Philippines E-commerce Market Size, Share, Trends and Forecast by Business Model, Mode of Payment, Service Type, Product Type, and Region, 2026-2034

Philippines E-commerce Market Size and Share:

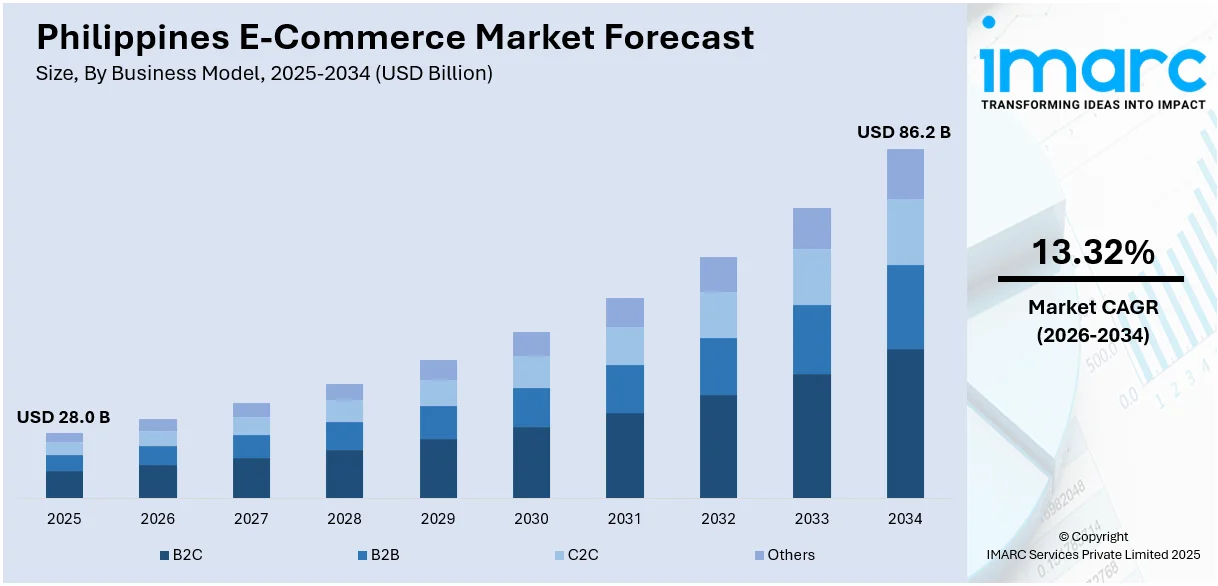

The Philippines e-commerce market size reached USD 28.0 Billion in 2025. Looking forward, the market is expected to reach USD 86.2 Billion by 2034, exhibiting a growth rate (CAGR) of 13.32% during 2026-2034. The Philippines e-commerce market share is expanding, driven by the growing investments in user-friendly websites and targeted online marketing to engage with users effectively, along with innovative features like encryption, two-factor authentication, and biometric verification in digital payment services, which lower the risk of fraud and theft.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.0 Billion |

| Market Forecast in 2034 | USD 86.2 Billion |

| Market Growth Rate (2026-2034) | 13.32% |

Key Trends of Philippines E-commerce Market:

Expansion of Retail Channels

The rising reliance on e-commerce platforms by established retail brands is impelling the Philippines e-commerce market growth. It is enabling the seamless integration of offline and online channels to extend their reach to a wider audience. Retailers are capitalizing on the changing shopping marketspace and buyer preferences, with digital commerce gaining traction among Filipinos. Online shopping is highly adaptive, as it reduces time spent while commuting and waiting in queues. Online retail provides shoppers the convenience to browse and purchase products from the comfort of their homes, without the hassle of visiting physical stores. Buyers have easy access to a vast selection of products, often beyond what is available in local stores. They can compare item features, prices, and reviews across multiple sellers to make informed and suitable decisions. Moreover, online platforms frequently offer discounts, deals, and price comparisons, helping customers make cost-effective choices. With the help of advanced algorithms, businesses provide customized suggestions according to browsing and buying habits, enhancing the shopping experience. Consumers can purchase products from international retailers, gaining access to unique items, without any geographical restraints. Traditional retailers, influenced by the high demand for digital solutions, are investing in user-friendly websites and targeted online marketing to engage with users more effectively. As per the IMARC Group’s report, the Philippines retail sector market is expected to reach USD 133.2 Billion by 2032.

