Philippines Doors Market Size, Share, Trends and Forecast by Type, Material, Mechanism, Application, End User, and Region 2026-2034

Philippines Doors Market Summary:

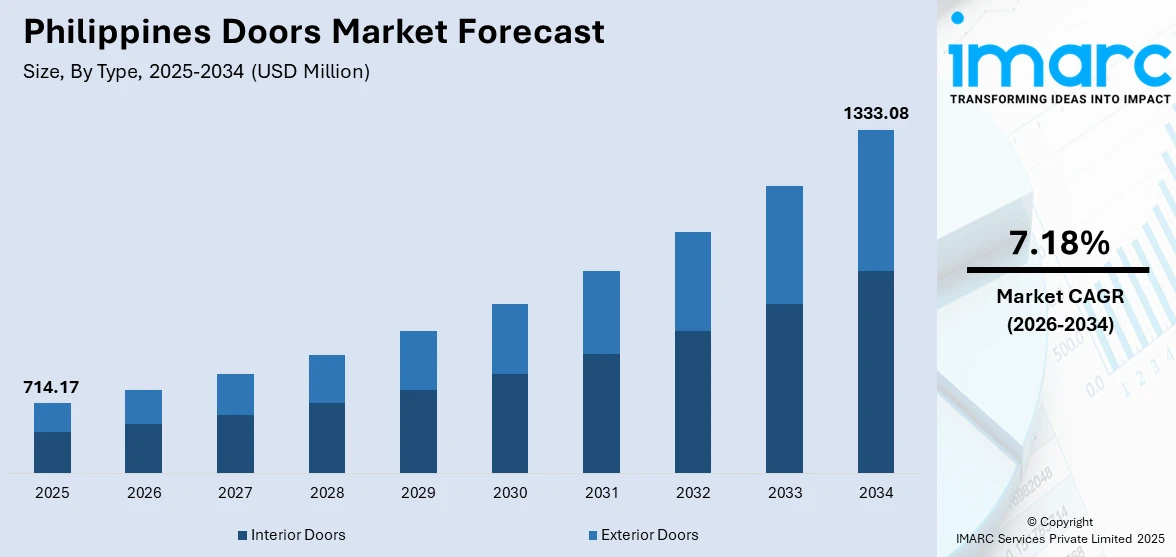

The Philippines doors market size was valued at USD 714.17 Million in 2025 and is projected to reach USD 1,333.08 Million by 2034, growing at a compound annual growth rate of 7.18% from 2026-2034.

The doors market in the Philippines is witnessing substantial growth due to strong construction sector expansion, swift urbanization, and infrastructure development driven by the government. Increasing housing needs fueled by demographic changes and urban migration are generating ongoing demands for high-quality door solutions in both residential and commercial sectors. The merging of eco-friendly construction methods, changing user preferences for attractive doors, and a heightened emphasis on safety regulations is fundamentally altering competitive landscapes and generating significant opportunities for industry players.

Key Takeaways and Insights:

- By Type: Interior doors dominate the market with a share of 55% in 2025, driven by extensive residential construction activity requiring multiple interior partitioning solutions and the growing user preference for aesthetically designed room dividers that enhance living space functionality.

- By Material: Wood leads the market with a share of 42% in 2025, owing to traditional architectural preferences, natural insulation properties, and cultural affinity for wooden construction elements that align with Philippine design aesthetics and climate requirements.

- By Mechanism: Swinging represents the largest segment with a market share of 60% in 2025. This dominance is because of cost-effectiveness, ease of installation, and widespread familiarity among builders and consumers across both residential and commercial applications.

