Philippines Data Center Server Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

Philippines Data Center Server Market Summary:

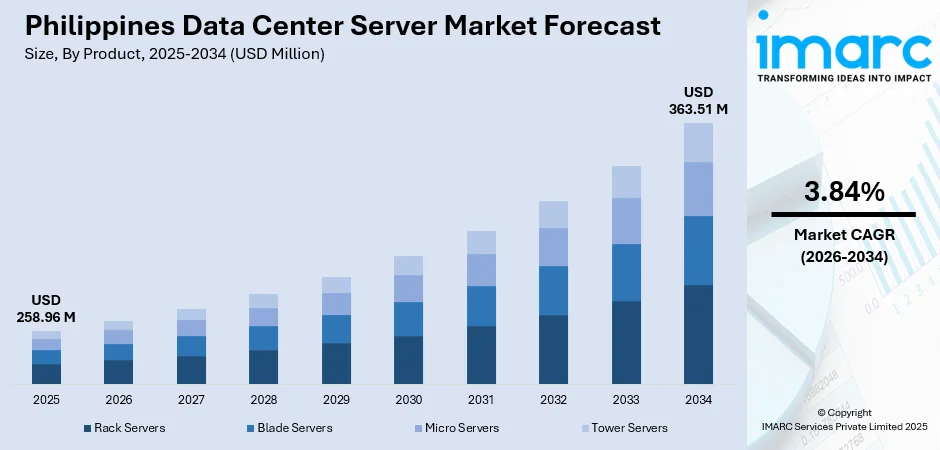

The Philippines data center server market size reached USD 258.96 Million in 2025. Looking forward, the market is expected to reach USD 363.51 Million by 2034, exhibiting a compound annual growth rate of 3.84% during 2026-2034.

Growing cloud use, digital transformation projects, and the expansion of IT infrastructure throughout the Philippines are driving the market's steady rise. Investments in cutting-edge server technology are being driven by growing demand from the banking, financial services, telecommunications, and e-commerce sectors. The country's strategic position as a regional digital hub, coupled with government initiatives supporting digital infrastructure development, is increasing operational efficiency and scalability across enterprise data centers, consequently strengthening the Philippines data center server market share.

Key Takeaways and Insights:

- By Product: Rack servers dominate the market with a 55% share in 2025, driven by their compact design, cost-effectiveness, and suitability for cloud computing environments.

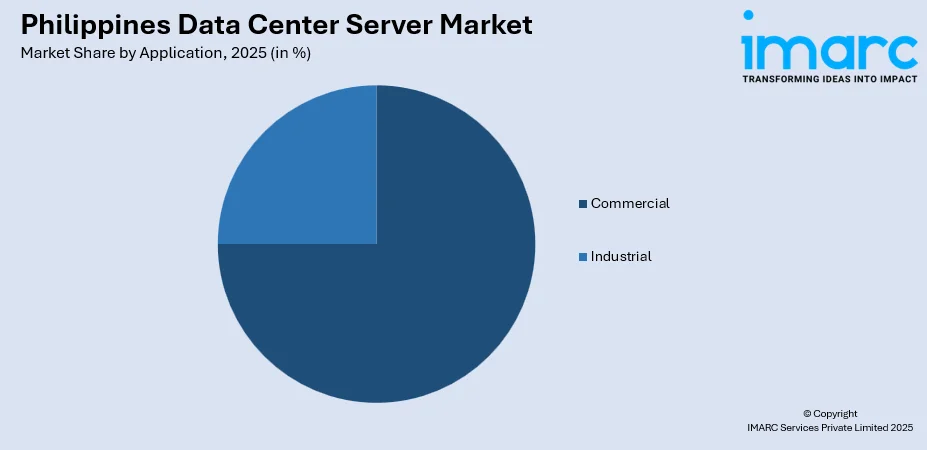

- By Application: The commercial segment leads the market with a 75% share in 2025, reflecting strong demand from financial services, telecommunications, and hyperscale cloud providers.

- Key Players: The market features a diverse mix of global IT infrastructure providers, multinational server manufacturers, and local telecommunications companies with data center subsidiaries driving competition and innovation.

To get more information on this market, Request Sample

The Philippines data center server market is moving quickly as the country’s digital economy gains strength. Growth is fueled by rising e-commerce activity, wider use of financial technology, and steady cloud migration among businesses of all sizes. Global operators are putting in fresh capital to expand capacity, and their interest is encouraging stronger competition and better technology standards. Government programs, including the National Broadband Plan and related digital infrastructure efforts, are helping create a friendlier environment for deployment, modernization, and long-term investment. Altogether, these factors are pushing the market toward faster adoption of advanced server solutions.

