Philippines Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Philippines Debt Collection Software Market Overview:

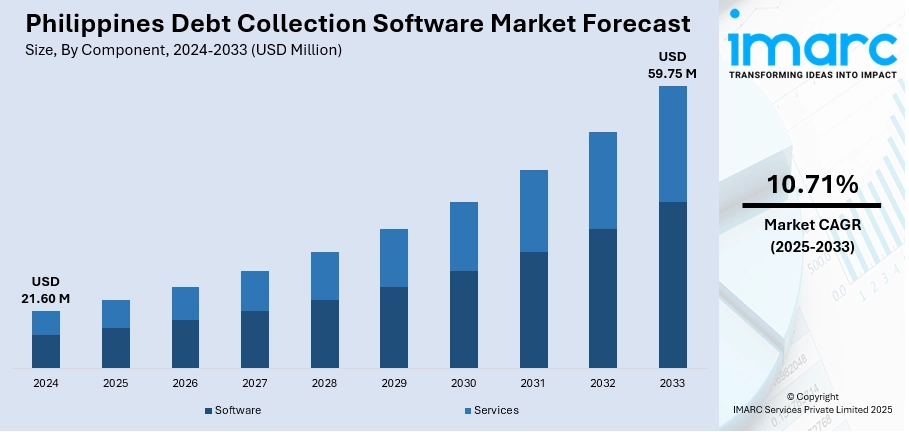

The Philippines debt collection software market size reached USD 21.60 Million in 2024. The market is projected to reach USD 59.75 Million by 2033, exhibiting a growth rate (CAGR) of 10.71% during 2025-2033. The market is expanding with rising adoption of automation, AI-based analytics, and cloud platforms. Growing focus on compliance, cost efficiency, and integration with digital payments continues to support the Philippines debt collection software market share across financial and collection service providers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 21.60 Million |

| Market Forecast in 2033 | USD 59.75 Million |

| Market Growth Rate 2025-2033 | 10.71% |

Philippines Debt Collection Software Market Trends:

Rising Adoption of Digital Tools

The Philippines debt collection software market growth is strongly influenced by the increasing reliance on digital solutions across banks, financial service providers, and collection agencies. Manual collection processes have long been associated with delays, limited transparency, and high labor costs. As companies look for efficiency, automation is emerging as a preferred approach, enabling faster communication, real-time payment tracking, and improved debtor management. Financial institutions are under pressure to manage rising volumes of overdue accounts, especially with economic uncertainties and fluctuating repayment capacities among consumers. Debt collection software provides structured workflows, digital reminders, and compliance monitoring, which reduce operational risks while ensuring that consumer rights are respected. Government and regulatory focus on fair debt recovery practices is also a driver, pushing organizations to use solutions that meet reporting and legal requirements. Additionally, the growth of digital payments in the Philippines aligns with the adoption of integrated systems that connect directly with online banking and e-wallet platforms. This creates a more seamless experience for both businesses and customers. Collectively, these drivers reflect a growing trend toward digital-first operations in the country, highlighting how technology adoption is steadily transforming the debt recovery ecosystem.

To get more information on this market, Request Sample

Growing Role of Analytics and AI

One of the trends influencing the Philippines debt collection software market is the growing application of data analytics and artificial intelligence. Organizations are increasingly adopting predictive solutions that analyze repayment trends, customer behavior, and account history to recommend customized strategies. It saves time and money in collections while increasing recovery. AI chatbots and automated messaging platforms are being deployed to sustain customer interaction, sending reminders and choices without the immediate need for human intervention. These technologies enable lenders to find a balance between efficiency and enhanced customer experience, which is paramount in a competitive financial services market. Analytics-fueled insights also aid compliance, with software capable of monitoring communication records and ensuring adherence to local regulatory requirements. As mobile payments and digital wallets become increasingly adopted in the Philippines, businesses prefer solutions that smoothly connect with new payment methods. Cloud deployment further fuels uptake, with scalability and cost-effectiveness for large and small agencies alike. Vendors are also differentiating more aggressively through features such as multilingual capabilities, customizable user interfaces, and mobile access, to meet the variability of Philippine firms. Together, these tech-based trends highlight how more intelligent, data-based recovery techniques are transforming debt collection in the nation.

Philippines Debt Collection Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

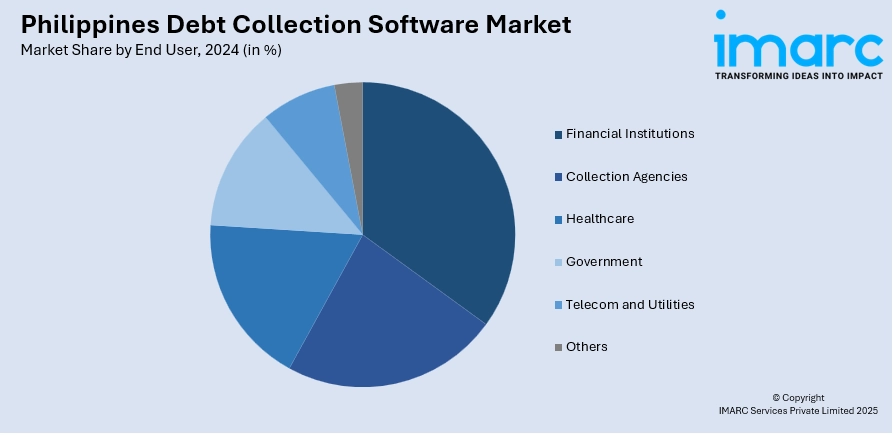

End User Insights:

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes financial institutions, collection agencies, healthcare, government, telecom and utilities, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Debt Collection Software Market News:

- February 2025: Helport AI launched its advanced debt collection software in the Philippines, offering AI-driven automation, predictive account prioritization, and compliance safeguards. The rollout improved recovery rates, reduced operational costs, and strengthened regulatory adherence, marking a significant development in the country’s debt collection software market.

Philippines Debt Collection Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Users Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines debt collection software market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines debt collection software market on the basis of component?

- What is the breakup of the Philippines debt collection software market on the basis of deployment mode?

- What is the breakup of the Philippines debt collection software market on the basis of organization size?

- What is the breakup of the Philippines debt collection software market on the basis of end user?

- What is the breakup of the Philippines debt collection software market on the basis of region?

- What are the various stages in the value chain of the Philippines debt collection software market?

- What are the key driving factors and challenges in the Philippines debt collection software market?

- What is the structure of the Philippines debt collection software market and who are the key players?

- What is the degree of competition in the Philippines debt collection software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines debt collection software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines debt collection software market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines debt collection software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)