Philippines Digital Twin Market Size, Share, Trends and Forecast by Type, Technology, End Use, and Region, 2025-2033

Philippines Digital Twin Market Overview:

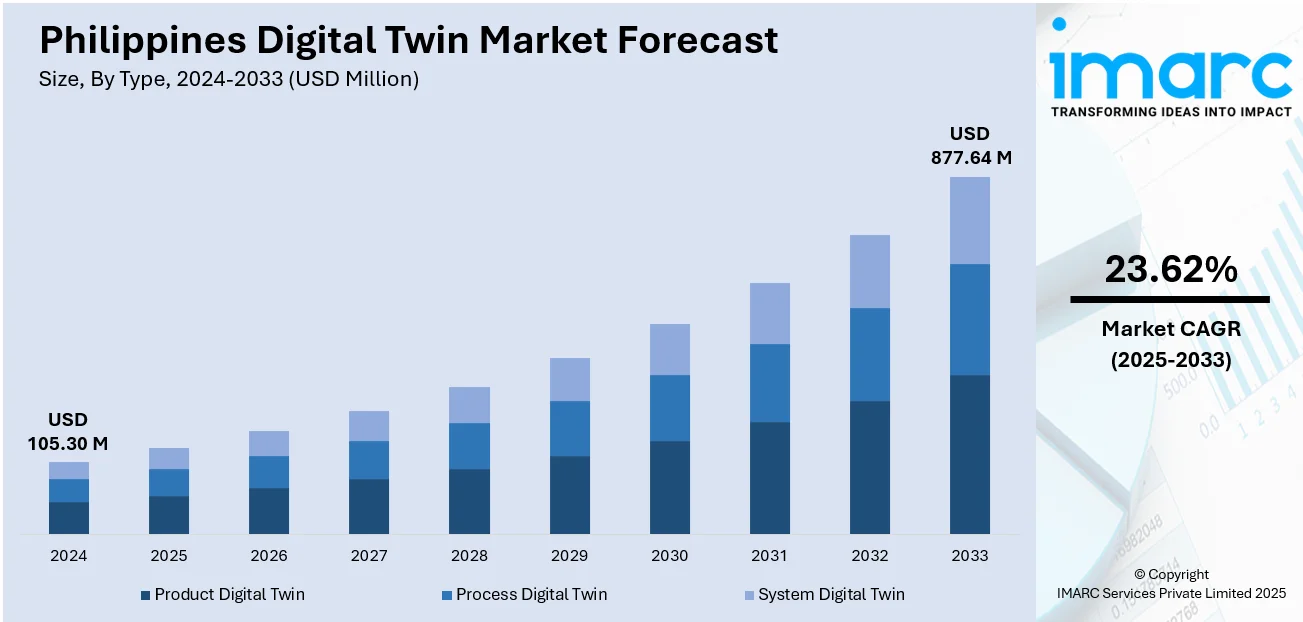

The Philippines digital twin market size reached USD 105.30 Million in 2024. The market is projected to reach USD 877.64 Million by 2033, exhibiting a growth rate (CAGR) of 23.62% during 2025-2033. The market is evolving through expanding adoption of virtual modeling technologies across industries. Organizations are integrating digital twin frameworks to enhance predictive maintenance, streamline operations, and optimize decision-making. Key players are leveraging advanced simulation, IoT, and AI to deliver innovative solutions tailored to sectors such as manufacturing, urban planning, and utilities. Regional growth trends reflect accelerating interest in smart infrastructure and digital transformation. Overall, these developments signal a promising trajectory for the Philippines digital twin market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 105.30 Million |

| Market Forecast in 2033 | USD 877.64 Million |

| Market Growth Rate 2025-2033 | 23.62% |

Philippines Digital Twin Market Trends:

Strategic Government Plans for Digital Transformation

The Philippine government is stepping up the drive to upgrade the nation's digital infrastructure as one of its global economic and innovation objectives. In January 2025, the National Economic and Development Authority (NEDA), in coordination with the Korea Trade-Investment Promotion Agency (KOTRA), promoted the Korean-Philippine Economic Innovation Partnership Program (EIPP). The program is directed at building core digital infrastructure projects, including the National Communications Satellite Roadmap and the Integrated Data Center. These initiatives are meant to increase connectivity, data management, and digital services across the country, especially in the rural areas. Through the enhanced country ICT backbone, the government hopes to provide a solid base for digital innovation and smart technologies. These efforts are likely to draw additional investments and induce cooperation between the private and public sectors. As these digital infrastructure projects continue, they create a conducive environment for technologies such as digital twins to develop. Ultimately, such government-driven modernization will have a role to play in enabling Philippines digital twin market growth.

