Philippines Digital Asset Management Market Size, Share, Trends and Forecast by Type, Component, Application, Deployment, Organization Size, End Use Sector, and Region, 2026-2034

Philippines Digital Asset Management Market Summary:

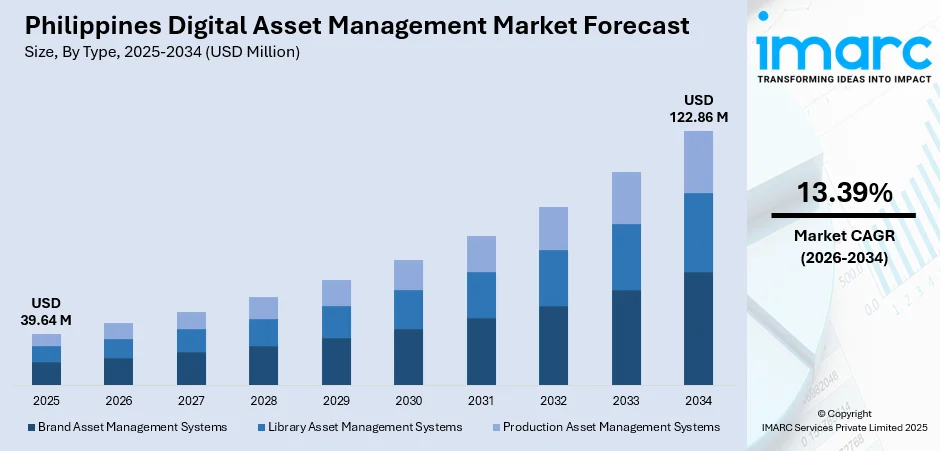

The Philippines digital asset management market size was valued at USD 39.64 Million in 2025 and is projected to reach USD 122.86 Million by 2034, growing at a compound annual growth rate of 13.39% from 2026-2034.

The Philippines digital asset management market is experiencing growth as enterprises across industries embrace digital transformation and expand their content management capabilities. Rising investments in cloud infrastructure, increasing popularity in digital media, and the growing adoption of marketing technology solutions are strengthening the demand for centralized asset repositories. The convergence of artificial intelligence (AI) integration, expanding e-commerce activities, and government-led digitalization initiatives is fundamentally reshaping how organizations manage, distribute, and monetize their digital content, creating substantial opportunities for market participants to capture Philippines digital asset management market share

Key Takeaways and Insights:

-

By Type: Brand asset management systems dominate the market with a share of 38% in 2025, driven by enterprises prioritizing brand consistency across omnichannel marketing campaigns and the need for centralized repositories to manage the growing volumes of brand assets across distributed teams.

-

By Component: Solutions lead the market with a share of 63.62% in 2025, reflecting strong enterprise demand for comprehensive software platforms that integrate storage, organization, search, and distribution functionalities within unified digital asset management ecosystems.

-

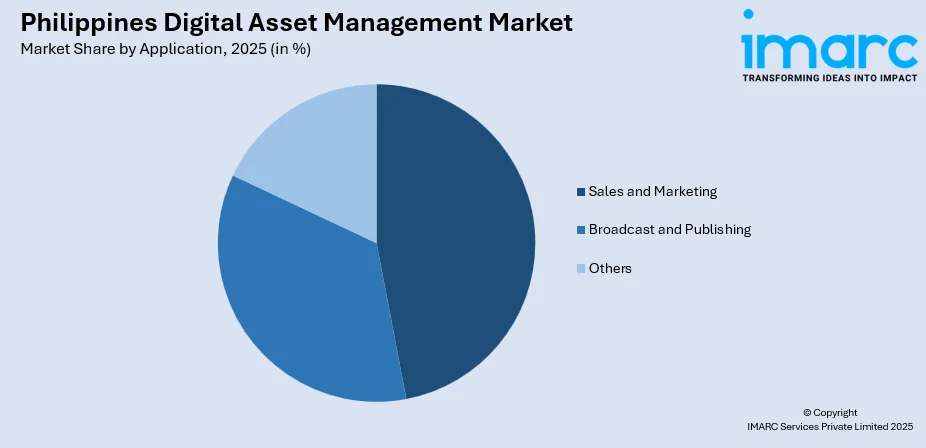

By Application: Sales and marketing represent the largest segment with a market share of 46.74% in 2025, as organizations leverage digital asset management platforms to accelerate campaign execution, ensure brand compliance, and streamline content distribution across multiple marketing channels.

