Philippines Dropshipping Market Size, Share, Trends and Forecast by Product and Region, 2026-2034

Philippines Dropshipping Market Summary:

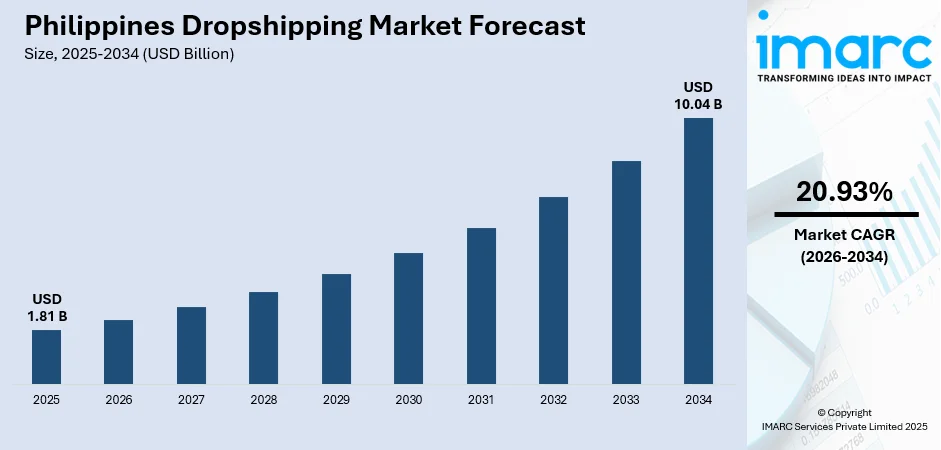

The Philippines dropshipping market size was valued at USD 1.81 Billion in 2025 and is projected to reach USD 10.04 Billion by 2034, growing at a compound annual growth rate of 20.93% from 2026-2034.

The Philippines dropshipping market is experiencing robust expansion driven by accelerating digital transformation, increasing smartphone adoption, and evolving consumer preferences toward online shopping convenience. The proliferation of e-commerce platforms has created an accessible entry point for entrepreneurs seeking low-capital business opportunities, while improved logistics infrastructure and expanding digital payment ecosystems continue to enhance operational efficiency across the archipelago.

Key Takeaways and Insights:

-

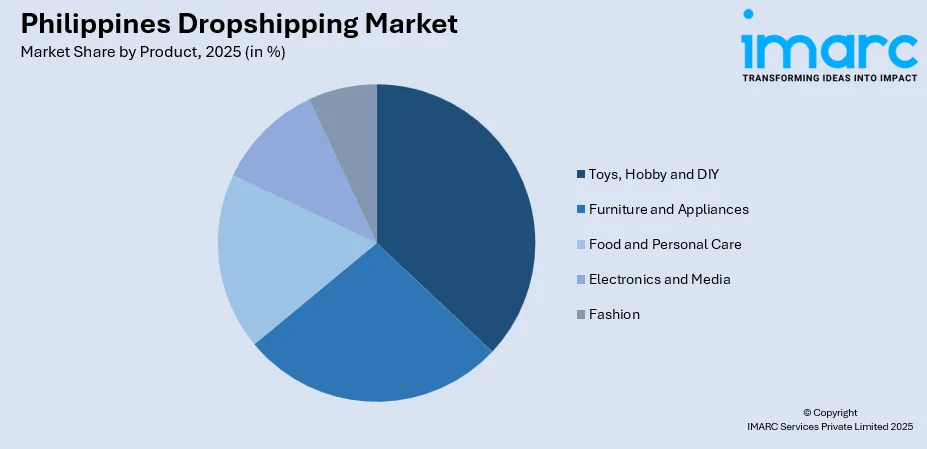

By Product: Toys, hobby and DIY segment dominates the market with a share of 21% in 2025, driven by growing consumer interest in recreational activities, crafting hobbies, and home improvement projects among Filipino households seeking creative outlets and personalized living spaces.

-

By Region: Luzon leads the market with a share of 61% in 2025, attributed to the concentration of Metro Manila's tech-savvy population, superior digital infrastructure, higher purchasing power, and the presence of major logistics hubs facilitating efficient order fulfillment across the island.

