Philippines Digital Payments Market Size, Share, Trends and Forecast by Component, Payment Mode, Deployment Type, End Use Industry, and Region, 2026-2034

Philippines Digital Payments Market Size and Share:

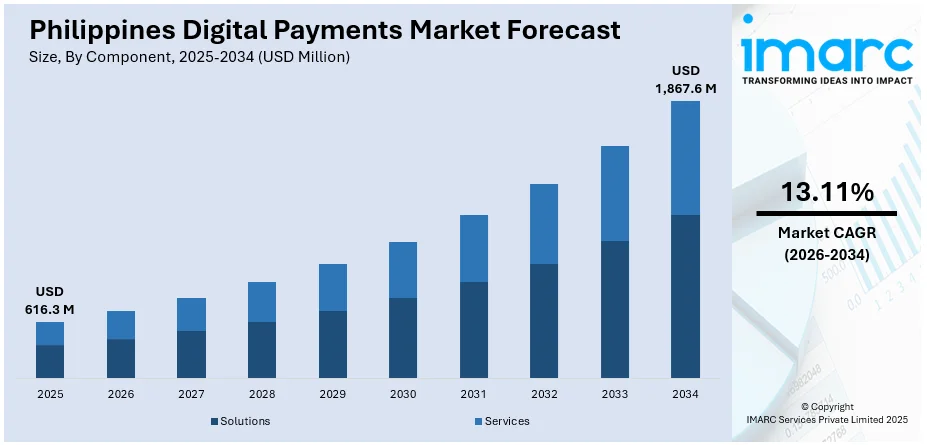

The Philippines digital payments market size reached USD 616.3 Million in 2025. Looking forward, the market is expected to reach USD 1,867.6 Million by 2034, exhibiting a growth rate (CAGR) of 13.11% during 2026-2034. The market is experiencing rapid growth, fueled by increased smartphone usage, government support for financial inclusion, and the rising popularity of e-wallets and mobile banking. Enhanced fintech innovation and shifting consumer preferences toward cashless transactions are accelerating adoption across sectors. These trends continue to shape the evolving landscape of the Philippines digital payments market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 616.3 Million |

| Market Forecast in 2034 | USD 1,867.6 Million |

| Market Growth Rate (2026-2034) | 13.11% |

Key Trends of Philippines Digital Payments Market:

Rise Of Digital Wallets

The rise of digital wallets is transforming the Philippines digital payments market outlook by enhancing transaction accessibility. Mobile wallets provide seamless money transfers, bill payments, and e-commerce transactions nationwide. Their user-friendly interfaces encourage adoption among individuals unfamiliar with traditional banking systems. Widespread smartphone usage enables digital wallet penetration, reaching urban and rural customers across the country. Many businesses now accept digital payments, reducing reliance on cash-based transactions in daily operations. Government initiatives support digital wallet integration, fostering financial inclusion and improving overall economic efficiency. The pandemic accelerated adoption, shifting customer behavior towards contactless transactions for safety and convenience. Digital wallets offer rewards, cashback incentives, and promotions, encouraging users to engage with cashless payment methods. To cater this growing demand, in February 2025, Rakuten Viber announced the upcoming launch of its digital wallet, Viber Pay, in the Philippines by the second quarter of 2025. This feature will enable peer-to-peer transactions within the messaging app, supporting both user-to-user and user-to-business payments. Viber Pay is set to facilitate transfers from banks and e-wallets like GCash and Maya via InstaPay. Future updates will include debit and credit card integration, along with QR code-based transactions. Targeting micro, small, and medium enterprises, the initiative aims to streamline in-app payments. Over a million users have already signed up, highlighting strong market demand.

To get more information on this market Request Sample

Expansion of E-Commerce Platforms

The expansion of e-commerce platforms is accelerating the Philippines digital payments market growth. Online marketplaces integrate digital payment options, making transactions seamless and efficient. For example, in June 2024, GHL Systems Philippines Inc., a subsidiary of GHL Systems Berhad, partnered with Alipay+ to expand cross-border digital payment acceptance for local businesses in the Philippines. This partnership enables merchants to process payments from major Asian mobile wallets, including AlipayHK (Hong Kong SAR), Kakao Pay (South Korea), Touch 'n Go eWallet (Malaysia), and Alipay (Chinese mainland). By broadening payment options, the collaboration enhances convenience for travelers while supporting local enterprises across multiple industries. Moreover, people prefer cashless payments for convenience, security, and faster order processing when shopping online. Digital wallets are dominating the e-commerce transactions, offering cashback, discounts, and promotional incentives. Businesses adapt to digital payments, reducing dependence on cash-on-delivery (CoD) methods that involve higher risks. Payment gateways provide secure and instant processing, increasing customer confidence in digital transactions. Growing internet penetration enables more Filipinos to access e-commerce platforms and digital payment solutions. Social commerce on Facebook, Instagram, and TikTok integrates digital payments for smooth and direct purchases. The rise of buy-now-pay-later (BNPL) services makes high-value purchases more accessible to Filipino customers. Small businesses benefit from e-commerce marketplaces, leveraging digital payments to scale operations efficiently.

