Philippines Dietary Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Distribution Channel, Application, End User, and Region, 2025-2033

Philippines Dietary Supplements Market Overview:

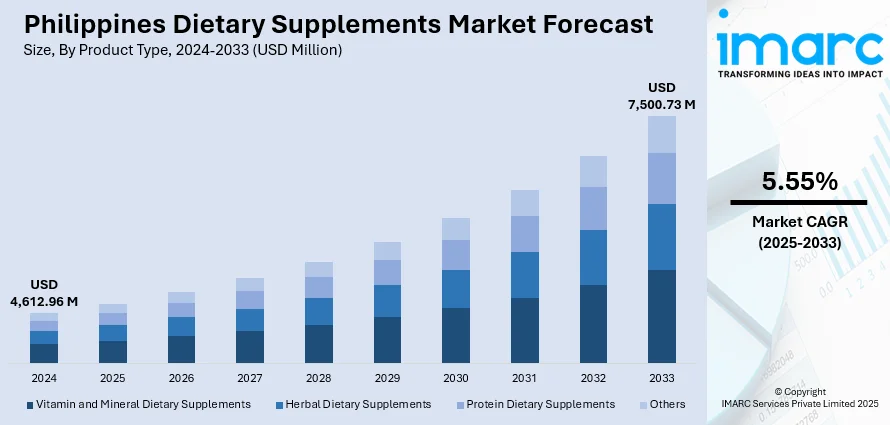

The Philippines dietary supplements market size reached USD 4,612.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 7,500.73 Million by 2033, exhibiting a growth rate (CAGR) of 5.55% during 2025-2033. At present, consumers are increasingly becoming health-conscious and putting preventive healthcare at the top of their priorities. Apart from this, the consistent increase in disposable incomes of the masses is impelling the market growth. Additionally, the enlargement of retail channels and rising adoption of e-commerce platforms are expanding the Philippines dietary supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,612.96 Million |

| Market Forecast in 2033 | USD 7,500.73 Million |

| Market Growth Rate 2025-2033 | 5.55% |

Philippines Dietary Supplements Market Trends:

Growing Health Consciousness Among Consumers

The Philippines dietary supplements industry is showing consistent growth as consumers are increasingly becoming health-conscious and putting preventive healthcare at the top of their priorities. Filipinos are regularly diverting their attention from reactive treatment to proactive wellness, and this is significantly impacting demand for vitamins, minerals, and herbal supplements. Rising knowledge of lifestyle diseases, including diabetes, hypertension, and obesity, is pushing people to add supplements to their daily lives. Further, social media platforms, online health forums, and fitness influencers are continuously advocating healthier lifestyles, thus pushing people towards using supplements. Consumers not only take conventional vitamins like Vitamin C but also look for specialist supplements for immunity, digestive health, and skin care. This trend is again reinforcing the notion of a need for daily supplementation in order to achieve long-term well-being, and therefore, the market is continually observing sustained consumer demand and steady product adoption across different demographic groups. In 2025, due to the increasing need for premium health supplements in the Philippines, Sole Pharma, a prominent European pharmaceutical manufacturer, declared its expansion into the Southeast Asian market. Products can be purchased online via Mercury Drug, Watson's, Rose's Pharmacy, and Allgreen RX, along with Sole Pharma's official stores on Lazada and Shopee.

To get more information on this market, Request Sample

Increasing Investments in Health-Benefiting Products

The Philippines dietary supplements market is growing, supported by the consistent increase in disposable incomes of the masses. As Filipinos earn better incomes and attain greater financial security, they are spending part of their earnings on health-related products, including nutritional supplements. The transition in consumer behavior and lifestyle is resulting in increased willingness to spend on premium and specialist categories of supplements, including probiotics, omega fatty acids, and individualized nutrition products. Also, a fast-paced lifestyle is changing the way people eat, with working professionals and working families tending to eat convenient but lower-nutrient foods, which is forcing the perceived necessity of supplements. Higher purchasing power from consumers is making them opt for high-quality, branded, and imported supplements. The rising level of household incomes is constantly increasing affordability and availability of products, ensuring the supplement market gains momentum progressively across the country.