-

Key Players: The Philippines dropshipping market exhibits a moderately fragmented competitive landscape, with numerous small and medium enterprises operating alongside established e-commerce platforms. Market participants leverage platform integrations, supplier partnerships, and digital marketing strategies to differentiate their offerings and capture consumer attention in the expanding online retail ecosystem.

To get more information on this market Request Sample

The Philippines dropshipping market continues to benefit from fundamental structural shifts in consumer behavior and digital commerce infrastructure. The nation's young, digitally-native population increasingly favors online shopping channels that offer product variety, competitive pricing, and doorstep delivery convenience. E-commerce platforms have streamlined their seller onboarding processes, providing integrated payment gateways, logistics partnerships, and marketing tools that reduce barriers to market entry. The Department of Trade and Industry's MSME Digitalization Agenda has catalyzed entrepreneurial activity by promoting digital adoption among micro and small enterprises, while fintech innovations in mobile payments have enhanced transaction security and consumer confidence. Recent government initiatives under the Digital Payments Transformation Roadmap aim to achieve fifty percent digital retail transactions by year-end, further supporting the ecosystem's growth trajectory.

Philippines Dropshipping Market Trends:

Rising Mobile Commerce Adoption

The proliferation of affordable smartphones and expanding mobile internet connectivity is reshaping online purchasing behavior across the Philippines. Consumers increasingly prefer shopping through mobile applications that offer seamless browsing, one-tap payments, and real-time order tracking functionalities. This mobile-first approach enables dropshipping businesses to reach customers beyond traditional urban centers, tapping into underserved provincial markets where desktop internet access remains limited but smartphone penetration continues to surge. The Philippines smartphone market size reached USD 563.5 Million in 2025. Looking forward, the market is projected to reach USD 588.1 Million by 2034.

Social Commerce Integration

Social media platforms are increasingly serving as direct sales channels, allowing dropshippers to connect with customers through live streaming and shoppable posts. Filipino consumers actively engage with influencer recommendations and peer reviews shared online, driving purchase decisions. This blend of social interaction and commerce offers dropshipping entrepreneurs a chance to build genuine customer relationships, promote products effectively, and create engaging, informative content. By leveraging these platforms, sellers can combine entertainment with e-commerce, enhancing brand visibility and boosting sales while catering to digitally savvy Filipino audiences.

Expanding Digital Payment Ecosystems

The rapid adoption of digital wallets and mobile banking solutions is transforming transaction patterns in the Philippine e-commerce landscape. Enhanced security features, instant fund transfers, and rewards programs are encouraging consumers to embrace cashless payment methods over traditional cash-on-delivery options. This shift reduces operational complexities for dropshipping businesses while accelerating order processing cycles and improving cash flow management across the supply chain. For instance, in November 2025, GCash, the Philippines’ leading financial super app, teamed up with global payment solutions provider BPC to introduce GCash PocketPay, a new card-present payment solution aimed at expanding digital payment access for millions of merchants.

Market Outlook 2026-2034:

The Philippines dropshipping market outlook remains highly favorable, supported by continued investments in digital infrastructure, expanding logistics networks, and progressive regulatory frameworks encouraging entrepreneurship. Government programs promoting MSME digitalization and e-commerce adoption are creating supportive conditions for market participants, while improvements in last-mile delivery capabilities are addressing historical challenges associated with the nation's archipelagic geography. Consumer confidence in online transactions continues strengthening as digital payment solutions mature and platform dispute resolution mechanisms improve. The market generated a revenue of USD 1.81 Billion in 2025 and is projected to reach a revenue of USD 10.04 Billion by 2034, growing at a compound annual growth rate of 20.93% from 2026-2034.

Philippines Dropshipping Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product |

Toys, Hobby and DIY |

21% |

|

Region |

Luzon |

61% |

Product Insights:

Access the comprehensive market breakdown Request Sample

- Toys, Hobby and DIY

- Furniture and Appliances

- Food and Personal Care

- Electronics and Media

- Fashion

The toys, hobby, and DIY segment dominates with a market share of 21% of the total Philippines dropshipping market in 2025.

