Philippines E-Cigarette Market Report by Product (Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette), Flavor (Tobacco, Botanical, Fruit, Sweet, Beverage, and Others), Mode of Operation (Automatic E-Cigarette, Manual E-Cigarette), Distribution Channel (Specialty E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, and Others), and Region 2026-2034

Philippines E-Cigarette Market Size and Share:

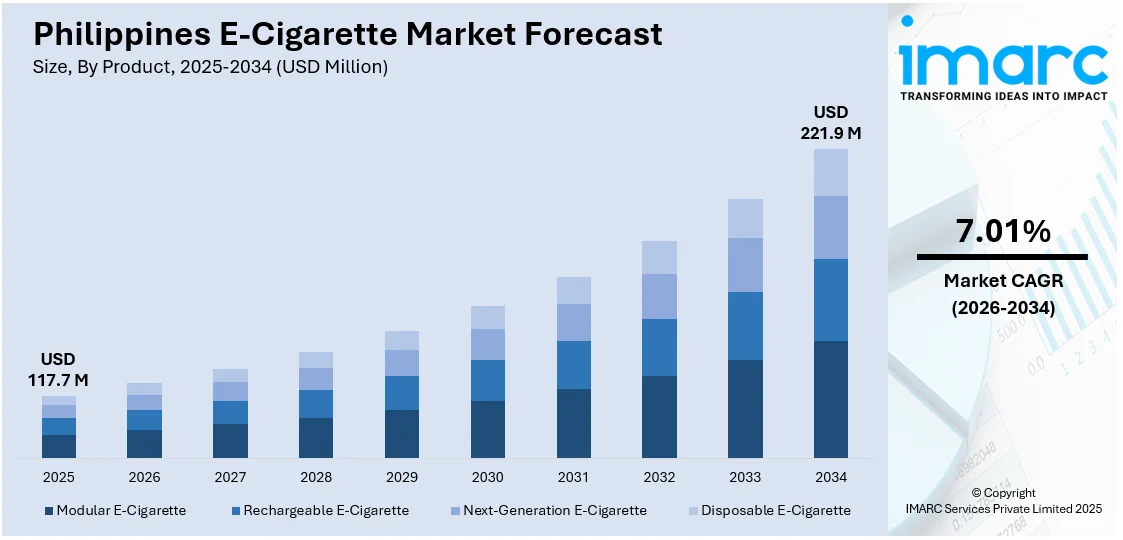

The Philippines e-cigarette market size reached USD 117.7 Million in 2025. Looking forward, the market is expected to reach USD 221.9 Million by 2034, exhibiting a growth rate (CAGR) of 7.01% during 2026-2034. The market is driven by the thriving e-commerce industry that enable users to easily obtain a diverse choice of e-cigarette products, along with the rising awareness among the masses about the negative health impact of smoking tobacco.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 117.7 Million |

| Market Forecast in 2034 | USD 221.9 Million |

| Market Growth Rate (2026-2034) | 7.01% |

Key Trends of Philippines E-Cigarette Market:

Thriving E-Commerce Industry

An article published in 2024 on the website of the International Trade Administration (ITA) shows that the Philippines’ eCommerce market sales reached $17 billion, largely contributed by 73 million online active users in 2021. This is projected to reach $24 billion, with 17% growth, through 2025. E-commerce platforms enable users across the country to easily obtain a diverse choice of e-cigarette products, including devices, e-liquids, and accessories, even in remote places where physical outlets may be limited. Online purchasing is convenient for people who like to browse and buy e-cigarette products from the comfort of their own homes or on mobile devices. According to the Philippines e-cigarette market analysis, this convenience element may encourage more people to research and purchase e-cigarette goods online. E-commerce platforms frequently provide a greater assortment of e-cigarette brands, flavors, and accessories than physical storefronts. This variety enables buyers to readily evaluate items and identify solutions that best meet their preferences and needs.

To get more information on this market Request Sample

The competitive nature of e-commerce pushes businesses to provide competitive pricing and promotional offers on e-cigarette items. This can attract price-sensitive customers and increase e-cigarette sales volume. E-commerce offers a discrete shopping experience for individuals who desire privacy while purchasing e-cigarette products, especially if vaping is socially stigmatized in their community. E-commerce platforms enable e-cigarette companies to carry out tailored marketing campaigns based on user data and preferences. This tailored approach helps reach specific demographics and promote e-cigarette items to appropriate buyers, which is driving the Philippines e-cigarette market growth.

