Philippines Dimethyl Ether Market Size, Share, Trends and Forecast by Raw Material, Application, End-Use Industry, and Region, 2025-2033

Philippines Dimethyl Ether Market Overview:

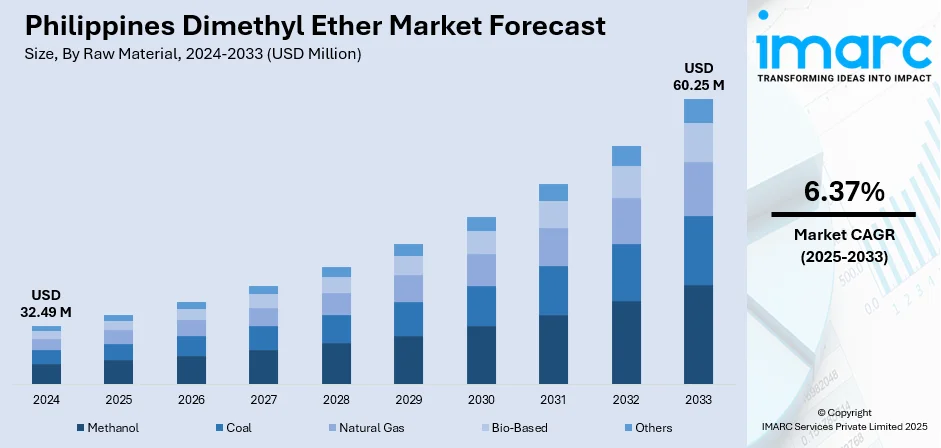

The Philippines dimethyl ether market size reached USD 32.49 Million in 2024. The market is projected to reach USD 60.25 Million by 2033, exhibiting a growth rate (CAGR) of 6.37% during 2025-2033. Growing demand for cleaner fuels and renewable alternatives is boosting adoption of dimethyl ether in energy and industrial sectors. Government support for reducing carbon emissions and focus on domestic production continue to strengthen the Philippines dimethyl ether market share across residential, transport, and manufacturing applications.

|

Report Attribute

|

Key Statistics

|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 32.49 Million |

| Market Forecast in 2033 | USD 60.25 Million |

| Market Growth Rate (2025-2033) | 6.37% |

Philippines Dimethyl Ether Market Trends:

Rising Adoption in Clean Energy Use

The Philippines dimethyl ether market growth is being shaped by the increasing emphasis on clean energy adoption. As the country moves toward lowering its dependence on conventional fossil fuels, dimethyl ether (DME) is gaining recognition as a viable alternative to liquefied petroleum gas (LPG). Its clean-burning properties, reduced carbon emissions, and compatibility with existing LPG infrastructure make it an attractive option for both households and industries. Urbanization and population growth are fueling energy demand, which is encouraging consumers and policymakers to explore more sustainable sources. Authorities are also supporting renewable and low-carbon fuels through incentives and strategic energy programs, creating conditions for gradual but steady adoption of DME. Recent developments highlight the potential of DME in transportation and energy storage. Pilot projects testing DME as a diesel substitute in buses and commercial vehicles are showing encouraging results, especially in lowering particulate emissions in densely populated cities. Similarly, small-scale initiatives for blending DME with LPG are paving the way for commercial use across residential and industrial sectors. While challenges related to large-scale production and infrastructure remain, the visible progress of these initiatives indicates a growing acceptance of DME as part of the Philippines’ future energy mix.

To get more information on this market, Request Sample

Industrial Applications Strengthening Market Demand

Industrial expansion in the Philippines is creating stronger prospects for dimethyl ether, with applications extending beyond household fuel use. Industries such as chemicals, pharmaceuticals, paints, and adhesives are turning to DME for its role as both a clean fuel and a potential feedstock. Growing construction activity and rising demand for industrial raw materials are indirectly pushing companies to consider more sustainable alternatives in their processes. In addition, the country’s rising energy consumption and concerns over fuel imports are encouraging investments in new energy solutions, where DME is gaining attention for its ability to balance affordability with environmental benefits. In recent years, there have been active discussions about setting up localized DME production facilities, supported by collaborations with regional players. These efforts aim to reduce exposure to volatile international oil prices while promoting domestic energy security. Furthermore, power generation sectors are assessing the feasibility of DME integration to diversify fuel supplies and meet renewable energy targets. The continuous development of industrial applications, combined with growing investor interest, signals that the Philippines’ dimethyl ether market is on a trajectory of steady expansion. These developments suggest that DME is no longer limited to trial applications but is advancing toward a wider role in the industrial and energy landscape.

Philippines Dimethyl Ether Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on raw material, application, and end-use industry.

Raw Material Insights:

- Methanol

- Coal

- Natural Gas

- Bio-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes methanol, coal, natural gas, bio-based, and others.

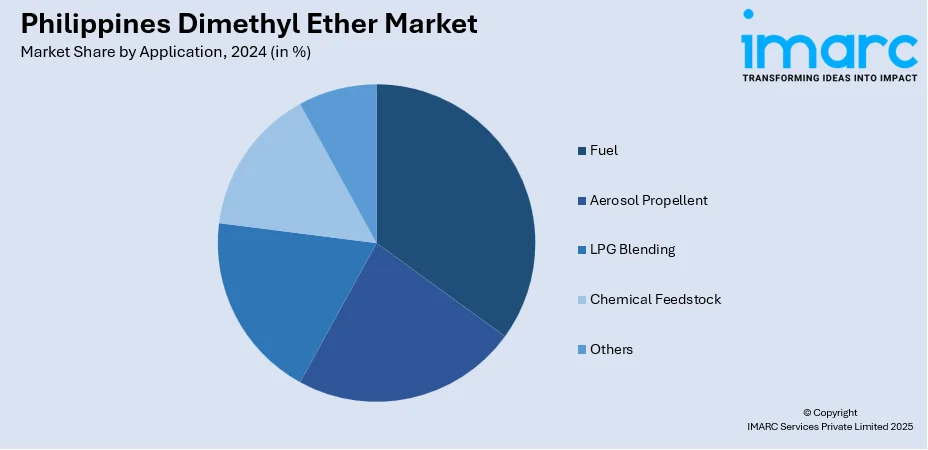

Application Insights:

- Fuel

- Aerosol Propellent

- LPG Blending

- Chemical Feedstock

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fuel, aerosol propellent, LPG blending, chemical feedstock, and others.

End-Use Industry Insights:

- Oil and Gas

- Automotive

- Power Generation

- Cosmetics

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes oil and gas, automotive, power generation, cosmetics, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Dimethyl Ether Market Report Coverage:

| Report Features | Details |

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Methanol, Coal, Natural Gas, Bio-Based, Others |

| Applications Covered | Fuel, Aerosol Propellent, LPG Blending, Chemical Feedstock, Others |

| End-Use Industries Covered | Oil and Gas, Automotive, Power Generation, Cosmetics, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Philippines dimethyl ether market performed so far and how will it perform in the coming years?

- What is the breakup of the Philippines dimethyl ether market on the basis of raw material?

- What is the breakup of the Philippines dimethyl ether market on the basis of application?

- What is the breakup of the Philippines dimethyl ether market on the basis of end-use industry?

- What is the breakup of the Philippines dimethyl ether market on the basis of region?

- What are the various stages in the value chain of the Philippines dimethyl ether market?

- What are the key driving factors and challenges in the Philippines dimethyl ether market?

- What is the structure of the Philippines dimethyl ether market and who are the key players?

- What is the degree of competition in the Philippines dimethyl ether market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines dimethyl ether market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines dimethyl ether market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines dimethyl ether industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)