The toys, hobby, and DIY segment maintains market leadership driven by Filipino consumers' increasing engagement with creative pursuits, home improvement projects, and recreational activities. The segment benefits from seasonal demand surges during festive periods and year-round interest in collectibles, craft supplies, and educational toys. Dropshippers capitalize on diverse product sourcing opportunities, offering niche items unavailable through traditional retail channels while catering to hobbyist communities seeking specialized materials and accessories.

Consumer spending patterns indicate growing investment in home-based leisure activities, with families prioritizing quality time and creative engagement opportunities. The segment's growth trajectory reflects broader lifestyle shifts toward personalization and self-expression, as consumers seek unique products that align with individual interests and preferences. Social media platforms amplify product discovery through tutorial content and community recommendations, driving sustained demand across diverse hobby categories.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The Luzon region exhibits a clear dominance with a 61% share of the total Philippines dropshipping market in 2025.

Several key factors are driving the growth of the dropshipping market in Luzon, the Philippines’ most economically active region. High internet and smartphone penetration across Metro Manila and surrounding provinces enables widespread access to e-commerce platforms, allowing entrepreneurs to sell online without maintaining inventory. Consumers increasingly prefer digital shopping due to convenience, broader product selection, and competitive pricing, encouraging more business owners to adopt the low-risk dropshipping model. E-commerce platform expansion, coupled with improved logistics and delivery networks, further supports reliable order fulfillment, while digital payment solutions such as GCash and Maya facilitate seamless cashless transactions, reducing operational hurdles.

Additionally, Luzon’s large middle-class population with rising disposable incomes drives demand for diverse product categories offered through dropshipping stores. Urban centers host numerous small and micro enterprises that leverage social commerce and digital tools to reach wider audiences. Government initiatives promoting MSME digitalization, including training, infrastructure support, and policy guidance, enhance entrepreneurial capabilities, enabling dropship businesses to scale effectively. Collectively, these factors create a conducive environment for dropshipping growth across Luzon’s urban and semi-urban markets.

Market Dynamics:

Growth Drivers:

Why is the Philippines Dropshipping Market Growing?

Accelerating Internet and Smartphone Penetration

The Philippines continues experiencing rapid expansion in digital connectivity, with mobile users increasingly accessing online platforms for product discovery and purchasing activities. According to recent Philippine mobile import data, the country has approximately 76 million mobile phone and smartphone users. Telecommunications infrastructure improvements are extending reliable internet coverage beyond metropolitan centers into provincial areas, unlocking previously underserved consumer segments. Affordable smartphone availability combined with competitive mobile data pricing enables broader population segments to participate in e-commerce ecosystems, creating expanding addressable markets for dropshipping entrepreneurs. This digital democratization empowers small businesses to reach nationwide audiences without requiring physical retail presence or substantial inventory investments, fundamentally lowering barriers to entrepreneurial entry.

E-Commerce Platform Ecosystem Development

Major e-commerce platforms have invested substantially in creating seller-friendly environments that simplify dropshipping operations and reduce operational complexities. The Philippines e-commerce market size reached USD 28.0 Billion in 2025. Looking forward, the market is expected to reach USD 86.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.32% during 2026-2034. Integrated systems connecting product listings, payment processing, and logistics coordination enable entrepreneurs to manage business operations through unified dashboard interfaces. Platform-provided marketing tools, promotional campaigns, and customer service frameworks help dropshippers build brand visibility and consumer trust without requiring extensive digital marketing expertise. These ecosystem developments reduce technical barriers that historically prevented small entrepreneurs from competing effectively in online retail spaces, democratizing access to e-commerce opportunities across diverse demographic segments.

Government Digital Entrepreneurship Support

Philippine government initiatives actively promote digital transformation among micro, small, and medium enterprises through comprehensive support programs addressing technology adoption, business capability building, and market access facilitation. The MSME Digitalization Agenda provides training resources, infrastructure support, and regulatory guidance, helping traditional businesses transition toward digital commerce models. Policy frameworks encouraging cashless transactions and digital financial inclusion create supportive conditions for online business growth, while inter-agency coordination ensures coherent support across relevant government departments. These initiatives reflect strategic recognition of e-commerce's economic potential and commitment to creating enabling environments that foster entrepreneurial success across the digital economy. For instance, Shopee Philippines kicked off the 2025 Tatak Pinoy MSME Training Roadshow, a nationwide program aimed at helping Filipino micro, small, and medium enterprises (MSMEs) thrive online. The multi-city initiative, launched in collaboration with local government units and national agencies, began on August 7, 2025, in Mandaluyong. The first 10 stops are scheduled to run through December 2025, extending Shopee’s decade-long commitment to supporting local businesses and fostering growth through e-commerce.

