Philippines Data Center Construction Market Size, Share, Trends and Forecast by Construction Type, Data Center Type, Tier Standards, Vertical, and Region 2026-2034

Philippines Data Center Construction Market Size and Share:

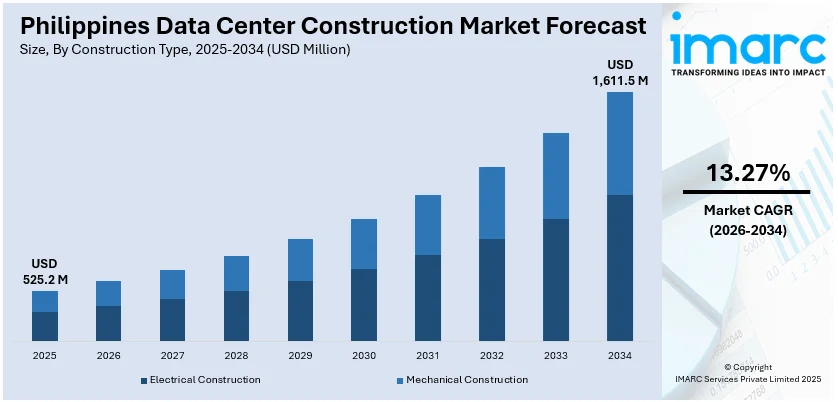

The Philippines data center construction market size reached USD 525.2 Million in 2025. Looking forward, the market is expected to reach USD 1,611.5 Million by 2034, exhibiting a growth rate (CAGR) of 13.27% during 2026-2034. The Philippines data center construction market share is expanding, driven by the increasing implementation of favorable initiatives by governing agencies that support digital transformation and artificial intelligence (AI). These agencies create the need for data centers, along with the rising adoption of cloud computing, which necessitates sophisticated infrastructure featuring rapid connectivity, effective cooling, and robust security, motivating developers to create contemporary and scalable data centers, which further contributes to the increase in Philippines data center construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 525.2 Million |

| Market Forecast in 2034 | USD 1,611.5 Million |

| Market Growth Rate (2026-2034) | 13.27% |

Key Trends of Philippines Data Center Construction Market:

Rising adoption of AI

The increasing adoption of AI is impelling the Philippines data center construction market growth. AI-oriented applications, including machine learning (ML) and big data analytics, require high-performance data centers to process and store massive amounts of information. As businesses and government agencies employ AI-driven solutions, the need for modern, scalable, and energy-efficient data centers rises. AI also improves data center operations by optimizing power usage, cooling systems, and security, making facilities more reliable and cost-effective. With the country’s growing digital economy, companies invest in AI-focused automation to enhance performance and reduce downtime. Apart from this, tech companies are expanding their presence in the Philippines, leading to more data center projects. Government initiatives supporting digital transformation and AI adoption further contribute to the Philippines data center construction market demand. According to the data published on the official website of the International Trade Administration (ITA), AI is a growing sub-sector in the Philippines. It was anticipated to hit USD 772.1 Million in 2024, with a yearly growth rate of nearly 29 percent, aiming for approximately USD 3.5 Billion by 2030.

To get more information on this market Request Sample

Increasing demand for cloud computing

The growing need for cloud computing is offering a favorable Philippines data center construction market outlook. Businesses and government agencies are shifting to digital operations. According to industry reports, the Philippines jumped 16 spots in the United Nations ‘E-Government Development Index, moving up from 89th in 2022 to 73rd in 2024. This notable advancement was achieved due to the nation's adoption of centralized cloud services and efforts to counter ineffectiveness. Organizations are using these cloud services for the storage of data, greater cybersecurity, and providing remote work solutions, translating to a need for more data centers to support huge workloads. E-commerce, fintech, and digital banking drive the demand for secure high-performing cloud infrastructure. Apart from this, data centers are being invested in by cloud providers and local telecom operators to cater to the increased demand for their services. Cloud computing requires a modern infrastructure with high-speed connectivity, effective cooling, and security. This is encouraging developers to build modern scalable data centers. Government initiatives promoting data localization further attract expenditure on cloud infrastructure. As organizations generate and process more data, the employment of reliable cloud storage solutions grows. This trend ensures the ongoing Philippines data center construction market growth and development.