Growth Drivers of Philippines Digital Payments Market:

Government-Led Financial Inclusion Programs

The Bangko Sentral ng Pilipinas (BSP) is playing a central role in accelerating digital payment adoption by promoting financial inclusion through strategic initiatives. Programs like the National Strategy for Financial Inclusion and the Digital Payments Transformation Roadmap aim to provide secure, affordable, and accessible financial services to unbanked and underserved Filipinos. These initiatives focus on increasing access to digital banking, electronic payments, and other fintech services, especially in rural and low-income areas. By encouraging collaboration between banks, fintech startups, and government bodies, BSP’s policies are helping to build a more inclusive and digitized financial ecosystem. These government-led efforts continue to enhance public trust in digital transactions and contribute to a broader shift toward cashless payment systems across the country.

Increasing Smartphone and Internet Penetration

The widespread availability of smartphones and expanding internet access have become key enablers of digital payments in the Philippines. Affordable mobile devices, coupled with low-cost data plans, have allowed a growing number of Filipinos to access financial services through their phones. Even in semi-urban and rural areas, improved connectivity is empowering individuals to use apps for mobile banking, QR code transactions, and digital fund transfers. This technological accessibility bridges the gap between traditional banking and underserved communities, enabling more people to engage in cashless transactions. As mobile-first platforms continue to evolve and user-friendly interfaces become more common, digital payment solutions are becoming a daily necessity, reshaping consumer behavior and financial participation nationwide.

Growing Trust in Contactless and Cashless Transactions

The COVID-19 pandemic significantly altered payment behavior in the Philippines, accelerating the public’s shift toward contactless and cashless methods. With health and safety becoming top priorities, many consumers started favoring digital transactions over physical cash to minimize contact and reduce infection risk. This change in behavior has continued post-pandemic, with users appreciating the added speed, convenience, and hygiene of digital payments. Industries such as retail, food delivery, public transport, and even local markets have increasingly adopted QR codes and digital payment terminals to accommodate this shift. As users grow more familiar with and confident in these systems, trust in cashless solutions strengthens—contributing to long-term adoption and fueling the ongoing transformation of the country’s payment landscape.

Opportunities in Philippines Digital Payments Market:

Integration with Transport and Public Services

Integrating digital payment systems into essential public services presents a major opportunity for market expansion in the Philippines. Contactless cards and QR code-enabled fare systems in transportation, tollways, and utilities simplify transactions and promote routine usage of digital platforms. These integrations not only enhance commuter and consumer convenience but also help build habits around cashless payments. By embedding digital payment solutions into daily interactions, such as paying for bus rides, water bills, or government services, users become more familiar and comfortable with the technology. Additionally, it streamlines operational efficiency for public service providers, offering better transaction tracking and cost control. This synergy between public infrastructure and digital payments can substantially accelerate adoption across diverse demographic segments.

Expansion in Rural and Semi-Urban Markets

Rural and semi-urban areas in the Philippines represent an untapped market for digital payment solutions due to limited access to traditional banking. Expanding into these regions through agent-assisted banking models, mobile point-of-sale (mPOS) systems, and simplified fintech apps can bridge the financial inclusion gap. Offering services in local languages and aligning them with cultural preferences can significantly enhance acceptance. Financial literacy campaigns tailored to these communities—especially through local influencers or institutions—can also raise awareness about the benefits of digital transactions. With government support and telecom partnerships improving internet connectivity, there is growing potential to serve farmers, micro-entrepreneurs, and informal workers. This rural outreach could unlock new customer bases and drive substantial growth in digital financial ecosystems.

Development of B2B and SME Payment Solutions

A large portion of small and medium-sized enterprises (SMEs) in the Philippines still operate in cash-heavy environments, which limits scalability and transparency. Providing customized digital payment solutions—such as automated invoicing, payroll disbursement, inventory tracking, and real-time expense management—can encourage these businesses to transition toward formal financial systems. Digital platforms that cater specifically to SME workflows enable better cash flow monitoring, easier tax compliance, and faster transactions with suppliers and customers. Financial service providers can also bundle credit access or insurance with digital payment tools to support business resilience and growth. As SMEs play a critical role in the country’s economy, empowering them through tailored, user-friendly digital solutions can significantly enhance market penetration and digital adoption.

Challenges in Philippines Digital Payments Market:

Cybersecurity and Data Privacy Concerns

With the rapid growth of digital payments in the Philippines, concerns around cybersecurity and data protection have become increasingly significant. Incidents involving online fraud, phishing scams, identity theft, and unauthorized access to user data have made some consumers hesitant to fully embrace digital platforms. This mistrust poses a barrier to widespread adoption, particularly among older adults and first-time users. To address these concerns, service providers must invest in advanced security features such as end-to-end encryption, biometric authentication, and fraud detection systems. Equally important is raising public awareness through digital literacy programs that educate users on safe transaction practices. Without strong cybersecurity infrastructure and public confidence, the expansion of digital payments may face resistance or slow long-term growth.

