Philippines Diesel Engine Market Size, Share, Trends and Forecast by Power Rating, End User, and Region, 2025-2033

Philippines Diesel Engine Market Overview:

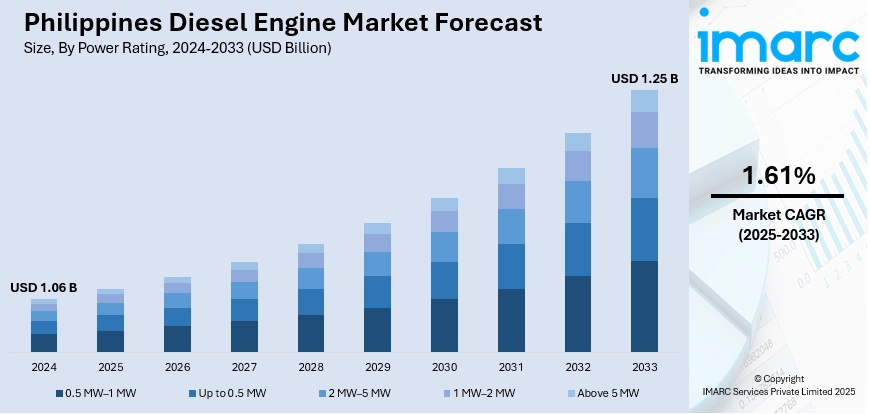

The Philippines diesel engine market size reached USD 1.06 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.25 Billion by 2033, exhibiting a growth rate (CAGR) of 1.61% during 2025-2033. Mass investments in road networks, bridges, airports, and seaports are continuously rising demand for heavy-duty construction equipment. Moreover, as farmers across the country are adopting mechanized practices, efficient engines are becoming vital for powering tractors, irrigation pumps, threshers, and other farming equipment. Additionally, ongoing issue of erratic electricity supply, particularly in off-grid and rural locations, is expanding the Philippines agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.06 Billion |

| Market Forecast in 2033 | USD 1.25 Billion |

| Market Growth Rate 2025-2033 | 1.61% |

Philippines Diesel Engine Market Trends:

Spreading Infrastructure Development Throughout the Archipelago

The Philippines diesel engine sector is driven by current infrastructure development initiatives under the government's Build, Better, More initiative. Mass investments in road networks, bridges, airports, and seaports are continuously rising demand for heavy-duty construction equipment driven by diesel engines. Developers and contractors are depending on diesel equipment for its toughness, torque-to-weight ratio, and applicability to remote and off-grid locations. Meanwhile, the tough terrain and scattered geography of the Philippines are rendering diesel engines a viable option for logistics and construction activities. With the government continuing to prioritize public infrastructure expenditures, particularly in rural and underdeveloped areas, demand for diesel engines in backhoes, bulldozers, and generators is growing more intense. This continued emphasis on enhancing connectivity and public infrastructure is underpinning long-term expansion in diesel engine imports, distribution networks, and aftersales services nationwide. In 2025, GWM Philippines distributor Luxuriant Automotive Group Inc. (LAGI) made an impact at the 2025 Manila International Auto Show (MIAS). Right before the yearly auto event kicks off, GWM Philippines hosted an exclusive sneak peek of one of their forthcoming vehicles. Making its public debut at this year's MIAS is the 2025 GWM Cannon, which receives more than just a makeover. Beneath the surface, the midsize pickup truck receives a new engine thanks to a 2.4L turbo-diesel powertrain. It produces 181 PS with 480 Nm of torque and is combined with a new 9-speed automatic transmission.