Emergence of Hyperscale and Green Data Centers in the Philippines

Another significant trend influencing the Philippines data center construction industry is the sudden growth of hyperscale and energy-efficient data centers. With global cloud service providers looking to expand their presence in Southeast Asia, the Philippines is also emerging as a popular location because of its geographical position, developing digital economy, and enhanced energy infrastructure. The nation's growing dependence on digital services across sectors such as e-commerce, fintech, and government digitization has fueled demand for scalable, high-capacity data infrastructure. Hyperscale facilities are now being prioritized by developers that can efficiently manage massive data workloads. At the same time, there is a significant local drive toward green building standards, and new data centers are being designed to adopt energy-efficient cooling systems, renewable power sources, and environmental-friendly materials. According to the Philippines data center construction market analysis, the region’s emphasis on renewable energy, particularly solar and geothermal, gives it a special edge in terms of lowering the carbon footprint of these complexes. Both local needs and worldwide practices are hence represented by this focus on scale and sustainability.

Growth Drivers of Philippines Data Center Construction Market:

Accelerated Digital Transformation and Enterprise Need

The Philippines is in the midst of a fast-moving digital revolution, spurred on by both government and private industry. Public sector initiatives to push digital services—ranging from national identification systems to e-governance platforms—have boosted demand sharply for strong, secure IT infrastructure. Concurrently, local businesses and multinational corporations with Philippine operations, particularly in finance, health, and business process outsourcing (BPO), are investing in their digital capabilities. These sectors need mission-critical systems that require low-latency and high-availability data center facilities. As an example, Metro Manila, Cebu, and Clark regional BPO centers are growing, which means they need scalable data center capacity to support more complex workloads, secure data transfer, and maintain business continuity. To address these new needs, firms are committing to top-of-the-line facilities featuring tiered redundancy, sophisticated cooling infrastructure to accommodate high ambient temperatures, and robust security measures. This has led to a rush of construction activity that is focused on providing the reliable infrastructure necessary to underpin the Philippines' growing digital economy.

Strategic Location and Regional Interconnectivity

The Philippines' geographical location in Southeast Asia has become a crucial element in data center construction development. As a geographical nexus in Asia-Pacific markets, the Philippines is becoming a gateway to regional connectivity. Submarine cable landings along Manila, Batangas, and other coastal centers have improved international connections, making the Philippines an attractive location to global cloud providers and systems integrators looking to reach domestic and regional customers. These connectivity assets facilitate the building of high-density data centers that are able to serve inter-Asia traffic efficiently. Local telcos and network providers are also investing in fiber backhaul and metro network expansions underpinning the demand for new edge and central point-of-presences. This combined emphasis on international and domestic connectivity has led to a surge of fresh data center developments close to key interconnection hubs, as investors position themselves to take advantage of geographic differentiation. The outcome is a data center market influenced not only by local demand, but by the Philippines' increasing importance in cross-border digital networks.

Sustainability Emphasis and Resilient Infrastructure in a Climate-Exposure Country

Both business continuity and climate resilience are pushing the Philippines' data center sector to focus on sustainability and disaster-resistant construction. Located on the Pacific Ring of Fire and regularly hit by typhoons, the nation requires construction resilient to natural threats. Developers are incorporating seismic-resistant design, raised construction to avoid flood risk, and resilient backup power systems into new developments. While this is happening, increased corporate focus on ESG (environmental, social, and governance) has created green building certification, renewable energy sourcing adoption, and high-efficiency systems such as free-air cooling and re-use of heat initiatives. These are design choices that respond to local environmental conditions—tropical heat, for example, and unstable weather—and worldwide expectations regarding carbon footprint minimization. As a result, building companies are incorporating green best practices into design from the very beginning, with data center projects that provide not only performance and reliability, but also resiliency and environmental stewardship adapted to the Philippines' specific requirements.

Opportunities of Philippines Data Center Construction Market:

Underserved Regional Hubs and Decentralization

Although Metro Manila remains dominant by way of available data center infrastructure, tremendous opportunity remains to expand into under-served regional markets. Davao, Cebu, Iloilo, and Clark are among the cities being viewed with more investment interest because they have developing business ecosystems, better infrastructure, and access to land at relatively lower prices. With government initiatives driving decentralized economic growth, these cities are proving to be the key sites for secondary and edge data centers. The potential is in serving local enterprise needs, hosting remote government services, and providing lower-latency access to rural communities increasingly dependent on digital platforms. Universities and pools of skilled labor are also available in close proximity within these areas, providing a sustainable basis for long-term operational support. For investors and developers, early entry into these non-Metro markets offers an opportunity to claim leading footprints and cater to a wider national base presently constrained by connectivity bottlenecks and centralized infrastructure.

