Philippines Digital Wallet Market Report by Type (Proximity, Remote), Deployment Type (On-premises, Cloud), Industry Vertical (Education, Gaming, Information Technology and Telecommunications, Aerospace and Defense, Legal, Media and Entertainment, Automotive, Banking Financial Services and Insurance, Consumer Goods, and Others), and Region 2026-2034

Philippines Digital Wallet Market Overview:

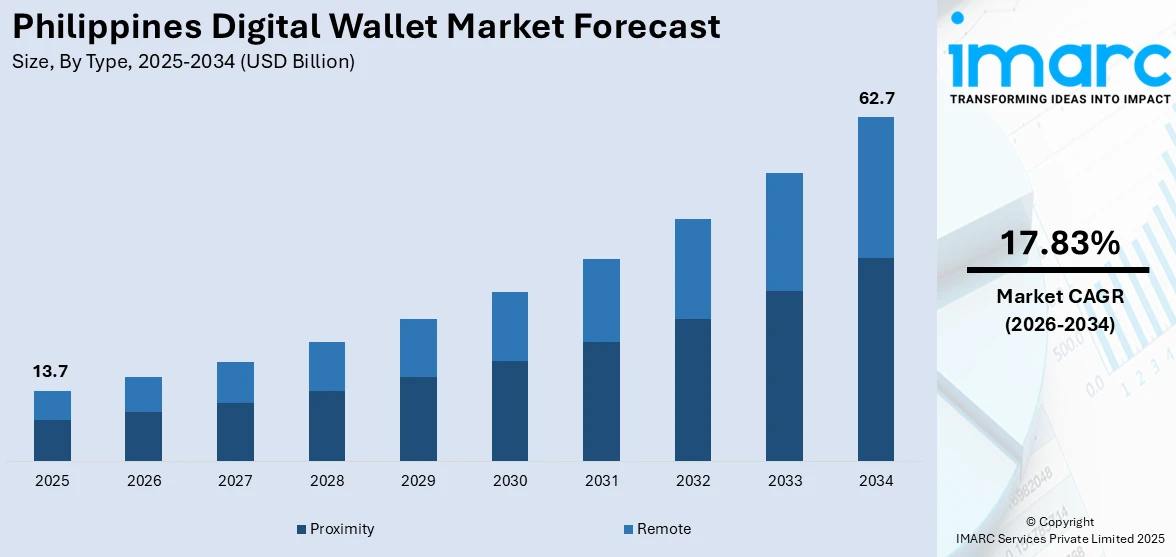

The Philippines digital wallet market size reached USD 13.7 Billion in 2025. Looking forward, the market is expected to reach USD 62.7 Billion by 2034, exhibiting a growth rate (CAGR) of 17.83% during 2026-2034. There are several factors that are driving the market, which include increasing adoption of smartphones and the ease of internet facilities, the thriving e-commerce sector, and collaboration between banks, telecommunications companies, and other stakeholders.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 13.7 Billion |

| Market Forecast in 2034 | USD 62.7 Billion |

| Market Growth Rate 2026-2034 | 17.83% |

Key Trends of Philippines Digital Wallet Market:

Rising Adoption of Smartphones and Ease of Internet Facilities

There is a rise in the utilization of smartphones, along with the ease of internet facilities. With smartphones, people can easily use digital wallets for daily purchases. Users save time and money when they can handle their finances, transfer money, and make payments all from their smartphones. Furthermore, digital wallet services are available to a wider range of users, including individuals who may not have had easy access to traditional banking services in remote locations, all because of smartphones and improved internet connectivity. This increased accessibility enables more people to participate in the digital economy and access financial services conveniently. In addition, digital wallets offer cost-effective alternatives to traditional banking services, particularly for small-value transactions. They also have lower transaction fees and various incentives such as cashback rewards. The number of mobile subscribers in the Philippines is anticipated to hit 159 million, and broadband subscribers will be around 10.8 million by 2025, as reported by the International Trade Administration (ITA).