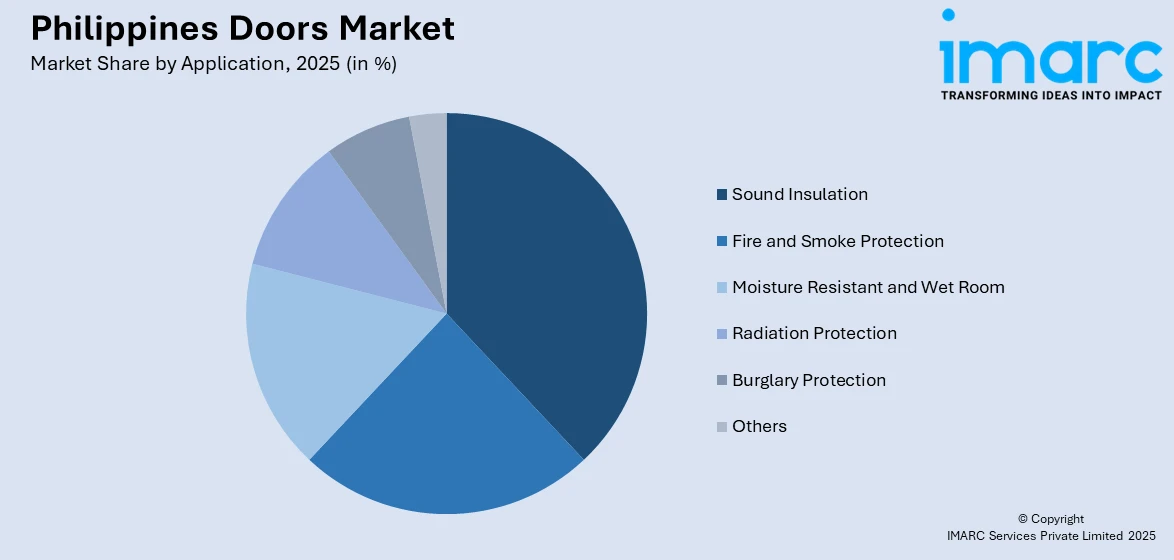

- By Application: Sound insulation dominates the market with a share of 25% in 2025, reflecting increasing urban density challenges and user demand for acoustic privacy solutions in residential apartments and commercial office environments.

- By End User: Residential leads the market with a share of 68% in 2025, underpinned by government housing initiatives, rising homeownership aspirations, and expanding condominium developments across metropolitan areas.

- By Region: Luzon represents the largest segment with a market share of 58% in 2025, due to concentrated economic activities, superior infrastructure networks, and high population density in Metro Manila and surrounding provinces.

- Key Players: The Philippines doors market exhibits moderate competitive intensity, with established local manufacturers competing alongside international brands offering diversified product portfolios. Companies are focusing on product innovation, distribution network expansion, and strategic partnerships to strengthen market positioning.

To get more information on this market Request Sample

The Philippines doors market is experiencing robust growth, driven by the rapid expansion of the real estate and construction sectors. As urbanization accelerates, more people are moving into newly developed residential areas, increasing the demand for high-quality, durable doors that align with modern home designs. In commercial spaces, there is a rise in the need for doors with advanced features like security, fire resistance, and soundproofing, particularly in office buildings, hotels, and shopping malls. The growing focus on energy efficiency is influencing the market, with eco-friendly and insulated doors gaining popularity to improve temperature control and reduce energy costs. The hospitality and retail industries further drive the demand, as new hotels, resorts, and retail outlets require specialized door solutions. A prime example of this trend is Arcadis Philippines Inc., which in 2025 secured three major project management contracts, including high-end residential mock-ups, a commercial building in Makati, and a foreign embassy relocation.

Philippines Doors Market Trends:

Increasing Demand for Residential Construction

The steadily increasing population and urban expansion in the Philippines are driving the demand for diverse door solutions, as both new housing developments and renovations require a variety of options. Homeowners are increasingly seeking doors that combine aesthetics, functionality, and security, contributing to a broad market for both interior and exterior doors. This demand is supported by developments, such as the 38 Park Avenue Project, announced in 2024 by NTT Urban Development Corporation in collaboration with Cebu Landmasters Inc. The condominium tower in Cebu City will feature approximately 900 units, further driving the need for high-quality door solutions.

Rising Affluence and Changing User Preferences

The increasing affluence of the population, coupled with a shift in user preferences, is catalyzing the demand for premium and luxury doors. As disposable incomes rise, there has been a notable increase in the purchase of high-end residential doors, such as custom-made wooden, glass, and security doors. Additionally, the growing demand for modern, sleek designs in both homes and commercial spaces is encouraging people to seek doors that align with their aesthetic standards. This trend is further supported by the latest data from the Philippine Statistics Authority (PSA), which revealed a 16.6% increase in gross savings, rising to PHP7.70 trillion in 2024. This growing affluence is driving the demand for luxury, high-quality, and personalized door designs.