Market Restraints:

What Challenges is the Philippines Dropshipping Market Facing?

Logistical Complexities in Archipelagic Geography

The Philippines' geographic composition presents inherent logistics challenges that complicate last-mile delivery operations and increase fulfillment costs for remote island destinations. Shipping infrastructure limitations in certain provinces result in extended delivery timelines that may negatively impact customer satisfaction and repeat purchase behavior. These geographic constraints require dropshipping businesses to carefully manage customer expectations while navigating variable shipping costs and delivery reliability across different regions.

Intense Competitive Pressure on Profit Margins

The relatively low barriers to entry in dropshipping have attracted numerous market participants, creating intense competitive pressure that compresses profit margins across product categories. Price-sensitive Filipino consumers actively compare offerings across multiple platforms, challenging dropshippers to differentiate through service quality, product uniqueness, or value-added offerings rather than competing solely on price. This competitive intensity requires continuous optimization of sourcing strategies, marketing investments, and operational efficiency to maintain viable business economics.

Cash-on-Delivery Payment Preferences

Despite growing digital payment adoption, significant consumer segments continue preferring cash-on-delivery payment methods due to trust concerns and familiarity with traditional transaction approaches. COD arrangements create operational complexities including higher return rates, cash handling requirements, and delayed revenue realization that impact business cash flow management. Dropshipping entrepreneurs must balance accommodating consumer payment preferences while managing associated operational and financial risks inherent in COD fulfillment models.

Competitive Landscape:

The Philippines dropshipping market features a highly fragmented competitive structure characterized by numerous small and medium enterprises operating alongside individual entrepreneurs leveraging e-commerce platform ecosystems. Market participants differentiate through product specialization, customer service quality, and strategic use of digital marketing channels to build brand recognition and consumer loyalty. Successful operators demonstrate proficiency in supplier relationship management, inventory-less supply chain coordination, and responsive customer engagement practices. Platform integration capabilities increasingly determine competitive positioning, as sellers leveraging advanced analytics, automated order processing, and multi-channel presence achieve operational efficiencies that support sustainable growth. The competitive landscape continues evolving as established players optimize operations while new entrants explore emerging product categories and underserved market segments.

Recent Developments:

-

In November 2025, Google Wallet launched in the Philippines with support for major e-wallets including GCash and Maya, enabling tap-to-pay functionality that enhances digital payment convenience for online and offline transactions across the e-commerce ecosystem.

-

In October 2024, the Department of Trade and Industry rolled out the MSME Digitalization Caravan 2.0 across Cebu, partnering with GCash, Maya, and Bangko Sentral ng Pilipinas to promote digital payment adoption and financial literacy among micro and small enterprises.

Philippines Dropshipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toys, Hobby and DIY, Furniture and Appliances, Food and Personal Care, Electronics and Media, Fashion |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Philippines dropshipping market size was valued at USD 1.81 Billion in 2025.

The Philippines dropshipping market is expected to grow at a compound annual growth rate of 20.93% from 2026-2034 to reach USD 10.04 Billion by 2034.

The toys, hobby, and DIY dominated the Philippines dropshipping market with approximately 21% share in 2025, driven by growing consumer interest in recreational activities, crafting hobbies, and home improvement projects among Filipino households.

Key factors driving the Philippines dropshipping market include accelerating internet and smartphone penetration, expanding e-commerce platform ecosystems with integrated seller support tools, government digital entrepreneurship initiatives, and growing consumer preference for online shopping convenience and product variety.

Major challenges include logistical complexities arising from archipelagic geography affecting delivery timelines and costs, intense competitive pressure compressing profit margins, persistent consumer preference for cash-on-delivery payments creating operational complexities, and supplier reliability concerns impacting product quality consistency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)