To get more information on this market Request Sample

Rising Digital Payment Adoption

In 2024, the World Bank Board of Directors approved a USD 750 Million second digital transformation development policy loan in Philippines to improve trust in e-commerce and build advanced payments infrastructure. According to the Philippines e-commerce market analysis, as more people use internet-connected smartphones, there is a rise in the adoption of online payment services. Digital payments enable quick and easy transactions anytime and anywhere, reducing dependency on physical cash or checks. Businesses can cater to wider audiences by accepting various digital payment methods. Payments can be completed in seconds, which minimizes delays in both online and in-person purchases. Digital payment services streamline payment processes and aid in reducing administrative tasks and transaction errors. Additionally, innovative features like encryption, two-factor authentication, and biometric verification reduce the risk of fraud and theft and ensure security. Digital payments automatically generate transaction histories, which help users to track expenses and manage finances. Furthermore, government initiatives promoting a cashless economy are offering a favorable Philippines e-commerce market outlook.

Rise of Mobile Commerce

The Philippines e-commerce market demand is increasingly defined by the boom in mobile commerce, a reflection of the nation's distinct digital landscape. With a young, tech-embracing population who are depending largely on smartphones for internet access, mobile shopping has emerged as the most preferred mode of online transactions. This is driven by low-cost mobile data plans and ubiquitous availability of cheap smartphones, making seamless online shopping accessible to consumers alike from both metropolitan areas such as Metro Manila and rural provinces. Filipino consumers tend to employ social media platforms not just for communication purposes but also as discovery vehicles for products, making social commerce integration with mobile e-commerce inevitable. In addition, mobile payments and digital wallets customized for mobile use have become increasingly popular, overcoming issues of convenience and trust. Filipino retailers have quickly adapted platforms for mobile usage, introducing app-only promotions and improving the user experience through regional delivery options and local language support. This mobile-first strategy overcomes issues of regional infrastructure and purchasing behavior, cementing mobile commerce as a cornerstone of the nation's e-commerce shift.

Growth Drivers of Philippines E-commerce Market:

Lifestyle Changes and Need for Convenience

The changing lifestyles of Filipino consumers are initiating a shift toward e-commerce adoption, particularly in urban locations where the work-life balance becomes ever so challenging to balance. Long drives to and from work, erratic weather patterns, and the road congestion in cities such as Metro Manila and Davao render shopping in brick-and-mortar stores inconvenient for many. In consequence, Filipinos are resorting to e-commerce websites to save effort and time. For ordering groceries, fashion products, electronics, or daily needs, online shopping is considered a convenient option compared to offline retail. The increased demand for convenience is also seen in mobile apps and live-selling events, where consumers prefer to browse and buy products without physically going out. Moreover, the boom in "pasabuy" or social buying has been combined with e-commerce, enabling groups of buyers within residential communities to combine orders to save on bulk and shared delivery. These lifestyle habits are driving digital shopping adoption both in urban and suburban areas.

Logistics Innovation and Better Delivery Infrastructure

The constant developments in logistics and delivery operations throughout the Philippines have become easier and more reliable for a wider group of consumers to access e-commerce. Major e-commerce sites, as well as domestic courier companies, have heavily invested in streamlining delivery speed and reach, particularly to cater to provincial town and distant island buyers. With a nation comprising more than 7,000 islands, regional fulfillment centers, localized sorting facilities, and motorcycle delivery fleets have been instrumental in filling gaps in geography. Scheduled deliveries, live tracking, and cashless proof-of-delivery systems are just a few innovations that have increased the smoothness and reliability of buying online. Even small sellers on social media are utilizing independent riders and localized apps to deliver orders quickly and effectively. As delivery infrastructure becomes more enhanced, particularly in less affluent regions, more consumers are becoming confident about online shopping, trusting that their goods will be delivered on time and in good condition.