Improved Distribution Channels and Retail Presence

The growth of modern distribution channels and retail presence is enhancing the availability and accessibility of doors in the Philippines. With the rise of e-commerce platforms, specialized retailers, and dedicated showrooms, people have greater access to a diverse range of door products in terms of design, material, and functionality. This trend is exemplified by data from the 2024 National Information and Communications Technology Household Survey (NICTHS), which reported that by October 2025, 15.4% of Filipinos were engaged in selling goods and services online. This expanded distribution network, combined with greater market visibility, is contributing to the growth of the doors market in the Philippines.

Market Outlook 2026-2034:

The Philippines doors market shows strong growth potential throughout the forecast period, driven by continuous construction activity and evolving building standards. The market generated a revenue of USD 714.17 Million in 2025 and is projected to reach a revenue of USD 1,333.08 Million by 2034, growing at a compound annual growth rate of 7.18% from 2026-2034. This growth is driven by urban expansion, rising demand for residential and commercial properties, and the increasing focus on energy-efficient and sustainable building practices. As the construction sector thrives, doors play a crucial role in modernizing building infrastructures.

Philippines Doors Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Interior Doors |

55% |

|

Material |

Wood |

42% |

|

Mechanism |

Swinging |

60% |

|

Application |

Sound Insulation |

25% |

|

End User |

Residential |

68% |

|

Region |

Luzon |

58% |

Type Insights:

- Interior Doors

- Exterior Doors

Interior doors dominate with a market share of 55% of the total Philippines doors market in 2025.

Interior doors lead the market, primarily due to the growing demand for residential and commercial properties. As urbanization accelerates, more homes, apartments, and office spaces are being built, increasing the need for interior doors. These doors are essential for privacy, security, and aesthetics, with varying designs, materials, and finishes catering to different preferences. With the rise in property developments and renovations, interior doors remain the most popular choice, driving significant market growth in both traditional and modern housing segments.

Furthermore, interior doors offer versatility, serving multiple functions, such as soundproofing, insulation, and enhancing the overall interior design. In residential homes, interior doors are often chosen based on style preferences, from traditional wood doors to contemporary glass or composite materials. In commercial spaces, functionality, durability, and cost-effectiveness are key considerations. As building standards evolve and homeowners seek aesthetic appeal combined with practicality, interior doors continue to dominate the market, contributing to sustained growth and innovation in design and material technology.

Material Insights:

- Wood

- Glass

- Metal

- Plastic

- Others

Wood leads with a market share of 42% of the total Philippines doors market in 2025.

Wood holds the majority of the market share, attributed to its natural appeal, versatility, and availability. Wood door is widely preferred for both residential and commercial properties because of its aesthetic value, which complements various interior styles. With a rich selection of hardwoods, such as Mahogany and Narra, wood offers durability, insulation, and a timeless look. In the Philippines, where timber is abundant and locally sourced, wood remains an affordable yet premium option, making it the material of choice for most consumers and builders.

Additionally, wood is highly customizable, allowing for intricate designs, carvings, and finishes that cater to diverse tastes. The material also performs well in tropical climates, providing natural thermal insulation, which is essential in maintaining comfortable indoor temperatures. Wood is an environmentally sustainable option when sourced responsibly, aligning with the growing user awareness of eco-friendly practices. As a result, the combination of aesthetic, functional, and sustainable qualities continues to make wood the dominant material in the Philippines doors market.

Mechanism Insights:

- Swinging

- Sliding

- Folding

- Revolving

- Others

Swinging exhibits a clear dominance with a 60% share of the total Philippines doors market in 2025.

Swinging represents the largest segment because of their simplicity, reliability, and versatility. Swinging door is widely used in residential, commercial, and industrial applications as it offers ease of use, especially in spaces where accessibility is a priority. Swinging door is ideal for both interior and exterior applications, providing smooth operation and the ability to customize the design. Its timeless mechanism is also cost-effective, making it a preferred choice for a wide range of projects across various sectors in the Philippines.

Additionally, swinging door is highly adaptable to different architectural styles and building requirements. Whether for homes, offices, or commercial establishments, it can be crafted from various materials, such as wood, metal, or glass to suit different needs. In tropical climates like the Philippines, swinging door offers an excellent ventilation and natural light, enhancing indoor comfort. Its ability to fit into different spaces, ease of installation, and minimal maintenance requirements further contribute to its dominance in the doors market, ensuring they remain a top choice for many builders and homeowners.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Sound Insulation

- Fire and Smoke Protection

- Moisture Resistant and Wet Room

- Radiation Protection

- Burglary Protection

- Others

Sound insulation dominates with a market share of 25% of the total Philippines doors market in 2025.