Philippines Data Center Server Market Trends:

Rising Cloud Adoption and Digital Transformation

Digital transformation across Philippine enterprises is accelerating data volumes, requiring robust server infrastructure for storage and processing. Cloud migration is intensifying as businesses across banking, retail, and telecommunications sectors adopt cloud-first strategies. In December 2024, Huawei Cloud launched its Philippines region, becoming the country's first local public cloud provider with three availability zones and over 100 cloud services. This development underscores growing demand for localized, high-performance server solutions capable of supporting advanced workloads.

Growth of AI-Ready Data Center Infrastructure

The Philippines is witnessing significant investment in AI-capable server infrastructure to support emerging computational demands. In April 2025, PLDT inaugurated VITRO Sta. Rosa, the country's first AI-ready hyperscale data center with 50 MW capacity, equipped with NVIDIA-powered GPU servers. This facility enables businesses to leverage GPU-as-a-Service offerings for artificial intelligence, machine learning, and high-performance computing workloads, signaling a strategic shift toward AI-enabled server deployments.

Hyperscale and Carrier-Neutral Facility Expansion

The expansion of hyperscale and carrier-neutral data centers is reshaping server demand patterns in the Philippines. In December 2024, ST Telemedia Global Data Centres Philippines completed the structural framework of STT Fairview 1, which upon full completion will become the country's largest data center with 124 MW IT capacity. This facility is designed to support hyperscaler requirements and AI workloads, driving procurement of advanced rack and blade server configurations.

Market Outlook 2026-2034:

The Philippines data center server market is poised for sustained expansion over the forecast period, driven by accelerating digitalization, government infrastructure programs, and foreign investment inflows. The market generated a revenue of USD 258.96 Million in 2025 and is projected to reach a revenue of USD 363.51 Million by 2034, growing at a compound annual growth rate of 3.84% from 2026-2034. Cloud services expansion, AI adoption, and e-commerce growth will continue to fuel demand for high-performance servers. Government initiatives supporting 100% foreign ownership in data centers and fiscal incentives under the CREATE MORE Act are expected to attract substantial global investments.

Philippines Data Center Server Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Rack Servers | 55% |

| Application | Commercial | 75% |

Product Insights:

- Rack Servers

- Blade Servers

- Micro Servers

- Tower Servers

Rack servers lead with a share of 55% of the total Philippines data center server market in 2025.

Rack servers dominate the Philippines data center server market due to their cost-effectiveness, compact footprint, and suitability for high-density computing environments. These servers are particularly favored by organizations that prioritize space efficiency without requiring the extreme modularity of blade solutions. Cloud service providers and enterprises migrating workloads to colocation facilities increasingly deploy rack servers to support diverse applications ranging from web hosting to database management and virtualization workloads.

The increased use of cloud-based IT solutions among Philippine firms is reinforcing rack server demand. According to an Alibaba Cloud-commissioned report, 85% of Philippine enterprises intend to be completely cloud-enabled by 2025. Scalable, dependable server infrastructure that can manage growing data volumes and challenging workloads is necessary for this fast cloud migration. Alibaba Cloud's commitment to expanding investments in the Philippines, following its local data center launch, further validates the strong growth trajectory for rack server deployments.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Industrial

- Commercial

The commercial segment holds a share of 75% of the total Philippines data center server market Rack market in 2025.

The commercial segment dominates the Philippines data center server market, driven by robust demand from financial services, telecommunications, and information technology sectors. Data center customers in the Philippines predominantly include banks, insurance companies, telecom operators, and hyperscale cloud providers, all of which have adopted cloud-first policies to optimize computing resources and reduce operational costs. The financial services sector, in particular, requires high-performance servers for real-time transaction processing, fraud detection, and regulatory compliance workloads.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Growth in the Luzon region is anchored by Metro Manila's concentration of enterprise headquarters, financial institutions, and technology companies. The National Capital Region benefits from advanced telecommunications infrastructure, high-speed internet connectivity, and access to a skilled IT workforce. Major data center developments including VITRO Sta. Rosa in Laguna and STT Fairview in Quezon City are expanding capacity in the greater Luzon region. Central Luzon, particularly Clark Special Economic Zone, is emerging as a growth corridor due to turnkey incentives, available land parcels, and proximity to submarine cable landing points.

Visayas is emerging as a secondary data center hub, with Cebu positioned as the region's primary technology center. Edge computing nodes serving fintech, e-commerce, and media workloads are gaining traction in the region. However, power cost volatility remains a concern, with wholesale electricity rates experiencing significant fluctuations.

