Philippines Data Center Chip Market Size, Share, Trends and Forecast by Chip Type, Data Center Size, Industry Vertical, and Region, 2025-2033

Philippines Data Center Chip Market Overview:

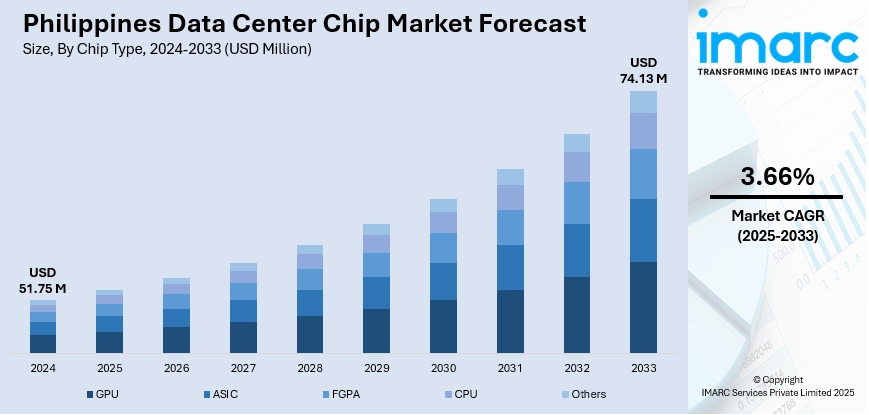

The Philippines data center chip market size reached USD 51.75 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 74.13 Million by 2033, exhibiting a growth rate (CAGR) of 3.66% during 2025-2033. The Philippines’ expanding cloud adoption, supportive regulations like the Public Service Act, and rising internet penetration drive data center demand. These factors are strengthening the Philippines data center market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.75 Million |

| Market Forecast in 2033 | USD 74.13 Million |

| Market Growth Rate 2025-2033 | 3.66% |

Philippines Data Center Chip Market Trends:

Cloud and Digital Service Expansion

The increasing adoption of cloud computing, over-the-top (OTT) content, and digital transformation across sectors such as finance, e-commerce, and education is driving significant demand for scalable and low-latency data infrastructure in the Philippines. To address this, hyperscale and colocation providers are actively investing in local data center facilities, particularly in regions outside the National Capital Region. These developments aim to enhance service performance and meet the growing expectations of users and enterprises. The ongoing expansion of digital infrastructure underscores the critical need for resilient and high-capacity systems. This trend is a major contributor to the growth of the country’s data center market, enabling broader access to digital services and supporting national digitalization objectives. For instance, in December 2024, STT GDC Philippines topped off STT Fairview 1, the first building of the country’s largest carrier-neutral, AI-ready data center campus. Scheduled to begin Phase 1 operations by Q2 2025, the facility offers advanced cooling, high power capacity, and sustainable design. Once complete, it will contribute to a national total of over 150 MW IT capacity across seven sites, all powered by 100% renewable energy. This expansion supports rising demand from hyperscalers and AI-driven enterprises in the Philippines' fast-growing digital economy.

To get more information on this market, Request Sample

Investment from Global Hyperscalers and Infrastructure Players

Global technology leaders are expanding their presence in the Philippines through new investments and the development of large-scale data center facilities. For instance, Alibaba Cloud is expanding its AI cloud services in the Philippines by opening its second data center in October 2025. This move supports growing demand for AI-driven cloud computing and digital transformation in the country. Alibaba’s investment is part of a broader regional strategy to strengthen cloud infrastructure across Southeast Asia. These investments bring advanced infrastructure, technical expertise, and operational scale to the local market, improving service reliability and international connectivity. The presence of major global players enhances the country’s competitiveness as a regional data center hub in Southeast Asia. As a result, the Philippines data center chip market growth is experiencing continuous acceleration, fueled by capital infusion, technological advancement, and integration into the broader global digital infrastructure network.

Philippines Data Center Chip Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on chip type, data center size, and industry vertical.

Chip Type Insights:

- GPU

- ASIC

- FGPA

- CPU

- Others

The report has provided a detailed breakup and analysis of the market based on the chip type. This includes GPU, ASIC, FGPA, CPU, and others.

Data Center Size Insights:

- Small and Medium Size

- Large Size

The report has provided a detailed breakup and analysis of the market based on the data center size. This includes small and medium size and large size.

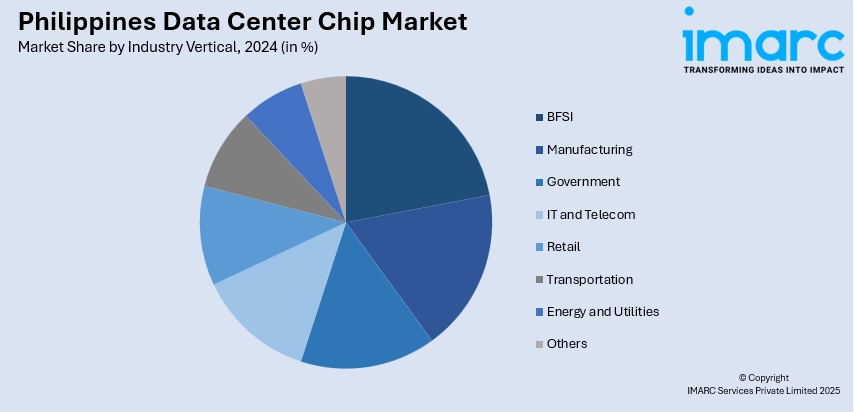

Industry Vertical Insights:

- BFSI

- Manufacturing

- Government

- IT and Telecom

- Retail

- Transportation

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, manufacturing, government, it and telecom, retail, transportation, energy and utilities, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major country markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Data Center Chip Market News:

- In April 2025, PLDT launched the Philippines’ first AI-first, GPU-powered hyperscale data center, VITRO Sta. Rosa (VSR), offering 50MW capacity and the country’s first GPU as a Service (GPUaaS) powered by NVIDIA. Located in Laguna, VSR is globally connected via subsea cables and aims to scale to 500MW, positioning the Philippines as a regional digital hub. VSR serves telcos, enterprises, and cloud providers, accelerating AI-driven digital transformation in sectors like healthcare, finance, and logistics.

Philippines Data Center Chip Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chip Types Covered | GPU, ASIC, FGPA, CPU, Others |

| Data Center Sizes Covered | Small and Medium Size, Large Size |

| Industry Verticals Covered | BFSI, Manufacturing, Government, IT and Telecom, Retail, Transportation, Energy and Utilities, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines data center chip market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines data center chip market on the basis of chip type?

- What is the breakup of the Philippines data center chip market on the basis of data center size?

- What is the breakup of the Philippines data center chip market on the basis of industry vertical?

- What are the various stages in the value chain of the Philippines data center chip market?

- What are the key driving factors and challenges in the Philippines data center chip market?

- What is the structure of the Philippines data center chip market and who are the key players?

- What is the degree of competition in the Philippines data center chip market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines data center chip market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines data center chip market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines data center chip industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)