-

By Deployment: Cloud dominates the market with a share of 59.01% in 2025, owing to its scalability advantages, reduced infrastructure costs, and enhanced remote collaboration capabilities that align with hybrid work models adopted by Philippine enterprises.

-

By Organization Size: Large enterprises lead the market with a share of 62.08% in 2025, due to complex digital asset requirements, substantial content volumes, and greater investment capacity for enterprise-grade digital asset management solutions with advanced integration capabilities.

-

By End Use Sector: Media and entertainment represent the largest segment with a market share of 37.65% in 2025, supported by massive content production requirements, sophisticated rights management needs, and the imperative to monetize digital assets across streaming platforms and distribution channels.

-

Key Players: The Philippines digital asset management market exhibits moderate competitive intensity, with global technology providers competing alongside regional solution vendors to deliver scalable platforms that address diverse industry requirements and digital transformation objectives.

To get more information on this market Request Sample

The Philippines digital asset management market is driven by the rapid adoption of digital technologies across multiple industries. As enterprises transition from traditional, paper-based processes to digital platforms, there is an increase in the need for efficient systems to manage, store, and retrieve vast quantities of digital content, alongside requirements for seamless integration and enhanced data security. This shift towards content-driven strategies is particularly evident in the marketing sector, where the focus is now on authentic engagement. For instance, in 2024, Havas Red Philippines launched SWAY, an influencer marketing arm that focuses on engaging with niche subcultures. This initiative, which prioritizes authentic connections over traditional metrics to foster genuine brand loyalty, necessitates advanced digital asset management solutions capable of organizing and quickly retrieving the diverse, high-quality digital assets required for tailored, targeted campaigns. The growing recognition of intellectual property value, coupled with the need to maintain brand consistency across all digital media, collectively propels the growth and sophistication of the digital asset management market in the Philippines.

Philippines Digital Asset Management Market Trends:

Rapid Digital Transformation Across Industries

The Philippines digital asset management market is driven by the accelerated digital transformation across key sectors, including banking, healthcare, and retail. As organizations transition from traditional paper-based systems to digital platforms, the demand for robust digital asset management solutions increases to efficiently manage, store, and retrieve vast digital content. This operational need is directly linked to the nation's broader economic shift. The Philippine digital economy expanded to P2.25 trillion in 2024, according to the Philippine Statistics Authority, accounting for 8.5% of the country’s gross domestic product. This notable rise in the digital economy underscores the increasing reliance on digital media and the critical need for advanced digital asset management systems to organize and protect data, thereby ensuring streamlined workflows and contributing to the market growth.

Growth of E-Commerce and Online Businesses

The expansion of online retailers, digital marketers, and content creators is driving the demand for digital asset management systems to manage a high volume of product images, videos, and marketing collateral. As digital commerce platforms grow, businesses require scalable and secure solutions to store and organize these assets, ensuring streamlined operations and cohesive user experiences. This trend is quantitatively supported by data from the 2024 National Information and Communications Technology Household Survey (NICTHS). As of October 2025, the survey revealed that the percentage of Filipinos selling goods and services online was 15.4% nationally. In the Cordillera region, this activity was even higher, reaching 24.6%. This substantial and geographically diverse engagement in online commerce underscores the critical and increasing need for digital asset management solutions across the Philippines.