Renewable Energy Integration and Green Construction

Increasing need for sustainable infrastructure offers significant opportunity in the Philippines data center construction sector. With the Philippines' rich renewable energy sources—solar, hydro, and geothermal—a developer has a strong motivation to build energy-efficient facilities that mirror global patterns toward sustainability. The Philippines' track record towards climate action and carbon reduction is influencing domestic as well as international investors to invest in green designs, particularly in energy-hungry industries such as data centers. Building companies that combine solar-ready roofs, battery storage solutions, and water-conserving cooling systems can attract green customers while lowering long-term operational expenses. In areas such as Ilocos, Bataan, and Mindoro, where renewable energy projects are pending or already operational, collocating data centers close to these resources can reap both logistical and economic benefits. By integrating green energy initiatives with infrastructure development, the Philippines data center industry can establish a competitive niche while enabling national sustainability objectives.

Public-Private Partnerships and Policy Support

The Philippines government's shift toward digital infrastructure building presents ample opportunities through public-private partnerships (PPPs). Government agencies have launched programs to digitize governing, enable e-learning, and digitize public healthcare—each demanding secure and reliable data storage and transmission. National agencies and local government units are seriously looking into partnerships with private sector players in co-developing secure and resilient facilities accommodating public services. This provides developers with the opportunity to partner on strategic infrastructure and take advantage of regulatory backing and incentives to facilitate permitting. Furthermore, green energy-friendly policies and fiscal incentives for infrastructure development render the Philippines an appealing hub for sustainable data center investment. These partnerships represent a rare opportunity to build mission-critical infrastructure with assured utilization, aligning with national development agendas. Through tapping these collaborations, developers can win long-term contracts and contribute to shaping the nation's digital infrastructure in ways that foster inclusive and resilient growth.

Challenges of Philippines Data Center Construction Market:

Limitations in Infrastructure and Energy Supply Restraints

Among the most urgent issues in building data centers throughout the Philippines is the lack of available infrastructure, especially power and connectivity. Though major cities such as Metro Manila and Cebu enjoy developed utilities, a majority of up-and-coming areas lack stable electricity supply, voltage stability, and access to redundant grid structures. These are major concerns to data center availability and long-term operational efficacy. Additionally, even in highly connected zones, the cost of energy is high, and there is limited capacity for large-scale, unintermittent power supply. This is problematic for hyperscale facilities that need uninterrupted, high-load consumption. Moreover, the unbalanced expansion of fiber optic connections throughout the archipelago makes site selection for data center projects even more difficult. Areas outside Luzon could have weak last-mile connectivity or no access to submarine cable landing stations. These limitations compel developers to either invest heavily in support infrastructure or restrict building to already-congested urban areas.

Natural Disaster Risks and Climate Resilience

The geographical position of the Philippines exposes it to strong natural hazards like typhoons, floods, earthquakes, and volcanic eruptions. All these environmental hazards pose significant challenges to the construction and long-term stability of data centers. The selection of the site will need to consider seismic zones, flood plains, and wind exposure, necessitating bespoke solutions like raised flooring, supported constructions, and specialized cooling systems. These additional design factors drive higher initial construction expense and lengthen project timelines. Additionally, severe weather can interrupt construction logistics, cause delivery delays, and destroy equipment prior to deployment. Even finished buildings demand ongoing expenditure in disaster readiness, including high-capacity backup generators, automated shutdown mechanisms, and remote monitoring equipment. Evacuation routes and emergency services in remote locations might be limited, raising operational risk. Such environmental facts of life render resilience an indispensable element in Philippine data center construction, presenting levels of complexity foreign investors and local contractors need to navigate with caution.

Regulatory Complexity and Bureaucratic Delays

Even with growing government interest in cyber infrastructure, operating within the regulatory framework for data center development in the Philippines can be a challenge. Developers usually encounter duplicative requirements between national and local government agencies, such as zoning approvals, environmental clearances, energy consumption permits, and tax registration. Variability of regional interpretations of national laws can cause project approval delays, even for technically qualified sites. In addition, bureaucratic procedures can be hampered by limited resources or paper-based documentation systems retained by some municipalities. Such delays can drive up construction schedules and discourage foreign investment, particularly from firms familiar with efficient permitting processes. Although recent policy reforms have sought to enhance ease of doing business, effective implementation at the local level varies across municipalities. Moreover, inexperience with the technical requirements of data centers from some regulatory agencies can lead to demands that are not effective for the industry. Working through these challenges necessitates local alliances, legal guidance, and proactive cooperation with authorities to steer clear of costly delays.

Philippines Data Center Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on construction type, data center type, tier standards, and vertical.

Construction Type Insights:

- Electrical Construction

- Mechanical Construction

The report has provided a detailed breakup and analysis of the market based on the construction types. This includes electrical construction and mechanical construction.

Data Center Type Insights:

- Mid-Size Data Centers

- Enterprise Data Centers

- Large Data Centers

A detailed breakup and analysis of the market based on the data center types have also been provided in the report. This includes mid-size data centers, enterprise data centers, and large data centers.