Sound insulation holds the biggest market share, driven by the increasing demand for privacy, noise reduction, and improved living and working conditions. With the rapid urbanization and growth of residential, commercial, and industrial developments, noise pollution is becoming a significant concern. Sound insulating doors, especially in densely populated areas, offer an effective solution for minimizing external noise from traffic, construction, and nearby activities. This is particularly important in apartment buildings, offices, and hotels, where peace and quiet are valued for both comfort and productivity.

Moreover, sound insulating doors are essential in areas, such as hospitals, schools, and entertainment venues, where controlling noise levels is crucial for health, safety, and concentration. The growing awareness about the need for better acoustic environments is encouraging architects and builders to prioritize soundproofing in their designs. These doors are made with specialized materials, such as solid cores, acoustic seals, and heavy-duty hardware, to enhance their noise-dampening capabilities. As urban noise continues to rise, the demand for sound-insulating doors in the Philippines remains strong.

End User Insights:

- Residential

- Non-Residential

Residential leads with a market share of 68% of the total Philippines doors market in 2025.

Residential dominate the market owing to the country’s booming real estate sector and the growing middle class. As urbanization accelerates and more people invest in their own homes, the demand for quality doors in new construction and renovation projects rises. Whether for private homes, townhouses, or condominiums, residential properties require a wide variety of door types, including interior, exterior, and security doors. Directly reflecting the rapid expansion of the residential real estate sector, Hankyu Hanshin Properties launched a fully owned subsidiary in the Philippines in 2025 to develop the Alaminos and Summit projects, which will add over 1,000 new residential units to the market.

Additionally, rising disposable incomes and the desire for modern, functional living spaces are making homeowners more willing to invest in premium door solutions. With a growing emphasis on energy efficiency, privacy, and style, residential doors are evolving to meet diverse user preferences. Homeowners are seeking durable, attractive options, from classic wooden doors to modern, energy-efficient designs that offer insulation and noise reduction. As the residential real estate market continues to grow, the demand for high-quality, customizable doors remains strong, ensuring its dominance in the Philippines doors market.

Regional Insights:

- Luzon

- Visayas

- Mindanao

Luzon exhibits a clear dominance with a 58% share of the total Philippines doors market in 2025.

Luzon leads the market driven by its status as the country’s economic and industrial hub. According to the data published by the International Trade Administration in 2024, Central Luzon, as an emerging growth center, contributes roughly 9% to the national GDP. The region includes Metro Manila, the capital and largest urban area, where demand for construction and infrastructure projects is consistently high. Residential, commercial, and industrial developments in Luzon require a vast array of doors, ranging from interior and exterior doors to specialized security and soundproof doors.

Furthermore, Luzon benefits from its strategic location as the center of trade, commerce, and manufacturing in the Philippines. The region houses a large number of door manufacturers and distributors, making it a key player in the supply chain. With a highly developed infrastructure and better access to raw materials, Luzon remains the focal point for door production and distribution. As economic activity continues to thrive, Luzon’s dominant role in the Philippines doors market is expected to grow, with increasing demand driven by both residential and commercial sectors.

Market Dynamics:

Growth Drivers:

Why is the Philippines Doors Market Growing?

Government Initiatives and Infrastructure Projects

Government-led initiatives and large-scale infrastructure projects are driving the demand for doors in the Philippines. As the government focuses on improving national infrastructure through public buildings and housing developments, the need for durable and functional doors increases. These projects, which include urban renewal, new urban developments, and the expansion of public facilities, require doors that meet safety, aesthetic, and functional standards. For example, in 2025, President Ferdinand Marcos Jr. inaugurated the San Lazaro Residences in Manila, a 20-story housing project with 382 units. This project emphasizes efficient housing solutions and highlights the growing demand for high-quality doors in such developments.

