Philippines Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Philippines Duty-Free and Travel Retail Market Overview:

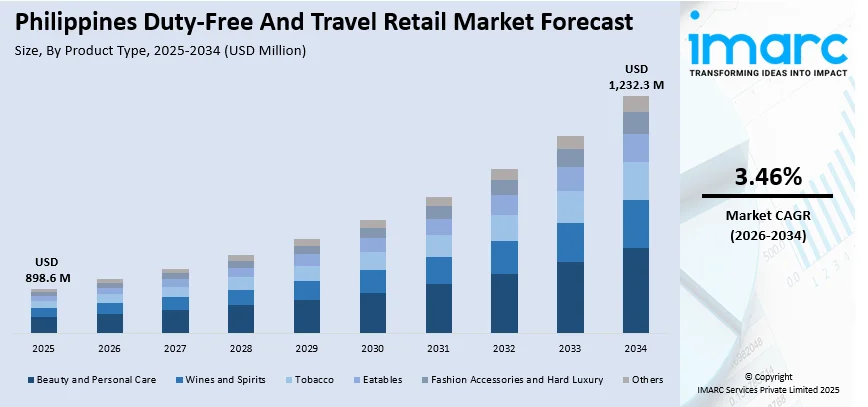

The Philippines duty-free and travel retail market size reached USD 898.6 Million in 2025. Looking forward, the market is expected to reach USD 1,232.3 Million by 2034, exhibiting a growth rate (CAGR) of 3.46% during 2026-2034. Strong inbound tourism, new international routes, airport expansions, rising disposable incomes, and growing middle-class shoppers contribute to the Philippines duty-free and travel retail market share. International brands, luxury goods demand, and innovative promotions keep travelers spending more in airports and downtown duty-free stores.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 898.6 Million |

| Market Forecast in 2034 | USD 1,232.3 Million |

| Market Growth Rate 2026-2034 | 3.46% |

Key Trends of Philippines Duty-Free and Travel Retail Market:

Surge in Local Traveler Spending

One clear trend is the rising contribution of domestic travelers to duty-free and travel retail sales. Traditionally, this market leaned heavily on international tourists. But more Filipinos are traveling within the country, and airports like Cebu and Clark are expanding routes that cater to local passengers. These travelers are spending more on small luxury items, cosmetics, and souvenirs they can’t easily find in provincial malls. Operators are tweaking product assortments and pushing targeted promotions to tap into this audience. Many duty-free stores now highlight local brands alongside imported goods, creating a sense of pride and novelty for Filipino buyers. Payment options are more flexible too, with duty-free and travel retails and installment plans making purchases more accessible to middle-income groups. This shift spreads revenue risk and helps stores cushion seasonal dips in foreign arrivals. It also pushes operators to rethink how they position duty-free shopping, from an occasional treat for balikbayans to a lifestyle habit for a growing segment of domestic flyers. These factors are intensifying the Philippines duty-free and travel retail market growth.

To get more information on this market Request Sample

Tech Upgrades Changing the Airport Retail Scene

Digital upgrades are reshaping how duty-free and travel retail operate across Philippine airports. Major players are investing in contactless checkout, pre-order platforms, and mobile payment systems that match the shopping habits of tech-savvy passengers. The pandemic fast-tracked this push, travelers now expect safer, quicker transactions. Stores at NAIA and other hubs have rolled out QR code payments and click-and-collect services where people shop online and pick up at departure gates. Beyond convenience, data from these platforms helps operators refine offers and loyalty perks. Interactive digital displays are appearing too, giving shoppers more product info and pairing suggestions on the spot. This cuts the time people linger and frees up staff to handle high-ticket sales. Combined with better tracking of inventory, stores can keep bestsellers in stock, avoiding lost revenue from out-of-stock popular items. Overall, this digital shift is turning a once old-school retail setup into a smoother, more personalized experience that matches global standards.

Growth Drivers of Philippines Duty-Free and Travel Retail Market:

Expanding International Tourism Influx

The Philippines is witnessing robust growth in international tourist arrivals, driven by strategic tourism campaigns, relaxed entry rules, and improved flight connections. Key destinations such as Boracay, Palawan, and Cebu attract high-spending travelers, many of whom consider duty-free shopping a core part of their trip. International passengers often purchase premium fragrances, cosmetics, alcohol, and branded accessories as souvenirs or gifts. Seasonal peaks during festivals, Chinese New Year, and summer holidays significantly boost foot traffic at airport terminals and seaports. With enhanced connectivity from regional hubs and the rising appeal of Philippine culture and beaches, retail operators benefit from a steady stream of potential buyers. According to the Philippines duty-free and travel retail market analysis, this sustained tourism inflow directly strengthens sales, fueling long-term growth in the country’s duty-free and travel retail sector.

Diversification of Product Offerings

Philippine duty-free and travel retail outlets are expanding beyond traditional categories like alcohol, tobacco, and perfumes to attract a wider customer base. Premium chocolates, branded apparel, high-end electronics, artisanal crafts, and eco-friendly products are increasingly featured to cater to varied traveler preferences. Exclusive collaborations with international brands and limited-edition releases create a sense of urgency and exclusivity. This product diversity appeals not only to foreign visitors but also to domestic travelers seeking unique purchases unavailable in local malls. By combining global luxury brands with authentic Filipino goods, retailers capture both impulse buyers and planned shoppers. This approach increases basket size, promotes repeat purchases, and strengthens customer loyalty, making assortment expansion a major driver of market competitiveness and sustained revenue growth.

Strategic Expansion of Retail Infrastructure

The Philippine government and private airport operators are investing heavily in upgrading travel hubs to meet rising passenger volumes, which is driving the Philippines duty-free and travel retail market demand. New terminals, modernized concourses, and improved passenger facilities create prime spaces for retail growth. Duty-free outlets are strategically placed in high-traffic departure and arrival areas, ensuring visibility and accessibility. Partnerships between airport authorities and retail operators enhance operational efficiency, inventory control, and quick service. The integration of lounge-style shopping, interactive brand displays, and spacious store layouts improves customer engagement. As airports evolve into lifestyle and commercial hubs, duty-free retail becomes a significant revenue generator. This infrastructure expansion not only accommodates increasing travelers but also provides the environment needed for higher sales conversion and long-term market growth.

Philippines Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines Duty-Free and Travel Retail Market News:

- In March 2025, the Philippines launched a VAT refund scheme for foreign tourists to boost spending and attract more international visitors. This move supports the duty-free and travel retail market by making the country a more appealing shopping hub. Recognized as Asia’s Leading Beach Destination in 2024, the Philippines aims to strengthen its position as both a leisure and shopping spot in Southeast Asia through this new policy.

Philippines Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines duty-free and travel retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The duty-free and travel retail market in the Philippines was valued at USD 898.6 Million in 2025.

The Philippines duty-free and travel retail market is projected to exhibit a CAGR of 3.46% during 2026-2034.

The Philippines duty-free and travel retail market is projected to reach a value of USD 1,232.3 Million by 2034.

Key trends in the Philippines duty-free and travel retail market include rising demand for luxury goods, growth in airport retail spaces, and increased spending by international tourists. Expanding product diversification, integration of digital payment solutions, and personalized shopping experiences are further shaping consumer behavior and driving market evolution.

The Philippines duty-free and travel retail market is driven by rising international tourist arrivals, expanding airport infrastructure, and increasing disposable incomes. Growing demand for premium and luxury products, coupled with enhanced shopping experiences and broader product assortments, further fuels market growth across major travel and tourism hubs nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)