Advancements in Cloud Computing and AI Integration

Technological advancements, particularly in cloud computing and AI, are fundamentally transforming the digital asset management landscape in the Philippines. Cloud-based digital asset management systems offer businesses the crucial scalability and flexibility needed to manage vast digital libraries without reliance on expensive on-premise infrastructure. This foundational shift is validated by major infrastructure developments. For instance, in 2024, Huawei launched its Philippines Region, marking the introduction of the country's first 3-AZ public cloud. This initiative underscores a commitment to the nation's digital transformation, offering over 100 cloud services to local industries. As a result, the integration of AI and machine learning (ML) into digital asset management solutions automates tasks like metadata tagging and asset retrieval, significantly enhancing the efficiency, accuracy, and functionality of digital asset management across various sectors in the Philippines.

Market Outlook 2026-2034:

The Philippines digital asset management market shows strong growth potential, driven by increasing digital transformation efforts and the rise in content production across various industries. The market generated a revenue of USD 39.64 Million in 2025 and is projected to reach a revenue of USD 122.86 Million by 2034, growing at a compound annual growth rate of 13.39% from 2026-2034. This growth highlights the country's evolving digital infrastructure and the growing demand for efficient asset management solutions.

Philippines Digital Asset Management Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Brand Asset Management System |

38% |

|

Component |

Solutions |

63.62% |

|

Application |

Sales and Marketing |

46.74% |

|

Deployment |

Cloud |

59.01% |

|

Organization Size |

Large Enterprises |

62.08% |

|

End Use Sector |

Media and Entertainment |

37.65% |

Type Insights:

- Brand Asset Management Systems

- Library Asset Management Systems

- Production Asset Management Systems

Brand asset management systems dominate with a market share of 38% of the total Philippines digital asset management market in 2025.

Brand asset management systems represent the largest segment due to their ability to streamline the storage, retrieval, and distribution of brand assets. These systems help businesses maintain consistency in marketing materials, ensuring that all assets align with brand guidelines.

Additionally, brand asset management systems enable efficient collaboration across teams, allowing marketing departments to quickly access and use approved materials. The rise of digital marketing and the need for consistent brand messaging across various platforms are catalyzing the demand for these systems, making them a crucial tool in the digital asset management landscape.

Component Insights:

- Solutions

- Services

- Consulting

- System Integration

- Support and Maintenance

Solutions lead with a market share of 63.62% of the total Philippines digital asset management market in 2025.

Solutions hold the biggest market share owing to their comprehensive approach to managing, organizing, and distributing digital assets. These solutions offer businesses a centralized platform to store, search, and retrieve assets, ensuring efficiency and consistency across all digital content.

Moreover, digital asset management solutions provide businesses with advanced features like metadata tagging, version control, and integration capabilities. These functionalities help streamline workflows, enhance collaboration, and ensure that assets are easily accessible. As the demand for efficient content management continues to rise, solutions remain integral to the success of digital asset management strategies in the Philippines.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sales and Marketing

- Broadcast and Publishing

- Others

Sales and marketing exhibit a clear dominance with a 46.74% share of the total Philippines digital asset management market in 2025.

Sales and marketing dominate the market, driven by the growing need for businesses to streamline content creation and distribution. Digital asset management systems allow marketing teams to easily access and repurpose assets, improving the efficiency of campaigns.

Furthermore, the rise of digital marketing channels, such as social media and online advertising, is driving the demand for assets that align with brand messaging. The rise of digital marketing channels, necessitating timely and relevant assets to align with brand messaging, is strongly reflected in the market's value, as the Philippines digital advertising market size reached USD 2.1 Billion in 2025, as per the IMARC Group. Digital asset management solutions help sales and marketing teams quickly retrieve the right content, ensuring timely and relevant communication, which boosts overall marketing effectiveness in the competitive market.

Deployment Insights:

- On-premises

- Cloud

Cloud dominates with a market share of 59.01% of the total Philippines digital asset management market in 2025.

Cloud leads the market because of its scalability and cost-effectiveness. Cloud-based solutions enable businesses to store large volumes of digital assets securely, while providing easy access from anywhere, which is especially valuable for remote teams and businesses with multiple locations.