Growing Awareness About Harmful Impact of Tobacco

According to an article published in 2024 on the website of the Global Action to End Smoking, around 16.4 million adults in the Philippines were tobacco products users in 2022. As people are getting aware about the negative health impact of tobacco in Philippines, they are looking for an alternative of traditional cigarettes. E-cigarettes are frequently seen as a possibly less dangerous alternative to traditional cigarettes, which is driving their popularity among smokers seeking to reduce or quit smoking. Many people struggle to quit smoking because of their nicotine addiction and smoking-related habits. E-cigarettes provide a smoking-like experience, including hand-to-mouth action and nicotine inhalation, which can aid smokers in transitioning away from traditional cigarettes. As a result, smokers who want to quit or reduce their tobacco consumption frequently turn to e-cigarettes as a smoking cessation tool. E-cigarettes are used as a kind of nicotine replacement therapy (NRT) for smokers who want to quit, which is boosting the Philippines e-cigarette market demand. Nicotine replacement therapy (NRT) products, such as patches, gums, and lozenges, are often used to help manage nicotine withdrawal symptoms while quitting. E-cigarettes have a similar nicotine delivery technique but also replicate the sensory features of smoking, making them a popular choice among many smokers attempting to quit.

Some public health groups and regulatory authorities see e-cigarettes as a risk-reduction option for smokers who are unable or unable to quit using traditional approaches. Policies and regulations that support harm reduction efforts, such as advocating the use of e-cigarettes as an alternative to smoking, can drive the expansion of the e-cigarette market by legitimizing its role.

Growth Drivers of Philippines E-Cigarette Market:

Youth-Oriented Product Innovation

E-cigarette companies are increasingly focusing on the preferences and behaviors of younger consumers by developing sleek, compact, and intuitive devices. These products often feature modern aesthetics, vibrant colors, rechargeable pods, and user-friendly mechanisms, making them more appealing to tech-savvy youth. Many devices now incorporate smart features such as battery indicators, draw activation, and customizable vape settings to enhance the user experience. This innovation not only attracts first-time users but also encourages brand loyalty through personalization and trend alignment. Social media marketing and influencer collaborations further amplify product appeal among young adults. By aligning product design with youthful preferences and lifestyle trends, manufacturers are strategically positioning themselves to capture the attention of a growing and influential consumer segment.

Regulatory Recognition and Product Segmentation

The implementation of Republic Act No. 11900 has brought a structured and transparent regulatory environment to the Philippines e-cigarette market. This legal framework provides manufacturers and distributors with clear guidelines on production, labeling, marketing, and sales, fostering confidence among stakeholders and consumers alike. The recognition of vaporized nicotine products under law legitimizes the industry and encourages responsible innovation. It also enables companies to segment their offerings more effectively developing specific products for adult smokers, transitioning users, or those seeking low or zero-nicotine alternatives. With government oversight ensuring quality and safety standards, the market is becoming more organized and competitive. This regulatory clarity not only reduces market ambiguity but also invites investment, supporting long-term growth and consumer protection.

Transition from Conventional Smoking

An increasing number of Filipino smokers are turning to e-cigarettes as an alternative to traditional tobacco products. This shift is largely influenced by the perception that vaping offers a less harmful way to consume nicotine, especially due to the absence of combustion and tar-related toxins. E-cigarettes also provide flexibility in nicotine levels and flavor choices, allowing users to personalize their experience and gradually reduce dependency. The discreet nature and modern design of vaping devices add to their appeal among former cigarette users. Public health campaigns and testimonials from switchers further support this behavioral transition. As health awareness rises and alternatives become more accessible, this growing shift from conventional smoking continues to fuel demand for e-cigarettes in the Philippines.

