Philippines Digital Signage Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, Location, Size, and Region, 2025-2033

Philippines Digital Signage Market Overview:

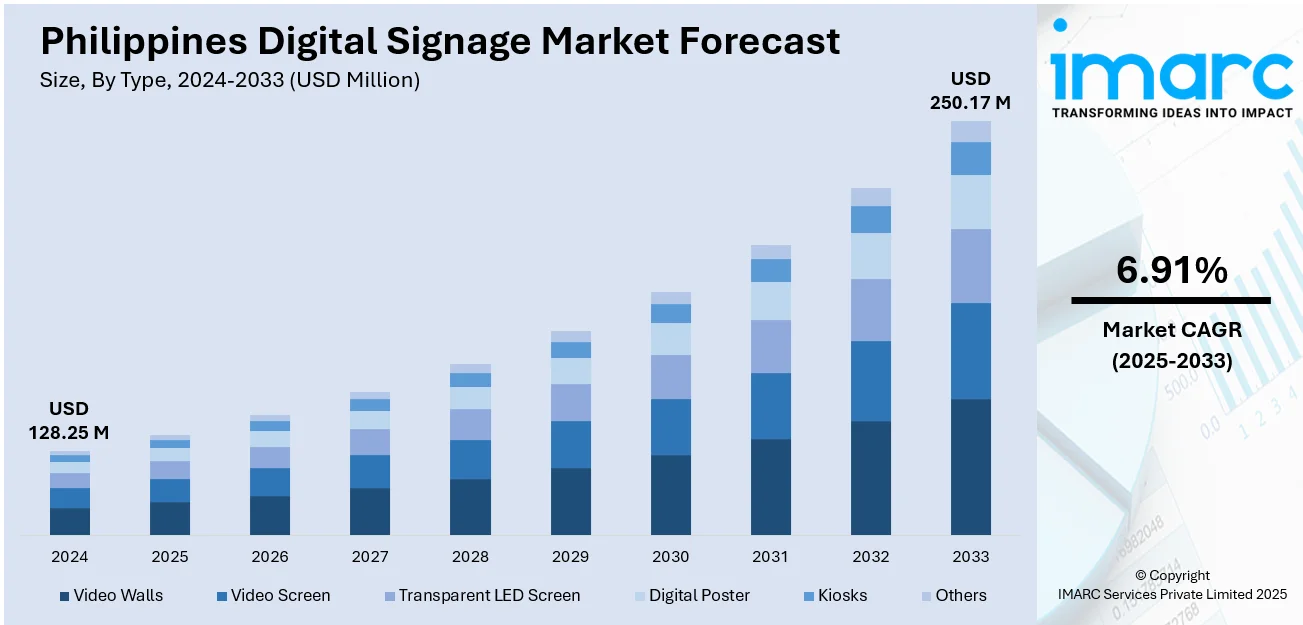

The Philippines digital signage market size reached USD 128.25 Million in 2024. The market is projected to reach USD 250.17 Million by 2033, exhibiting a growth rate (CAGR) of 6.91% during 2025-2033. The market is rapidly evolving amid growing demand for visually compelling communication across businesses, institutions, and public spaces. Sign makers are embracing advanced technologies like digital printing, and LED displays to deliver highly customized and durable digital signage solutions. Innovation is driving a shift toward more dynamic and interactive formats, while eco-friendly materials and practices are gaining traction. These trends underscore the industry’s adaptability and future potential in enhancing branding, wayfinding, and promotional effectiveness ultimately shaping the Philippines digital signage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 128.25 Million |

| Market Forecast in 2033 | USD 250.17 Million |

| Market Growth Rate 2025-2033 | 6.91% |

Philippines Digital Signage Market Trends:

Expansion of Digital signage Infrastructure

In the Philippines, there’s a noticeable shift as digital signage begins replacing static displays across public and commercial spaces. This change reflects a move toward smarter, more responsive ways to communicate whether that’s useful information in transit hubs or engaging messages in community areas. Digital infrastructure improvements, such as better internet and lighting, are helping bring dynamic digital signage into everyday use. In June 2025, a Department of Information and Communications Technology bulletin highlighted how the rollout of free public Wi‑Fi in remote towns is paving the way for more digitally driven displays in underserved areas. As connectivity improves, digital signage becomes easier to install and maintain, creating new opportunities for real‑time updates and targeted messaging. This kind of interactive digital signage is growing beyond shops and malls finding its place in public squares, local government offices, and even rural learning centers. It signals that the sector is evolving from hardware-heavy installations to intelligent, networked systems. These shifts in technology and access are laying the groundwork for stronger Philippines digital signage market growth.

To get more information on this market, Request Sample

Surge in Export of Digital Signage Products

The Philippines digital signage sector is expanding beyond local borders, with more producers tapping into regional markets. Filipino digital signage is gaining traction in countries with increasing demand for affordable, well-designed visual communication tools. This trend reflects the country’s strength in producing digital signage that balances visual impact with practical execution appealing to diverse commercial and municipal applications abroad. Key export destinations include neighboring ASEAN economies and select Middle Eastern markets, where growth in construction and retail sectors continues to drive demand for digital signage solutions. In July 2024, the Department of Trade and Industry announced that total merchandise exports had reached a record high for the year, with visual communication products including digital signage contributing to this upward trend. While the export volume may vary by product category, the overall movement signals a healthy demand pipeline. It also shows the sector’s ability to align with international standards while keeping efficient production practices. As more Filipino-made digital signage reaches global markets, this signals broader adaptability and innovation across the space helping define evolving Philippines digital signage market trends.