To get more information of this market Request Sample

Thriving E-Commerce Industry

The escalating demand for digital wallets on account of the burgeoning e-commerce sector in the Philippines is contributing to the market growth. People are preferring the convenience of digital wallets for making online payments. Digital wallets offer a seamless checkout experience, allowing users to complete transactions quickly and securely without the need to enter their payment details for each purchase. They provide an extra layer of security by encrypting users' financial data and offering features like two-factor authentication, thereby reducing the risk of fraud and unauthorized transactions. This enhanced security makes digital wallets a trusted payment method for e-commerce transactions. Furthermore, many e-commerce platforms and online retailers in the Philippines integrate digital wallet payment options into their checkout processes. This integration makes it easier for users to pay using their preferred digital wallet, further driving adoption among online shoppers. According to the International Trade Administration (ITA), Philippines’ e-commerce market sales are estimated to reach US$ 24 Billion by 2025.

Growth Drivers of Philippines Digital Wallet Market:

Increasing Financial Inclusion Efforts by Banks and Fintechs

Banks and fintech companies in the Philippines are playing a pivotal role in bridging the financial access gap by targeting unbanked and underbanked communities. Through intuitive, user-friendly digital wallet platforms, these institutions enable individuals without traditional bank accounts to perform essential transactions such as payments, money transfers, and savings directly from their mobile devices. This strategy is enabling the displacement of the physical visits in the bank, which is a reduction in the participation costs in the formal financial system. Providing cost-effective, convenient and safe services, providers are creating the independence of the low-income population and remote populations. The increased level of outreach, which is assisted by collaborations between financial institutions and local businesses, is driving the usage of digital payments among various demographics, which, in turn, advances financial inclusion in the country.

Expansion of Contactless Payment Infrastructure

The rapid growth of contactless payment infrastructure, including NFC-enabled terminals and QR code payment systems, is significantly boosting the Philippines digital wallet market demand. These technologies are now widely available across retail stores, public transportation systems, and service-based sectors, offering consumers a fast, secure, and hygienic payment alternative to cash. Merchants benefit from quicker transaction processing, reduced handling costs, and enhanced customer satisfaction. The increasing acceptance of these systems by both large retail chains and small businesses is driving consumer confidence in cashless transactions. Additionally, government and private sector initiatives promoting digital payment adoption further encourage widespread use. As more industries adopt contactless technologies, digital wallets are becoming an integral part of daily transactions, fueling continuous growth in the cashless economy.

Integration of Loyalty and Rewards Programs

Digital wallet providers in the Philippines are enhancing user engagement and retention by integrating loyalty and rewards programs into their platforms, which is fueling the Philippines digital wallet market share. Features such as cashback offers, loyalty points, and personalized discounts incentivize repeat transactions and strengthen customer relationships. By leveraging data analytics, providers can tailor these rewards to match individual spending habits, creating a more personalized and satisfying user experience. This approach not only differentiates brands in a highly competitive market but also encourages higher transaction frequency. Furthermore, partnerships with retail chains, restaurants, and service providers expand the scope of rewards, increasing the perceived value of using digital wallets. As consumers increasingly seek both convenience and added benefits, loyalty-driven incentives are emerging as a key driver of long-term digital wallet adoption.

Opportunities of Philippines Digital Wallet Market:

Cross-Border Payment Solutions

The Philippines, with its substantial overseas workforce, presents a major opportunity for digital wallet providers to expand into cross-border payment services. Remittances are a critical part of the nation’s economy, and integrating low-cost, real-time transfer capabilities into wallet platforms can significantly enhance their value proposition. By offering faster processing, competitive exchange rates, and transparent fee structures, digital wallets can attract more users seeking efficient ways to send and receive funds internationally. These features not only increase user engagement but also position wallets as a convenient alternative to traditional remittance channels. Strategic partnerships with global payment networks and fintech companies can further strengthen this capability, enabling seamless transactions across borders while improving accessibility for both senders and recipients.