Opportunities in Philippines E-Cigarette Market:

Rural Market Expansion

As the popularity of e-cigarettes grows beyond metropolitan hubs, rural and semi-urban areas in the Philippines represent a largely untapped consumer base. With increasing digital connectivity and rising awareness of alternative smoking options, these regions offer strong potential for market penetration. By focusing on affordable pricing, simplified product formats, and improved retail distribution, brands can attract first-time users in these underserved areas. Local partnerships with community stores or mobile vendors could help improve access and visibility. Additionally, educational outreach and responsible marketing tailored to local cultures and preferences can build trust and drive sustained adoption. Tapping into the rural market can significantly expand brand presence and strengthen nationwide reach for both domestic and international e-cigarette companies.

Product Diversification and Customization

The evolving needs of Filipino consumers are driving demand for a broader range of e-cigarette products. Opportunities lie in offering customized and diverse options such as zero-nicotine formulations, herbal or plant-based blends, and refillable or reusable devices. Consumers increasingly value the ability to tailor their vaping experience based on flavor, nicotine strength, and device style. This opens the door for companies to innovate with modular designs, adjustable controls, and health-conscious alternatives. Such product diversification not only helps attract new users, particularly those transitioning from traditional tobacco, but also retains existing customers seeking new experiences. Providing options that align with personal health goals and lifestyle preferences gives brands a competitive edge in a market driven by variety and user engagement.

Strategic Retail and Franchise Models

Retail strategy is becoming a key differentiator in the Philippines' e-cigarette market. Establishing branded vape shops, dedicated kiosks in malls, and curated in-store experiences can significantly enhance visibility and consumer trust. Franchising models offer scalable opportunities for rapid expansion, enabling brands to reach new regions without heavy capital investment. Shop-in-shop formats within lifestyle and convenience stores also provide effective points of sale with high foot traffic. These retail models allow companies to educate users, provide product demonstrations, and strengthen customer loyalty through personalized service. Additionally, integrating loyalty programs and community engagement within these outlets can further boost repeat purchases. As competition intensifies, a strong retail footprint supported by strategic partnerships will be crucial for long-term growth and market leadership.

Challenges in Philippines E-Cigarette Market:

Health and Safety Concerns

While e-cigarettes are gaining popularity as alternatives to traditional smoking, concerns about their long-term health effects remain a significant barrier. Scientific research on the impact of prolonged vaping is still evolving, with some studies indicating potential links to respiratory issues, cardiovascular complications, and other health risks. These uncertainties continue to shape negative public opinion and contribute to hesitation among potential users. Media reports and expert warnings add to the skepticism, especially among health-conscious consumers and older age groups. As health agencies and governments remain cautious, these concerns could lead to tighter regulations or restrictions. Without more definitive long-term studies proving safety, doubts about the health impact of vaping may slow down broader market adoption in the Philippines.

Youth Access and Misuse

The increasing use of e-cigarettes among minors and teenagers is a growing concern in the Philippines. Despite existing age restrictions, weak enforcement and easy availability—especially through online platforms and small retailers—make it easier for underage individuals to access these products. Some marketing tactics, such as colorful packaging, sweet flavors, and social media promotions, unintentionally or deliberately appeal to younger audiences. This rising trend of youth vaping has drawn criticism from parents, educators, and health advocates, potentially inviting stricter government action. If not addressed effectively, this issue may lead to reputational damage for brands and tighter controls on advertising, sales, and product features. Preventing misuse through age verification and responsible marketing is essential for sustainable market growth.

Dependence on Imports and Limited Local Manufacturing

The Philippines e-cigarette market currently relies heavily on imported products, including devices, cartridges, and e-liquids. This dependency exposes the market to supply chain disruptions, foreign exchange volatility, and pricing fluctuations. Delays in shipping or changes in international trade policies can significantly impact inventory availability and consumer satisfaction. Moreover, the absence of strong domestic manufacturing limits the market's ability to innovate based on local preferences, such as cultural flavor trends or pricing needs. Local production could improve responsiveness and reduce reliance on international suppliers, but the infrastructure and investment needed remain limited. Without strengthening local capabilities, the market risks stagnation in product diversity and competitiveness, especially if global supply chains become less predictable or costlier over time.

Philippines E-Cigarette Market News:

- November 2023: VOOPOO launched its new DRAG X2 and DRAG S2 with PnP X Platform to push the boundaries of innovations.

- June 2023: RELX International (RLX) announced that it will be partnering with the Philippine Department of Trade and Industry (DTI) to strengthen regulations on the sales of e-cigarette products.