To get more information on this market, Request Sample

Rural Sector Expansion in Agricultural Mechanization

Agricultural modernization is supporting the Philippines diesel engine market growth. As farmers across the country are increasingly adopting mechanized practices, diesel engines are becoming vital for powering tractors, irrigation pumps, threshers, and other farming equipment. Government initiatives such as the Rice Competitiveness Enhancement Fund (RCEF) are continuously promoting the acquisition of machinery to improve productivity and reduce manual labor dependency. In areas such as Central Luzon, Ilocos, and Western Visayas, where intensive rice and sugarcane cultivation prevails, diesel engines are becoming a must for sustaining intensive farming cycles. Affordability, reliability, and simplicity of maintenance are such that diesel engines are a favorite among small to medium-scale farmers. The fact that cooperatives and agricultural service organizations are also investing in mobile machinery fleets is driving demand for diesel engines. IMARC group predicts that the Philippines agribusiness market is projected to attain USD 86.96 Billion by 2033.

Increasing Demand for Sure Backup Power Solutions

The ongoing issue of erratic electricity supply, particularly in off-grid and rural locations, is driving the demand for diesel generators as a reliable means of backup power. Manufacturers, healthcare, retail, and hospitality businesses are increasingly fitting diesel-driven generators to maintain operations during power outages. Diesel gensets are gaining popularity due to their rapid start times, high energy density, and extended runtime, and they fit well for both prime and standby power applications. In typhoon- and disaster-prone areas, gensets with diesel motors are assuming a pivotal role in disaster preparedness and emergency response. Demand in the commercial space is being met with increasing residential take-up in areas with inconsistent grid connectivity. With growing electricity usage and the national grid continuing to be strained, the use of diesel-powered power solutions is constantly rising in Philippines.

Philippines Diesel Engine Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on power rating and end user.

Power Rating Insights:

- 0.5 MW–1 MW

- Up to 0.5 MW

- 2 MW–5 MW

- 1 MW–2 MW

- Above 5 MW

The report has provided a detailed breakup and analysis of the market based on the power rating. This includes 0.5 MW–1 MW, up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, and above 5 MW.

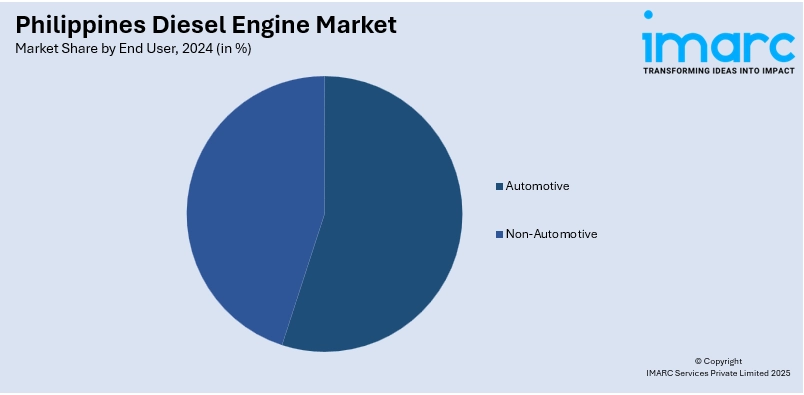

End User Insights:

- Automotive

- On-Road

- Light Vehicles

- Medium/Heavy Trucks

- Light Trucks

- Off-Road

- Industrial/Construction Equipment

- Agriculture Equipment

- Marine Applications

- On-Road

- Non-Automotive

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes automotive (on-road (light vehicles, medium/heavy trucks, and light trucks) and off-road (industrial/construction equipment, agriculture equipment, and marine applications)) and non-automotive.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Diesel Engine Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Power Ratings Covered | 0.5 MW–1 MW, Up to 0.5 MW, 2 MW–5 MW, 1 MW–2 MW, Above 5 MW |

| End Users Covered |

|

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines diesel engine market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines diesel engine market on the basis of power ratings?

- What is the breakup of the Philippines diesel engine market on the basis of end users?

- What is the breakup of the Philippines diesel engine market on the basis of region?

- What are the various stages in the value chain of the Philippines diesel engine market?

- What are the key driving factors and challenges in the Philippines diesel engine market?

- What is the structure of the Philippines diesel engine market and who are the key players?

- What is the degree of competition in the Philippines diesel engine market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines diesel engine market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines diesel engine market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines diesel engine industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)