Microfinance and Credit Integration

Digital wallets have the potential to expand beyond basic payment functions by integrating microfinance and credit services, especially for underserved and unbanked communities in the Philippines. Collaborations with microfinance institutions can allow wallets to offer small loans, bill financing, and flexible repayment plans directly through their platforms, further driving the Philippines digital wallet market growth. Additionally, using transaction histories to build credit scores can open new financial opportunities for users lacking traditional banking records. Such integration increases platform stickiness, as customers are more likely to remain loyal to services that meet broader financial needs. By combining convenience, accessibility, and affordability, wallet providers can empower individuals and small businesses, fostering financial inclusion while creating new revenue streams through interest-based services and value-added financial products.

Rural Market Penetration

Rural areas in the Philippines remain an untapped market for digital wallets, offering immense growth potential for providers willing to address infrastructure and accessibility challenges. To succeed, wallets can introduce simplified, user-friendly interfaces tailored for first-time users, along with offline payment functionalities for regions with limited internet connectivity. Localized customer support, available in native languages, can further enhance trust and adoption. Partnerships with rural merchants, cooperatives, and community organizations can help integrate digital wallets into daily transactions, from market purchases to utility bill payments. By aligning product design with rural needs and offering practical, low-cost solutions, wallet providers can expand financial inclusion while capturing a significant share of this underpenetrated segment, ultimately driving nationwide adoption and usage growth.

Government Support for Philippines Digital Wallet Market:

Regulatory Framework for Digital Payments

The Bangko Sentral ng Pilipinas (BSP) has established a robust regulatory framework designed to ensure the safety, transparency, and efficiency of digital payment systems in the Philippines. These regulations set clear operational standards for digital wallet providers, covering areas such as cybersecurity, consumer protection, and anti-money laundering compliance. By enforcing strict guidelines, the BSP aims to safeguard users from potential risks while promoting trust and confidence in cashless transactions. The framework also encourages innovation by creating a secure environment where fintech companies and banks can introduce new services without compromising consumer safety. This proactive regulatory approach not only strengthens the country’s digital payment infrastructure but also fosters greater adoption among individuals and businesses, contributing to the growth of a secure, inclusive financial ecosystem.

National ID System Rollout

The introduction of the Philippine Identification System (PhilSys) is playing a transformative role in expanding digital wallet adoption across the country. By providing every citizen with a single, verifiable national ID, the process of account verification and onboarding for digital payment platforms has become faster, simpler, and more accessible. This universal identification system reduces the need for multiple documents, eliminating one of the major barriers to opening digital financial accounts, especially for unbanked individuals in rural areas. As a result, more citizens can register and begin transacting with ease, boosting financial inclusion nationwide. In addition, PhilSys enhances security by providing a reliable means of identity authentication, which helps minimize fraudulent account creation and supports compliance with know-your-customer (KYC) regulations.

Public Sector Digital Payment Initiatives

Government adoption of digital payment solutions is accelerating the shift toward a cashless economy in the Philippines. Various agencies are implementing e-payment options for public services such as license renewals, taxes, and permit applications, making transactions faster and more convenient for citizens. Additionally, social aid and welfare benefits are increasingly distributed through digital wallets, ensuring secure, direct, and timely disbursement to beneficiaries while reducing the risks and inefficiencies associated with cash handling. These initiatives not only improve service delivery but also familiarize a broader segment of the population with digital transactions, encouraging wider adoption. By leading the way in cashless payments, the public sector sets a strong example for private enterprises, driving the overall growth and integration of digital payment systems in everyday life.