Philippines E-Cigarette Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product, flavor, mode of operation, and distribution channel.

Product Insights:

- Modular E-Cigarette

- Rechargeable E-Cigarette

- Next-Generation E-Cigarette

- Disposable E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the product. This includes modular e-cigarette, rechargeable e-cigarette, next-generation e-cigarette, and disposable e-cigarette.

Flavor Insights:

- Tobacco

- Botanical

- Fruit

- Sweet

- Beverage

- Others

The report has provided a detailed breakup and analysis of the market based on the flavor. This includes tobacco, botanical, fruit, sweet, beverage, and others.

Mode of Operation Insights:

- Automatic E-Cigarette

- Manual E-Cigarette

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes automatic e-cigarette and manual e-cigarette.

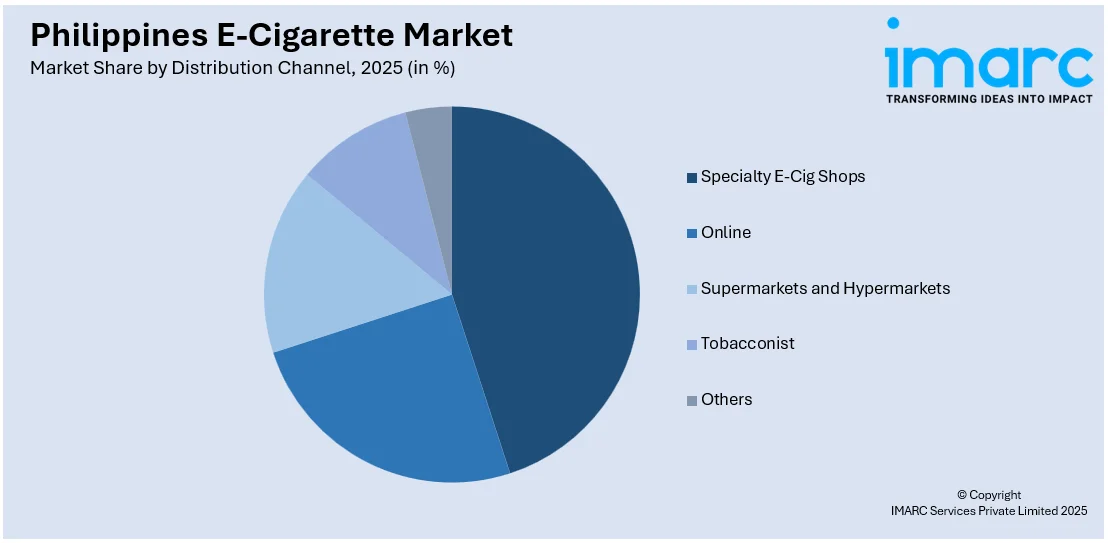

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty E-Cig Shops

- Online

- Supermarkets and Hypermarkets

- Tobacconist

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes specialty e-cig shops, online, supermarkets and hypermarkets, tobacconist, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Philippines E-Cigarette Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Modular E-Cigarette, Rechargeable E-Cigarette, Next-Generation E-Cigarette, Disposable E-Cigarette |

| Flavors Covered | Tobacco, Botanical, Fruit, Sweet, Beverage, Others |

| Mode of Operations Covered | Automatic E-Cigarette, Manual E-Cigarette |

| Distribution Channels Covered | Specialty E-Cig Shops, Online, Supermarkets and Hypermarkets, Tobacconist, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines e-cigarette market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines e-cigarette market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines e-cigarette industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-cigarette market in the Philippines was valued at USD 117.7 Million in 2025.

The Philippines e-cigarette market is projected to exhibit a CAGR of 7.01% during 2026-2034.

The Philippines e-cigarette market is projected to reach a value of USD 221.9 Million by 2034.

The key trends of the Philippines e-cigarette market are rising demand for sleek pod-based and disposable vapes, growing preference for nicotine salt formulations, and increasing traction among urban youth driven by social media influence, flavor diversity, and lifestyle branding.

Health-conscious smokers shifting from traditional tobacco, expanding online and offline retail access, continuous product innovations, supportive taxation and regulation under RA 11900, and competitive pricing are propelling the growth of the Philippines e-cigarette market across urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)