Growth of Tourism and Hospitality Sector

As the Philippines continues to be a premier destination for international tourists, the demand for high-quality doors in the construction of hotels, resorts, and recreational facilities is growing. These establishments require doors that provide security, soundproofing, fire resistance, and aesthetic appeal to enhance guest experiences. According to World Travel & Tourism Council (WTTC) 2025 Economic Impact Research (EIR) forecast, the Philippines travel and tourism sector would contribute PHP 5.9 trillion to the economy, highlighting the significant role of the hospitality industry in driving construction and, consequently, the demand for specialized door solutions.

Expansion of Commercial Real Estate

The growth of the commercial real estate sector is influencing the Philippines doors market, as businesses establish and expand operations. The increasing demand for office buildings, retail spaces, and industrial facilities is driving the need for specialized doors that meet diverse requirements such as security, functionality, and aesthetics. Illustrating this expansion, Megaworld Corp. announced a P30-billion investment plan in 2025 to broaden its office portfolio across the Philippines over the next five years. These office buildings will incorporate sustainability features and aimed for LEED certification, highlighting the growing trend of eco-friendly commercial spaces that require advanced door solutions.

Market Restraints:

What Challenges the Philippines Doors Market is Facing?

Elevated Material Costs and Supply Chain Constraints

Rising costs of raw materials including wood, steel, and glass are pressuring door manufacturers and constraining the market expansion. The dependence of the country on imported wood products, combined with energy inflation and shipping constraints affecting material availability, creates pricing challenges. Contractors in island provinces face freight premiums that increase overall construction costs and limit affordability.

Skilled Labor Shortages in Manufacturing and Installation

The construction industry faces ongoing labor shortages, impacting door manufacturing and installation services. Skilled carpenters, installers, and manufacturing technicians are in short supply, which hampers production capacity and delays project timelines. This shortage creates a significant barrier to market growth, despite the strong demand driven by ongoing construction projects and the need for high-quality, custom-built doors in residential and commercial developments.

Inconsistent Building Code Enforcement in Regional Markets

Variable enforcement of building codes and fire safety regulations across local government units leads to uneven demand for specialized doors. In regions with minimal enforcement, builders are less incentivized to invest in compliant door solutions. Inconsistent standards further complicate product specification and marketing for manufacturers, making it difficult to align offerings with diverse regulatory requirements and creating challenges in maintaining market consistency across different regions.

Competitive Landscape:

The Philippines doors market exhibits moderate competitive intensity characterized by the presence of established local manufacturers alongside international brands competing across price segments and distribution channels. Market dynamics reflect strategic positioning, ranging from premium, innovation-driven offerings emphasizing design and durability to value-oriented products targeting cost-conscious builders. The competitive landscape is increasingly shaped by product innovation incorporating smart technology features, sustainability initiatives using eco-friendly materials, distribution network expansion to regional markets, and e-commerce capabilities enabling direct buyer access. Strategic partnerships between local distributors and international manufacturers facilitate technology transfer and product diversification.

Recent Developments:

- February 2025: Guangzhou Baige Building Products Co., Ltd. announced their participation in the Philippine World Building and Construction Exposition, which took place from March 13 to 16, 2025. The company planned to showcase a variety of doors and windows, offering an opportunity for direct customer interaction.

Philippines Doors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Interior Doors, Exterior Doors |

| Materials Covered | Wood, Glass, Metal, Plastic, Others |

| Mechanisms Covered | Swinging, Sliding, Folding, Revolving, Others |

| Applications Covered | Sound Insulation, Fire and Smoke Protection, Moisture Resistant and Wet Room, Radiation Protection, Burglary Protection, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines doors market size was valued at USD 714.17 Million in 2025.

The Philippines doors market is expected to grow at a compound annual growth rate of 7.18% from 2026-2034 to reach USD 1,333.08 Million by 2034.

Interior doors dominate the Philippines doors market with a share of 55% in 2025, driven by the growing demand for residential and commercial properties. As urbanization accelerates, more homes, apartments, and office spaces are being built, increasing the need for interior doors.

Key factors driving the Philippines doors market include the rising affluence, shifting user preferences towards premium and luxury options, and the increasing demand for custom-made wooden, glass, and security doors. The 16.6% increase in gross savings reported by the Philippine Statistics Authority in 2024 further supports this growth.

Major challenges include elevated material costs and supply chain constraints affecting wood and metal imports, skilled labor shortages in manufacturing and installation services, inconsistent building code enforcement across regional markets, competition from low-cost imports, and infrastructure limitations in island provinces increasing distribution costs.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)