In addition, cloud offers automatic updates and maintenance, reducing the burden on internal IT teams. The flexibility of cloud platforms allows businesses to expand storage as needed without significant upfront investments in hardware. This makes cloud deployment an attractive option for companies in Philippines seeking efficient and scalable digital asset management solutions.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead with a market share of 62.08% of the total Philippines digital asset management market in 2025.

Large enterprises dominate the market, owing to their complex operations and extensive content needs. These organizations manage a wide array of digital assets across multiple departments, requiring robust systems to ensure efficient storage, retrieval, and distribution.

Moreover, large enterprises benefit from digital asset management systems by streamlining collaboration and improving brand consistency. With larger teams and more stakeholders involved in content creation and usage, these systems provide the necessary infrastructure to manage and control assets effectively.

End Use Sector Insights:

- Media and Entertainment

- Banking, Financial Services and Insurance (BFSI)

- Retail

- Manufacturing

- Healthcare and Life Sciences

- Education

- Travel and Tourism

- Others

Media and entertainment exhibit a clear dominance with a 37.65% share of the total Philippines digital asset management market in 2025.

Media and entertainment represent the largest segment due to the vast amount of digital content they produce and manage. These industries rely on digital asset management systems to store, organize, and quickly access a large volume of multimedia files, such as videos, images, and audio.

Furthermore, the fast-paced nature of media production demands efficient workflows and collaboration tools. Digital asset management systems help media and entertainment companies maintain version control, ensure seamless sharing of assets across teams, and streamline the distribution of content, making them crucial for operations in this sector in the Philippines.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon is one of the most economically developed island in the Philippines. It hosts the nation's capital, Manila, and serves as the primary hub for trade, finance, and industry, contributing significantly to the country's overall economic growth. According to the data published by the International Trade Administration in 2024, Central Luzon, as an emerging growth center, contributes roughly 9% to the national GDP.

The Visayas is known for its rich culture, beautiful beaches, and thriving tourism industry. It is a central region for agriculture, fisheries, and trade, playing an essential role in the Philippine economy with cities like Cebu acting as key economic centers.

Mindanao is renowned for its agricultural resources and mining industry. It has a growing economy, with major industries including agriculture, aquaculture, and manufacturing, while also being a key hub for trade and infrastructure development.

Market Dynamics:

Growth Drivers:

Why is the Philippines Digital Asset Management Market Growing?

Increased Adoption of Mobile and Remote Work Solutions

The growing shift toward mobile and remote work in the Philippines is driving the need for flexible and accessible digital asset management solutions. As the number of employees working remotely increases, companies require cloud-based digital asset management systems that provide secure, real-time access to digital assets from any location, ensuring efficient collaboration and sustained productivity. This trend is further formalized by government policy. For instance, in 2025, the Philippines introduced a Digital Nomad Visa (DNV), allowing remote workers to live and work in the country for up to one year. This initiative, established under Executive Order 86, is designed to attract global professionals and boost local digital entrepreneurship. This widespread adoption of flexible work arrangements critically contributes to the growing demand for digital asset management systems that effectively support flexible, real-time asset management across geographical barriers.

Expansion of Creative and Digital Agencies

The proliferation of creative and digital agencies in the Philippines is catalyzing the demand for digital asset management systems. These agencies manage vast volumes of digital content for diverse clients, making efficient asset storage, organization, and distribution crucial for their operations. Digital asset management solutions provide essential tools for managing access and ensuring consistency across campaigns. The expansion of this sector, driven by the demand for high-quality content creation, is exemplified by industry-specific growth. For instance, in 2025, Ellerton & Co., a Southeast Asia-based PR agency, launched the Ellerton Creative Studio to offer high-impact visual storytelling integrated with communications services. This new studio, which strengthens the agency's presence in multiple markets including the Philippines, emphasizes the need for centralized digital strategies, thereby propelling the growth of the market.

