Competition intensifies around managed security services as talent shortages drive outsourcing demand. Vendors differentiate through AI-enhanced threat detection, cloud-native architectures, and integrated platforms that consolidate multiple security functions. Strategic partnerships between international vendors and Philippine distributors expand market coverage, while vendor consolidation trends encourage buyers to prefer fewer suppliers with broader capabilities.

Philippines Cybersecurity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Types Covered | Cloud-based, On-premises |

| User Types Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | IT and Telecom, Retail, BFSI, Healthcare, Defense/Government, Manufacturing, Energy, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines cybersecurity market size was valued at USD 1.4 Billion in 2025.

The Philippines cybersecurity market is expected to grow at a compound annual growth rate of 8.08% from 2026-2034 to reach USD 2.8 Billion by 2034.

Solutions dominated the market with a share of 52%, driven by enterprise demand for integrated security platforms providing comprehensive threat prevention, detection, and response capabilities across diverse IT environments.

Key factors driving the Philippines cybersecurity market include escalating cyber threats and attack sophistication, government initiatives such as the National Cybersecurity Plan 2023-2028, rapid digital transformation expanding attack surfaces, and regulatory requirements mandating security compliance.

Major challenges include acute cybersecurity talent shortage with 77% of organizations reporting skills gaps creating additional risks, budget constraints among small and medium enterprises, limited supply chain security visibility, and high frequency of breaches with 84% of organizations experiencing incidents.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)