Greater Accessibility Through Retail Expansion and E-Commerce

The industry in the Philippines is constantly growing, with distribution channels becoming increasingly diversified and accessible. Electronic platforms are taking a key role in redefining the purchasing behavior of consumers, as online platforms are providing a diverse array of supplements at reasonable prices along with doorstep delivery. This realignment is allowing both domestic and foreign brands to move more deeply into the market and access consumers in urban and rural environments. Pharmacies, supermarkets, and specialty health stores are also increasing product assortments, offering increased convenience and visibility for supplements. Digital marketing efforts, influencer backing, and online promotion are raising product awareness and prompting trial purchases among tech-savvy consumers at an all-time high. Furthermore, subscription-based delivery models of supplements are becoming increasingly popular, ensuring product availability on a regular basis and encouraging consumption behavior. IMARC Group predicts that the Philippines e-commerce market is projected to attain USD 75.59 Billion by 2033.

Philippines Dietary Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, form, distribution channel, application, and end user.

Product Type Insights:

- Vitamin and Mineral Dietary Supplements

- Herbal Dietary Supplements

- Protein Dietary Supplements

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others.

Form Insights:

- Tablets

- Capsules

- Powders

- Liquids

- Soft Gels

- Gel Caps

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes tablets, capsules, powders, liquids, soft gels, and gel caps.

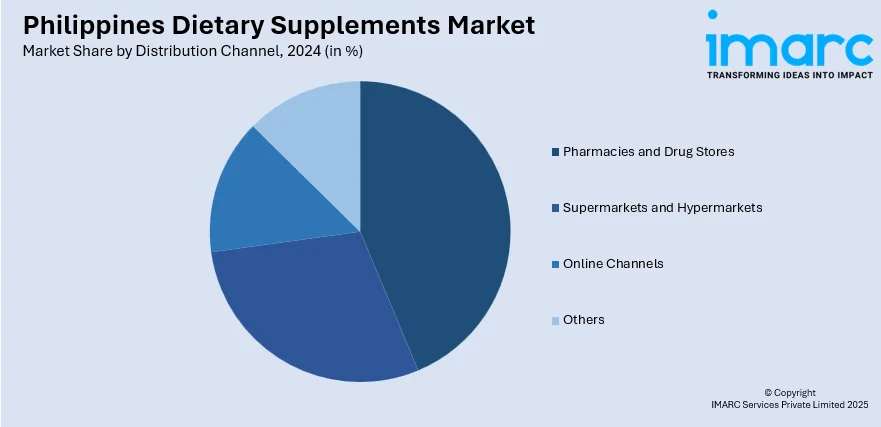

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Channels

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, supermarkets and hypermarkets, online channels, and others.

Application Insights:

- Additional Supplements

- Medicinal Supplement

- Sports Nutrition

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes additional supplements, medicinal supplements, and sports nutrition.

End User Insights:

- Infant

- Children

- Adults

- Pregnant Women

- Old-Aged

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes infant, children, adults, pregnant women, and old-aged.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Dietary Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Vitamin and Mineral Dietary Supplements, Herbal Dietary Supplements, Protein Dietary Supplements, Others |

| Forms Covered | Tablets, Capsules, Powders, Liquids, Soft Gels, Gel Caps |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Channels, Others |

| Applications Covered | Additional Supplements, Medicinal Supplement, Sports Nutrition |

| End Users Covered | Infant, Children, Adults, Pregnant Women, Old-Aged |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines dietary supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines dietary supplements market on the basis of product type?

- What is the breakup of the Philippines dietary supplements market on the basis of form?

- What is the breakup of the Philippines dietary supplements market on the basis of distribution channel?

- What is the breakup of the Philippines dietary supplements market on the basis of application?

- What is the breakup of the Philippines dietary supplements market on the basis of end user?

- What is the breakup of the Philippines dietary supplements market on the basis of region?

- What are the various stages in the value chain of the Philippines dietary supplements market?

- What are the key driving factors and challenges in the Philippines dietary supplements market?

- What is the structure of the Philippines dietary supplements market and who are the key players?

- What is the degree of competition in the Philippines dietary supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines dietary supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines dietary supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines dietary supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)