To get more information on this market, Request Sample

Developments in Smart Manufacturing and Industry 4.0

The Philippines is slowly but surely adopting Industry 4.0 technologies to develop its manufacturing industry, and digital twins are increasingly taking part in this process. The government's partnership with technology providers is intended to assist micro, small, and medium enterprises (MSMEs) in adopting automation as well as digital technologies that make production more efficient and better quality. In June 2024, the Department of Trade and Industry (DTI) and Siemens established a partnership to create the industry 4.0 Pilot Factory. The project will showcase digital and automation technologies that can be utilized by manufacturers to automate operations and minimize downtime. Through offering a hands-on environment, the pilot factory facilitates building awareness and competence in smart manufacturing practices and sets the stage for larger-scale application of digital twins in the industry. This is all within a broader initiative to bring Philippine manufacturing more up to date, making it more competitive both at home and abroad. These specific efforts illustrate increasingly mainstream emerging technologies are becoming in the industrial future of the country, influencing the Philippines digital twin market trends.

Expansion of the Digital Economy and Workforce Capacity

The Philippines is experiencing high growth in its digital economy, making it a good platform for technologies such as digital twins to gain traction. These key sectors of e-commerce, digital services, and content creation are growing at very high speeds, fueling demand for high-end digital solutions. The government is focusing on initiatives to enhance digital infrastructure and increase internet coverage, especially in rural and underdeveloped areas. In March of 2024, the Department of Information and Communications Technology (DICT) announced broad coverage of nationwide broadband roll-out under the Philippine Digital Infrastructure Project aimed at closing the digital gap and improving connectivity throughout the archipelago. These infrastructure investments are key to making real-time data processing and simulation technologies possible, which are the bedrock of digital twin technologies. The increasing digitally literate workforce offers additional impetus to digital transformation initiatives. These characteristics combined create a climate conducive to technology adoption and innovation. As the digital economy deepens, these advances pave the way for greater utilization of digital twins across different sectors throughout the Philippines.

Philippines Digital Twin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and end use.

Type Insights:

- Product Digital Twin

- Process Digital Twin

- System Digital Twin

The report has provided a detailed breakup and analysis of the market based on the type. This includes product digital twin, process digital twin, and system digital twin.

Technology Insights:

- IoT and IIoT

- Blockchain

- Artificial Intelligence and Machine Learning

- Augmented Reality, Virtual Reality and Mixed Reality

- Big Data Analytics

- 5G

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes IoT and IIoT, blockchain, artificial intelligence and machine learning, augmented reality, virtual reality and mixed reality, big data analytics, and 5G.