Infrastructure Gaps and Interoperability Issues

The uneven digital infrastructure in the Philippines presents a major hurdle for widespread digital payment adoption. While urban areas benefit from stable internet and electricity, many rural and remote regions still suffer from inconsistent connectivity and limited access to digital tools. These technical barriers make it difficult for users to rely on digital payments for daily transactions. Additionally, interoperability challenges—such as fragmented platforms that fail to integrate banks, e-wallets, and payment gateways—disrupt user experience and hinder seamless financial management. Lack of standardization can lead to failed transactions or confusion, discouraging continued usage. Bridging these infrastructure and integration gaps is essential to ensure consistent access, improve reliability, and create a more unified digital financial ecosystem across the country.

Limited Financial Literacy Among Users

Although smartphone usage is rising rapidly in the Philippines, many individuals—particularly in rural areas and older demographics—still lack a clear understanding of how digital financial tools work. Misconceptions about mobile banking, confusion over digital wallets, and inadequate awareness of online security practices often result in underutilization or improper use of these platforms. This knowledge gap can lead to costly mistakes, user frustration, or complete disengagement from digital financial services. To overcome this, targeted financial education campaigns are essential. These programs should be delivered in local languages and adapted to different age groups and literacy levels. Promoting digital literacy not only empowers users to manage their finances safely, but also strengthens trust and long-term engagement with digital payment solutions.

Philippines Digital Payments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on Component, Payment Mode, Deployment Type, and End Use Industry.

Component Insights:

- Solutions

- Application Program Interface

- Payment Gateway

- Payment Processing

- Payment Security and Fraud Management

- Transaction Risk Management

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (application program interface, payment gateway, payment processing, payment security and fraud management, transaction risk management, others) and services (professional services, managed services).

Payment Mode Insights:

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Others

A detailed breakup and analysis of the market based on the payment modes have also been provided in the report. This includes bank cards, digital currencies, digital wallets, net banking, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment modes have also been provided in the report. This includes cloud-based and on-premises.

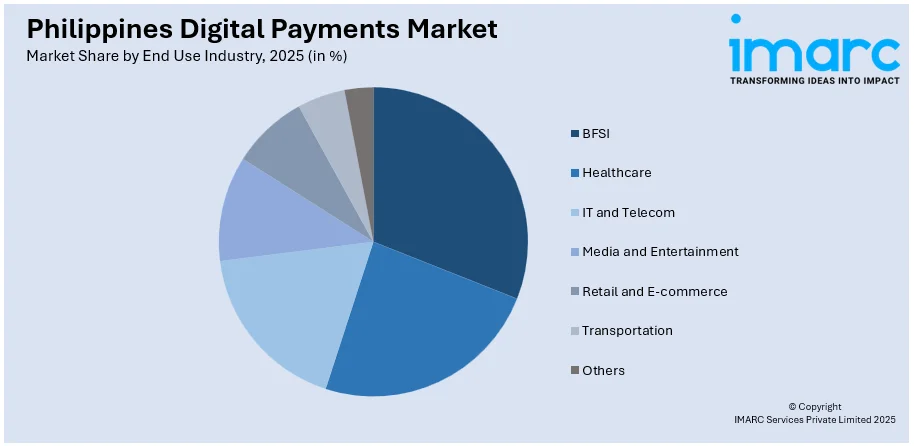

End Use Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- BFSI

- Healthcare

- IT and Telecom

- Media and Entertainment

- Retail and E-commerce

- Transportation

- Others

A detailed breakup and analysis of the market based on the end use industries have also been provided in the report. This includes BFSI, healthcare, IT and telecom, media and entertainment, retail and e-commerce, transportation, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Digital Payments Market News:

- In August 2024, PayMongo, a payment processing platform, launched the PayMongo Wallet to support small and medium-sized enterprises (SMEs) in the Philippines. This digital wallet simplifies financial transactions by offering a secure and accessible solution tailored to business needs.

- In April 2024, Higala, an inclusive instant payment system (IIPS), launched in the Philippines to lower real-time payment costs for underserved communities. Designed as a "financial superhighway," it connects thrift banks, rural banks, and microfinance institutions to instant payment networks. With only 4.5% of the country’s 400 rural banks subscribed to InstaPay due to high costs, Higala offers an affordable alternative for users and merchants.

Philippines Digital Payments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Payment Modes Covered | Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Media and Entertainment, Retail and E-commerce, Transportation, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines digital payments market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines digital payments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines digital payments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital payments market in the Philippines was valued at USD 616.3 Million in 2025.

The Philippines digital payments market is projected to exhibit a CAGR of 13.11% during 2026-2034.

The Philippines digital payments market is projected to reach a value of USD 1,867.6 Million by 2034.

The key trends of the Philippines digital payments market include the rising mobile wallet adoption, widespread use of QR Ph for retail transactions, growing real-time fund transfers via InstaPay and PESONet, and increasing integration of payment features into social media, e-commerce, and super apps.

Strong smartphone and internet penetration, rapid e-commerce expansion, Bangko Sentral ng Pilipinas-led initiatives promoting cashless ecosystems, inclusive financial services for the unbanked, and improved trust in secure, seamless, and convenient digital transactions are the major growth factors of the Philippines' digital payments market across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)