Smart Digital Signage via Digital Transformation

Across the Philippines, there’s growing interest in smart digital signage powered by software, rather than just hardware displays. This includes digital signage systems that can be updated remotely, integrate with emergency alerts, and connect seamlessly with city-wide networks. These type of platforms are becoming valuable tools for local governments and institutions aiming to share timely information without constant on-site revisions. In August 2025, a government news release highlighted a new suite of e‑governance upgrades like mobile IDs and digital procurement platforms being rolled out across the archipelago, demonstrating how digital infrastructure is being layered into everyday public communication tools. As this foundation becomes stronger, it creates opportunities for intelligent digital signage that’s flexible, scalable, and deeply connected to other systems. You start to see applications ranging from dynamic digital wayfinding in city halls to real-time alerts in municipal centers, all managed centrally. What’s happening is a shift toward digital signage that’s not static display, but a living, adaptive interface. It’s easy to see how this momentum is contributing directly to Philippines digital signage market.

Philippines Digital Signage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, technology, application, location, and size.

Type Insights:

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes video walls, video screen, transparent LED screen, digital poster, kiosks, and others.

Component Insights:

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and service.

Technology Insights:

- LCD/LED

- Projection

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LCD/LED, projection, and others.

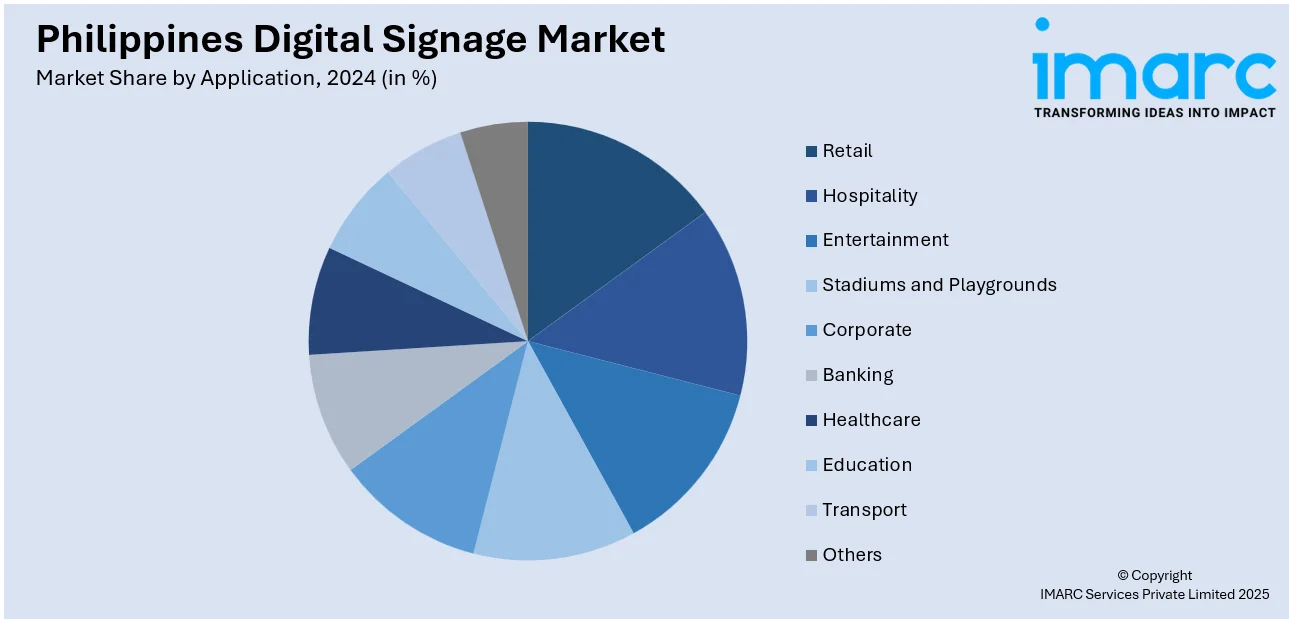

Application Insights:

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport, and others.

Location Insights:

- Indoor

- Outdoor

The report has provided a detailed breakup and analysis of the market based on the location. This includes indoor and outdoor.

Size Insights:

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes below 32 inches, 32 to 52 inches, and more than 52 inches.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Digital Signage Market News:

- July 2025: CAYIN Technology has unveiled its new SMP digital signage player, offering enhanced integration capabilities across sectors such as manufacturing, healthcare, government, and transportation. Designed to connect with existing systems like ERP, HIS, and HIS platforms, the device streamlines content delivery and supports centralized remote control for multizone displays. Its flexible and reliable performance positions it as a vital tool for efficient communication, operational insight, and public service environments. This launch underscores the growing relevance of smart display solutions in the Philippines.

Philippines Digital Signage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others |

| Components Covered | Hardware, Software, Service |

| Technologies Covered | LCD/LED, Projection, Others |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transport, Others |

| Locations Covered | Indoor, Outdoor |

| Sizes Covered | Below 32 Inches, 32 to 52 Inches, More Than 52 Inches |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines digital signage market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines digital signage market on the basis of type?

- What is the breakup of the Philippines digital signage market on the basis of component?

- What is the breakup of the Philippines digital signage market on the basis of technology?

- What is the breakup of the Philippines digital signage market on the basis of application?

- What is the breakup of the Philippines digital signage market on the basis of location?

- What is the breakup of the Philippines digital signage market on the basis of size?

- What is the breakup of the Philippines digital signage market on the basis of region?

- What are the various stages in the value chain of the Philippines digital signage market?

- What are the key driving factors and challenges in the Philippines digital signage market?

- What is the structure of the Philippines digital signage market and who are the key players?

- What is the degree of competition in the Philippines digital signage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines digital signage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines digital signage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines digital signage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)