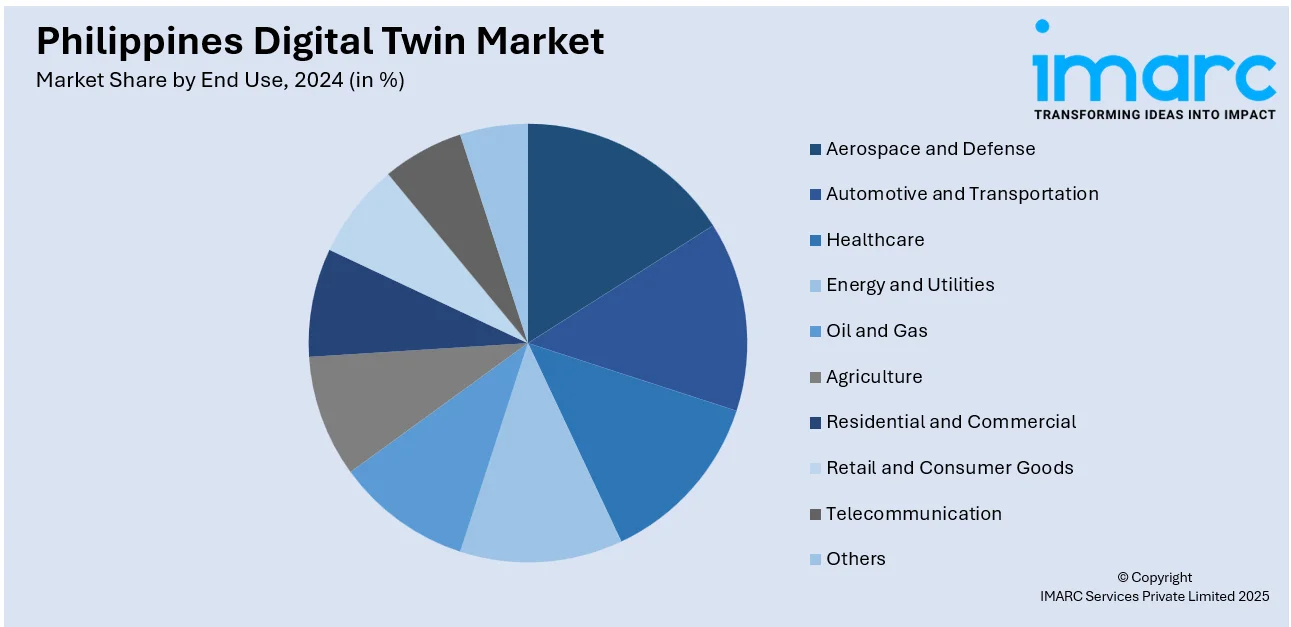

End Use Insights:

- Aerospace and Defense

- Automotive and Transportation

- Healthcare

- Energy and Utilities

- Oil and Gas

- Agriculture

- Residential and Commercial

- Retail and Consumer Goods

- Telecommunication

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes aerospace and defense, automotive and transportation, healthcare, energy and utilities, oil and gas, agriculture, residential and commercial, retail and consumer goods, telecommunication, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Digital Twin Market News:

- June 2025: Arup, together with RiverRecycle and the Asian Development Bank, is creating a digital twin of the Pasig River to fight plastic pollution in the Philippines. The project will bring together satellite data, surveys, and weather modeling to track plastic flow, allowing authorities to implement targeted clean-up efforts. The project aids the Philippine government's rejuvenation of Pasig River and encourages community participation for eco-friendly environmental solutions

- May 2024: Aboitiz Power, in partnership with Thai company REPCO NEX Industrial Solutions, is launching the Philippines’ first smart power plants through “Project Arkanghel.” This initiative involves creating digital twins for two coal-fired plants: Therma South in Davao City and Therma Visayas in Cebu. These virtual models will simulate operations to enable real-time fault detection and advanced scenario testing. By integrating AI and data science, the project aims to improve operational efficiency, optimize performance, and support predictive maintenance for sustainable energy management in the Philippines.

Philippines Digital Twin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Product Digital Twin, Process Digital Twin, System Digital Twin |

| Technologies Covered | IoT and IIoT, Blockchain, Artificial Intelligence and Machine Learning, Augmented Reality, Virtual Reality and Mixed Reality, Big Data Analytics, 5G |

| End Uses Covered | Aerospace and Defense, Automotive and Transportation, Healthcare, Energy and Utilities, Oil and Gas, Agriculture, Residential and Commercial, Retail and Consumer Goods, Telecommunication, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines digital twin market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines digital twin market on the basis of type?

- What is the breakup of the Philippines digital twin market on the basis of technology?

- What is the breakup of the Philippines digital twin market on the basis of end use?

- What is the breakup of the Philippines digital twin market on the basis of region?

- What are the various stages in the value chain of the Philippines digital twin market?

- What are the key driving factors and challenges in the Philippines digital twin market?

- What is the structure of the Philippines digital twin market and who are the key players?

- What is the degree of competition in the Philippines digital twin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines digital twin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines digital twin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines digital twin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)