Entrepreneurial Culture and Platform Ecosystem Support

The Philippines' high entrepreneurial spirit has greatly contributed to the development of its e-commerce market. From home-based entrepreneurs to full-fledged online brands, local entrepreneurs are taking advantage of digital channels to sell their wares to more people. The minimal entry costs of establishing online shops, especially on marketplace platforms, have enabled a younger generation of entrepreneurs nationwide. These include niche sellers of products, handmade goods, and local specialties that tend to be supported avidly by the Filipino diaspora. E-commerce websites in the country have also extended strong logistical and marketing assistance to sellers, such as warehousing, delivery services, and targeted advertising. Campaigns like "double-digit" sale days and free shipping promotions have also aided the development of social and competitive online buying and selling culture. With robust community activity and increasing support from logistics partners, the Philippines' dynamic e-commerce marketplace continues to attract new merchants and loyal buyers from all over.

Opportunities of Philippines E-commerce Market:

Hidden Markets in Rural and Provincial Locations

One of the biggest opportunities within the Philippines e-commerce market is in the huge numbers of underpenetrated customers across rural and provincial areas. While urban locations such as Metro Manila and Cebu were the initial focus of most platforms, increasing internet penetration and smartphone adoption have provided new opportunity in smaller cities and outlying towns. Shoppers in such regions usually have restricted access to brick-and-mortar retail stores, particularly for specialty items, branded products, and foreign goods. Online shopping offers a convenient remedy, enabling rural buyers to have access to a wide variety of products that could be out of reach in their local markets. Platforms that adapt their logistics and payment channels to the requirements of such communities—e.g., cash-on-delivery or community pick-up locations—are likely to build a loyal customer base. As local governments also drive digital inclusion and infrastructure development, e-commerce platforms that make early investments in rural outreach can avail themselves of first-mover benefits and long-term regional brand equity.

Expansion of Local Brands and Niche Product Categories

The Philippine online shopping market offers a great potential for the emergence of local homegrown brands and niche products that are attuned to the Filipino palate and requirements. The market is looking for more products that are locally manufactured, ranging from personal care products using local ingredients to fashion clothing reflecting local identity. Filipino culture- and lifestyle-based products being sold by sellers are increasingly popular, especially among young, socially aware consumers who appreciate authenticity and community support. Additionally, specialty categories like ecologically friendly products, organic produce, and artisanal products are gaining popularity and are usually underserved by mass-market retailers. E-commerce offers a great platform for these niche sellers to gain wider exposure, both locally and among overseas Filipinos. With comparatively low entry barriers and the scope to narrate brand stories through online content, local businesspeople can differentiate themselves in a competitive market and build meaningful, long-lasting customer relationships.

Cross-Border Trade and Regional Integration

As the Philippines deepens trade links in Southeast Asia and the rest of the world, cross-border e-commerce is emerging as an increasingly viable growth option. Filipino shoppers are already demonstrating keen interest in goods from nearby countries like South Korea, Japan, and China—especially in categories such as beauty, electronics, and apparel. E-commerce sites able to facilitate international shipping, customs, and localized customer support will be able to reach increasing volumes of cross-border consumers. Concurrently, Philippine-based vendors may export locally produced products, particularly those with cultural interest or natural elements, to foreign markets. Filipino expatriate communities abroad are also a high-potential market for authentic local products. With regional trade policy and logistics infrastructures ever-changing, vendors with capabilities in international fulfillment and multilingual customer service will be best placed to grow beyond local borders and access the wider ASEAN and global e-commerce market.

Challenges of Philippines E-commerce Market:

Logistics Complexity in an Archipelagic Nation

One of the most enduring issues for the Philippines e-commerce industry is the logistical intricacy of doing business in an archipelago nation. With more than 7,000 islands, providing regular and timely delivery to all markets is expensive and operationally taxing. Though Metro Manila and its surrounding urban centers enjoy relatively advanced infrastructure, most of the regions—particularly those in Visayas and Mindanao—suffer from underdeveloped roads, inadequate access to reputable couriers, and cumbersome customs clearing at provincial ports. Slower delivery, hefty shipping charges, and delivery damage are typical problems in outlying or rural areas. These issues impact buyer satisfaction and are burdensome to sellers. To expand nationally, e-commerce players need to invest in warehousing at local levels, optimization of routes, and collaboration with regional logistics companies. These, however, need huge capital outlays and long-term commitments, and hence extensive coverage across the nation is a major hurdle, particularly for small and medium enterprises attempting to play in the online market.