Tier Standards Insights:

- Tier I and II

- Tier III

- Tier IV

The report has provided a detailed breakup and analysis of the market based on the tier standards. This includes tier I and II, tier III, and tier IV.

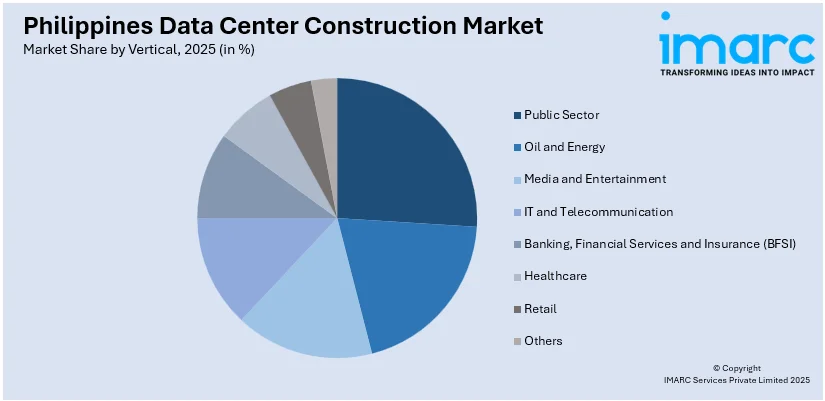

Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Public Sector

- Oil and Energy

- Media and Entertainment

- IT and Telecommunication

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Others

A detailed breakup and analysis of the market based on the verticals have also been provided in the report. This includes public sector, oil and energy, media and entertainment, IT and telecommunication, banking, financial services and insurance (BFSI), healthcare, retail, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Data Center Construction Market News:

- In September 2024, A-FLOW, a prominent company that develops and operates data centers in the Philippines, reached a significant construction milestone with the recent topping off of its new ML1 Data Centre located in Bian, Laguna, Philippines. The three-building carrier-neutral campus aimed to achieve high levels of energy efficiency, scalability, and security while prioritizing site resilience and reliability. The facility’s operational opening was planned for the fourth quarter of 2024. In the initial stage, the data center was to be equipped with a 6MW capacity ready for operation.

- In April 2025, the Philippines operator PLDT officially launched VITRO Sta. Rosa (VSR) asserts that it is the nation’s inaugural hyperscale data center designed specifically for managing Artificial Intelligence (AI) tasks. Created by VITRO, a division of ePLDT and the data center branch of PLDT, VSR is strategically positioned in the rapidly expanding tech corridor of Laguna. It has been functioning since July 2024 and presently caters to telcos, businesses, and worldwide cloud providers. The 50-megawatt data center is built to provide secure, high-performance solutions for AI and cloud applications.

- In April 2025, PLDT Chairman Manuel V. Pangilinan announced that the company intends to boost its data center capacity to 500 megawatts (MW), with the goal of equaling Malaysia’s capacity and reinforcing their dedication to making the Philippines a data center hub. Covering five hectares, VITRO Sta. Rosa is currently the largest data center campus in the country, providing a capacity of as much as 50 MW. The firm has acquired the location for its upcoming plant in General Trias, Cavite. The new facility, which is set to begin construction in 2026 and complete by 2028, will initially operate with a 20 MW capacity and will grow in stages to reach a maximum of 100 MW (double the capacity of VITRO Sta. Rosa).

Philippines Data Center Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Construction Types Covered | Electrical Construction, Mechanical Construction |

| Data Center Types Covered | Mid-Size Data Centers, Enterprise Data Centers, Large Data Centers |

| Tier Standards Covered | Tier I and II, Tier III, Tier IV |

| Verticals Covered | Public Sector, Oil and Energy, Media and Entertainment, IT and Telecommunication, Banking, Financial Services and Insurance (BFSI), Healthcare, Retail, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines data center construction market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines data center construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines data center construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines data center construction market was valued at USD 525.2 Million in 2025.

The Philippines data center construction market is projected to exhibit a CAGR of 13.27% during 2026-2034.

The Philippines data center construction market is expected to reach a value of USD 1,611.5 Million by 2034.

The Philippines data center construction market is fueled by fast digitalization, rising cloud use, and greater data storage needs across sectors. Government support, expanding internet penetration, and interest in efficient energy infrastructure also power the market. Pressure to build hyperscale and edge data centers further fuels market expansion and investment.

The Philippines data center construction market is witnessing hyperscale facility building, growth of edge computing, and accelerating demand for green, energy-efficient design. Moreover, strategic public-private alliances and supportive government policies are complemented by increasing foreign investment, cloud use, 5G deployment, and AI-led infrastructure demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)