Philippines DevOps Market Size, Share, Trends and Forecast by Type, Deployment Model, Organization Size, Tools, Industry Vertical, and Region, 2025-2033

Philippines DevOps Market Overview:

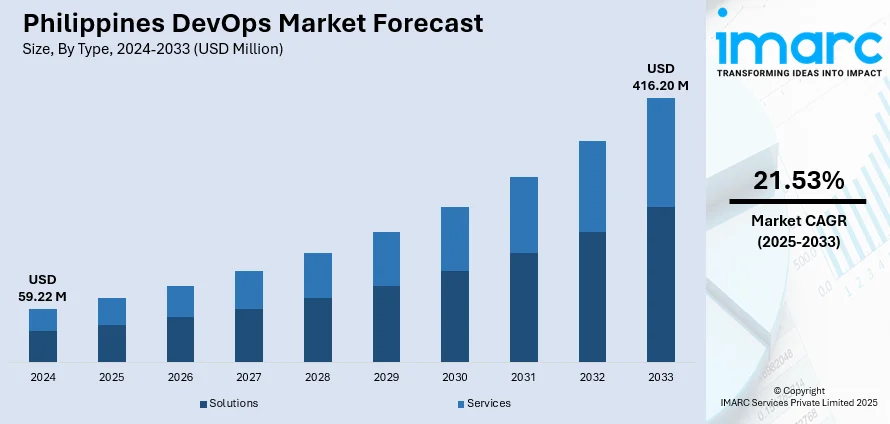

The Philippines DevOps market size reached USD 59.22 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 416.20 Million by 2033, exhibiting a growth rate (CAGR) of 21.53% during 2025-2033. The rise of 5G connectivity and the government’s push for digital governance are accelerating DevOps adoption in the Philippines. Faster networks and expanded e-services demand agile development, automation, and continuous monitoring, driving collaboration, reliability, and scalability across industries and public service delivery, thereby influencing the Philippines DevOps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 59.22 Million |

| Market Forecast in 2033 | USD 416.20 Million |

| Market Growth Rate 2025-2033 | 21.53% |

Philippines DevOps Market Trends:

Growing Role of 5G and Improved Connectivity

The ongoing rollout of 5G technology and enhancements in broadband connectivity are reshaping the digital services landscape in the Philippines, creating significant momentum for the adoption of DevOps practices. The availability of faster and more reliable networks is enabling the development and scaling of advanced applications across fintech, gaming, e-commerce, and enterprise platforms, all of which require low latency and high availability to meet user expectations. To maximize the potential of these emerging opportunities, organizations must adopt agile and scalable IT practices, with DevOps serving as the critical foundation for managing rapid deployment cycles, seamless integration, and continuous optimization of applications. The urgency to deliver services quickly and reliably in order to capture early adopters places additional pressure on businesses, highlighting the value of DevOps-driven automation and monitoring. Telecommunications providers are at the forefront of this transformation. In 2025, Smart Communications launched its first Smart 5G Max City in Bonifacio Global City, Taguig, as part of its broader infrastructure expansion. This initiative, which promises enhanced productivity and improved digital experiences, underscores how infrastructure upgrades and software agility go hand in hand. Smart’s 5G Max rollout not only reflects a strategic push to expand reliable connectivity nationwide but also aligns with Sustainable Development Goal 9 on industry, innovation, and infrastructure. With plans to extend 5G Max to additional cities in 2025, such projects illustrate how advancements in telecommunications infrastructure act as a catalyst for accelerating DevOps adoption across multiple industries in the Philippines.

To get more information on this market, Request Sample

Expansion of E-Government and Public Digital Services

The strong commitment of the governing body to shift towards digital governance is leading to transformation in public service delivery and simultaneously reinforcing the adoption of DevOps practices across the technology ecosystem. By investing in digital systems for tax submission, medical records, licensing, and other crucial services, the governing body aims to enhance accessibility, efficiency, and transparency for its citizens. In 2024, the Government launched the eGovPH app, aimed at streamlining access to government services and digital identification documents. Created with HID's goID SDK, it emerged as Asia's inaugural ISO-compliant digital government platform, offering secure storage for identification documents like the National ID and the Professional Regulation Commission ID. The app broadened its offerings to feature services such as tax payments and SIM registration, aiming for 10 million downloads within the year and guaranteeing global accessibility for Filipinos overseas. Creating and sustaining such platforms necessitates agile methods, robust automation, and ongoing monitoring, all of which are essential functions of DevOps. Extensive system integrations require strong cooperation between development and operations teams to ensure system reliability, reduce downtime, and provide prompt updates. This method allows the government to respond effectively to evolving policies and user demands, enhancing digital trust and durability. This method allows the government to respond effectively to evolving policies and user demands, enhancing digital trust and durability, while contributing to the Philippines DevOps market growth.