Mindanao is gaining strategic importance due to improved submarine cable connectivity. Davao's landing station introduces route diversity and positions the region as a potential gateway for international data traffic. Growing digitalization across agriculture and business process outsourcing sectors is gradually driving localized server infrastructure demand.

Market Dynamics:

Growth Drivers:

Why is the Philippines Data Center Server Market Growing?

Strategic Investments from Global Technology Players

Strategic investments by international data center operators are accelerating market development in the Philippines. Global companies are acquiring local assets and constructing new facilities to capitalize on the country's growing digital economy. In June 2025, Equinix completed the acquisition of three Manila data centers from Total Information Management, marking its formal entry into the Philippine market. The acquired facilities include more than 1,000 cabinets of carrier-neutral capacity and host four of Manila's main internet exchanges. This acquisition enables Equinix to immediately serve local and multinational customers seeking digital infrastructure in the fast-growing Southeast Asian market. Additionally, the Bases Conversion and Development Authority has leased 47 hectares in New Clark City for a planned 300 MW hyperscale campus, illustrating government support for large-scale data center development.

Government Digital Infrastructure Initiatives

Government-led programs targeting digital infrastructure development are creating favorable conditions for data center server investments. The National Broadband Plan and Digital Philippines Campaign are expanding connectivity nationwide and encouraging cloud adoption across public and private sectors. Under the CREATE MORE Act, data centers registered with investment promotion agencies are eligible for income tax holidays ranging from four to seven years, zero-rated VAT on local purchases, and duty-free importation of capital equipment. Republic Act 11659 opened data center ownership to 100% foreign equity, eliminating the previous 40% ceiling and accelerating inbound capital flows.

Expansion of E-Commerce and Digital Services

The rapid growth of e-commerce, digital payments, and online services is intensifying demand for high-performance server infrastructure. Filipinos are among the world's most active internet users. The Bangko Sentral ng Pilipinas reports that 50% of retail payments were digital in 2024, driving demand for real-time fraud detection and transaction processing capabilities. Content streaming, social media, and online gaming platforms are generating massive data loads requiring scalable server solutions.

Market Restraints:

What Challenges is the Philippines Data Center Server Market Facing?

High Electricity Costs and Power Supply Volatility

Electricity prices in the Philippines place a heavy burden on data center operators, cutting into margins and complicating long-term planning. Power supply swings add another layer of uncertainty, making it harder to manage operating expenses or ensure predictable performance. These conditions force operators to rely on more resilient energy strategies, further raising the cost of running facilities in the country.

Skilled Workforce Shortage

Data center operators continue to struggle with a limited pool of specialists who can manage advanced infrastructure, from engineering roles to HVAC and power system maintenance. The broader IT workforce is strong, yet highly technical training programs are still scarce. This gap slows deployment timelines, increases reliance on foreign expertise, and raises labor costs for projects that require deeper knowledge of modern server environments.

Land Availability and Infrastructure Constraints

Securing suitable land for data center construction is increasingly challenging, particularly in densely populated urban areas like Metro Manila. Limited land availability drives up costs and complicates site selection for large-scale developments. Power grid constraints outside Metro Manila require significant investment in backup systems and dedicated power feeders to ensure operational reliability.

Competitive Landscape:

The Philippines data center server market features a diverse mix of global IT infrastructure providers and local telecommunications companies. Leading international server vendors have established strong market presence, providing enterprise-grade solutions to data center operators across the country. Local telecommunications giants are major market participants through their data center subsidiaries, leveraging existing network infrastructure and customer relationships. The market has attracted new entrants from global digital infrastructure companies, intensifying competition and driving technology upgrades across the sector. Strategic partnerships between international cloud vendors and local operators are promoting improved connectivity and infrastructure availability.

Philippines Data Center Server Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Rack Servers, Blade Servers, Micro Servers, Tower Servers |

| Applications Covered | Industrial, Commercial |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines data center server market size reached USD 258.96 Million in 2025.

The Philippines data center server market is expected to grow at a compound annual growth rate of 3.84% from 2026-2034 to reach USD 363.51 Million by 2034.

Rack servers lead the product segment with a 55% market share, driven by their compact design, cost-effectiveness, and suitability for cloud computing and colocation environments.

Key factors include increasing cloud adoption, digital transformation initiatives, expansion of e-commerce and digital payments, government infrastructure programs, and strategic investments from global technology players.

Key challenges include high electricity costs (the highest in Southeast Asia), power supply volatility, skilled workforce shortages in specialized data center roles, and limited land availability in urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)