Digital Payment Gaps and Consumer Trust Issues

Although electronic payment systems are expanding, trust and accessibility continue to be among the major issues in e-commerce in the Philippines. Most consumers, especially in rural regions or older populations, still prefer cash-on-delivery since they are not familiar with digital wallets, are afraid of online fraud, or lack exposure to banking services. The reliance on cash makes it difficult for online merchants, as they need to handle returns, non-delivery, and payment reconciliation with increased overhead. Moreover, fear of scams, counterfeits, and bad customer support keep most new buyers away. Even experienced consumers can be hesitant against lesser-known sellers, particularly on sites with minimal consumer protection. Consequently, trust-building features like transparent return policies, product feedback, and secure payment facilities are necessary but still not universally in place on all sites. Closing these gaps needs a joint effort in digital literacy, consumer education, and enhanced transparency to establish long-term trust in online shopping.

Uncertainty of Regulation and Compliance Challenges

E-commerce players in the Philippines are confronted with a changing and occasionally unclear regulatory environment that can hinder expansion and introduce operational risk. Government authorities are yet to establish complete frameworks for online trade, taxation, customer protection, and data privacy. For merchants, particularly those selling from multiple provinces or employing cross-border fulfillment strategies, adherence to different local requirements can be complex and labor-intensive. Moreover, ambiguous policy guidelines for marketplace obligations regarding counterfeit goods, product safety, and seller authentication provide avenues for abuse and erode customer confidence. Regulatory inconsistencies have also implications on digital marketing, delivery services, and return policies, especially on smaller platforms that lack the capabilities to keep up with such fast-paced adaptations. Although growing government attention to governing and enabling digital commerce is welcome, the policy pace of rollout at present might not yet match the growth rate in the market. Companies must remain nimble and ahead of the game in terms of meeting compliance requirements to minimize disruption and fines.

Philippines E-commerce Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on business model, mode of payment, service type, and product type.

Business Model Insights:

- B2C

- B2B

- C2C

- Others

The report has provided a detailed breakup and analysis of the market based on the business models. This includes B2C, B2B, C2C, and others.