Philippines DevOps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, deployment model, organization size, tools, and industry vertical.

Type Insights:

- Solutions

- Services

The report has provided a detailed breakup and analysis of the market based on the type. This includes solutions and services.

Deployment Model Insights:

- Public Cloud

- Private Cloud

- Hybrid Cloud

A detailed breakup and analysis of the market based on the deployment model have also been provided in the report. This includes public cloud, private cloud, and hybrid cloud.

Organization Size Insights:

- Large Enterprises

- Medium-Sized Enterprises

- Small-Sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises, medium-sized enterprises, and small-sized enterprises.

Tools Insights:

- Development Tools

- Testing Tools

- Operation Tools

A detailed breakup and analysis of the market based on the tools have also been provided in the report. This includes development tools, testing tools, and operation tools.

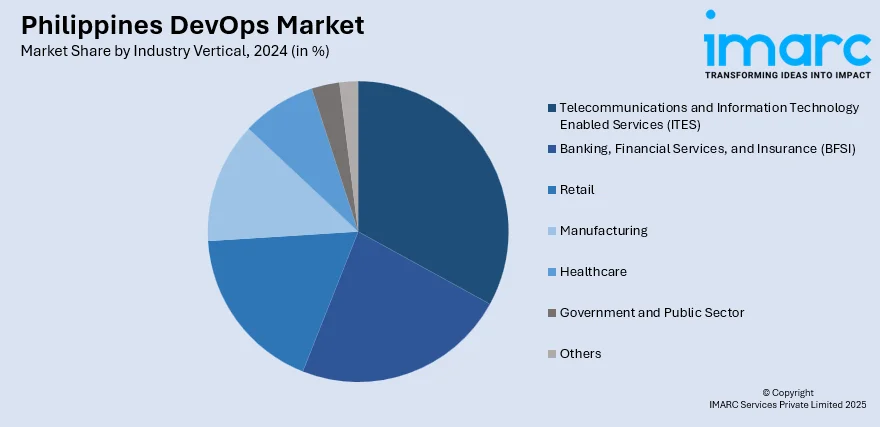

Industry Vertical Insights:

- Telecommunications and Information Technology Enabled Services (ITES)

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare

- Government and Public Sector

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes telecommunications and information technology enabled services (ITES), banking, financial services, and insurance (BFSI), retail, manufacturing, healthcare, government and public sector, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines DevOps Market News:

- In August 2025, The Asia DevOps Conference is taking place at the New World Makati Hotel, Philippines on August 15. The event focuses on DevOps trends, automation, AI, Kubernetes, and security in modern IT landscapes. Industry leaders, including Mark Rivera and Eugene Reynes, will share insights on driving agility and innovation in IT.

- In April 2024, PLDT Inc. and Smart Communications launched the Cloud Center of Excellence (CCOE) in the Philippines, focusing on DevOps practices to enhance cloud capabilities, innovation, and agility. The initiative aimed to improve workforce efficiency, customer experience, and operational excellence.

Philippines DevOps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solutions, Services |

| Deployment Models Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Organization Sizes Covered | Large Enterprises, Medium-Sized Enterprises, Small-Sized Enterprises |

| Tools Covered | Development Tools, Testing Tools, Operation Tools |

| Industry Verticals Covered | Telecommunications and Information Technology Enabled Services (ITES), Banking, Financial Services, and Insurance (BFSI), Retail, Manufacturing, Healthcare, Government and Public Sector, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines DevOps market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines DevOps market on the basis of type?

- What is the breakup of the Philippines DevOps market on the basis of deployment model?

- What is the breakup of the Philippines DevOps market on the basis of organization size?

- What is the breakup of the Philippines DevOps market on the basis of tools?

- What is the breakup of the Philippines DevOps market on the basis of industry vertical?

- What is the breakup of the Philippines DevOps market on the basis of region?

- What are the various stages in the value chain of the Philippines DevOps market?

- What are the key driving factors and challenges in the Philippines DevOps market?

- What is the structure of the Philippines DevOps market and who are the key players?

- What is the degree of competition in the Philippines DevOps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines DevOps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines DevOps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines DevOps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)