Challenges of Philippines Digital Wallet Market:

Cybersecurity and Fraud Risks

As digital wallet transactions grow in volume and value, the risk of cyberattacks such as hacking, phishing, and identity theft increases significantly. Fraudulent activities not only result in financial losses but also erode consumer trust in digital payment systems. To address these threats, providers must implement advanced security measures, including robust encryption protocols, multi-factor authentication, and AI-powered fraud detection tools capable of identifying suspicious activity in real time. Additionally, regular system audits, continuous security updates, and user education on safe online practices are essential to minimizing vulnerabilities. Building a reputation for security can help digital wallet operators retain existing customers, attract new users, and maintain compliance with evolving regulations designed to safeguard both consumers and financial institutions.

Low Digital Literacy in Certain Segments

Despite strong adoption of digital wallets in urban centers, a significant portion of the rural population and elderly demographic in the Philippines remains unfamiliar with mobile financial technology. According to the Philippines digital wallet market analysis, this low digital literacy can create barriers to entry, as potential users may find registration, navigation, and transaction processes confusing or intimidating. Without proper knowledge, individuals are also more vulnerable to scams or misuse, further deterring adoption. To bridge this gap, wallet providers and policymakers can launch targeted awareness programs, hands-on training sessions, and simplified app interfaces designed for ease of use. Localized language support, visual guides, and community-based education can empower these groups to confidently utilize digital wallets, ultimately broadening market reach and ensuring more inclusive financial participation nationwide.

Interoperability Issues Between Platforms

The Philippines digital wallet ecosystem features multiple providers, each with distinct platforms and transaction systems, leading to interoperability challenges. Users often face difficulties when transferring funds between wallets or from wallets to bank accounts, reducing the convenience and efficiency that drive digital payment adoption. This fragmentation forces consumers and merchants to maintain multiple accounts, complicating financial management. Addressing this barrier requires collaborative efforts between wallet providers, banks, and regulatory bodies to create standardized frameworks and shared payment infrastructures. Initiatives such as unified QR code systems, cross-platform transfer agreements, and centralized settlement networks can significantly enhance user experience. Improved interoperability not only increases transaction efficiency but also fosters a more competitive and innovative market, benefiting both service providers and end-users.

Philippines Digital Wallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, deployment type, and industry vertical.

Type Insights:

- Proximity

- Remote

The report has provided a detailed breakup and analysis of the market based on the type. This includes proximity and remote.

Deployment Type Insights:

- On-premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

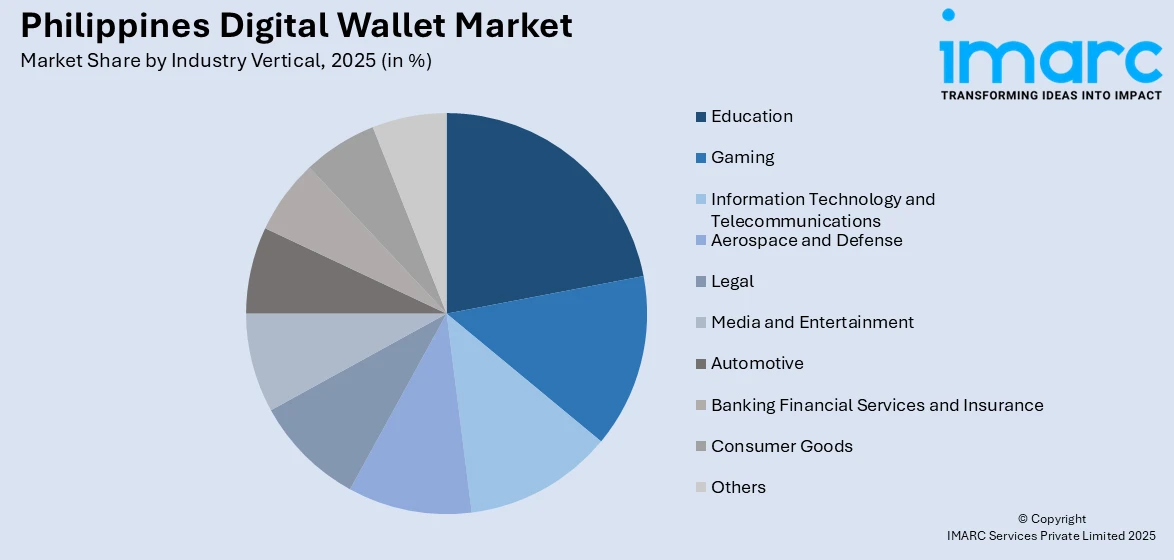

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- Education

- Gaming

- Information Technology and Telecommunications

- Aerospace and Defense

- Legal

- Media and Entertainment

- Automotive

- Banking Financial Services and Insurance

- Consumer Goods

- Others

The report has provided a detailed breakup and analysis of the market based on the Industry Vertical. This includes education, gaming, information technology and telecommunications, aerospace and defense, legal, media and entertainment, automotive, banking financial services and insurance, consumer goods, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Digital Wallet Market News:

- 13 August 2025: In support of its goal to modernize the nation’s transportation system with advanced payment technologies, the Philippine government teamed up with the country’s top e-wallet provider. Collaborating with GCash, the Department of Transportation (DOTr), the Bangko Sentral ng Pilipinas (BSP), and the Department of Information and Communications Technology (DICT) have introduced state-of-the-art cashless payment options for the Metro Rail Transit System Line 3 (MRT-3) in Metro Manila. This initiative aims to deliver a seamless, world-class commuting experience by integrating modern financial technology into one of the capital’s busiest rail networks.

- 14 April 2025: Flag carrier Philippine Airlines (PAL) introduced its proprietary e-wallet, enabling passengers to consolidate multiple electronic cards into one convenient account. The PAL e-wallet can store various digital cards, including travel credits, Miles, compensation vouchers, and e-gift cards, providing a streamlined and organized way to manage these benefits.

- 6 November 2024: Thunes, known as the Smart Superhighway for global money movement, announced a strategic partnership with GCash, the Philippines’ leading digital wallet. Through this innovative collaboration, GCash users can now directly top up their wallet balances via the app using funds from bank accounts in the UK and Europe. The initiative enables real-time, cost-efficient cross-border top-ups, providing GCash customers in Europe with greater convenience and enhanced control over their finances.

- 22 May 2024: GLOBE Telecom’s popular fintech app GCash announced that it may go public in the Philippines next year as it keeps the door open for new investors and an overseas listing.

- 26 September 2023: The Asia United Bank (AUB), a publicly listed bank in the Philippines, enabled more local merchants to accept cross-border digital payments from Hong Kong, South Korea, and Malaysia via Alipay+ and AUB PayMate. It allows travelers to pay using their home country’s e-wallets for purchases related to tourism, retail, food and beverage, and entertainment and attractions in the Philippines.

Philippines Digital Wallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Proximity, Remote |

| Deployment Types Covered | On-premises, Cloud |

| Industries Vertical Covered | Education, Gaming, Information Technology and Telecommunications, Aerospace and Defense, Legal, Media and Entertainment, Automotive, Banking Financial Services and Insurance, Consumer Goods, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines digital wallet market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines digital wallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines digital wallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital wallet market in the Philippines was valued at USD 13.7 Billion in 2025.

The Philippines digital wallet market is projected to exhibit a CAGR of 17.83% during 2026-2034.

The Philippines digital wallet market is projected to reach a value of USD 62.7 Billion by 2034.

Key trends in the Philippines digital wallet market include increasing integration of QR code payments, expansion of financial services beyond transactions, and rising adoption in rural areas. Strategic partnerships, enhanced security features, and gamified rewards are further shaping user engagement, driving broader acceptance across various consumer and merchant segments.

The Philippines digital wallet market is driven by rising smartphone penetration, government initiatives for financial inclusion, and increasing cashless payment adoption. Expanding e-commerce, improved internet connectivity, and innovative value-added services further boost usage, enhancing convenience and accessibility for both urban and rural consumers nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)