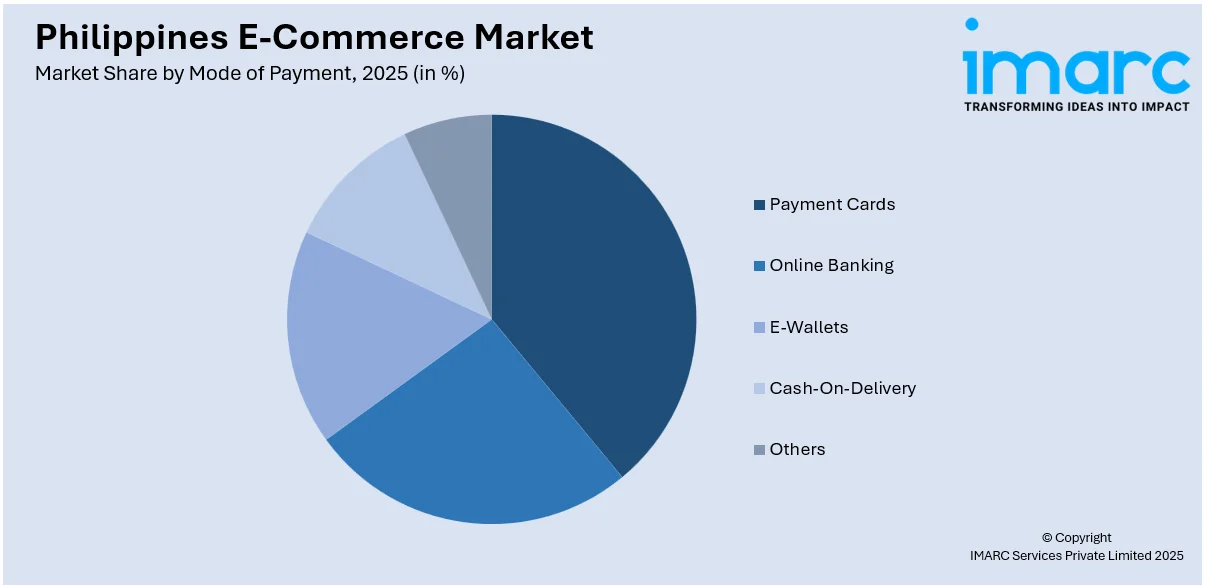

Mode of Payment Insights:

Access the Comprehensive Market Breakdown Request Sample

- Payment Cards

- Online Banking

- E-Wallets

- Cash-On-Delivery

- Others

A detailed breakup and analysis of the market based on the modes of payments have also been provided in the report. This includes payment cards, online banking, e-wallets, cash-on-delivery, and others.

Service Type Insights:

- Financial

- Digital Content

- Travel and Leisure

- E-Tailing

- Others

The report has provided a detailed breakup and analysis of the market based on the service types. This includes financial, digital content, travel and leisure, e-tailing, and others.

Product Type Insights:

- Groceries

- Clothing and Accessories

- Mobiles and Electronics

- Health and Personal Care

- Others

A detailed breakup and analysis of the market based on the product types have also been provided in the report. This includes groceries, clothing and accessories, mobiles and electronics, health and personal care, and others.

Regional Insights:

- Luzon

- Visayas

- Mindanao

The report has also provided a comprehensive analysis of all the major regional markets, which include Luzon, Visayas, and Mindanao.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Carousell

- IKEA Philippines

- Kimstore

- Lazada Group

- Sephora Digital SEA Pte Ltd

- Shopee

- Sterling Galleon Corporation

- Temu Philippines

- Zalora

Philippines E-Commerce Market News:

- In March 2024, HSBC Philippines introduced ‘Omni Collect’, an advanced payment solution with in-built application programming interface (API) designed for e-commerce businesses. It ensures seamless transactions across online, offline, and mobile platforms and enables businesses to accept payments from various sources through a centralized interface.

- In July 2024, FedEx teamed up with eBay, a top-rated e-commerce business to extend their marketspaces. This alliance was set to roll out in Philippines and other countries of the Asia-Pacific region to enhance the online shopping and delivery experience of customers.

Philippines E-commerce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | B2C, B2B, C2C, Others |

| Modes of Payments Covered | Payment Cards, Online Banking, E-Wallets, Cash-On-Delivery, Others |

| Service Types Covered | Financial, Digital Content, Travel and Leisure, E-Tailing, Others |

| Product Types Covered | Groceries, Clothing and Accessories, Mobiles and Electronics, Health and Personal Care, Others |

| Regions Covered | Luzon, Visayas, Mindanao |

| Companies Covered | Carousell, IKEA Philippines, Kimstore, Lazada Group, Sephora Digital SEA Pte Ltd, Shopee, Sterling Galleon Corporation, Temu Philippines, Zalora, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Philippines e-commerce market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Philippines e-commerce market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Philippines e-commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Philippines e-commerce market was valued at USD 28.0 Billion in 2025.

The Philippines e-commerce market is projected to exhibit a CAGR of 13.32% during 2026-2034

The Philippines e-commerce market is expected to reach a value of USD 86.2 Billion by 2034.

The key trends of the Philippines e-commerce market are rising internet access and mobile shopping. Social media platforms like Facebook and TikTok drive sales through live selling and influencer marketing. Popular digital wallets improve convenience. Government programs encourage small businesses online, making the market dynamic and expanding quickly across the country.

The Philippines e-commerce market is fueled by increasing internet penetration, extensive smartphone adoption, and increasingly trusting consumers of online payments. Urbanization and hectic lifestyles enhance demand for convenience shopping. Favorable government policies supporting digital infrastructure and increasing logistics networks also enhance accessibility and delivery efficiency, driving growth of the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)