Growing Role of E-Government and Digital Services

The expansion of e-government initiatives and digital public services in the Philippines is driving the demand for digital asset management solutions within the public sector. As government agencies rapidly digitize services, processes, and records, there is a critical need for secure and organized digital asset management to ensure regulatory compliance. This major national focus on digital transformation is formalized by key policies. For instance, in 2024, the Department of Information and Communications Technology (DICT) launched the eGovernment Masterplan (eGMP) at the first-ever Chief Information Officer (CIO) Conference in Manila. This pivotal plan aimed to unify ICT efforts across the Philippines, enhancing public service delivery through a citizen-centric, integrated, and transparent digital government. The scale of this initiative, supported by over 600 CIOs, highlighting the need advanced digital asset management systems to manage the nation's growing volume of digital data.

Market Restraints:

What Challenges the Philippines Digital Asset Management Market is Facing?

High Implementation and Customization Costs

The implementation of digital asset management systems requires significant investment in licensing, integration, and customization, which can be a barrier for organizations with limited resources. Enterprise-grade solutions often come with ongoing costs for maintenance, support, and scalability, contributing to the total cost of ownership. These financial considerations may deter smaller or resource-constrained organizations from fully adopting and benefiting from digital asset management systems.

Limited Technical Expertise and Skills Gap

Deploying a digital asset management system successfully requires specialized technical knowledge in platform configuration, integration, and ongoing management, which many organizations lack. Skills shortages in key areas of digital transformation hinder the effective deployment and optimization of digital asset management systems. This gap in expertise creates significant challenges, as organizations struggle to ensure that digital asset management platforms are used to their full potential and deliver optimal value.

Connectivity Gaps in Regional Markets

In regional areas, the lack of reliable internet access and quality infrastructure limits the adoption of cloud-based digital asset management solutions. As internet connectivity remains concentrated in urban centers like Metro Manila, organizations in provincial regions face challenges in leveraging cloud technologies. These connectivity gaps restrict the potential for digital asset management systems to expand beyond established commercial hubs, limiting market reach and growth opportunities.

Competitive Landscape:

The Philippines digital asset management market exhibits moderate competitive intensity characterized by the presence of global enterprise software providers alongside specialized vendors and regional technology partners. Market dynamics reflect strategic positioning across cloud-native platforms emphasizing AI-powered capabilities, integration depth, and scalable architecture. The competitive landscape is increasingly shaped by vendor investments in artificial intelligence features, marketing technology ecosystem integration, and localized support capabilities. Platform providers are expanding partnership networks with system integrators and marketing agencies to enhance implementation delivery and client success outcomes across industry verticals.

Recent Developments:

-

In December 2025, GoTyme Bank launched cryptocurrency trading in the Philippines in partnership with Alpaca. The new feature enables Filipinos to invest in digital assets like Bitcoin, Ethereum, and Solana with enhanced security and simplicity. This initiative aims to provide easy access to crypto trading for everyday users, especially in a market with a high demand for digital-first financial solutions.

Philippines Digital Asset Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brand Asset Management Systems, Library Asset Management Systems, Production Asset Management Systems |

| Components Covered |

|

| Applications Covered | Sales and Marketing, Broadcast and Publishing, Others |

| Deployments Covered | On-Premises, Cloud |

| Organization Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| End Use Sectors Covered | Media and Entertainment, Banking, Financial Services and Insurance (BFSI), Retail, Manufacturing, Healthcare and Life Sciences, Education, Travel and Tourism, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines digital asset management market size was valued at USD 39.64 Million in 2025.

The Philippines digital asset management market is expected to grow at a compound annual growth rate of 13.39% from 2026-2034 to reach USD 122.86 Million by 2034.

Brand asset management systems dominate the market with 38% share in 2025, driven by enterprise requirements for centralized brand asset repositories, consistent visual identity governance, and omnichannel marketing support capabilities.

Key factors driving the Philippines digital asset management market include the accelerated digital transformation in sectors like banking, healthcare, and retail. As organizations move from paper-based systems to digital platforms, the demand for robust solutions grows, with the digital economy reaching P2.25 trillion in 2024, or 8.5% of GDP.

Major challenges include high implementation and customization costs, limited technical expertise and digital skills gaps, connectivity infrastructure disparities in regional markets, organizational change management complexity, and integration challenges with legacy enterprise systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)